K-FAST Global Roundtable: Opening New Chapter in Korea-US Streaming Collaboration

Led by Rasenberger Media's Cathy Rasenberger at New York's Harvard Club, Discussion Focuses on Korean FAST Channels' US Market Entry Strategy

New York, November 12, 2025 - A historic gathering was held to advance Korean FAST (Free Ad-supported Streaming TV) channels' global expansion. The 'K-FAST Global Roundtable' took place on November 12 at New York's Harvard Club, bringing together major Korean FAST channel operators and US platform representatives.

The event was organized and led by Cathy Rasenberger, a prominent consultant in the US media industry, and co-hosted by Korea's Ministry of Science and ICT (MSIT) and KAIT

Participating were six leading Korean FAST channel operators and two AI technology startups, including CJ ENM, NEW ID, SMR, K20, Hudson AI, and Dost 11. From the US side, key streaming platform and media tech industry representatives from Vizio, fubo Sports, A&E Networks, Wurl, Amagi, Local Now, TV Rev, and Canvas Space attended to discuss practical collaboration opportunities.

Rasenberger: "Tremendous Opportunity for Korea-US Partnership"

Cathy Rasenberger, who was Organizer and served as the overall moderator of the event, opened with remarks expressing gratitude to "Korea's Ministry of Science and ICT, KAIT, and K-EnterTech Hub for making this gathering possible today," adding "I hope this roundtable enables Korean and US companies to build substantial partnerships."

With over 20 years of experience in global media consulting, Rasenberger is recognized for her exceptional expertise in streaming platform strategy, content distribution, and global partnership development, particularly focusing on helping content businesses from global markets including Korea enter the US market. She is also the founder of Rasenberger Media, where she has been instrumental in bridging international content and innovative platforms, assisting numerous global players in successfully launching and scaling their presence within the highly competitive US streaming ecosystem.

Beginning the roundtable discussion, Ms. Rasenberger emphasized, "There's obviously a huge amount of opportunity for us to partner and work together," noting the "incredibly huge popularity of K-content in the US and around the world."

Strong Korean Government Support for FAST Industry

In his opening address, Changhun Baek Deputy Director of MSIT, stated, "The FAST industry is creating new opportunities in the global media market by combining Korean content with AI technology," adding, "The Korean government recognizes the potential of this future media industry and is committed to supporting its development."

Director Baek expressed strong government support, stating, "We will continue to support global collaboration across the entire ecosystem, including content production, platforms, and advertising technology." This demonstrates Korea's strategic positioning to become a core player in the global streaming ecosystem beyond simply being a content exporter.

Rapidly Growing US FAST Market: Opportunities by the Numbers

Global FAST Market Status and Outlook

TVRev co-founder Alan WolK is credited with coining the term 'FAST.' Since his definition, the FAST market has grown at a remarkable pace. In his keynote address, WolK diagnosed that "the era of 'monoculture' dominated by TV, radio, and newspapers has ended, and the era of 'Feudal Media' has arrived, where millions of self-sustaining communities exist across hundreds of platforms."

