The Living Room War Enters a New Phase: Substack TV App Launch Signals Battle for the Big Screen

From Newsletter Platform to Video Platform, Now to TV... The Living Room Is Social Media's Final Destination

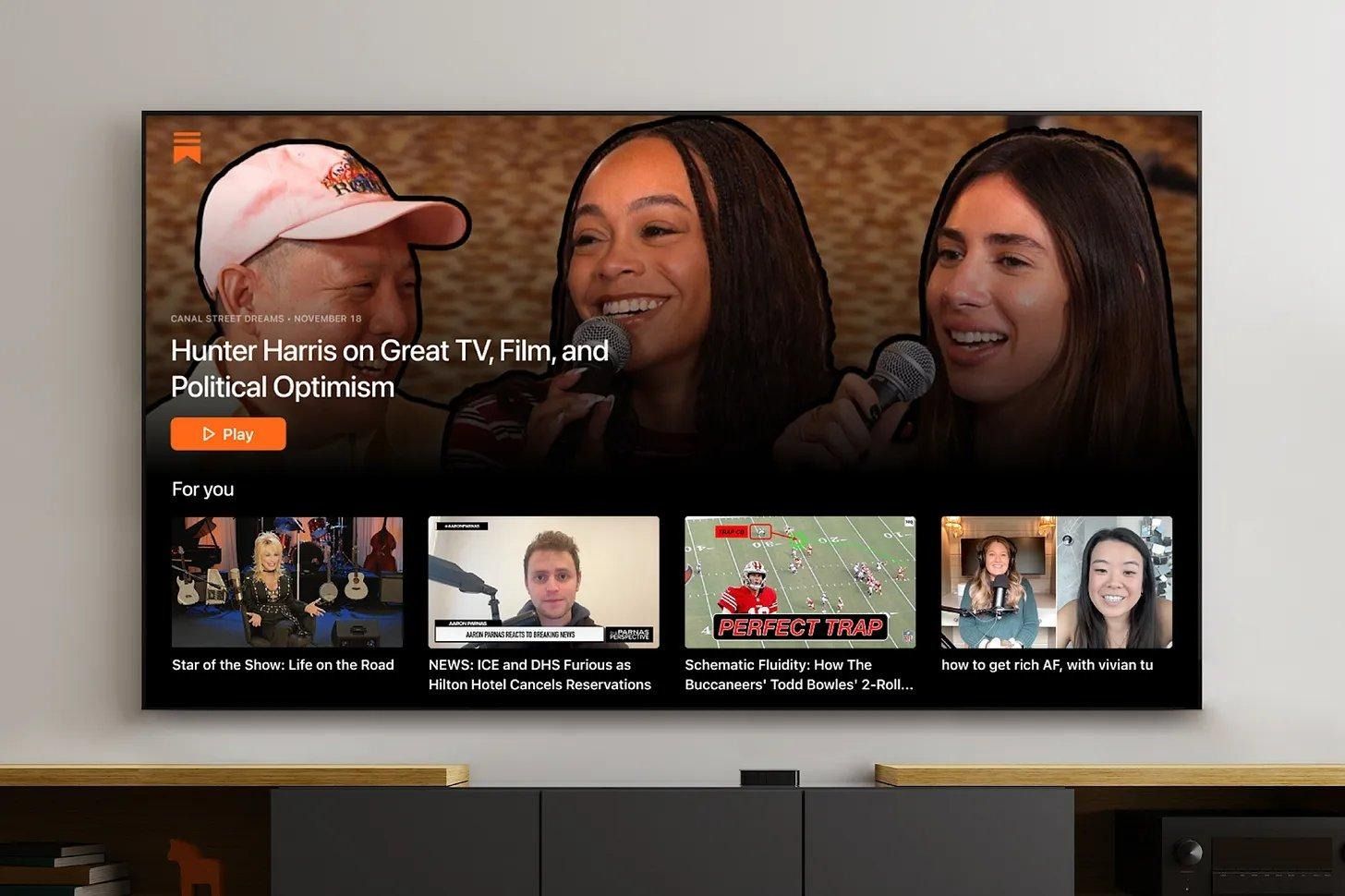

Substack TV app interface. The 'For You' section lets subscribers browse subscribed content and recommended videos. (Source: Substack)

Email newsletter platform Substack launched its TV app for Apple TV and Google TV on January 22, 2026. A platform built for reading has moved into video, and now it's conquering the living room TV.

