[CES 2026] "Monoculture Is Dead" Tubi and Samsung TV Plus Lead the Future of Free Streaming

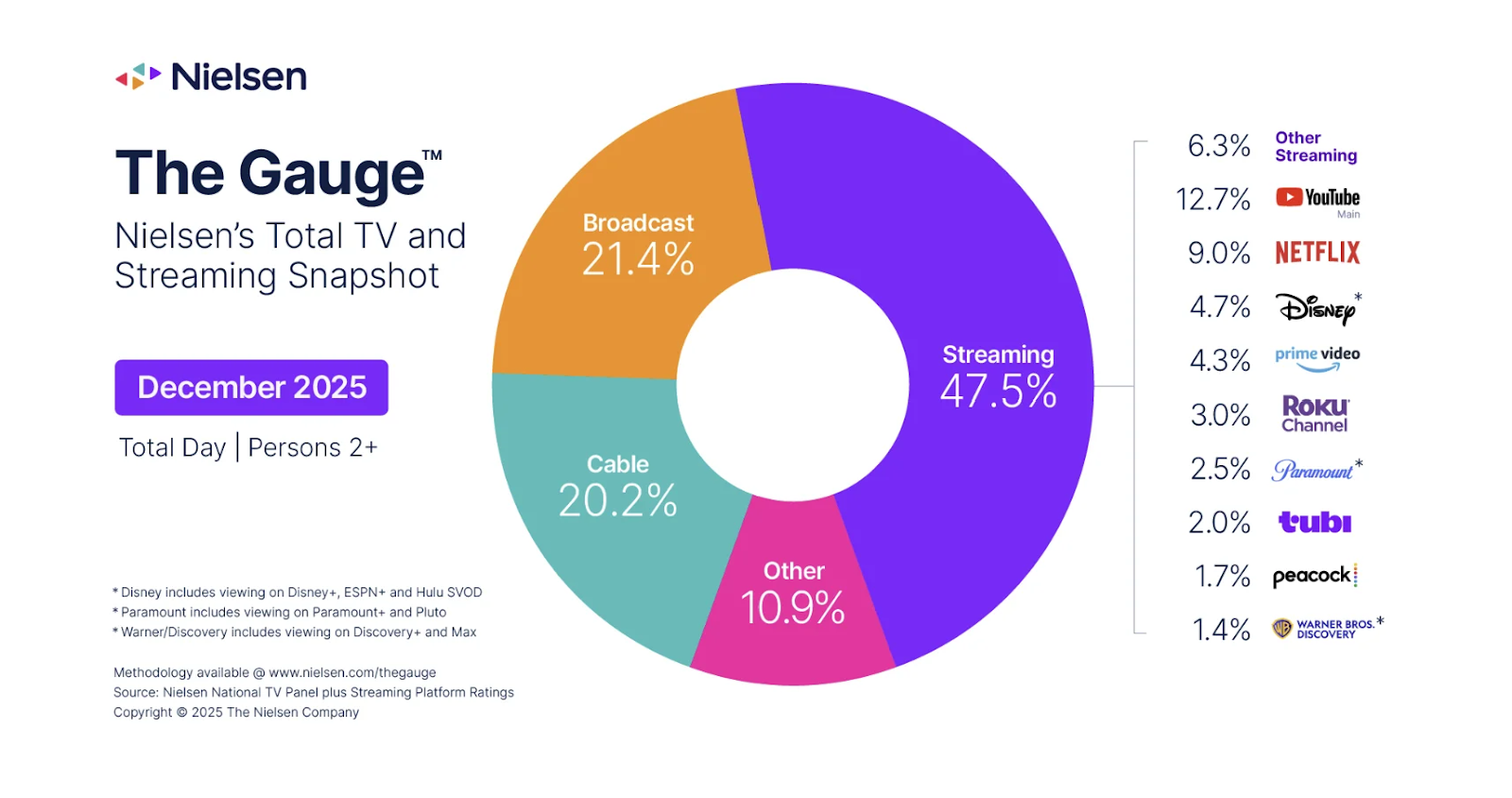

In the Era of 47.5% Streaming Share, AVOD and FAST Drive a Seismic Shift in Media

Tubi and Samsung TV Plus Both Cross 100 Million MAU, Ushering in the Free Streaming Era