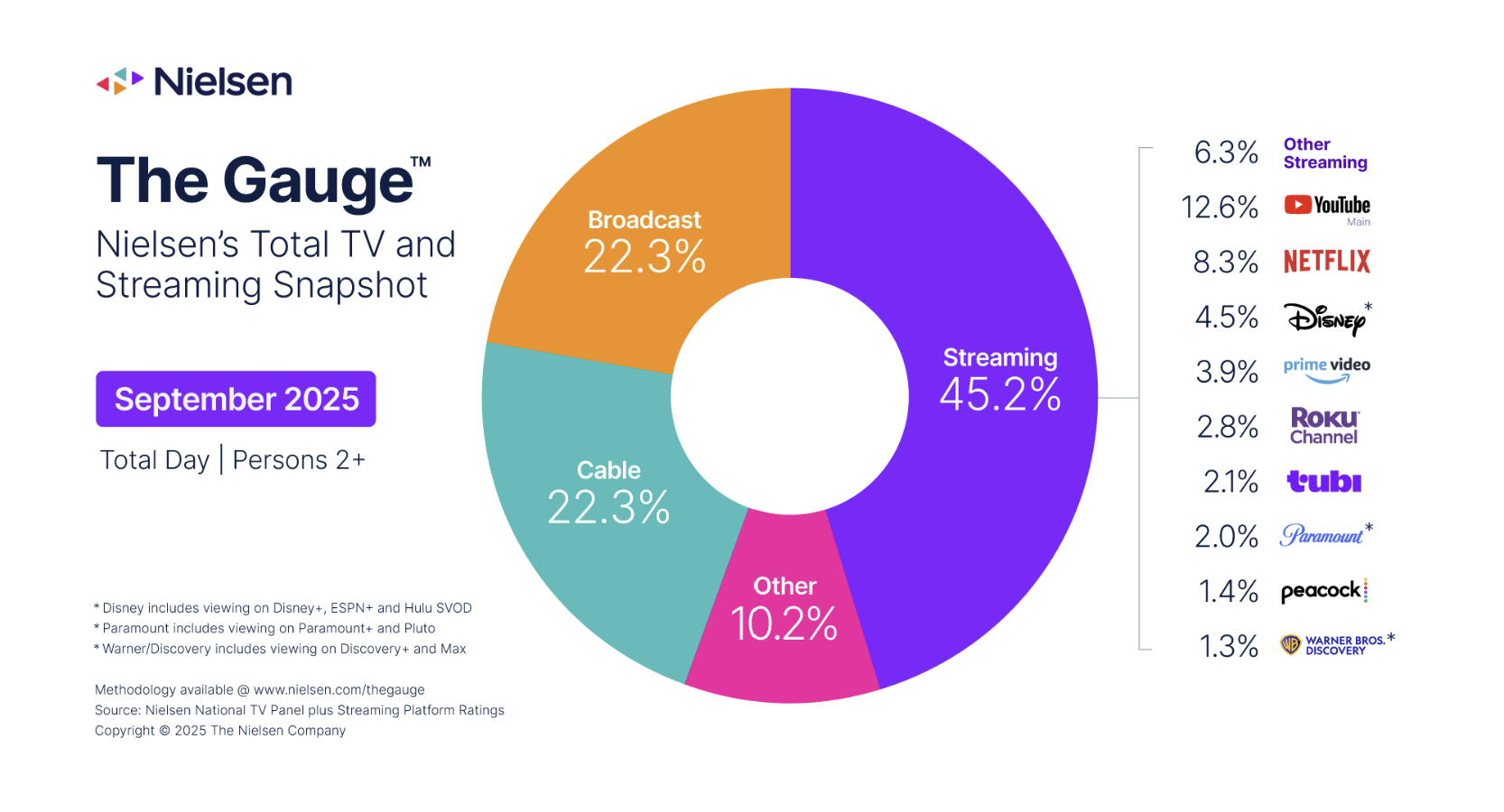

He noted that "YouTube and TikTok are emerging as new superpowers with global audiences," presenting statistics showing that "in the US, more people watch YouTube on TV than watch Netflix."

WolK advised Korean FAST operators to "use AI to find new audiences globally" and "leverage existing fandom for Korean content and K-pop to expand. Korean language classes are surging in Mexico."

Wurl's Data: Explosive FAST Market Growth

David Bernath, CEO of streaming tech company Wurl, demonstrated the rapid growth of the US FAST market through specific data. Wurl is the industry's largest media platform, supporting over 5,000 CTV channels, recording over 5.5 billion viewing hours monthly, and delivering content to over 600 million devices monthly.

Key statistics presented by David Bernath as of September 2025 include:

- Total FAST viewing time: 29% year-over-year increase

- FAST service accessing households: 12% increase

- Viewing time per household: 16% increase

- Average session time per channel: 25% increase

Particularly noteworthy is that the average household still watches only 3-4 FAST channels per month. Burnet analyzed, "This is far fewer than the 10-15 channels viewed during the cable TV era, indicating tremendous growth opportunity in terms of content discovery and diversity."

YouTube's TV Dominance: Warning and Opportunity

David expressed particular concern about YouTube's increasing TV viewing share. He stated, "A quarter of US streaming viewing time currently occurs on YouTube, and it will reach one-third by early 2026," noting that "YouTube CTV (Connected TV) viewing has surpassed mobile and computer viewing."

