CNN Left Out of Hollywood's Biggest Deal: Netflix-WBD Merger Reshapes Global News Capital Landscape

As CNN spins off into Discovery Global, U.S. newsrooms pivot to Middle East capital while editorial independence faces new tests

KEY TAKEAWAYS:

• Netflix acquires Warner Bros. Discovery for $82.7B, excluding CNN from the deal

• CNN to be spun off into 'Discovery Global' with legacy cable assets amid structural decline

• Reuters, WSJ, Semafor accelerate Middle East expansion as U.S. ad market contracts

• UK tightens foreign ownership rules to 15%; U.S. maintains looser regulatory stance

The Mega Deal That Left CNN Behind

Netflix has agreed to acquire Warner Bros. Discovery (WBD) for approximately $82.7 billion, marking Hollywood's largest deal in history. Yet CNN—the pioneering 24-hour news network—was conspicuously excluded from the transaction.

Instead, CNN will be spun off into a separate publicly traded entity called 'Discovery Global,' alongside legacy cable channels including TNT, TBS, Discovery Channel, HGTV, and Food Network. While this exclusion might appear as a snub, it has provided temporary relief from politically sensitive acquisition scenarios—though structural uncertainties remain.

"How will this deal affect CNN and its future?"

— Brian Stelter (@brianstelter) December 6, 2025

Here's my answer to @WolfBlitzer's question pic.twitter.com/xN32QqQM4P

Inside CNN: Between Relief and Anxiety

According to The New York Times, CNN Chairman and CEO Mark Thompson addressed employee concerns in an internal memo following the announcement. 'Many of you have asked what today's news means for us,' Thompson wrote. 'The answer is this: This decision allows us to continue pursuing our strategy of successfully leading a digital transition to secure CNN's great future.'

Thompson emphasized that CNN's 2026 budget has already been increased, with approval secured from WBD CEO David Zaslav and CFO Gunnar Wiedenfels prior to the sale. He pledged close collaboration with Discovery Global's new leadership while focusing on 'delivering the best journalism to audiences across all platforms—TV, streaming, and digital.'

The relief among CNN staff stems primarily from avoiding a Paramount acquisition. Since Zaslav put WBD up for sale in late October 2025, anxiety about potential buyers had mounted—particularly regarding Paramount's aggressive bid.

The Paramount Scenario: Why CNN Feared Skydance

Paramount CEO David Ellison actively participated in the WBD bidding process. Unlike Netflix, which focused exclusively on entertainment and streaming assets, Ellison reportedly wanted the entire WBD portfolio—including CNN. Given that Paramount already owns CBS, a CNN acquisition would have made CBS News-CNN integration a logical next step.

The concern centered on Paramount's recent changes at CBS News. Ellison appointed Bari Weiss, a controversial opinion journalist and former New York Times opinion editor known for representing conservative voices within progressive media, as CBS News Editor-in-Chief. CNN staff worried that a Paramount acquisition could fundamentally shift the network's ideological direction.

Adding to these concerns was the Ellison family's relationship with President Trump. David Ellison and his father, Oracle founder Larry Ellison, have maintained close ties with Trump, who has publicly praised them on multiple occasions this year. The family has shown openness to leveraging their media assets in ways that align with Trump's political and business interests.

Netflix Wasn't Ideal Either

Would a Netflix acquisition have been better for CNN? Industry analysts suggest not necessarily. Netflix operates in over 190 countries and has occasionally complied with local government censorship demands to maintain market access.

The most notable example came in 2019, when Netflix removed an episode of Hasan Minhaj's talk show at Saudi Arabia's request. The episode criticized Crown Prince Mohammed bin Salman. Netflix has also blocked specific content in Singapore, Vietnam, and other countries to comply with local regulations.

At the 2019 New York Times DealBook conference, Netflix co-founder and Chairman Reed Hastings defended the Minhaj episode removal: 'We're not in the news business. We're not trying to do truth to power. We're trying to entertain.' This philosophy directly conflicts with journalism's fundamental mission of holding power accountable.