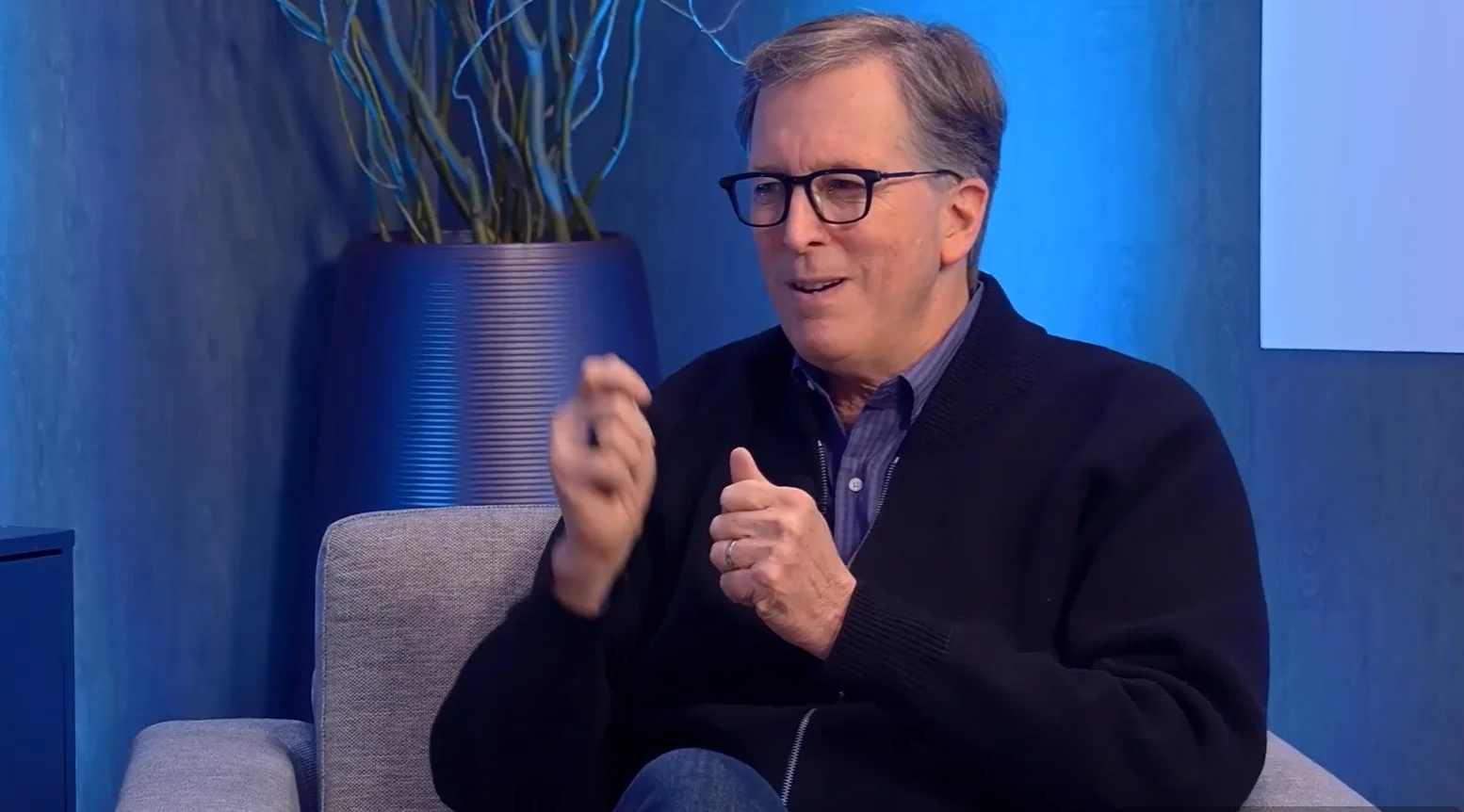

▲ Interview at CES 2026 C Space Studio. Host James Kotecki (left) and Tubi CRO Jeff Lucas (right). Tubi's mascot rabbit plush sits on the table.

"Monoculture is dead. The era when everyone watched the same thing is over."

At CES 2026 in Las Vegas, Tubi's Chief Revenue Officer Jeff Lucas declared a paradigm shift in the media industry from the C Space Studio stage. He was picking up the thread from CEO Anjali Sud's keynote message at the same venue last year.