But the battle for the living room is shifting again. Just one day after Substack's TV app launch, on January 23, TikTok finalized its U.S. joint venture. With Oracle, Silver Lake, and MGX each holding 15%, and U.S. investors controlling 80.1% total, TikTok's American operations have stabilized.

The platform that shut down its TV app in June 2025 has regrouped and may now re-enter the living room market. Meanwhile, Samsung TV Plus is recruiting mega-creators like MrBeast and Mark Rober for FAST channels, Netflix is pursuing an $83 billion acquisition of Warner Bros., and Instagram has launched its own TV app. The 'living room war' has entered a new phase.

KEY TAKEAWAYS

>> TikTok finalizes U.S. joint venture on January 23 - Oracle, Silver Lake, MGX each hold 15%, ByteDance retains 19.9%

>> TikTok TV app shutdown in June 2025 may be reversed - potential return to living room market with 200M+ U.S. users

>> Samsung TV Plus recruits MrBeast, Mark Rober, Dhar Mann for FAST channels - 'Creators are the new media startups'

>> Three-way battle: Substack 'subscription-based' vs FAST 'ad-supported free' vs TikTok 'short-form'

>> Netflix's Sarandos: 'TV is now everything, Instagram is coming next' - pursuing $83B Warner Bros. acquisition

>> FAST market projected to reach $11B by 2030 - Substack bets on 'long-form content' differentiation

New Players Enter the Living Room TV Market

On January 22, 2026, Substack - a platform that began as an email newsletter service - launched a beta TV app for Apple TV and Google TV. A platform built for reading has moved into video, and now it's reaching into the living room.

But just one day after Substack's TV app launch, on January 23, news broke that could reshape the living room battlefield. TikTok's Chinese parent company ByteDance finalized the establishment of 'TikTok USDS Joint Venture LLC.' Oracle, Silver Lake, and Abu Dhabi-based MGX each hold 15% stakes, while ByteDance retains only 19.9%. With U.S. and global investors holding 80.1% total, the 'majority American ownership' requirement has been met.

This opens the possibility for TikTok - which shut down its TV app in June 2025 - to regroup and re-enter the living room market. If TikTok, with over 200 million U.S. users, relaunches its TV app, it would become a formidable competitor not just for Substack, but for Samsung TV Plus, Instagram, and YouTube as well.

The living room war is already intense. Throughout 2025, Samsung TV Plus aggressively recruited YouTube mega-creators including MrBeast, Mark Rober, and Dhar Mann for its FAST channels. Two days before Substack's TV app launch, on January 20, Netflix co-CEO Ted Sarandos declared: "The TV landscape has never been more competitive than it is today" and warned that "Instagram is coming next."

Traditional broadcasters, streaming services, social media platforms, FAST channels, and independent creators are all competing for the same screen. What's particularly notable is the clash of business models: Substack's 'subscription-based' model, Samsung TV Plus/Tubi/Roku's 'ad-supported free (FAST)' model, and TikTok's 'short-form advertising' model are all going head-to-head on the same living room TV.

Substack's Official Announcement: 'A Natural Home for Long-Form Content'

Source: Substack Official Blog (https://on.substack.com/p/introducing-the-substack-tv-app-now)

Substack announced its TV app launch through its official blog, making its identity clear: "Substack is home to the best long-form content that creators work hard on and subscribers invest their time in," and "now these thought-provoking videos and livestreams can be properly experienced in their natural home - TV."

What Substack emphasizes is 'long-form' and 'immersive.' Not TikTok's 15-second clips or Instagram Reels' short videos, but content that viewers can 'settle in' to watch deeply. This positions Substack differently from the entertainment and educational content of MrBeast and Mark Rober recruited by Samsung TV Plus, and the short-form content TikTok might bring back.

Features at Launch

The initial TV app version focuses on stable, high-quality viewing experiences, with plans to continuously improve based on actual usage patterns. Features available to subscribers at launch include: watching video posts and livestreams from subscribed creators and publications, a 'For You' section showing subscribed content and recommended videos, and dedicated pages to explore more videos from specific publications.

Both free and paid subscribers can log into the TV app, with viewing permissions matching their current subscription level. Importantly, creators already posting videos automatically have their content available on the TV app without any additional work. For creators, this means gaining a new distribution channel with zero extra effort.

Examples of content available on the TV app include Dolly Parton reflecting on her entertainment career journey, George Saunders reading from his books, and Tina Brown's interviews with major figures in news and culture. All deep, long-form content.

Creator Reactions: 'Revolution'

Veteran journalist and former CNN anchor Jim Acosta, who hosts a daily news show using Substack's live video feature, expressed strong enthusiasm. "I'm thrilled to announce that the Substack revolution is coming to television," he said. "This is a game-changing moment for the rise of independent media. Substack has proven that legacy media consumers are not only looking for new alternatives, but actually finding them."