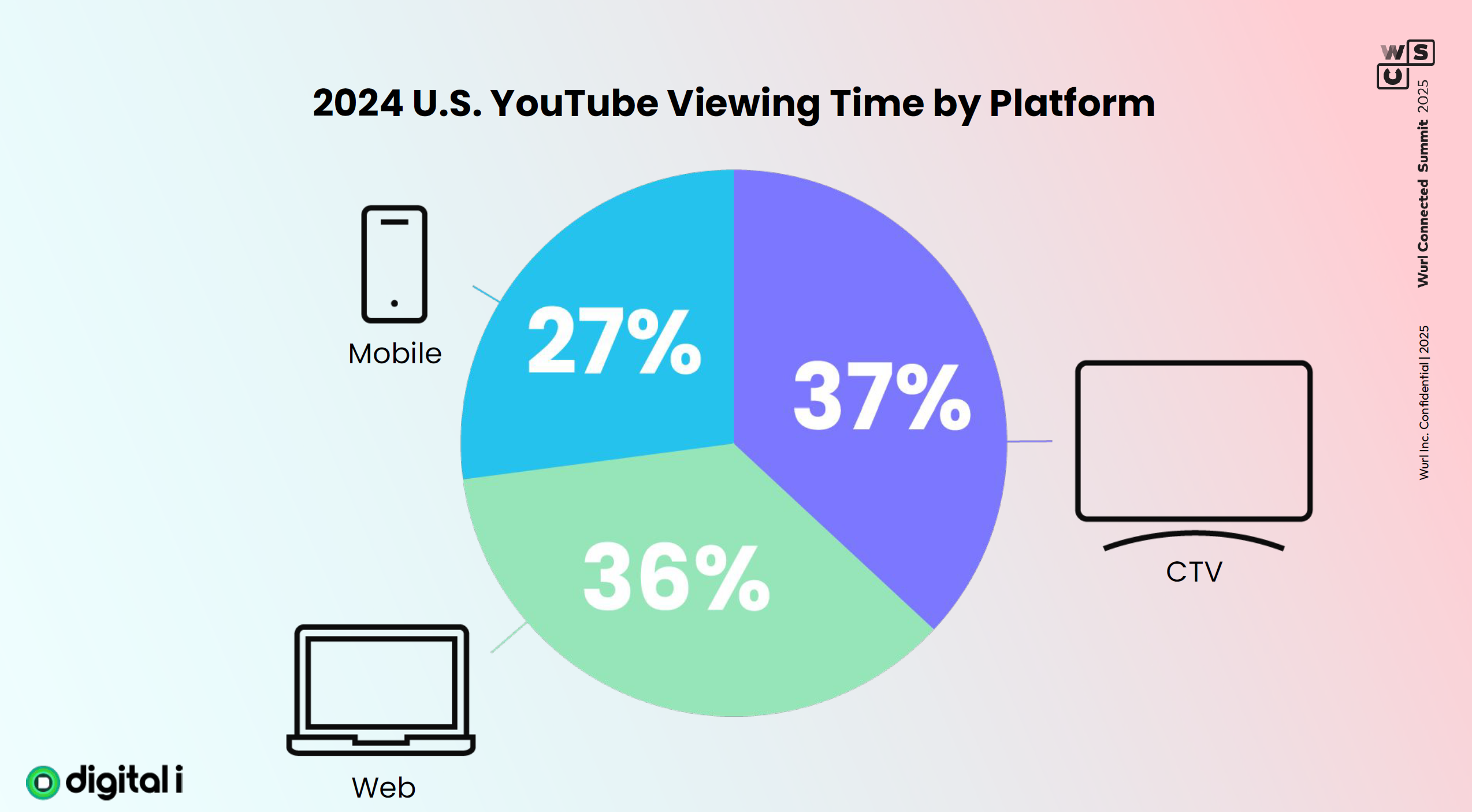

The surge in YouTube TV viewing in the US is noteworthy. YouTube CEO Neal Mohan stated last February that "TV has now become the primary device for YouTube viewing in the US." While personal devices like PCs and smartphones once dominated, a culture of family and friends watching together on large living room TVs has clearly established itself.

2024 US YouTube viewing platform distribution shows CTV at 37%, web at 36%, and mobile at 27%. With YouTube CTV viewing reaching 46% among viewers aged 35 and above, YouTube's TV expansion presents both opportunity and threat to FAST channels.

Bernath advised, "When establishing a FAST strategy, recognize it's a little bit of a race against time," adding, "You need to enter the market as quickly as possible to build connections with viewers and secure mind share."

Korean FAST Channels' Diverse Entry Strategies

CJ ENM: Leading US Market with 8 Channels

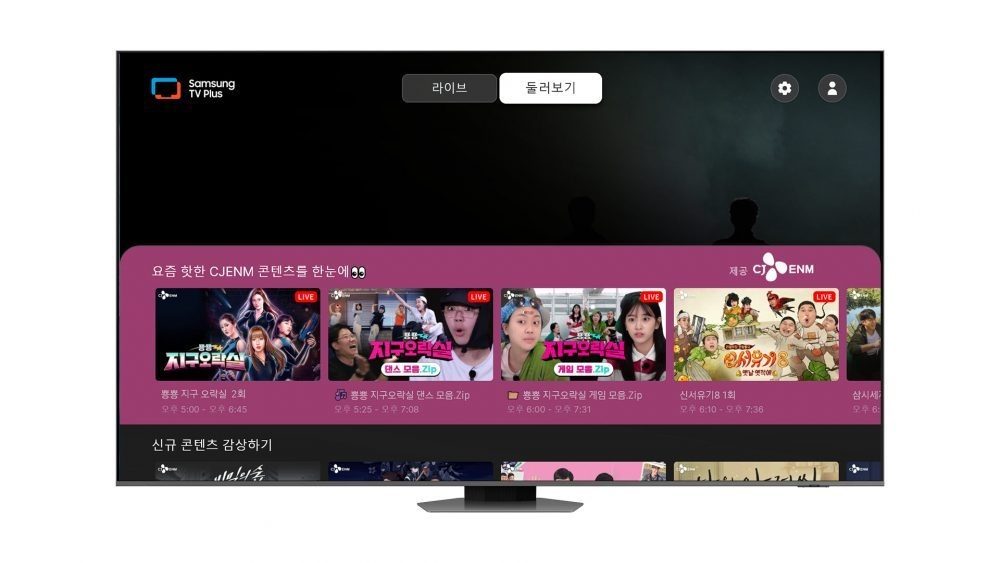

Leading Korean content company CJ ENM already operates eight FAST channels in the US. Manager Lee Nam-joo explained, "We are operating eight channels in the US. We have K dramas and K show, K food... we have more than 500 hours per channels."

CJ ENM's success lies not simply in quantitative content superiority but in establishing clear target audiences for each channel and providing customized content. They particularly gain global audience response by utilizing popular content already proven in Korea, such as Transit Love, Hotel Del Luna, and Street Woman Fighter.

NEW ID: Launching World's First AI-Dubbed K-Movie Channel

Jun Park, CEO of NEW ID, Asia's largest media tech company, made an innovative announcement: "Thanks to the Korean government, we can provide nine premium content FAST channels in fully English and Spanish," revealing plans to launch the world's first AI-dubbed FAST channel specializing in Korean films.

NEW ID is Asia's leading media tech company already operating over 400 FAST channels. Through the NEW KMOVIES channel, they're breaking down language barriers by providing premium K-movies like the "Along with the Gods" series starring Ma Dong-seok and Lee Jung-jae, and "The Attorney" starring Song Kang-ho, in local languages. Park emphasized, "Dubbing is very key part of boosting monetization."

