Crunchyroll's 114 series orders dwarf Netflix's 4, marking anime platform's decisive victory

Japanese anime captures 44% and K-dramas 35% of global preferences, rivaling Hollywood's reach

'Korean Crunchyroll' on horizon as K drama Streaming accelerate international expansion

K-Drama and Japanese Anime Emerge as Twin Pillars of the Streaming Era

Japanese anime and Korean dramas have firmly established themselves as the twin pillars of the global entertainment industry, reshaping how content is produced, distributed, and consumed worldwide. The stark contrast between Crunchyroll's 114 series orders and Netflix's mere 4 in 2024 exemplifies anime's explosive growth trajectory. With Japanese anime capturing 44% and K-dramas 35% of global viewer preferences, Asian content has definitively proven it can stand shoulder-to-shoulder with Hollywood productions.

The Rise of Japanese Animation

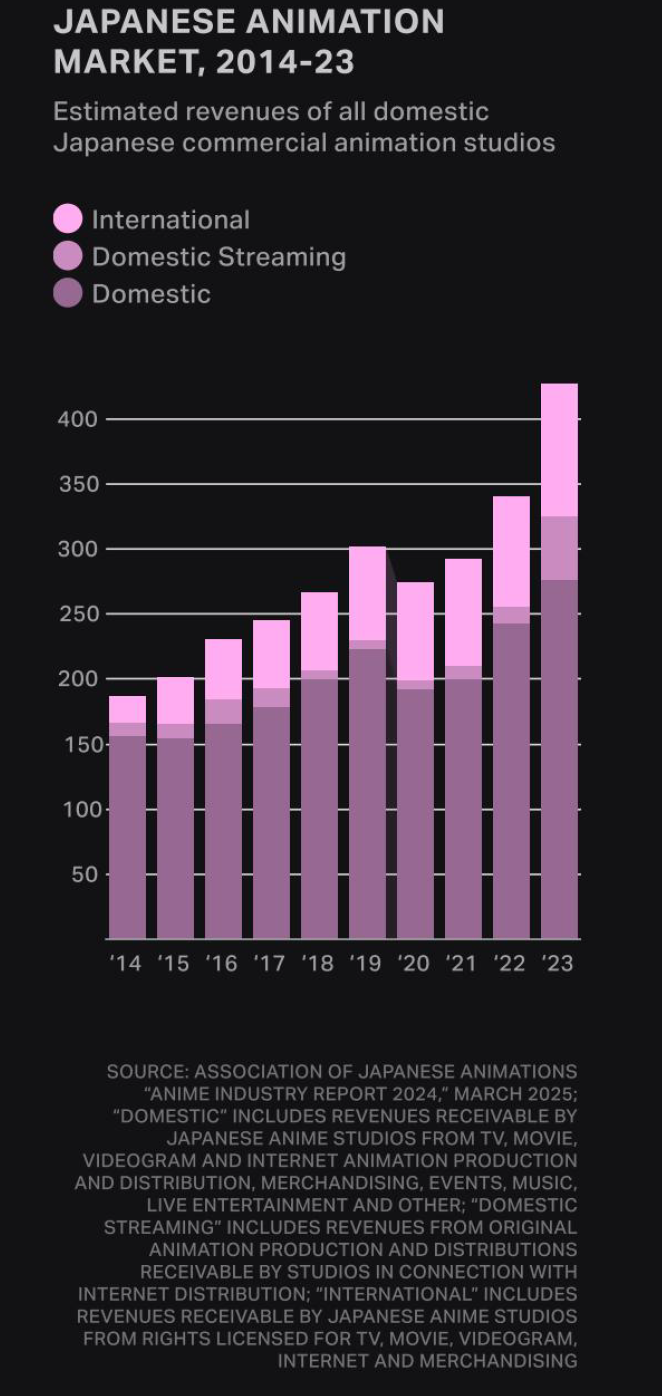

Japanese animation has evolved from a niche market to a global powerhouse. The industry's revenue soared from approximately 150 billion yen in 2014 to over 400 billion yen in 2023, representing a 2.7-fold increase. Remarkably, over 60% of this revenue now comes from international markets, solidifying Japan's position as the world's second-largest animation exporter after the United States.

Crunchyroll's dominance tells a compelling story. Since Sony Pictures' $1.2 billion acquisition in 2021, the platform has transformed from a distribution channel into the industry's largest producer. Its market share jumped from 50% in 2018 to an overwhelming 84% in 2024, while traditional cable networks saw their orders decline from 23 to 18 series over the same period.

K-Drama's Global Conquest

K-dramas have carved their own path to international success through distinctive storytelling, efficient production systems, and universal emotional themes. The genre's strength lies in its versatility - from romance and thrillers to zombie apocalypses - all delivered in digestible 8–16-episode seasons perfectly suited for binge-watching culture.

Global platforms have invested heavily in Korean content. Netflix's successes with "Squid Game," "Kingdom," and "Extraordinary Attorney Woo" have proven K-drama's worldwide appeal. Disney+ and Amazon Prime Video have followed suit, establishing local production deals and exclusive partnerships with Korean studios.