Chris Cillizza, a CNN veteran political reporter now running the Substack newsletter 'So What' while actively producing video content, said: "Video doesn't have to live in just one place. It should be wherever viewers choose to be. The Substack TV app does exactly that."

Both are legacy media veterans, and their statements reflect the direction of talent movement in the media industry. Cable news anchors and reporters are moving to independent platforms, and now those platforms are returning to TV - a circular structure is forming.

The Ankler: 'Substack's TV Move Is a Precursor to Advertising'

Source: The Ankler 'Like & Subscribe' / Natalie Jarvey (https://theankler.com/p/scoop-substack-is-launching-a-tv)

Hollywood and media industry publication The Ankler broke the Substack TV app story exclusively, providing in-depth analysis of the strategic implications and industry context not revealed in the official announcement.

Full Pivot to Video Platform: According to Ankler reporter Natalie Jarvey, Substack has been actively recruiting video-focused creators since introducing live video in January 2025. Jim Acosta, Katie Couric, Aaron Parnas, and Dolly Parton are notable examples.

CEO Chris Best told The Ankler via email: "By enabling live shows, podcasts, videos, and ultimately all articles to be viewed on TV, we're helping users spend more time with media that's truly valuable."

Precursor to Advertising Business: A key aspect of The Ankler's report is Substack's potential entry into advertising. Substack has positioned itself as an 'ad-free platform' since its founding. However, according to The Ankler, Substack has recently shown a more open attitude toward advertising.

In 2025, Substack raised $100 million from The Chernin Group, BOND, sports agent Rich Paul, and Andreessen Horowitz, achieving an $1.1 billion valuation. In this context, the TV app launch can be interpreted not just as distribution expansion, but as groundwork for an advertising business. TV advertising commands higher rates than mobile or web advertising. Building a TV viewer base now would enable higher revenue when video advertising is eventually introduced - a model already proven by Samsung TV Plus, Tubi, and Roku.

TikTok Regroups: U.S. Joint Venture and TV App Comeback Potential

TikTok U.S. Joint Venture Finalized: 'Owned by Great American Patriots'

Source: Reuters (January 23, 2026)

One day after Substack's TV app launch, on January 23, 2026, TikTok's Chinese parent company ByteDance announced it had finalized the establishment of 'TikTok USDS Joint Venture LLC.' This joint venture will protect U.S. user data, apps, and algorithms through data privacy and cybersecurity measures.

The joint venture's ownership structure: Cloud computing giant Oracle, private equity firm Silver Lake, and Abu Dhabi-based MGX each hold 15% as 'managing investors.' ByteDance retains only 19.9%, with U.S. and global investors holding 80.1% total, meeting the 'majority American ownership' requirement.

Additional investors include Dell Family Office (founder Michael Dell's investment firm), Vastmere Strategic Investments, Alpha Wave Partners, Revolution, Merritt Way, Via Nova, Virgo LI, and NJJ Capital.

President Donald Trump praised the deal on social media, stating: "TikTok will now be owned by a group of Great American Patriots and Investors, the Biggest in the World." He also thanked Chinese President Xi Jinping "for working with us and, ultimately, approving the Deal."

TikTok TV App Comeback: Targeting 200M U.S. Users' Living Rooms

TikTok's restructuring also has implications for TV market competition. TikTok shut down its TV app service on June 15, 2025. At the time, this was interpreted as service reduction amid U.S. TikTok ban discussions. However, with the joint venture now stabilizing U.S. operations, the possibility of TikTok relaunching its TV app has emerged.

TikTok's U.S. user base exceeds 200 million. President Trump himself has over 16 million followers on his personal TikTok account and has publicly stated that TikTok contributed to his re-election. The White House also opened an official TikTok account in August 2025.

If TikTok relaunches its TV app, it would be a formidable competitor for Substack. Even if Substack differentiates with 'long-form immersive content,' TikTok's 15-second short-form could still be powerfully engaging in the living room. Instagram Reels launching its 'IG for TV' app follows the same logic.

However, one reason TikTok's TV app shut down in 2025 was the question of short-form content's suitability for TV. Translating TikTok's core experience - vertical format, short videos, rapid transitions - to horizontal TV screens remains a challenge both technically and in terms of user experience. How TikTok solves this problem upon its return will be worth watching.