SMR: Launching 'Series K' with Legacy Broadcaster Content

Jeon Seung-hoon, CEO of SMR, jointly established by Korea's two largest broadcasters MBC and SBS, announced the December launch of the "Series K" channel, stating, "We currently have over 100 titles and 2,000 episodes."

CEO Jeon explained, "The passion for K content has never been higher," adding, "Through our extensive catalog, we can customize and create content tailored to each platform's image or target audience."

SMR is preparing three thematic channels:

- Series K Love: Romantic comedies and family dramas

- Series K Kingdom: Historical dramas and fantasy

- Series K Edge: Action and crime thrillers

This demonstrates how Korean broadcasters' extensive content libraries can be utilized as new revenue sources in the global FAST market. Dramas that achieved high viewership in Korea, such as Stove League, Hwangjini, and Pasta, will be provided to global audiences through multilingual AI dubbing technology.

K20: New Approach to Gaming and K-Food Content

Jenna Kim, CEO of K20, a cable broadcasting and channel operation specialist, presented a differentiated strategy. "Gaming may not be as mainstream, but it's set for incredible growth in the future," she explained, introducing strategies specializing in gaming and K-food channels.

K20 is promoting Korean food culture globally through the FAST FoodON channel. Providing various formats including cooking recipes, mukbang, documentaries, and entertainment with proven food content such as Baek Jong-won's Les Misérables, they create differentiated value through proprietary advertising sales and data-driven strategy.

CEO Kim emphasized, "Our channel features major global gamers... It's 100% dubbed into English."

Accelerating K-Content Globalization with AI Technology

Hudson AI: AI Dubbing that Conveys Emotion

Hyunjin Shin CEO of Korean AI startup Hudson AI, emphasized differentiated technological capabilities: "We are focusing on delivering very authentic emotion, even in real time, like for the drama, film or sports game," revealing, "We support over 80 languages and dubbed over 300 hours of drama with CJ ENM this year."

Shin expressed confidence: "Google already adopted AI dubbing, but it has some limitation on the emotion, also in the real time serving. However, we can do that." This signifies that Korean AI technology has reached a level where it can convey not just simple translation but cultural nuances.

Shin expressed active willingness to collaborate, stating, "If you are interested in global monetization of K-content, please contact us."

Dost11: Revolutionizing Broadcaster Workflow

Yang Hyo-geol, CEO of Dost11, an AI media solution company and MBC subsidiary, introduced their "'Video Schooler' automatic indexing solution, where AI quickly analyzes and categorizes vast information when clips and videos are uploaded, enabling broadcast-related workers to use it more conveniently."

He also mentioned 100% AI-generated scene production technology using generative AI. "It's an impressive change for use in broadcasting," he emphasized, "Such technological innovation has become a key element in enhancing the competitiveness of Korean FAST channels by maintaining quality while reducing content production costs."

US Platforms' Response: "K-Content is a Treasure Trove"

Vizio's Active Interest: Considering Dedicated K-Content Hub

Greg Barnard, Senior Director at Walmart-acquired Vizio, expressed "very strong interest in K-content," particularly interest in AI dubbing technology's emotional expression capabilities.

Barnard emphasized, "Spanish content is a treasure trove, and unfortunately, for better or worse, my audience is not going to read subtitles. So dubbing is really critical." This accurately identifies US viewer characteristics, clearly showing why Korean FAST channels must invest in high-quality AI dubbing.

Barnard revealed, "We're considering placing a dedicated 'K-content hub' separately in our user interface (UI) where users can access all Korean content in one place," stating, "We want to create a space where anyone can easily access all K-content." This is interpreted as a strategic approach to present K-content as a whole brand to viewers, beyond simply providing individual channels.

Barnard emphasized that content 'discoverability' is paramount. "Good content remains good content—that fact doesn't change. The question is how easily accessible it is," he stated. "We're in the business of creating viewer habits, behaviors on our platform," advising, "You need to provide content that viewers repeatedly seek out, content that becomes habit-forming."

fubo Sports: "We're Already Partners"

Pamela Jovi of fubo Sports Network stated, "We're partners with every one of you," adding, "We're growing rapidly... we're always looking for new content."

Jovi expressed interest, "I was very interested in conversation about data," suggesting Korean companies must provide clear performance indicators and data when entering the US market. This means that beyond simply providing good content, data-driven performance measurement and optimization are essential.

A&E Networks: Exploring AI Dubbing

Jessica from A&E Networks stated, "We're definitely exploring AI dubbing," adding, "It's about knowing what content performs well and monetizes well." She expressed interest in specific business models, asking Korean companies, "We want to know what the average structure of these channels is."

Industry Experts' Market Outlook

Maria Rua Aguete, Senior Consultant at UK-based media research firm Omdia, emphasized Korean content's global competitiveness. "The whole world is now enthusiastic about Korean content," she asserted, "Platforms must have Korean content to succeed in the global market. This isn't just statistics—it's reality."

Maria added context: "Just a few years ago, Spanish content was most popular on Netflix. Everyone was absorbed in Spanish dramas. But now, Korean content is undoubtedly receiving attention worldwide."

She particularly analyzed, "Korean content isn't confined to one genre—romance, thriller, comedy, food, history combine together. This fresh combination creates new viewer experiences." Citing the "Bon Appetit" drama she watched, she explained, "It was a unique work blending time travel, food, history, and love."

