[CES2026]"Cannibalization Is Dead" The Era of 'New Syndication' Powered by FAST

Distribution strategies for the Creator Economy presented by Evan Shapiro at CES 2026 'Variety Business of Creators Summit.'

From the Letterman library to Jonas Brothers concerts—the 'magic of addition' proven by FAST platforms.

[CES 2026 'New Hollywood Power Players: The Rise of Creators on TV' Session]

Session Speakers

Executive Summary

In the history of the TV industry, 'Syndication' was the golden goose. Hit sitcoms like Friends, Seinfeld, and The Big Bang Theory generated billions of dollars in revenue through reruns for decades after their original broadcasts ended. Syndication—the model of selling a single piece of content to multiple broadcasters for distribution—was the core revenue structure of 20th-century American television.

But the streaming era brought this model into crisis. Netflix weaponized 'exclusivity,' while Disney+ and HBO Max pulled their libraries from other platforms. 'One platform, one piece of content' became the new rule.

Syndication was declared dead.

Yet in 2026, syndication is being resurrected from an unexpected quarter.

FAST (Free Ad-Supported Streaming TV) platforms are the protagonists of this revival. As ad-supported free streaming services like Samsung TV Plus, Pluto TV, and Tubi experience explosive growth, a new distribution strategy is emerging—one that 'ubiquitizes' rather than 'monopolizes' content.

What's even more intriguing is that the protagonists of this new syndication aren't traditional broadcasters, but Creators. As digital-native creators who grew up on YouTube expand to FAST platforms, an era has dawned where individuals can enjoy the benefits of syndication that were once exclusive to broadcasting networks.

This has been the content industry's longstanding fear. 'Cannibalization'—the logic that spreading the same content across multiple platforms would fragment audiences and dilute value on each platform. Especially during the streaming wars era when exclusive content was the key to competitiveness, this concern operated as an unwritten rule in the industry.

At the 'Variety Business of Creators Summit' at CES 2026, Samsung and media experts presented their answer to this question with data and real cases.

Key Speaker: Evan Shapiro

[Evan Shapiro at CES 2026 Variety Business of Creators Summit]

In this session, Shapiro shared insights that integrate the broadcast, streaming, social, and FAST/CTV ecosystems. Samsung TV Plus VP Takashi Nakano, Managing Director of Enterprise Sales Ryan Wilson, and Head of Partnerships Rishita Patel supported this with real-world cases.

Shapiro's conclusion was emphatic:

Multi-platform distribution creates not cannibalization but 'Amplification.' YouTube subscriber counts for creators who distributed content on Samsung TV Plus actually increased, and the Jonas Brothers added 20 more shows to their tour after FAST live streaming due to increased ticket sales. This is the reality of the 'New Syndication' as proven by data.

This report analyzes the meaning of the 'New Syndication' era ushered in by FAST platforms and its implications for K-Content, based on key insights and real cases shared at CES 2026.

1. Key Insight: The 'Yes, And' Principle

'Yes, And' is a concept from improvisational comedy. Instead of rejecting a partner's suggestion (Yes, But), you accept it as is (Yes) and then add a new element (And). Evan Shapiro applied this concept to content and platform strategy.

In this session moderated by Variety's Co-Editor in Chief Cynthia Littleton, Shapiro provided a clear answer to the question creators ask most often. "If I put content on a new platform, won't it cannibalize my existing platform's audience?" It had been the industry's longstanding concern.

According to Shapiro, new platforms (Samsung TV Plus, FAST/CTV, new social media) don't replace existing platforms (YouTube, Facebook, etc.). They function as additional channels that enhance each other's presence. In the Creator Economy, the strategy of "Yes, And (both, and more)" is valid, not "Either/Or (one or the other)."

This isn't just theory. The Samsung TV Plus team proved it with actual data. VP Takashi Nakano revealed, "We've repeatedly confirmed a pattern where YouTube subscriber counts for creators who distributed content on our platform actually increased."

2. Case Study: The David Letterman Channel

Evan Shapiro and Takashi Nakano's team launched the David Letterman channel on Samsung TV Plus. A 20-year-old late night talk show library found new life on a FAST platform.