FAST Channels' Creator Battle: Samsung, Tubi, and Roku's Offensive

Samsung TV Plus: 'Creators Are the New Media Startups'

Source: Samsung Newsroom, Hollywood Reporter, Tubefilter

Existing FAST platforms that have been dominating living room TVs are also on alert with Substack's entry. After all, there's no reason Substack couldn't launch its own FAST channel. FAST platforms and Substack overlap in content provision - FAST channels also heavily depend on 'creator economy' content.

About two months before Substack entered the TV market, on November 12, 2025, Samsung TV Plus simultaneously launched former NASA engineer-turned-YouTuber Mark Rober's first FAST channel 'Mark Rober TV' across 18 countries. Recruiting Mark Rober - who has 71 million YouTube subscribers - represented the pinnacle of Samsung's aggressive creator acquisition strategy.

Salek Brodsky, SVP and Global Head of Samsung TV Plus, declared: "Samsung TV Plus is shaping the next era of television as a premium destination for world-class Creators, redefining what entertainment looks like on the biggest screen in the home."

Samsung TV Plus's creator lineup is already formidable. MrBeast (the most-subscribed individual YouTube channel), Dhar Mann, Michelle Khare, The Try Guys, Smosh, Donut Media, and Epic Gardening already operate dedicated channels on Samsung TV Plus. In North America alone, 11 creator channels are available, with total subscribers exceeding 175 million.

Particularly notable is Samsung TV Plus's industry-first FAST original content production deal with Dhar Mann Studios. 13 original episodes will be produced exclusively for Samsung TV Plus. Moving beyond repackaging existing YouTube videos, FAST platforms are now directly investing in content production.

Mark Rober: 'You Don't Cannibalize Audiences by Moving to Different Mediums'

Source: Hollywood Reporter (November 12, 2025)

Mark Rober explained his reasons for entering FAST channels in an interview with The Hollywood Reporter: "We found that you generally don't cannibalize an audience by moving to a different medium. It seems weird, but people who are generally on Facebook are on Facebook, people who are generally on YouTube are on YouTube, people that are generally on Netflix are on Netflix. So with this, we saw an opportunity of just expanding our mission of reaching as many brains as possible with the best partner in this space for FAST channels, which is Samsung TV Plus. It was kind of a no brainer, to be honest."

Rober's statement reveals why creators find FAST channels attractive. FAST channels offer what YouTube cannot: premium advertising rates and global distribution without platform algorithm uncertainty. Traditional TV maintains higher CPMs (cost per thousand impressions) than digital advertising, making the economics attractive even with smaller total viewership.

Interestingly, Mark Rober also signed a multi-project deal with Netflix in August 2025, bringing his science experiment content to Netflix and developing a Kids & Family competition series for 2026 release with Jimmy Kimmel's Kimmelot production company. One creator existing simultaneously on YouTube, FAST (Samsung TV Plus), and subscription streaming (Netflix) exemplifies the multi-platform strategy.

Tubi and Roku's Creator Offensive

Source: Hollywood Reporter (October 22, 2025), StreamTV Insider

Samsung isn't alone in recruiting creators. Fox-owned Tubi secured a major deal in August 2025 for 5,000 episodes of content from popular YouTubers and TikTokers including MrBeast. MrBeast YouTube channel seasons 6-8 (2023-2025 videos) are available on Tubi.

Rich Bloom, Tubi's EVP for Creators, stated: "Our point of view is that creators are the new media startups. They own their own IP, they have distribution, they have these built-in fandoms." This captures the fundamental shift in the creator economy. Creators are no longer content suppliers dependent on platforms - they're growing into independent media companies.

The Roku Channel has also been seriously adopting creator FAST channels since 2023, featuring content from MrBeast, Hot Ones, Mythical Entertainment's Rhett & Link, and Unspeakable. Lisa Holme, Roku's head of content, explained: "FAST is emerging as an attractive method for creators since it offers a curated way for them to reach incremental audiences that they're not already connecting with YouTube and other social platforms."

The Platform War for the Living Room

YouTube's Living Room Dominance: 'They Are TV'

Source: Nielsen Media Distributor Gauge, Hollywood Reporter (January 20, 2026)

To understand the competition between Substack, FAST channels, and TikTok, we must first examine YouTube's position in American living rooms. As Ted Sarandos put it, YouTube is no longer just a video platform - it is TV.

According to Nielsen's latest data, YouTube accounts for 12.7% of total U.S. TV viewing - the #1 single platform (December 2025). In July 2025, it peaked at 13.4%. A digital platform has become the living room's master, surpassing Netflix, Disney+, and Amazon Prime Video.