According to Omdia survey data, as of Q2 2025, Korean FAST channels serviced overseas show drama as the predominant genre with 24 channels. However, areas are rapidly diversifying with news (3), food (2), sports, and music channels.

Maria noted, "Netflix has played the role of 'global ambassador' for Spanish and Korean content," assessing, "With blockbusters like 'Squid Game' distributed globally through Netflix, Korea has risen to the center of the global media market." She re-emphasized, "What Netflix does, everyone follows—'Squid Game' decisively elevated K-content's status."

Wurl's JJ: "We're the Uber Eats of the FAST Industry"

John Jun, Wurl's Asia-Pacific (APAC) Partnership Director, revealed, "I've lived in the US for over 35 years as a Korean American, but in the past, there was virtually no realistic way for Korean content to reach American audiences." He noted, "Now with technological advancement and the established FAST ecosystem, the situation has completely changed," comparing Wurl's role to food delivery platform Uber Eats. "Just as Uber Eats directly connects restaurants and customers, we use technology to seamlessly connect content creators and viewers worldwide."

John Jun added, "Wurl doesn't directly produce content—as a complete technology company, we maintain neutrality by not touching any creative work. However, if Korean media companies pursue full-scale entry into the US or the West in general, Wurl can be the optimal strategic partner in global FAST and CTV ecosystems, data-driven marketing support, and more."

Indeed, Wurl supports over 5,000 connected TV (CTV) channels and over 60 global streaming services, processing over 11 billion 30-second ad impressions monthly, making it one of the world's largest FAST/CTV distribution technology platforms. For Korean FAST channels targeting the US market, partnerships with Wurl can play a decisive role in viewer acquisition, advertising revenue growth, and data-driven channel operations.

The industry expects that "as Wurl has positioned itself as a global 'hub' connecting the two pillars of content and platforms, it will play an indispensable role in K-content and Korean media companies' North American expansion." Director John Jun also emphasized, "We will continue to actively support the globalization of Korean Wave content with technology, networks, and data."

Micro Dramas: New Opportunity or Challenge?

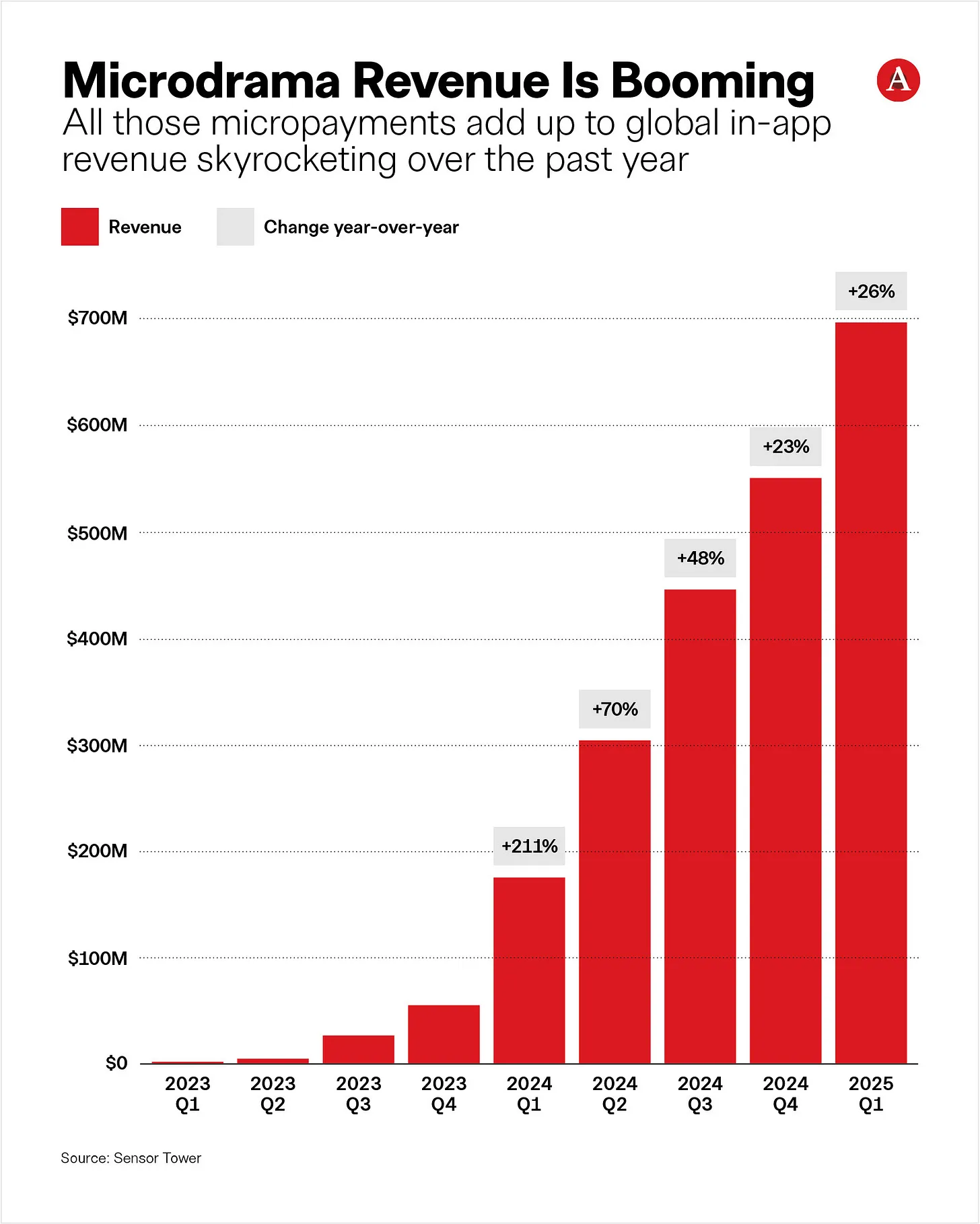

As the roundtable discussion reached its midpoint, an interesting discussion unfolded about 'micro dramas' and other short-form content markets.