The core of this case is IP ownership. Letterman secured ownership of his show when he moved to CBS in the early 1990s. It was an unprecedented decision at the time—a TV talent owning their own show was unheard of. That choice created a new revenue stream 30 years later: a FAST channel.

In the session, Shapiro directly connected this case to today's creators. The IP ownership strategy that Letterman secured 30 years ago applies directly to creators who have grown on YouTube and social media today.

Dhar Mann is a motivational short-form content creator with 19 million subscribers on YouTube. Mark Rober is a former NASA engineer with 62 million subscribers for his science content. Hannah Stocking is a comedy creator with 27 million followers. What do they have in common? They all own 100% of their content.

3. Case Study: Jonas Brothers Live Concert

Samsung TV Plus streamed 6 live concerts from the Jonas Brothers' 'Greetings From Your Hometown' tour. Initially, there were concerns. Would future live concert ticket sales decrease? Would exclusivity be compromised? Both the artist's side and the platform had worries.

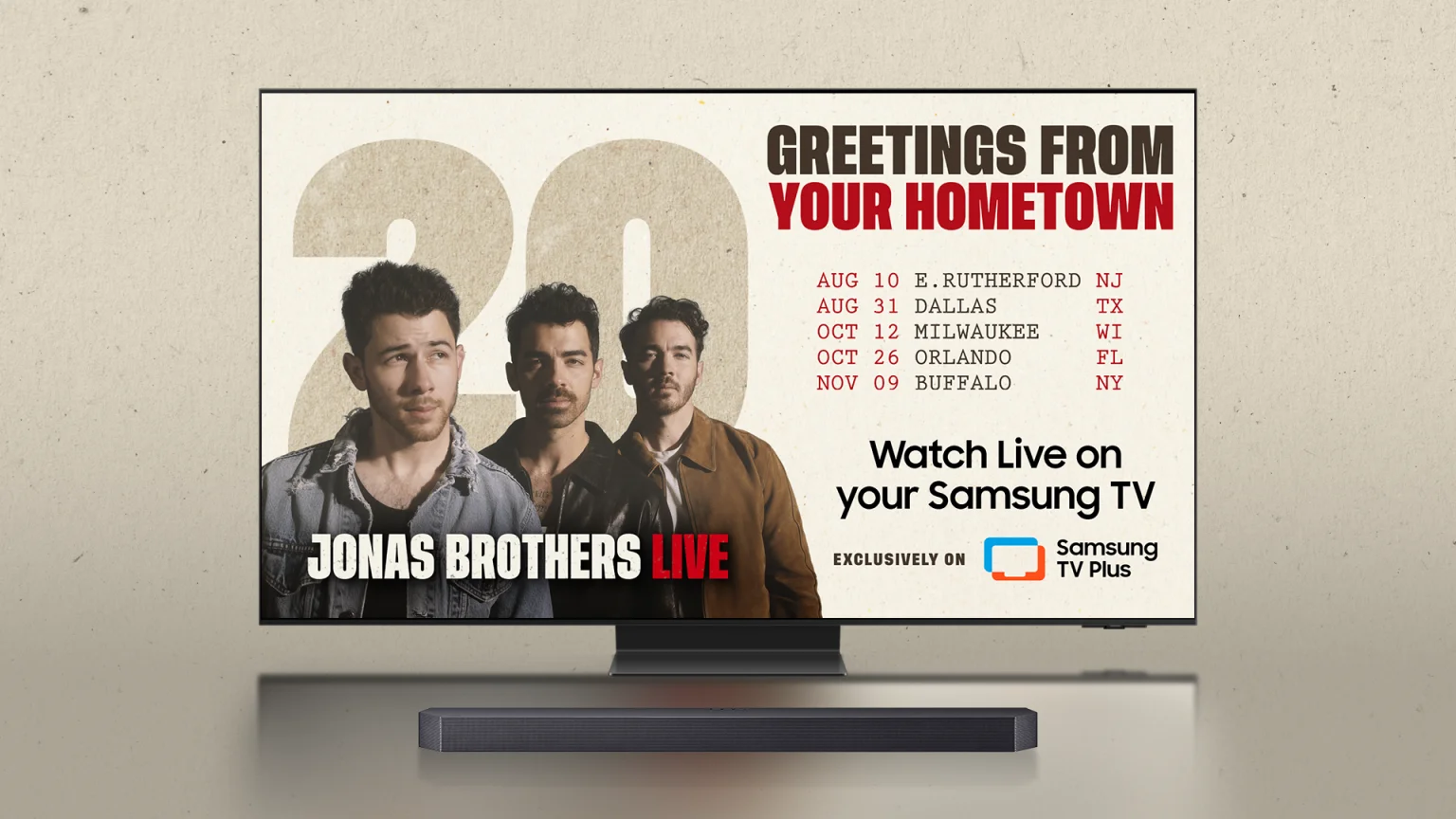

[Jonas Brothers 'Greetings From Your Hometown' Tour streaming on Samsung TV Plus]

The results were the opposite. Actual results shared by Ryan Wilson, Samsung's Managing Director of Enterprise Sales, at the session:

- 20 additional shows added to the tour due to increased ticket sales

- Simultaneous trending on Twitter and Instagram

- Samsung TV Plus functioned as a 'catalyst' for their business

- Explosive increase in real-time social engagement