His words were far from mere rhetoric. Just the day before, Nielsen's December 2025 "The Gauge" data backed up his claim. Streaming captured 47.5% of total TV viewing, setting an all-time record. At the heart of this shift are free ad-supported streaming services—AVOD (Ad-supported Video on Demand) and FAST (Free Ad-Supported Streaming TV)—led by platforms like Tubi.

Samsung Electronics also fired a powerful signal at the opening of CES 2026, announcing that Samsung TV Plus has surpassed 100 million monthly active users worldwide. Standing shoulder to shoulder with Tubi's 100 million MAU, this marks a historic moment when the two giants of the FAST market simultaneously crossed the 100 million threshold.

Samsung TV Plus Surpasses 100 Million MAU

Samsung Electronics' January 21 announcement of Samsung TV Plus's performance symbolically demonstrates the explosive growth of the FAST market.

Along with surpassing 100 million global MAU, streaming hours increased 25% year-over-year. Particularly noteworthy is the 92% three-month retention rate—meaning 92% of viewers who used the service for three consecutive months continued using it in the fourth month, demonstrating industry-leading viewer loyalty.

"Surpassing 100 million monthly active users is an extraordinary milestone that reflects the trust our viewers place in Samsung TV Plus and the team's commitment to providing exceptional entertainment," said Salek Brodsky, Senior Vice President and Head of Global at Samsung TV Plus.

Samsung TV Plus offers over 4,300 free channels across 30 countries worldwide. It's available exclusively on Samsung devices including Samsung TVs, Galaxy smartphones, XR headsets, Galaxy Tab, Smart Monitor, and Family Hub lineups. It will also be featured on the 2026 TV lineup announced at CES 2026, spanning Micro RGB TV, Neo QLED, OLED, The Frame, The Frame Pro, and more.

Live Events and Creator Partnerships

Samsung TV Plus dominated the cultural zeitgeist in 2025 with its bold expansion into live events. The Jonas Brothers' livestreamed concert series "JONAS 20: Greetings From Your Hometown" tour stands out as a prime example.

During this livestream, Samsung TV Plus launched a first-of-its-kind "FanVote" feature, which gave fans at home the power to vote for their favorite song via remote, with the winning track performed live on stage. Over 13% of CTV viewers participated in the vote, delivering unprecedented engagement. This transformed passive viewing into active engagement, showcasing new possibilities for FAST platforms.

Creator partnerships also expanded significantly. The platform launched former NASA engineer Mark Rober's first-ever FAST channel and partnered with digital storytellers including Michelle Khare, Dhar Mann, and Smosh. Partnerships with Spotify, David Letterman, Conan O'Brien, and major sports leagues including NHL, MLB, NBA, and NFL were also strengthened.

Streaming at 47.5%: The Significance of a Record High

▲ Nielsen's "The Gauge" December 2025 data. Streaming reached 47.5%, Broadcast 21.4%, Cable 20.2%. (Source: Nielsen)

The parallel growth of Tubi and Samsung TV Plus aligns with the overall market trajectory. Nielsen's December 2025 "The Gauge" data, released on January 20, 2026, clearly illustrates the structural transformation of the U.S. TV viewing market.

Streaming captured 47.5% of total TV viewing, setting the highest share in Nielsen's The Gauge history. This surpassed the previous record set in July 2025. Meanwhile, Broadcast fell to 21.4% and Cable to 20.2%, continuing their decline. The era of streaming dominance over traditional TV has officially begun.

Christmas Day's performance was particularly remarkable. On December 25, streaming viewing time exceeded 55.1 billion minutes, setting an all-time daily record. This was 8% higher than the previous year (51.2 billion minutes), and only two days in TV history have seen daily streaming exceed 50 billion minutes. That day, streaming captured 54% of total TV viewing.

December 13 marked another milestone. Streaming recorded 50.4% of daily TV viewing, crossing the 50% threshold for the first time ever. This number symbolically shows that streaming is no longer an "alternative" but the "mainstream."

AVOD and FAST: The Rise of Free Streaming

What deserves even closer attention in the December data is the growth of free ad-supported streaming. The Roku Channel achieved a record-high 3.0% share. Tubi recorded 2.0%, maintaining steady growth.