CJ ENM noted, "Micro dramas are quite popular in China, but actually making profit is very difficult," showing a still-cautious attitude from a business perspective.

Regarding how it works, Vizio's Greg Barnard diagnosed, "For the micro drama genre to properly establish itself on CTV platforms, it needs a separate design called 'micro jumpers' that segments ad insertion points, not just simple break composition. This part is actually quite complex, and most CTV platforms currently don't have ad products to handle this."

TV Rev's Alan Wolk mentioned the business model of ReelShort, a representative micro drama platform, analyzing, "ReelShort is more like a powerful gaming platform than a content platform. A very small number of 'enthusiasts' among all viewers pay around $80 monthly and generate most of the revenue."

This discussion suggests that for new content formats to succeed, not just technology or creative trends, but innovative changes in business infrastructure like advertising and platform products must accompany them.

In other words, 'technology-business co-evolution' beyond short-term trends was emphasized as key.

Recommendations for Successful Collaboration

K-FAST US Entry Success Strategy - Rasenberger: "Content, AI Dubbing, Data, and Speed are Key"

At the K-FAST Global Roundtable, key US industry figures and Rasenberger presented K-FAST success strategies.

1. Content Curation that Creates Habits

Vizio's Greg Barnard emphasized, "The era of simply uploading good content is over. Curation technology that directly creates viewer behavior is needed." In the US FAST market, discoverability—making viewers naturally find channels within platforms—determines business success or failure. The advice is to connect Korean content's diversity and originality with data-driven curation.

2. High-Quality AI Dubbing that Conveys Emotion: Weapon of Localization

Industry voices continued that subtitles alone have limitations in capturing American audiences. Multiple platform strategy officials stated, "Korean AI dubbing technology that delicately conveys emotion will determine K-content's global success." Startups like NEW ID, Hudson AI, and Dost11 are already standing out in the market with AI dubbing and broadcast workflow innovation.

3. Building Trust with Data and Performance Metrics

fubo's Director Pamela stated, "Performance metrics and data transparency are key to partnerships." Systematically analyzing viewing time, completion rates, demographics, and other data to share substantial information with partners and advertisers is identified as an essential element for US market entry success.

4. Fast Market Entry: Race Against Time

Wurl's Dave Burnet pointed out, "This market is urgent. YouTube is already taking 25% of TV viewing time, overwhelming traditional broadcasting." For FAST channels to survive competition, swift entry and rapid local network building are important. In this regard, CJ ENM is attacking the US market with 8 channels, NEW ID has opened the world's first AI-dubbed K-movie channel, SMR focuses on strategic curation of legacy broadcaster content, and K20 targets niches with gaming and K-food specialization.

Re-evaluation of K-Content Value in Global Market

Omdia's Maria stated, "If you want to succeed, you must have Korean content." Indeed, starting with Netflix, Disney, Warner, and FAST platforms have successively introduced K-content.

Rasenberger emphasized, "Korea-US media collaboration and networking have become rapidly important. The Korean government and industry must strategically approach by understanding American viewer habits, dubbing technology, data performance, and other characteristics."

[Event Overview]

Date: November 12, 2025

Location: Harvard Club, New York

Hosts: Korea Ministry of Science and ICT (MSIT), National IT Industry Promotion Agency (NIPA)

Moderator: Cathy Rasenberger

Organizer: Rasenberger Media

Participating Companies:

- Korea: CJ ENM, UID, SMR, K20, Huddleup AI, 11cast

- US: Vizio, fubo Sports, A&E Networks, Wurl, Amagi, Local Now, TV Rev, Canvas Space

[Key Statistics]

US FAST Market Growth Indicators (September 2025, Wurl Data)

- Total FAST viewing time: 29% year-over-year increase

- FAST accessing households: 12% increase

- Viewing time per household: 16% increase

- Average session time per channel: 25% increase

- Average monthly channels viewed per household: 3-4 (growth opportunity exists compared to 10-15 during cable TV era)

YouTube CTV Market Dominance

- 25% of US streaming viewing time (projected 33% by early 2026)

- 2024 US YouTube viewing platform distribution: CTV 37%, Web 36%, Mobile 27%

- YouTube CTV viewing among 35+ age group: 46%

- YouTube CTV viewing has surpassed mobile and web viewing

Wurl Platform Scale

- Supports 5,000+ CTV channels

- 5.5+ billion viewing hours monthly

- Reaches 600+ million unique devices monthly

- 11+ billion 30-second ad impressions monthly

- Supports 60+ global streaming services

Global K-FAST Channel Status (Omdia, Q2 2025)