Sarandos described YouTube's transformation in Netflix's January 20, 2026 earnings call: "YouTube is no longer just UGC (user-generated content) and cat videos. YouTube has feature films, new episodes of scripted and unscripted TV shows. They have NFL football games and the Oscars. BBC is about to produce original content for YouTube. They are TV. So we compete with them on every dimension - for talent, for advertising dollars, for subscription dollars, and for all forms of content."

Instagram's TV Push: 'Instagram Is Coming Next'

Source: Meta Official Blog (https://about.fb.com/news/2025/12/instagram-for-tv/), Hollywood Reporter

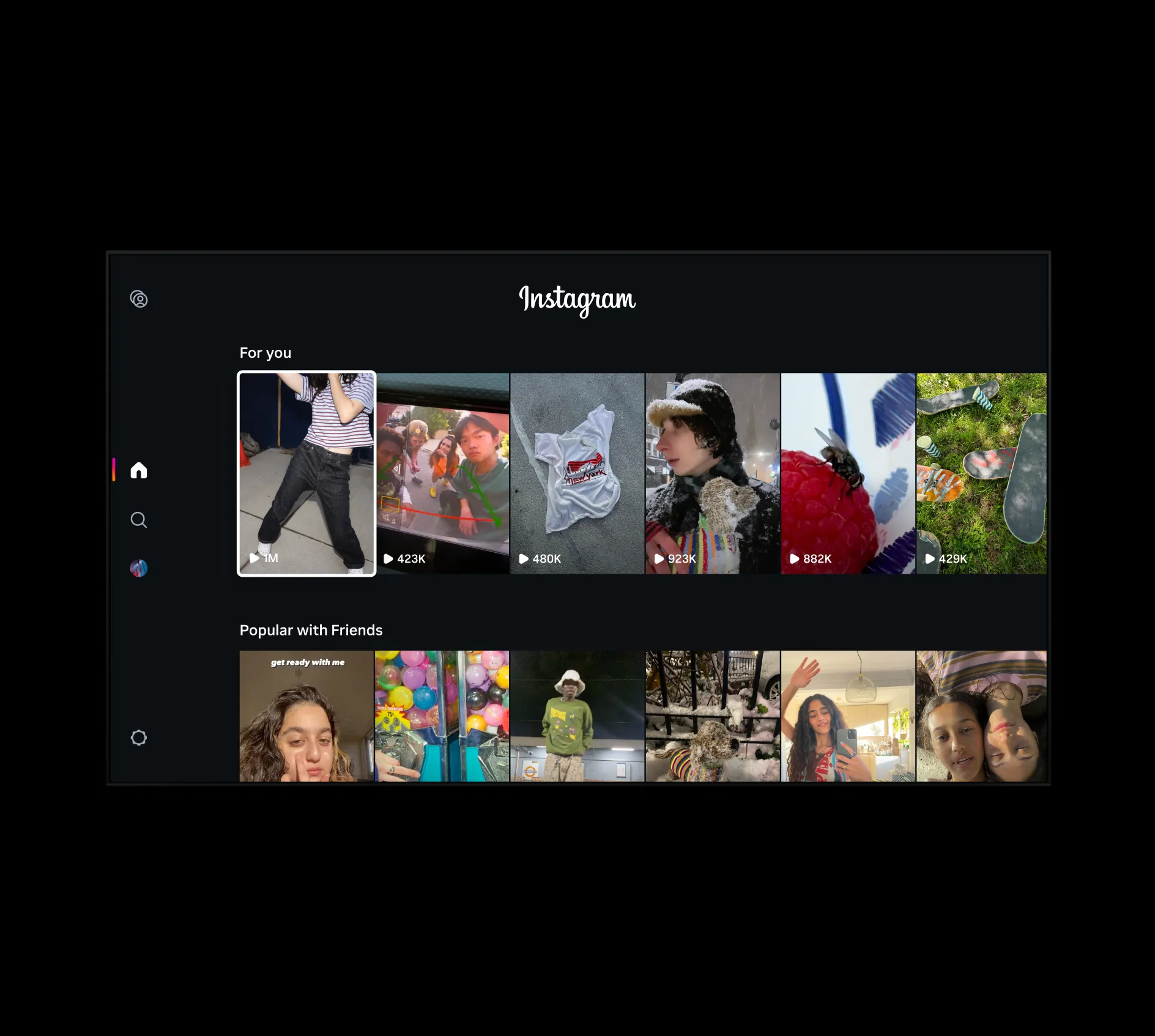

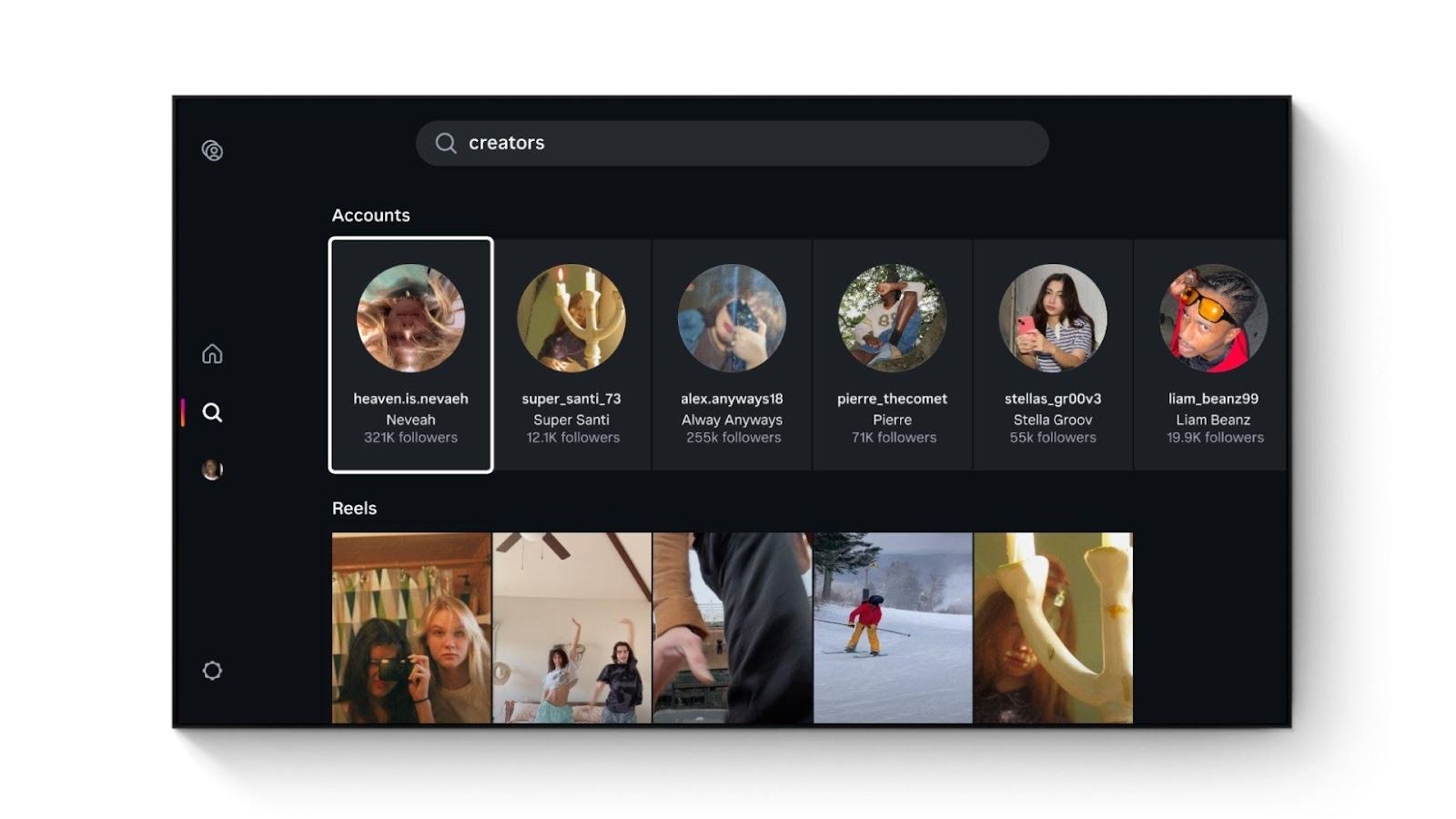

Behind Sarandos's warning that "Instagram is coming next" lies Meta's aggressive push into the TV market. Meta's Instagram launched the 'IG for TV' app on December 16, 2025, targeting living room viewers. Reels - the short-form video service introduced to compete with TikTok - is now coming to TV screens.

The 'IG for TV' app interface. Users can search for creator accounts and watch Reels content on their TV. (Source: Meta)

Currently testing only on Amazon Fire TV in the U.S., with plans to expand to other platforms. Reels' annual advertising revenue run rate stands at $50 billion. If TikTok relaunches its TV app, it will directly compete with Instagram Reels. A showdown between the two giants in the short-form TV app market is coming.