Hypothetically, had Netflix acquired CNN, reporters investigating Saudi Arabia's crown prince or India's digital surveillance practices could face conflicts if their parent company was simultaneously negotiating market access in those countries. From this perspective, CNN's exclusion may paradoxically protect editorial independence.

Discovery Global's Structural Challenges

Avoiding Netflix doesn't guarantee a rosy future. Discovery Global will be anchored in the declining cable TV business. As cord-cutting accelerates, traditional cable networks face structural declines in both viewership and advertising revenue.

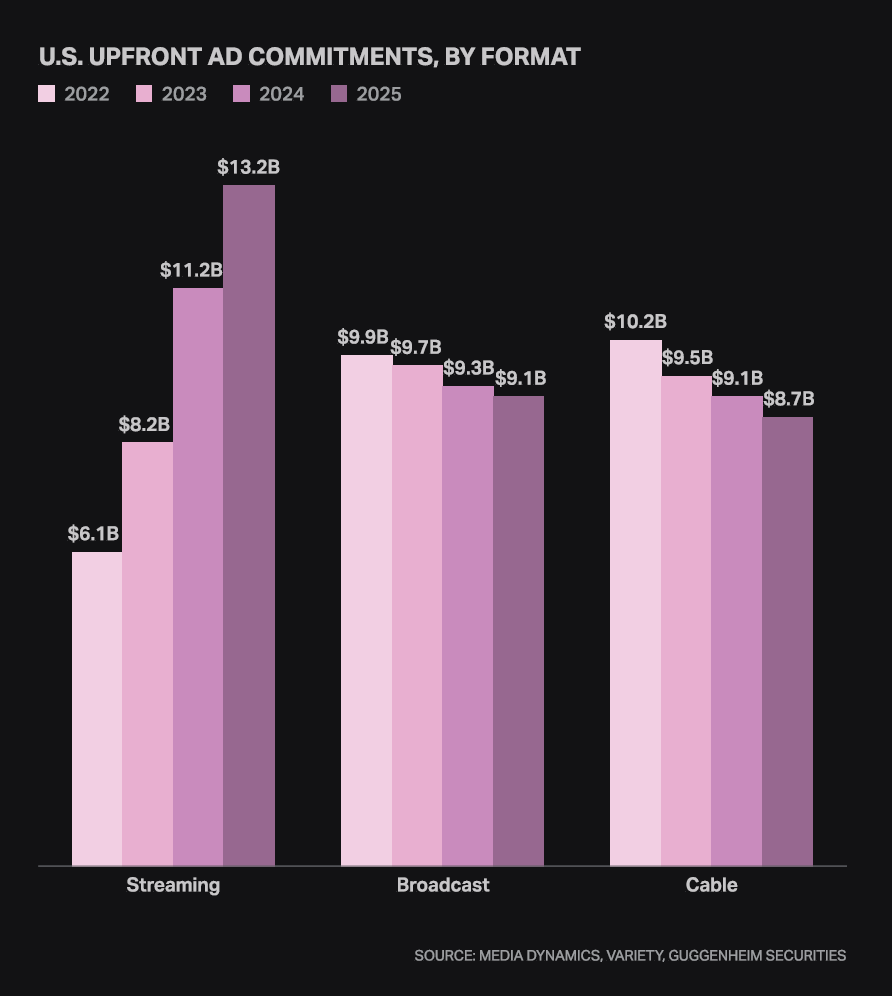

According to Luminate, U.S. cable TV ad sales (upfront commitments) have declined annually, reaching just $8.7 billion in 2025. Meanwhile, streaming ad revenue has grown to $13.2 billion. Within this environment, CNN becomes a high-cost asset inside a shrinking business. Operating a 24-hour global news network requires maintaining correspondents and bureaus worldwide—an enormous expense increasingly difficult to sustain within a declining cable ecosystem.

CNN isn't a publicly funded broadcaster like the BBC. In the Netflix era, privately funded news organizations without public support face existential challenges. Cost-cutting while preserving editorial independence is possible, but in the 'social video age' dominated by YouTube and TikTok, meaningful investment is required not just for format innovation but for maintaining basic coverage.