- Drama: 24 channels

- News: 3

- Food: 2

- Sports: 2

- Music: 2

- Other (faith, children, general, entertainment, film, animation): 1 each

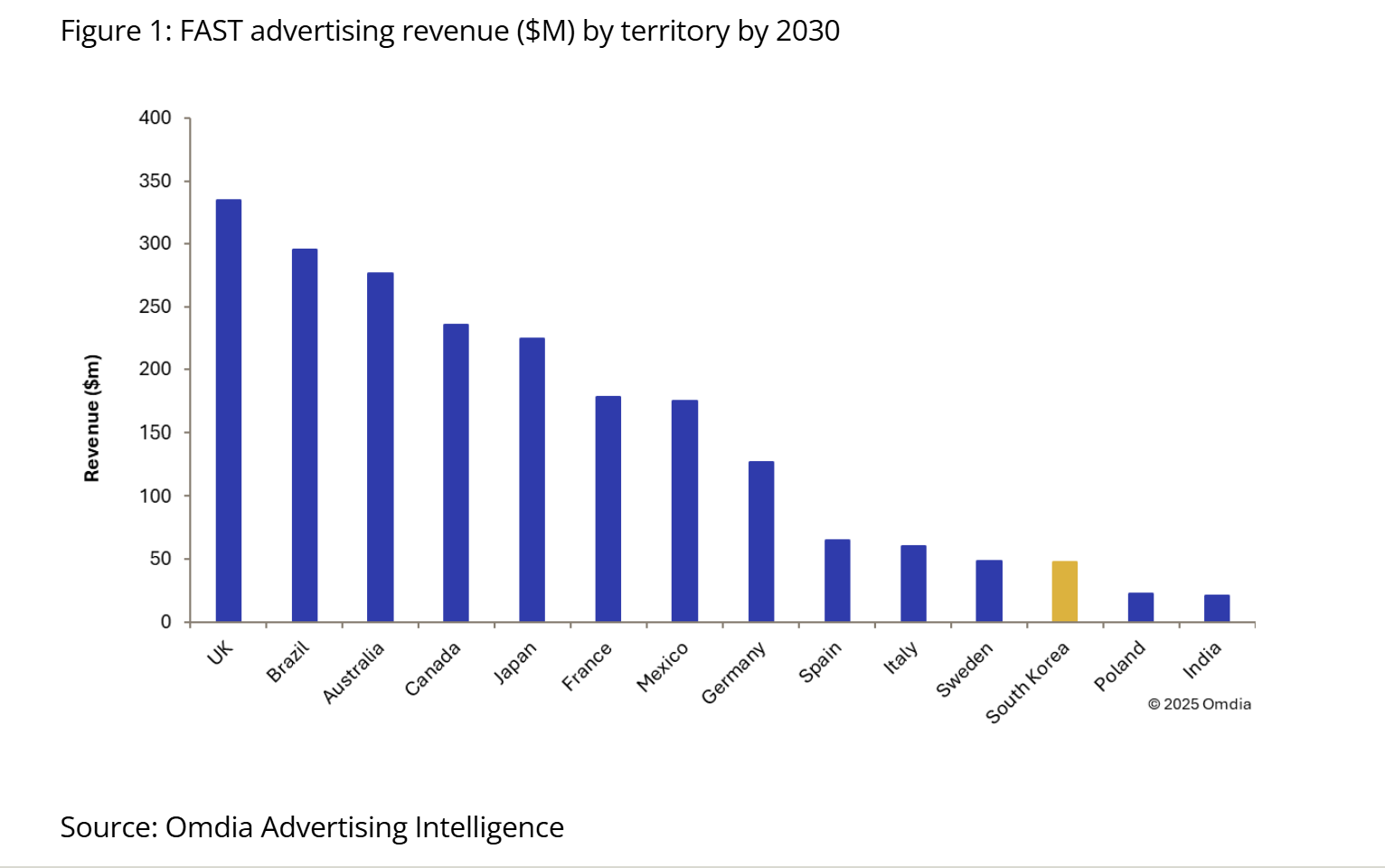

Global FAST Market Outlook (Omdia)

- 2020: $800 million

- 2030 projection: $11 billion (approximately 14x growth in 10 years)

- US market share: 76%

- Korea market size projection (2030): Approximately $50 million (world's 12th largest FAST market)