Subscription-based platforms also set new records. Netflix reached 9.0%, up 10% month-over-month, with "Stranger Things" new episodes recording over 15 billion viewing minutes as December's most-watched title. Prime Video surged 12% month-over-month to 4.3%, driven by NFL Thursday Night Football and the original series "Fallout." Paramount (Paramount+/Pluto) recorded 2.5%, with "Landman" becoming December's second most-watched title at 6.2 billion viewing minutes.

Within this trend, the growth of AVOD and FAST is structural. As subscription fatigue intensifies, platforms offering quality content for free are winning viewers' choices. Tubi at 100 million MAU and Samsung TV Plus at 100 million MAU—the simultaneous crossing of the 100 million threshold by these two major FAST platforms represents a symbolic event marking the market's maturation. Market research firms project the FAST market to grow from $5.8 billion in 2025 to $10.6 billion by 2030.

"All Streaming Should Be Free" - Tubi's Philosophy

▲ Tubi CRO Jeff Lucas explaining the AVOD strategy at CES 2026.

In this market environment, Tubi champions a clear philosophy. Lucas declared, "We think all entertainment streaming should be free."

Tubi's weapon is its overwhelming content scale. With 300,000 movies and series, it boasts 20 times the library of a typical streaming platform's approximately 15,000 titles. Lucas explained, "Whether you like fantasy, sci-fi, art films, or coming-of-age dramas—you can go deep into whatever fandom you want."

This is why Tubi's mascot is a rabbit. It represents how viewers can dive deep into the "rabbit hole" of their desired content world. In fact, the average Tubi session viewing time exceeds two hours.

It's not just about library size. Tubi produces over 400 original content pieces, with 15 of them reaching Luminate's top 10 programs. They analyze data to create exactly what fandoms want.

The Identity of 100 Million "Unreachable" Viewers

Tubi's monthly active users reach 100 million. But what Lucas emphasizes is not the number—it's who these viewers are.

"Our core target is Gen Z, millennials, and multicultural young people—roughly 18 to 34. These are really hard-to-find people." Lucas mentioned his experience at MTV and Viacom, saying, "I was always chasing them, and they kept moving. But we found them."

The numbers he presented are striking. 69% of Tubi viewers are cord cutters or cord nevers. 80% have never subscribed to cable TV. Even more remarkable is the reach data: 90% of them are unreachable through broadcast, 80% through cable, and 70% through other streaming platforms.

Samsung TV Plus is targeting a similar audience. Samsung Electronics emphasizes that it "connects advertisers with highly coveted audiences, including millennial families and influential viewers in a brand-safe environment." Both platforms having secured young audiences unreachable through traditional channels demonstrates FAST's advertising business potential.

There's a common misconception that free platforms are primarily used by low-income audiences. Lucas directly countered this: "25% of our viewers earn over $150,000 annually. They're not here because it's free—they're here because we have the content they want. We found this magical honeypot."

AVOD vs. FAST: What's the Difference?

As the free streaming market grows, AVOD and FAST are often conflated, but Lucas clearly distinguished between the two.

"Tubi is 95-96% VOD (Video on Demand). Viewers watch what they want, when they want. FAST channels are different. They operate in a linear fashion, with content broadcast according to a schedule."

Samsung TV Plus is a typical FAST service offering over 4,300 linear channels. Tubi, on the other hand, is a VOD-centric AVOD platform. While both share the commonality of being free and ad-supported, the viewing experience differs. FAST operates like traditional TV where you flip through channels, while AVOD works like Netflix where you select what you want to watch.

The ad experience also differs. FAST channels typically have ads inserted every 13 minutes, with 6-7 minutes of ad slots per hour. The problem is the "dead space" that occurs when ads don't fill—"You get a 'we'll be right back' slate that breaks the viewing experience."

Tubi's approach is different. Ads run only 4 minutes per hour—overwhelmingly less compared to cable TV's 22 minutes per hour. Lucas emphasized, "It's not just about content personalization. Ad personalization matters too. If you only show relevant ads to viewers, 4 minutes is enough."

AI-Powered Personalized Experiences

How do you help viewers find what they want among 300,000 pieces of content? Tubi's answer is AI.

"We use machine learning and AI to implement personalization. We figure out what viewers want, what type of content resonates with them, and show them that." Lucas added that personalization doesn't just apply to content: "The same goes for ads. We minimize disruption by only showing relevant ads."