Post-spin-off, CNN will lose access to WBD's streaming platform Max and Warner Bros. Studios' content library, eliminating potential synergies. Thompson's 'digital transition' strategy—centered on CNN ALL ACCESS, a $6.99/month subscription bundle combining articles, live streaming, on-demand video, and CNN Originals—will determine the network's medium-term survival.

A Decade of Turmoil: CNN's Ownership History

CNN staff's relief at avoiding another major M&A upheaval reflects a turbulent decade of ownership changes. The network has cycled through AT&T, WarnerMedia, and WBD in less than ten years, with leadership instability to match.

2016: Time Warner agrees to sell to AT&T for approximately $85 billion.

2018: AT&T-Time Warner merger completes after defeating DOJ antitrust lawsuit; media assets rebranded as WarnerMedia.

Early 2022: CNN President Jeff Zucker resigns over undisclosed workplace relationship; his sudden departure shocks the organization.

April 2022: AT&T spins off WarnerMedia and merges it with Discovery in a $43 billion deal, creating Warner Bros. Discovery under CEO David Zaslav.

2022-2023: Chris Licht serves as CNN Chairman for just 13 months, departing amid controversies including a live Trump town hall.

August 2023: Former New York Times CEO Mark Thompson appointed CNN Worldwide Chairman and CEO.

October 2025: Zaslav puts WBD up for sale; Netflix and Paramount enter bidding.

December 2025: Netflix announces WBD acquisition agreement, excluding CNN.

Paramount May Return

Despite avoiding immediate uncertainty, CNN remains a potential acquisition target. Paramount's interest deserves particular attention. Ellison wanted all of WBD but lost to Netflix. Once Discovery Global becomes a separate company, acquiring CNN alone becomes far simpler.

This scenario may actually be more attractive to Paramount for several reasons. First, price: Netflix's disinterest in CNN likely depresses its valuation—similar to how a major buyer's indifference can lower real estate prices. Second, regulation: A Netflix-CNN combination would have faced Congressional hearings and international regulatory scrutiny, particularly in Europe and Korea. A Paramount-CNN deal, as a domestic news media consolidation, faces lower barriers. The FCC has shown flexibility toward such mergers as cable markets decline, and unlike CBS broadcasting, CNN isn't subject to Communications Act regulations. Third, strategic synergy: A CBS News-CNN merger would create one of America's most powerful news organizations, combining CBS's broadcast news capabilities with CNN's 24-hour cable presence and global newsgathering infrastructure.

The Netflix-WBD deal still requires extensive regulatory approval—DOJ antitrust review, FCC media ownership review, and EU and international regulatory clearance. Given Netflix's existing streaming market dominance, adding HBO Max could raise market concentration concerns. Regulatory approval may take over a year, with Discovery Global's spin-off proceeding first. After the expected summer 2026 spin-off, CNN and other cable assets could return to the market.

CNN Looks to the Middle East

Amid complex U.S. media dynamics, CNN is seeking new revenue sources and growth opportunities abroad—starting with the Middle East. CNN recently announced 'CNN Creators,' a new program based in Doha, Qatar. This multiplatform initiative features digital-native journalists covering AI, technology, arts, culture, sports, and social trends.

'Qatar has become increasingly important as a cultural, business, and sports hub in recent years,' said Meara Erdozain, CNN's Senior Vice President of International Programming. 'Doha's airport is among the world's most connected, serving roughly 170 destinations globally, making it an excellent base for newsgathering.'

Erdozain emphasized that the Qatar partnership is limited to facility and technology support: 'There is absolutely no compromise on editorial production or output. It is completely independent and will always remain so.'

U.S. News Media's Middle East Pivot

CNN's Middle East expansion reflects a broader industry trend. As U.S. advertising markets face structural decline, major American news organizations are targeting Middle Eastern capital and audiences through regional events, sponsorships, and digital expansion.