Particularly noteworthy was the real-time interaction experiment. When they conducted live voting to select the final song during the concert, the related content generated 11x tweets and click-throughs. The voting results were reflected on the live screen 20 minutes later, creating an experience where TV viewers directly determined the direction of the concert.

Rishita Patel, Head of Partnerships, identified the key factor in this success as 'experimental spirit.' "The Jonas Brothers team approached it with an open mind from the start. It wasn't 'what if it doesn't work' but 'what can we learn if we try.' That mindset created the results."

4. Asymmetric Distribution Strategy

The 'Asymmetric Distribution' strategy proposed by Evan Shapiro at the CES session presents new distribution principles for the Creator Economy era. If traditional media distribution was 'concentrate on one channel,' the new strategy is 'be everywhere, but optimize for each platform.'

The core principles are as follows:

First, Shelf Presence on every possible platform. Be present wherever audiences exist—YouTube, FAST, streaming, social media. The question is no longer 'where should I post' but 'is there any reason NOT to post here.'

Second, Search Mindset. SEO and recommendation algorithm optimization to make consumers come to you is essential. Understand each platform's search and recommendation systems, and optimize so content can be discovered.

Third, IP Franchise. Build not just a show but a universe, expanding to podcasts, short-form, long-form, and merchandise. Convert a single IP into various formats and distribute them optimized for each platform.

Fourth, Fandom First. Community building with fandom consideration at every level is key. Platforms are just touchpoints connecting with fans—the ultimate goal is growing the fandom itself.