Revenue Models: Substack vs FAST vs TikTok - A Three-Way Battle

Competition for living room TV content is intensifying. Beyond the legacy TV vs streaming battle, YouTube and social media services (Reels, TikTok) have joined in, and now Substack has declared its TV entry. A living room war among big tech and entertainment tech platforms is beginning.

From a revenue perspective, the competitive structure breaks down into two main categories: subscription models and advertising models.

Substack operates on a subscription-based model. Viewers pay subscription fees directly to creators, with Substack taking a 10% commission. Samsung TV Plus, Tubi, Roku and other FAST channels use an ad-supported free model - viewers watch content for free, with advertising revenue shared between platforms and creators. If TikTok relaunches its TV app, it would join the competition with a vertical short-form advertising model.

Each model has its strengths and weaknesses. Substack's subscription model can generate stable revenue with just a small number of loyal subscribers. It's not dependent on algorithms, and creates direct relationships between creators and subscribers. This model suits journalists like Jim Acosta and Chris Cillizza. The challenge is subscriber growth.

FAST's advertising model has no entry barrier. Being free, it can reach more viewers. As Mark Rober said, FAST is advantageous if you want to 'reach as many brains as possible.' It suits mass entertainment and educational content like MrBeast and Mark Rober's.

TikTok's short-form model is also advertising-based, with its powerful draw coming from 200 million U.S. users. Short, addictive content could be popular for 'background viewing' in the living room. However, optimizing vertical short-form for horizontal TV screens remains a challenge.

Hollywood's Response: Netflix and Traditional Media Strategy

Ted Sarandos's Warning: 'TV Is Now Everything'

Source: Hollywood Reporter (January 20, 2026)

Digital video's penetration into the living room is a top concern in Hollywood. Netflix co-CEO Ted Sarandos warned of rapid environmental changes in his Q4 2025 earnings call on January 20, 2026.

Sarandos stated: "The TV landscape has never been more competitive than it is today. The competition for creators, for consumer attention, for advertising dollars and subscription dollars has never been as intense. The lines of competition around TV consumption are already blurring."

He summarized the changing media environment: "TV is not what we grew up on. TV is now just about everything. The Oscars and the NFL are on YouTube. Amazon owns MGM. Apple is competing for Emmys and Oscars. And Instagram is coming next."

Sarandos made this statement two days before Substack's TV app launch and three days before TikTok's joint venture confirmation. His warning has already become reality. Substack, TikTok, Instagram, and Samsung TV Plus are all now competing on the same living room TV.

FAST Market Surge: $11 Billion by 2030

Source: Omdia, Grand View Research, Comscore 2025 State of Streaming Report

The FAST market is surging. According to Omdia, the market is projected to grow from approximately $6 billion in 2025 to $11 billion by 2030. Grand View Research projects even more aggressive growth from $9.73 billion in 2024 to $40.2 billion by 2033, representing 16.9% CAGR. Comscore's 2025 State of Streaming report shows U.S. FAST viewing time increased 43% year-over-year.

Samsung TV Plus viewership grew 30% compared to the previous year through 2025. This is precisely why Substack is eyeing the TV advertising market.

Korean Content and FAST Channels

The FAST market also holds significant meaning for Korean content's global expansion. Samsung TV Plus partnered with SM Entertainment to launch the SMTOWN channel, exclusively live-streaming the SMTOWN LIVE 2025 30th Anniversary Concert in LA in May 2025. Korean broadcasters and content companies are entering the U.S. market through FAST channels.

The Future of Media: 'The Lines of Competition Are Already Blurring'

The biggest trend revealed by Substack's TV app launch, Instagram's moves, and TikTok's joint venture establishment is the disappearance of what Sarandos called 'the lines of competition around TV consumption.' In the past, roles were clear. Now those distinctions have completely blurred - exactly as Sarandos said. 'Instagram is coming.'

Netflix is simultaneously a distribution platform and a major content producer. Samsung TV Plus is a hardware manufacturer's FAST platform that's co-producing original content with Dhar Mann. Substack is a newsletter platform that's also a video platform, and now a TV app operator. TikTok is a short-form social media platform exploring new business models through its U.S. joint venture.

On the living room TV screen, NBC News, Netflix dramas, YouTube podcasts, Instagram Reels, Samsung TV Plus's Mark Rober channel, Substack's Jim Acosta news show, and TikTok's short-form (if relaunched) are all competing. From the viewer's perspective, a single remote button can toggle between all of these.