Reuters expanded its flagship Reuters NEXT leadership summit to Abu Dhabi with 'Reuters NEXT Gulf' in October 2025, accelerating its Middle East strategy including Arabic website development and subscription business growth. The organization is pursuing new revenue streams through partnerships with regional businesses and governments.

The Wall Street Journal extended its invitation-only 'WSJ Tech Live' conference to Doha, Qatar, holding its first Middle East event in 2025. The premium event attracts hundreds of global C-suite executives, investors, and startups, operating as a new revenue model intertwining media and government interests aligned with Qatar's tech and investment hub ambitions.

Semafor launched 'Semafor Gulf,' securing First Abu Dhabi Bank, G42, Mubadala, and Invest Qatar as founding partners. The digital-native publication is pursuing revenue diversification through newsletters, events, and brand partnerships, targeting premium financial, policy, and business readers across Saudi Arabia, UAE, and Qatar.

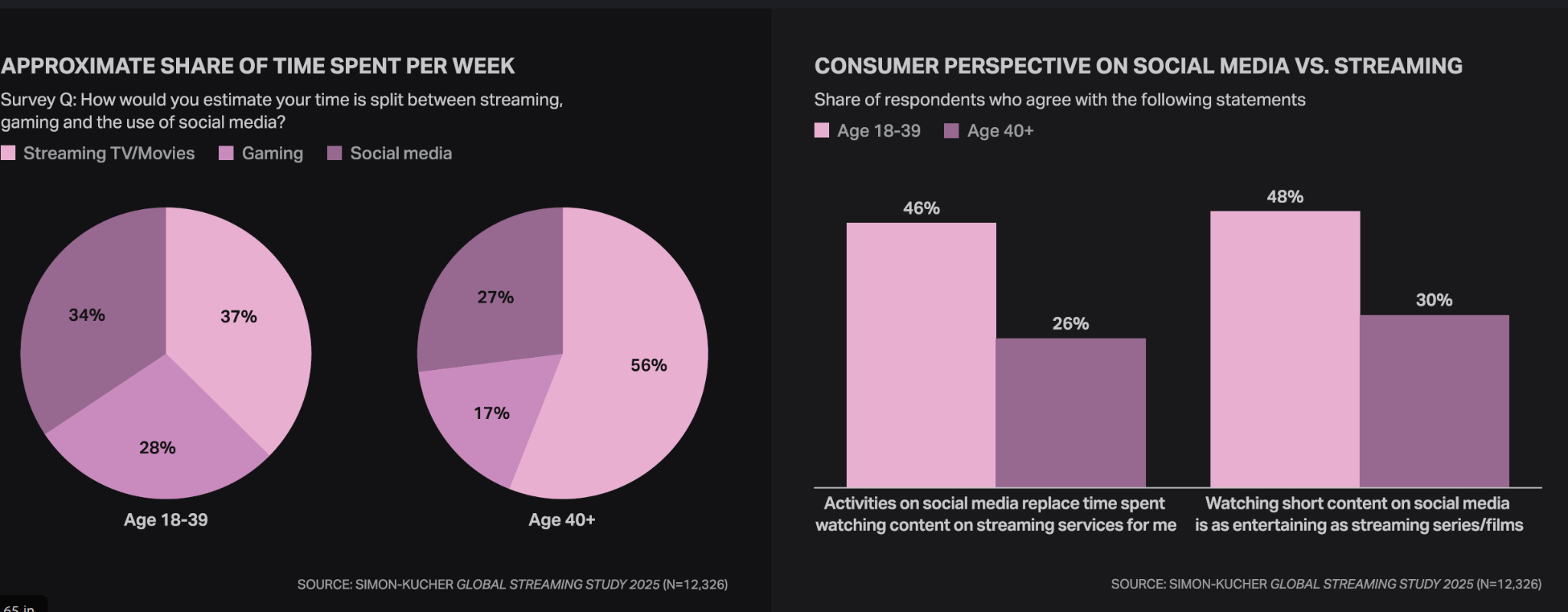

This migration reflects a structural crisis: Google and Meta's dominance of digital advertising has long-term eroded traditional news media's ad revenue. With audiences under 40 increasingly consuming news through social video platforms, U.S. subscription and advertising models offer limited growth. Media companies are turning to Gulf states, where governments, sovereign wealth funds, and major financial institutions actively sponsor content and events.