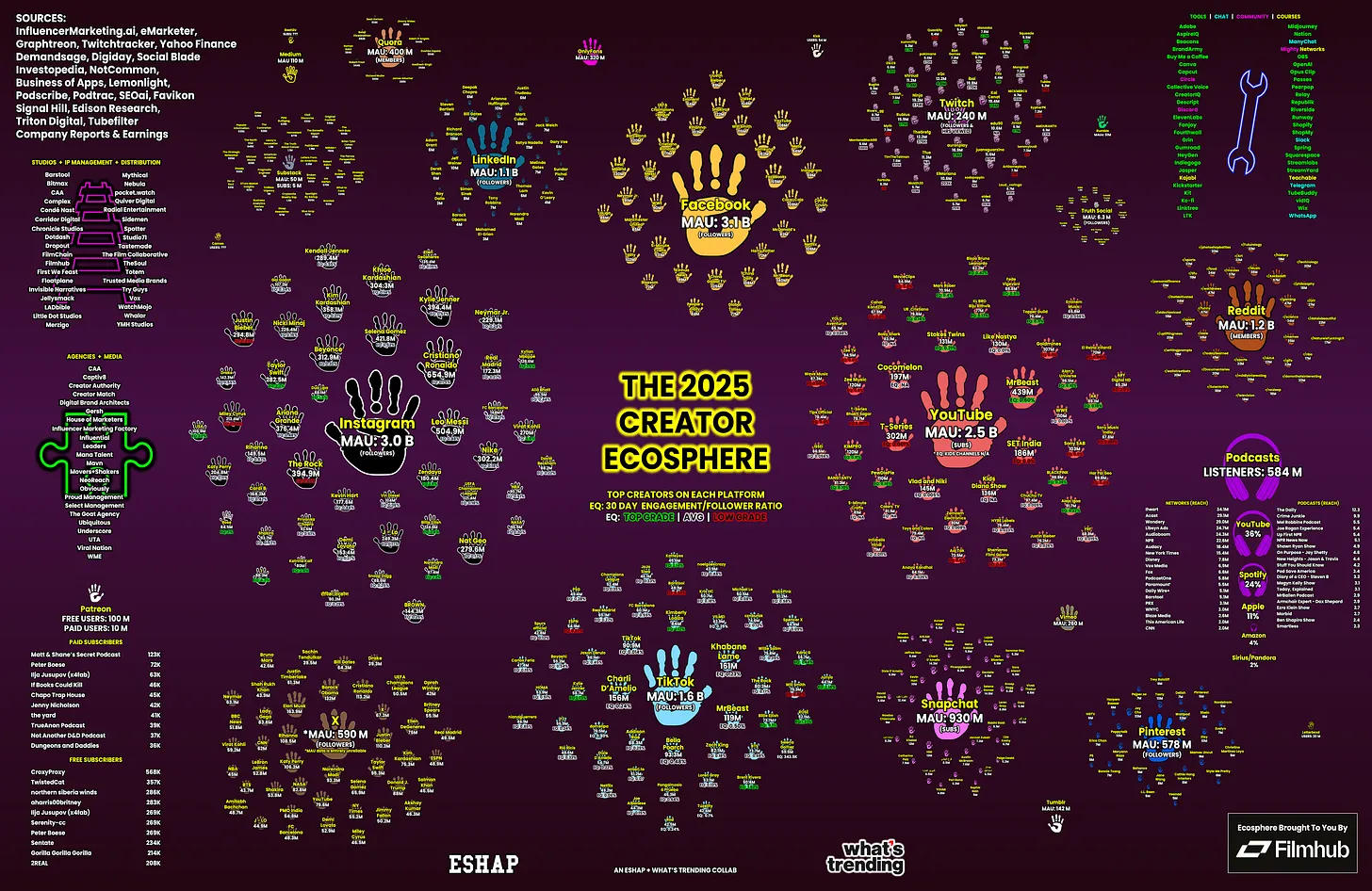

5. Creator Ecosphere: The New Power Map

YouTube has 4.6 million active channels. TikTok has approximately 1.6 billion active users. Instagram has surpassed 3 billion monthly active users (MAU). Americans now consume more news from social media than any other medium.

Evan Shapiro pointed out in the session that "there's no reliable single source of information for the current Creator Economy." To solve this problem, he created the 'Creator Ecosphere' map with Filmhub, Shira Lazar of What's Trending, and others. This map, released through the Hollywood Reporter, created significant resonance in the industry.

This is an extension of the 'Media Universe Map' Shapiro has been creating since 2020. His map shows at a glance all players participating in the "Attention War"—from traditional players like Netflix, Disney, Apple, and Amazon to TikTok, YouTube, OnlyFans, and Roblox.

The key metric of this map is 'Engagement Quality (EQ)'—data showing the empirical difference between followers and true fans, beyond simple follower counts. It's a new standard for measuring the actual business value of creators, going beyond vanity metrics like MAU.

For example, MrBeast not only has more followers than Eminem but records 10x higher engagement. This is how Jimmy Donaldson became a billionaire. It's the depth of fandom, not the number of followers, that determines business value.

Shapiro emphasized in the session: "Creators are now companies, and companies are now creators." All content that matters in contemporary culture, including mainstream media like Wicked, Barbie, and Sinners, starts and ends on creator platforms.