Partnerships with retail media networks are also expanding. "They have customers they reach on their own platforms, but they need to extend that reach. We play that role." They're also experimenting with instant commerce—inserting QR codes in "pause ads" that connect directly to purchases.

FAST Channel Expansion: The SI TV Launch Case

The growth of the free streaming market is also driving traditional media brands to enter the FAST channel space. A prime example is Sports Illustrated's launch of SI TV.

SI TV is available 24/7 for free on Amazon Fire TV, DIRECTV, Sling Freestream, Plex, and DistroTV, with The Roku Channel coming soon. It offers diverse content including 70 years of archived material, original docuseries, live games, and betting insights.

Steve Cannella, Editor-in-Chief of Sports Illustrated, said, "SI TV is a new platform that does what we've always done—tell the best stories in sports with an authoritative voice and unique approach." The 133% year-over-year increase in Sports Illustrated YouTube views and 162% increase in watch time in 2025 served as the backdrop for the FAST channel entry.

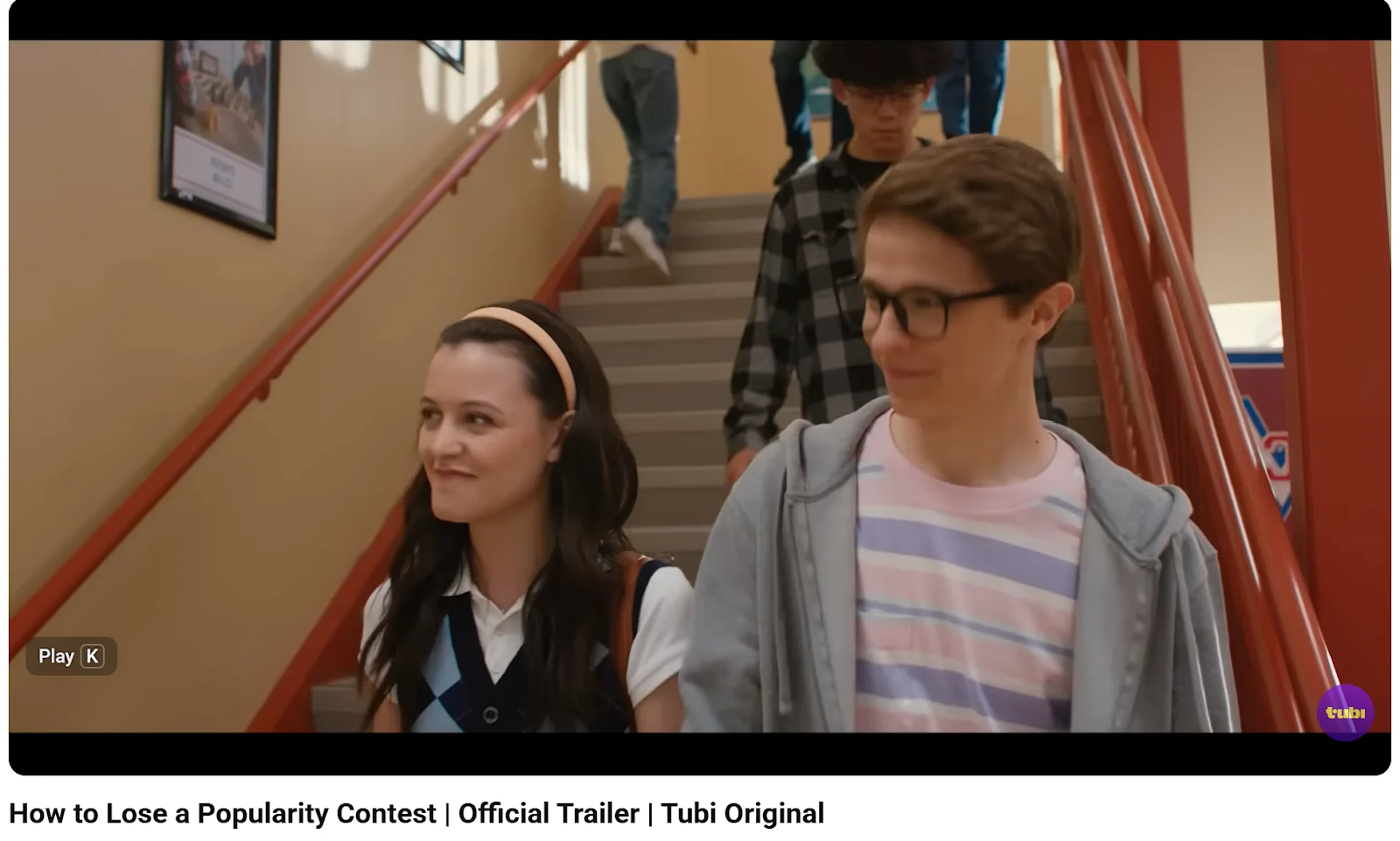

Tubi's YA Original Strategy

▲ Official trailer for Tubi original YA film "How to Lose a Popularity Contest." (Source: Tubi)

Tubi is also ramping up original content investment to capture young audiences. On January 17, they held a premiere event for the new YA (Young Adult) original film "How to Lose a Popularity Contest" at Scarr's Pizza in New York.

This high school romantic comedy about an underachiever and a perfectionist teaming up for a student council election is based on a screenplay selected as "Best Unproduced Romance Script" at The Love List 2024. Sara Waisglass and Chase Hudson star.

Adam Lewinson, Tubi's Chief Content Officer, said, "Sara's screen charisma and vulnerability play in perfect contrast to Chase's bad-boy charm," adding that they will "continue delivering fun and engaging YA content to maintain momentum with young audiences."