Middle Eastern Capital Penetrates U.S. News Media

Beyond advertising and sponsorships, American and European news organizations are opening doors to direct Middle Eastern investment. After the 2018 Jamal Khashoggi murder temporarily froze Gulf investment in Western media, organizations have gradually resumed commercial cooperation with Gulf states—particularly Qatar and the UAE—outside Saudi Arabia.

Penske Media Corporation (owner of Variety) received $200 million from Saudi Research and Marketing Group, an entity with close Saudi government ties, before the Khashoggi incident.

Newsmax raised approximately $50 million from Qatar's royal family in 2019-2020.

RedBird IMI (a joint venture between RedBird Capital Partners and Abu Dhabi's International Media Investments) has invested in multiple media ventures including Front Office Sports. The short-lived digital outlet The Messenger also had IMI as a minority investor, and IMI funded another defunct digital publication, Grid. Bloomberg and Vice established commercial partnerships with Middle Eastern entities in 2023.

Asian Capital Targets Western News Brands

Asian capital is also actively acquiring prominent U.S. and European news brands, seeking to combine the brand value created by Western press freedom with strategic capital deployment.

Fortune was acquired by Thai businessman Chatchaval Jiaravanon for approximately $150 million in 2018, becoming a landmark case of Asian private capital purchasing an entire American business journalism brand.

Financial Times was sold to Japan's Nikkei for approximately $1.3 billion in 2015, combining a conservative Japanese media conglomerate with Britain's premier global business newspaper.

Forbes came under Hong Kong-based Integrated Whale Media ownership in 2014, placing the global wealth and business brand synonymous with 'rich lists' under Asian investment capital.

These transactions demonstrate that Western news brands' credibility, editorial independence, and elite global readership are valued as premium assets. Asian investors and media groups share strategies of combining brand trust with ancillary businesses including finance, conferences, and data services. Yet market and industry concerns persist about whether new ownership structures can maintain editorial independence and press freedom principles—the core components of brand value.

The Structural Tension: Foreign Capital vs. Editorial Independence

The principle that commercial transactions and fundraising should never influence editorial decisions has long been emphasized in journalism. But as global media market competition intensifies, this principle faces mounting real-world pressure.

Middle Eastern governments have expanded partnerships with foreign news organizations to enhance their international image. However, such collaborations raise concerns about compromising press independence. The Guardian reported in 2023 that Vice 'repeatedly blocked stories that could upset the Saudi government' during its collaboration with Saudi-sponsored MBC Group—a case demonstrating how commercial foreign government influence can translate into direct editorial interference.

CNN's Erdozain maintains that the Qatar partnership is 'limited to facility and technology support' with 'absolutely no compromise on editorial production or output. It is completely independent and will always remain so.' Media analysts note, however, that such principles require ongoing verification as financial pressures mount.

U.S. vs. UK: Divergent Regulatory Approaches

Regulatory responses to foreign capital in news media vary dramatically between nations.

The United States maintains the Foreign Agents Registration Act (FARA) for organizations receiving foreign government or sovereign fund money, but has rarely enforced registration consistently against news companies. While the DOJ requested FARA registration from Al Jazeera's U.S. digital channel AJ+ in 2020, enforcement stalled amid civil society and political disputes—symbolizing relatively low barriers for foreign sovereign and state media capital entering the U.S. news ecosystem.

Foreign capital acquiring news company stakes can theoretically trigger Committee on Foreign Investment in the United States (CFIUS) review, but deals are often structured with voting rights arrangements or stake percentages designed to fall below 'foreign control' thresholds, avoiding regulatory scrutiny. The U.S. system effectively relies on post-hoc transparency while capital structures remain open to global sovereign funds and state enterprises.