6. Implications for K-Content: Time to Execute 'Yes, And'

K-Content has already proven its presence in the global streaming market. Squid Game became the most-watched series in Netflix history, while The Glory, Moving, and Gyeongseong Creature have dominated global charts. K-Pop has conquered Billboard, and K-Drama is nominated for Emmys.

But one question remains: Is K-Content ready for the 'New Syndication' era?

Currently, global distribution of K-Content is concentrated on premium streamers like Netflix, Disney+, and Amazon. Strategic utilization on FAST platforms is still in its infancy. While FAST platforms like Samsung TV Plus, Pluto TV, and Tubi are experiencing explosive growth, a systematic FAST strategy for K-Content is absent.

Based on insights shared at CES 2026, we propose strategic actions K-Content should take in the 'New Syndication' era.

Action 1. Strategic Redistribution of Legacy Libraries

Just as the 20-year-old Letterman talk show found new life on FAST, vast K-Drama and variety show libraries can meet new global fans on Samsung TV Plus, Pluto TV, and more.

Decades of content libraries held by terrestrial broadcasters like KBS, MBC, SBS, and content companies like CJ ENM and JTBC can themselves become FAST channels. From Jewel in the Palace and Winter Sonata to the Reply series and Infinite Challenge—content sleeping in warehouses can become new revenue streams. The key is distributing while maintaining IP ownership.

Action 2. FAST Simultaneous Streaming Experiments for K-Pop Live

The Jonas Brothers case provides direct implications for K-Pop. FAST streaming doesn't cannibalize ticket sales. Rather, it created 20 additional shows.

What if world tour concerts by K-Pop artists like BTS, BLACKPINK, Stray Kids, aespa, and SEVENTEEN were simultaneously broadcast on Samsung TV Plus? It could become a powerful catalyst for expanding global fandom. Combined with real-time voting and social integration, we can expect the 11x engagement amplification effect confirmed in the Jonas Brothers case.

As Ryan Wilson said, "When partners say 'let's try it and see what happens,' magic happens." What K-Pop agencies need is an experimental spirit.

Action 3. K-Creator Entry into FAST Channels

Major Korean YouTubers already have millions of subscribers. Programming their content as FAST channels could create new touchpoints for global audiences who consume Korean-language content.

Just as Dhar Mann and Mark Rober succeeded on Samsung TV Plus, K-Creators can also acquire new audiences through FAST. According to the 'Yes, And' principle, FAST entry doesn't cannibalize YouTube subscribers—it actually reinforces them.

Action 4. Fundamental Mindset Shift: From Either/Or to Yes, And

The most important thing is the mindset shift. "If we supply exclusively to Netflix, won't revenue from other places decrease?" "If we put content on FAST, won't premium value decline?" These concerns belong to the old era.

Data proves it: multi-platform means amplification, not cannibalization. Being present on every shelf while never letting go of IP ownership—this is the survival formula for the creator era that Letterman secured 30 years ago and MrBeast practices today.

References

• CES 2026: Variety Business of Creators Summit - New Hollywood Power Players: The Rise of Creators on TV

• Hollywood Reporter - Creator Ecosphere Map: https://www.hollywoodreporter.com/business/digital/creators-ecosphere-map-definitive-guide-1236395936/

• Evan Shapiro's Media Universe Map: ESHAP

![[CES 2026]AI가 만든 역설: 창작의 문턱은 낮아졌는데 성공의 기준은 더 높아졌다](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/wvsmh8_202601171826.jpg)

![[보고서]CES2026 엔터테크 보고서](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/pkmea9_202601250121.jpeg)

![[CES2026]미디어 기업 업프론트(광고 설명회) 장소로 변신](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xjbio9_202601222334.png)

![[CES 2026]레딧, 구글 메타 도전장 '맥스 캠페인 진행'](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/o4o2vj_202601220249.jpg)

![[CES 2026] AI, 스트리밍 전쟁, 마이크로드라마](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/nf0b2a_202601210349.png)

![[CES 2026] 크리에이터 이코노미 보고서(무료 요약본)](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/5wiefh_202601190237.png)