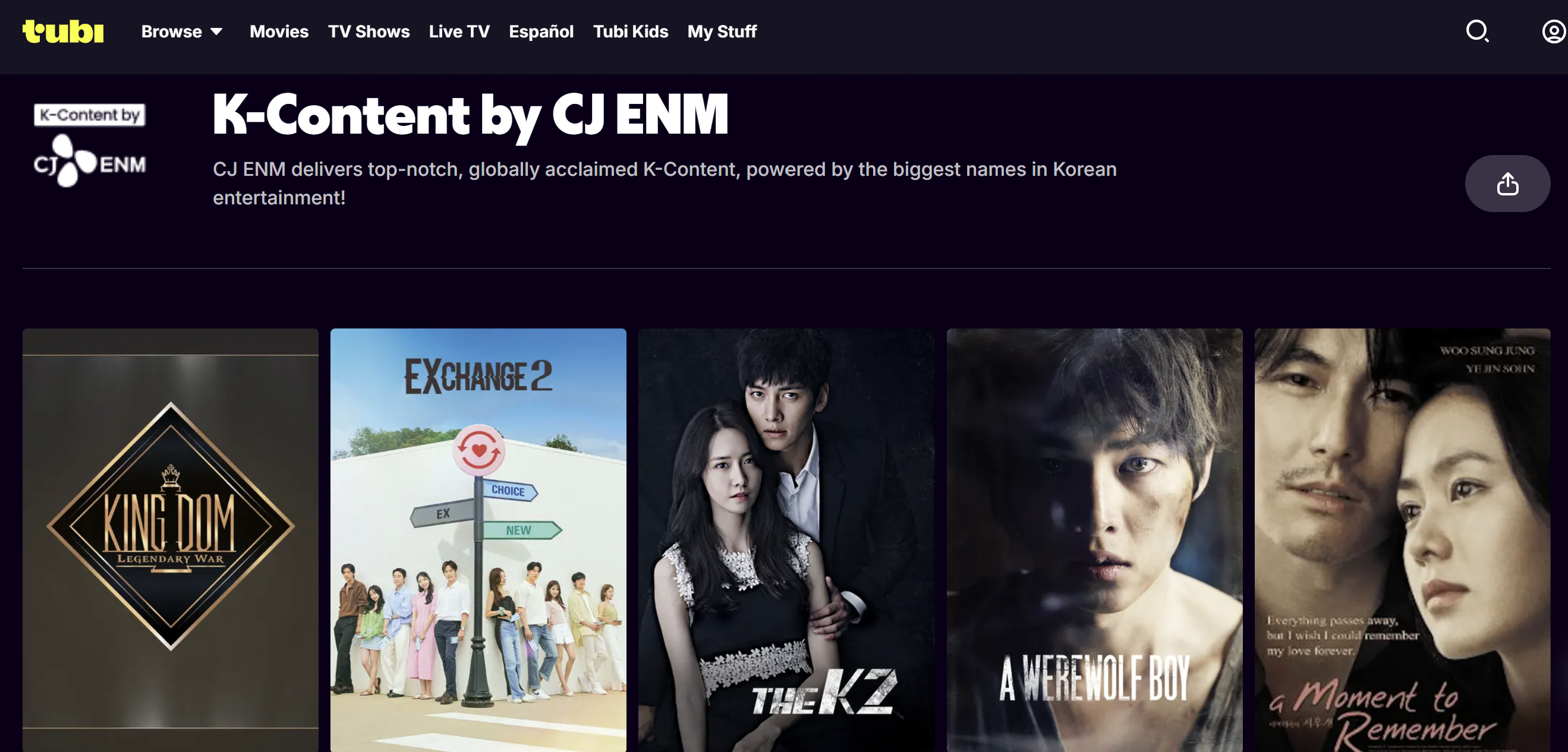

Implications for K-Content: Seize the AVOD/FAST Opportunity

The achievements demonstrated by Tubi and Samsung TV Plus at CES 2026, along with Nielsen's market data, carry significant implications for the Korean content industry.

First, free streaming market growth is a structural trend. As subscription fatigue intensifies, AVOD and FAST have firmly established themselves as new growth pillars. The simultaneous crossing of 100 million MAU by both Tubi and Samsung TV Plus symbolizes this market's maturation. Even Netflix has introduced an ad tier, validating this trend.

Second, K-content can reach the "unreachable" audience. The cord-cutter/cord-never generation that Tubi discovered is inaccessible through traditional channels. AVOD and FAST represent the intersection where the global fandom of K-dramas and K-entertainment can meet these audiences.

Third, the "death of monoculture" presents an opportunity for K-content. Tubi's 300,000-content library and "rabbit hole" strategy target niche fandoms. K-drama's deep fandom culture and genre-segmented fan bases align perfectly with this approach. If the era when everyone watched the same thing is over, K-content with its passionate fandoms could emerge as winners in the new era.

Fourth, Samsung represents a platform partner. Samsung TV Plus operates 4,300 channels across 30 countries and comes pre-installed on Samsung TVs. It could be the most natural partner for Korean content companies expanding into the global FAST market.

Fifth, AI-based personalization capabilities are core to platform competitiveness. Recommendation technology that helps viewers find what they want amid vast content libraries is becoming a key differentiator. Korean OTT platforms must also secure such technological capabilities when expanding globally.