The TikTok joint venture establishment is a variable that could change the living room war's dynamics. 200 million U.S. users, President Trump's 16 million followers, the White House official account - TikTok's American influence is formidable. With U.S. operations stabilized, TikTok's TV app relaunch may be just a matter of time.

Creator Negotiating Power Strengthens

As platform competition intensifies, creator negotiating power strengthens. In the past, leaving YouTube meant having nowhere to go. Now options have multiplied: FAST channels (Samsung TV Plus, Tubi, Roku), subscription platforms (Substack, Patreon), streaming services (Netflix), and short-form platforms (TikTok, Instagram).

Mark Rober exists simultaneously on YouTube, Samsung TV Plus (FAST), and Netflix (subscription streaming). As Chris Cillizza said, 'Video doesn't have to live in just one place.' Multi-platform strategy is becoming the new standard.

Conclusion: A New Phase in the Living Room War

Substack TV app launch on January 22, 2026. TikTok U.S. joint venture confirmed on January 23, 2026. These two consecutive days of news signal that the living room war has entered a new phase.

Substack is betting on subscription-based 'long-form immersive content.' Samsung TV Plus, Tubi, and Roku have recruited mega-creators like MrBeast and Mark Rober with their ad-supported free model. TikTok may target TV app re-entry after stabilizing U.S. operations. Netflix is pursuing an $83 billion Warner Bros. acquisition, going all-in on content acquisition. Instagram is leveraging its $50 billion advertising business to attack the TV market.

At the heart of this war is a clash of three business models. Substack's 'subscription,' FAST's 'ad-supported free,' and TikTok/Instagram's 'short-form advertising' are all meeting on the same living room TV. Which model is more sustainable, which suits which types of creators and viewers - only time will tell.

If Mark Rober is right that 'you don't cannibalize audiences by moving to different mediums,' this war may not have a single winner. Subscription-based Substack, ad-supported FAST channels, and short-form TikTok/Instagram may coexist, serving different viewers and different types of creators.

As Ted Sarandos said, 'TV is now everything.' And in an era where everything competes on a single living room screen, perhaps the true winners are the viewers who enjoy this diverse array of choices.

Sources

Substack Official Blog: https://on.substack.com/p/introducing-the-substack-tv-app-now

The Ankler Exclusive: https://theankler.com/p/scoop-substack-is-launching-a-tv

Reuters (TikTok Joint Venture): https://www.reuters.com/technology/tiktok-seals-deal-new-us-joint-venture-avoid-american-ban-2026-01-23/

Samsung Newsroom (Mark Rober FAST Channel): https://news.samsung.com/us/samsung-tv-plus-expands-creator-lineup-worldwide-launch-former-nasa-engineer-mark-robers-first-ever-fast-channel/

Hollywood Reporter (Mark Rober Interview): https://www.hollywoodreporter.com/business/digital/mark-rober-youtube-creator-fast-channel-samsung-tv-plus-1236424000/

Hollywood Reporter (Sarandos Comments): https://www.hollywoodreporter.com/business/business-news/ted-sarandos-instagram-coming-netflix-competition-1236276893/

Hollywood Reporter (Tubi/Roku Creators): https://www.hollywoodreporter.com/business/digital/tubi-roku-youtube-1236405292/

Meta Official Blog (Instagram TV): https://about.fb.com/news/2025/12/instagram-for-tv/

Netflix Warner Bros. Acquisition: http://about.netflix.com/en/news/netflix-to-acquire-warner-bros

Tubefilter (Samsung Creator Strategy): https://www.tubefilter.com/2025/07/30/samsung-tv-plus-fast-creator-content-dhar-mann-studios/

Roku 2026 Predictions: https://advertising.roku.com/2026-predictions

Omdia (FAST Market): https://www.telecoms.com/digital-ecosystem/fast-market-growing-fast-to-11-billion-by-2030

- END -

![[CES 2026] "모노컬처는 죽었다"

투비(Tubi)·삼성 TV 플러스(Samsung TV Plus)가 이끄는 무료 스트리밍의 미래](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xe6byc_202601212355.png)

![[보고서]CES2026 엔터테크 보고서](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/pkmea9_202601250121.jpeg)

![[CES2026]미디어 기업 업프론트(광고 설명회) 장소로 변신](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xjbio9_202601222334.png)

![[CES 2026]레딧, 구글 메타 도전장 '맥스 캠페인 진행'](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/o4o2vj_202601220249.jpg)

![[CES 2026] AI, 스트리밍 전쟁, 마이크로드라마](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/nf0b2a_202601210349.png)

![[CES 2026] 크리에이터 이코노미 보고서(무료 요약본)](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/5wiefh_202601190237.png)