The United Kingdom takes a far stricter approach to foreign state-linked newspaper ownership. When RedBird IMI pursued Telegraph and Spectator acquisitions, the Conservative government introduced legislation effectively blocking foreign state capital investment in British newspapers. After months of regulatory review, RedBird withdrew its bid.

In 2025, the UK government relaxed rules to allow foreign state-owned investors to hold up to 15% of British newspaper stakes—but clearly signaled it won't permit controlling ownership. The message: 'Investment doors are open, but keys to public opinion stay home.'

Broadcasting faces even stricter regulation. Ofcom has long maintained tight control over television and radio licenses, with powers extending to license revocation when 'foreign governments or political parties' are deemed to exercise 'actual control.'

While foreign state-funded entities can technically own TV channels if structured as independent corporations with editorial responsibility systems meeting fairness and balance requirements, any determination of political control fails 'fit and proper' requirements. CGTN, China's state broadcaster, lost its UK broadcasting license in 2021 after Ofcom determined the Chinese Communist Party held ultimate control.

The FCC has also moved to address foreign influence concerns, requiring broadcasters to disclose foreign-sponsored programming under revised rules effective June 2025, with compliance deadline extended to December 2025. These rules, however, apply only to broadcasting—digital and print media remain largely unregulated.

The U.S. approach of 'post-hoc transparency with gradual regulation' versus the UK's 'stake caps with prior review' reflects fundamentally different philosophies about who controls public opinion infrastructure. Nations face a choice: broadly accept foreign capital for financial sustainability, or prioritize information sovereignty with high barriers and tight oversight at the cost of growth.

Conclusion: CNN's Fate and the Global Shift in News Capital Power

CNN's exclusion from the Netflix-WBD mega deal represents more than one media group's sale. It symbolically reveals the structural transformation facing American news industry and the global capital flows reshaping public opinion infrastructure.

CNN avoided the politically sensitive Paramount scenario, temporarily securing editorial independence. Yet it simultaneously inherits the structural challenge of being a high-cost organization trapped within declining cable TV business. The 2026 budget increase and digital transition strategy offer positive signs, but catching the rapidly accelerating global media market's shift toward streaming, AI, and subscription models remains a steep climb.

From a macro perspective, this deal reveals Western news ecosystem's 'great capital migration.' Reuters, WSJ, and Semafor expanding into the Middle East, while Qatar, UAE, and Saudi sovereign funds actively acquire and partner with Western news brands, signals that the news industry no longer operates within national boundaries.

Middle Eastern capital strategically absorbs the brand credibility created by Western press freedom. Asian capital builds 'editorial independence + brand asset' combination models through Fortune, FT, and Forbes. A quiet restructuring is underway—shifting journalism's center of gravity from Western public broadcasting systems toward a 'hybrid private/global sovereign fund system.'

The larger question is whether 'editorial independence' can survive this new landscape. As the Vice-Saudi partnership case revealed, boundaries between commercial cooperation and political influence grow increasingly blurred. America's loose post-hoc regulation accelerates capital inflows while risking internal erosion of press credibility. Britain, meanwhile, defends information sovereignty under the principle 'investment doors open, but public opinion keys stay home' through stake caps and prior review.

Four key variables will shape what comes next:

1. Whether Netflix-WBD receives antitrust approval and under what conditions

2. CNN's potential resale after Discovery Global spin-off

3. Which among Paramount, Middle Eastern sovereign funds, or Asian capital leads the next acquisition wave

4. Whether digital transition and subscription-centered 'private news survival experiments' prove market-viable

Ultimately, the CNN situation poses a question to the entire global news industry: 'Who will own the infrastructure of public opinion?' Capital globalization has already begun; press independence now faces tests in corporate and investment structure design rather than nation-state frameworks.

If CNN succeeds in building a new model through its ALL ACCESS digital subscription strategy, it will represent more than one broadcaster's survival—it could become the final proof that traditional journalism can redefine itself amid the tides of capital.

---

Originally reported in Korean. English adaptation by K-EnterTech Hub.