At the end of the interview, Jeff Lucas handed over the rabbit plush "Taboo." Just as viewers fall into Tubi's rabbit hole, the global media market is diving into a new hole called AVOD.

"Monoculture is dead." This declaration represents both crisis and opportunity. Tubi at 100 million, Samsung TV Plus at 100 million—the era of free streaming has officially begun. How Korean media companies ride this wave will make 2026 a decisive turning point.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Sources

• CES 2026 C Space Studio, Tubi CRO Jeff Lucas Interview (January 7, 2026)

• Samsung Electronics, Samsung TV Plus 100 Million MAU Announcement (January 21, 2026)

• Nielsen's "The Gauge" December 2025 (Released January 20, 2026)

• Media Play News, "Tubi Now Streaming Original YA Romantic Comedy" (January 20, 2026)

• TV Tech, "Sports Illustrated Launches New Streaming Channel SI TV" (January 2026)

![[CES 2026]로쿠(Roku), AI·저가 스트리밍·광고 '3대 전략'으로](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/2ug8x9_202601150040.jpeg)

![[CES2026]생성 AI, '있으면 좋은 것'에서 '필수 인프라'로”](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/7dbmg3_202512271017.jpeg)

![[CES2026]미디어 기업 업프론트(광고 설명회) 장소로 변신](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xjbio9_202601222334.png)

![[CES 2026]레딧, 구글 메타 도전장 '맥스 캠페인 진행'](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/o4o2vj_202601220249.jpg)

![[CES 2026] AI, 스트리밍 전쟁, 마이크로드라마](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/nf0b2a_202601210349.png)

![[CES 2026] 크리에이터 이코노미 보고서(무료 요약본)](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/5wiefh_202601190237.png)

![[CES 2026]크리에이터 이코노미 종합 분석 리포트](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/d48ydy_202601190208.jpeg)

![[2026엔터테크] 윤리적 AI 스튜디오 종합 보고서](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/ylqs2w_202601040723.png)