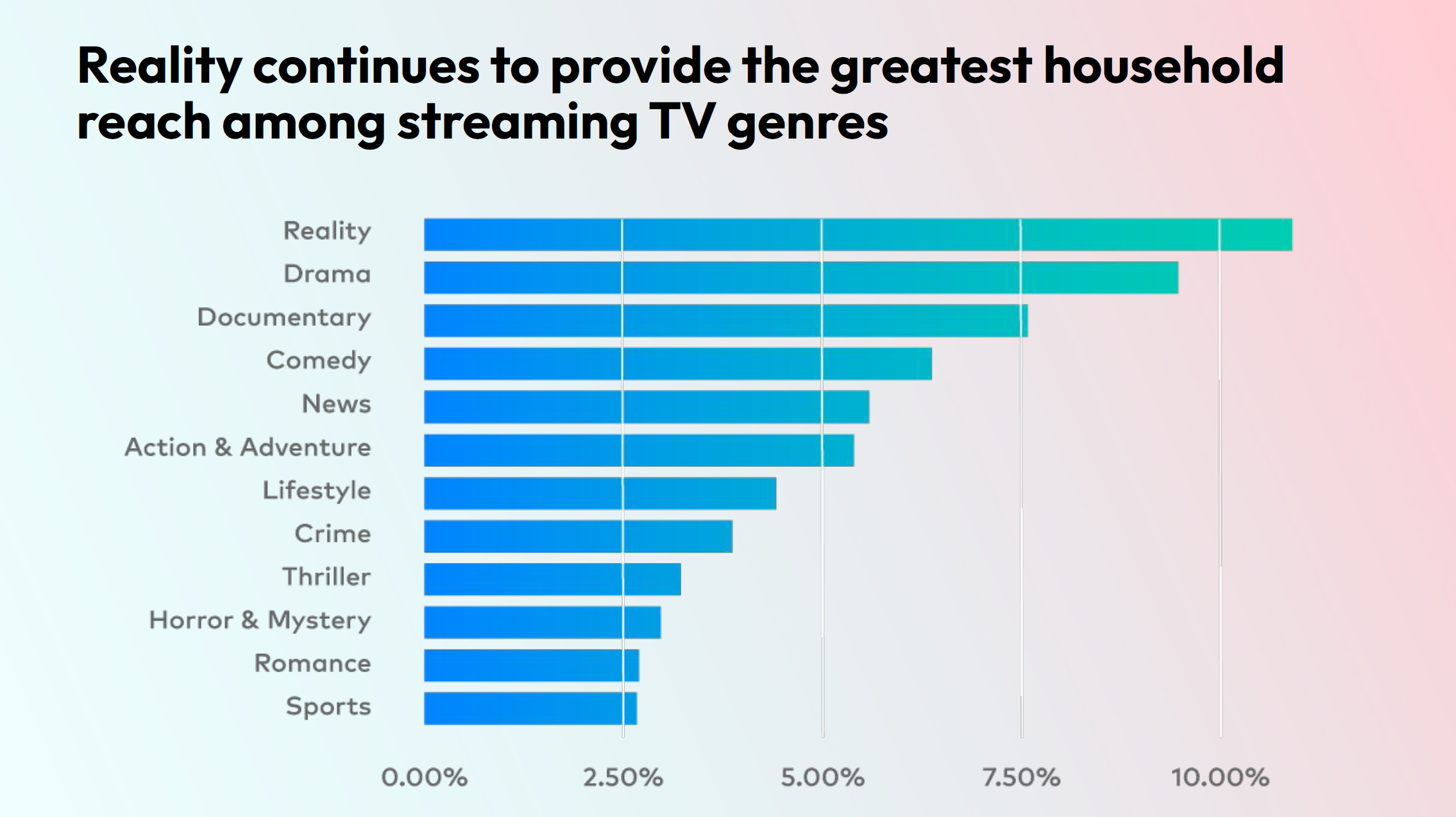

FAST Viewing Genre by Household Reach Rate

- Reality

- Drama

- Documentary

- Comedy

- News (Followed by action/adventure, lifestyle, crime, thriller, horror/mystery, romance, sports)

Attendees: Thank you, Ms. Rosenberger

| Country | Organization/Company | Name | Title |

|---|---|---|---|

| USA | Rasenberger Media and Sports Studio | Cathy Rasenberger | President |

| USA | Omdia | Maria Rua Aguete | Senior Research Director, Media & Entertainment |

| USA | TV Rev | Alan Wolk | Co-Founder |

| USA | WURL | David Bernath | CEO |

| USA | VIZIO | Greg Barnard | Senior Director, Acquisition |

| USA | Fubo Sports Network | Pamela Duckworth | Head |

| USA | Fubo | Isabel Bonebrake | Director, Content Strategy |

| USA | Canvas Space | Vignesh Ramswamy | Founder |

| USA | A&E | Jessica Hermanowski | VP, Product Operations and Strategy |

| USA | The Weather Group | Tom O’Brien | President |

| USA | CableFax | John Saavedra | Senior Editor |

| USA | Omdia | Maria Rua Aguete | Head of Media and Entertainment |

| USA | WURL | John Jun | Head of Strategic Partnerships |

| USA | Amagi | Stephen Bach | News and Strategic Accounts Lead |

| USA | Fubo | Biana Illion | Head of PR |

| Korea | NEWID | June Park | CEO |

| Korea | NEWID | Jin Gu Lee | BD Manager |

| Korea | DOST | Hyo Geol Yang | CEO |

| Korea | SMR | Seung Hun Jeon | CEO |

| Korea | Hudson AI | Hyunjin Shin | CEO |

| Korea | CJ ENM | Nam Ju Lee | Director |

| Korea | CJ ENM | So Young Choe | Manager |

| Korea | K20 | Jenna Kim | CEO |

| Korea | Ministry of Science and ICT (MSIT) | Changhun Baek | Deputy Director |

| Korea | Korea Association for ICT Promotion (KAIT) | Hyeongjun Park | Team Leader |

| Korea | Korea Association for ICT Promotion (KAIT) | Dongkun Cho | Deputy General Manager |

| Korea | Korea Association for ICT Promotion (KAIT) | Changil Chae | Deputy General Manager |

| Korea | Korea Association for ICT Promotion (KAIT) | Yongho Lim | Deputy General Manager |

| Korea | Korea Association for ICT Promotion (KAIT) | Wonki Kim | Team Leader |

| Korea | Korea Association for ICT Promotion (KAIT) | Eunjin Hu | Deputy General Mana |

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)