Generational Preferences Paint Clear Picture

The data reveals striking generational patterns. Among American teens (13-17), 59% prefer anime while 48% favor K-dramas. British young adults (18-28) show similar enthusiasm with 51% choosing anime and 41% selecting K-dramas. Even in Brazil (42% anime, 34% K-drama) and India (24% anime, 20% K-drama), both genres outperform traditional local content among younger demographics.

The Crunchyroll Model and K-Drama's Future

Crunchyroll's success offers a blueprint for K-drama's next evolution. The platform didn't just stream anime; it created an ecosystem - simultaneous releases, rapid subtitling, dubbed versions, merchandise, and direct collaboration with Japanese studios. This comprehensive approach transformed anime from subcultural interest to mainstream entertainment.

Korean companies are taking notice. CJ ENM's TVing is aggressively expanding into Japan and Southeast Asia. Wavve and Watcha are exploring international partnerships. Korea's major broadcasters - KBS, MBC, and SBS - are discussing a unified global platform. The creation of a "Korean Crunchyroll" - a dedicated K-content streaming service with global reach - appears increasingly viable.

Industry insiders predict such a platform could launch within 2-3 years, potentially backed by Korean conglomerates like Samsung or LG, or through partnerships with global tech giants seeking to differentiate their content offerings.

Cross-Cultural Influence Reshaping Entertainment

The influence of Asian content extends beyond viewership numbers. Western productions increasingly adopt anime aesthetics and K-drama storytelling techniques. Netflix's "Blue Eye Samurai" merged Western narrative with anime visual style to win multiple Emmy awards. Riot Games' "Arcane" borrowed heavily from anime action sequences and emotional expression. "K-pop Demon Hunters" represents a fusion of Korean and Japanese cultural elements.

This cross-pollination demonstrates that Asian content isn't just being consumed - it's fundamentally changing how stories are told globally.

Challenges and Opportunities Ahead

Both industries face significant challenges. Japanese animation struggles with chronic labor shortages, with animators earning only 60% of Japan's average wage while working 60+ hour weeks. Korean drama production faces escalating costs and intense competition for talent as global platforms drive up budgets.

AI technology presents both opportunity and threat. While it could improve production efficiency, creators worry about job displacement and artistic integrity. Both industries are cautiously experimenting with AI as a supplementary tool rather than replacement for human creativity.

The Streaming Era's New World Order

As 2025 unfolds, the landscape continues evolving. Crunchyroll plans 34 new series, maintaining its dominant position despite scaling back from 2024's peak. Netflix's reduction to a single anime series signals extreme selectivity rather than retreat. Cable networks attempt a comeback with 28 planned series.

The emergence of metaverse platforms, VR/AR technologies, and interactive content opens new frontiers for both anime and K-dramas. Gen Z and Gen Alpha's preference for short, impactful content drives adaptation of webtoons and web novels into animated and live-action formats.

Conclusion: A Shared Victory

Japanese anime and K-dramas aren't just competing; they're collectively redefining global entertainment. Each genre's unique strengths - anime's fantasy worlds and action sequences, K-drama's emotional depth and contemporary narratives - complement rather than cannibalize each other.

The potential emergence of a K-drama equivalent to Crunchyroll could further strengthen Asian content's global position. As Western productions increasingly embrace Asian storytelling techniques and aesthetics, the cultural influence becomes irreversible.

The true winners in this streaming revolution aren't platforms or production companies, but global audiences enjoying unprecedented access to diverse, high-quality content. As Japanese anime and K-dramas continue their parallel ascent, they're not just claiming market share - they're fundamentally transforming what global entertainment looks like in the 21st century.

"글로벌 슈퍼팬 장악한 K-드라마와 일본 애니메이션, 스트리밍 시대 ‘양대 축’으로 떠오르다"

일본 애니메이션 시장이 2023년 약 4,000억 엔(약 4조 3,600억 원)으로 급성장하며, 전체 매출의 60% 이상이 해외에서 발생할 정도로 글로벌 콘텐츠 산업의 중심축으로 자리잡고 있다. 특히 전문 스트리밍 서비스 크런치롤은 일본 애니메이션을 Z세대와 알파세대에 전달하며, 컬처 아이콘으로 부상한 막강한 팬덤을 형성하고 있다.

2025년 글로벌 콘텐츠 시장에서는 K-드라마와 일본 애니메이션이 서로 다른 강점과 팬덤으로 스트리밍 경쟁의 핵심 영역을 점령 중이다.

K-드라마는 독창적인 스토리와 빠른 제작 시스템, 글로벌 플랫폼의 적극적 마케팅을 기반으로 미주·아시아·남미 등에서 영향력을 확대하고 있다. 이에 반해 일본 애니메이션은 전통의 2D 제작과 강력한 IP 파워, 세대를 아우르는 팬 충성도 덕분에 국제 무대에 뚜렷한 존재감을 드러내고 있다. 이처럼 K-드라마와 일본 애니메이션은 각자의 색깔과 전략으로 글로벌 팬덤을 확장하며, 문화 콘텐츠 산업의 미래를 이끄는 양대 축으로 자리매김하고 있다.

<일본 애니메이션 시장(2014~2023년)의 연도별 수익(억 엔)>

![[스페셜 오피니언]CES에는 왜 이토록 많은 아시아 기업과 방문객들이 모이는가?](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/o8so22_202601121822.jpg)