Microdramas Enter the Mainstream

LA City Council Approves Historic Tax Incentive

A $5 million grant program signals Hollywood's recognition of the vertical video revolution

As blockbuster budgets deflate and theatrical distribution diversifies, another transformation is underway. On January 28, 2026, the Los Angeles City Council voted unanimously 14-0 to approve a $5 million grant program for microdrama production—the short-form vertical videos, typically 1-2 minutes per episode, that have exploded in popularity on TikTok and YouTube Shorts.

This marks the formal entry of microdramas into Hollywood's institutional framework. Despite California operating a $750 million annual film tax credit program, the $1 million minimum budget requirement has structurally excluded microdramas, which average around $200,000 per production.

"A lot of these productions don't qualify for state tax credits," said Councilmember Bob Blumenfield, who introduced the motion. "We need to address this."

Reviving the Creative Middle Class

Jay Blumenfield, the councilmember's brother and a TV industry veteran who has produced Her Heart, Held Hostage and Hired to Obey for the MyDrama platform, emphasized the social significance of microdramas.

"Microdramas are one way to revive the creative middle class in this city—a class that has been completely hollowed out by mergers and acquisitions, moguls, and foolish decisions," he said. His remarks reflect the harsh reality facing mid-level production workers who lost jobs during the streaming wars, studio restructuring, and the 2023 strikes.

"If we could get an extra $20,000 to $30,000, that could be the difference between shooting in LA or not," Blumenfield explained. The city's proposal includes not only grants but also reduced filming permit fees and a new "micro-budget concierge" service targeting three-day permit approvals.

Regional Film Production Incentives Comparison

The Global Microdrama Market: A $26 Billion Industry by 2030

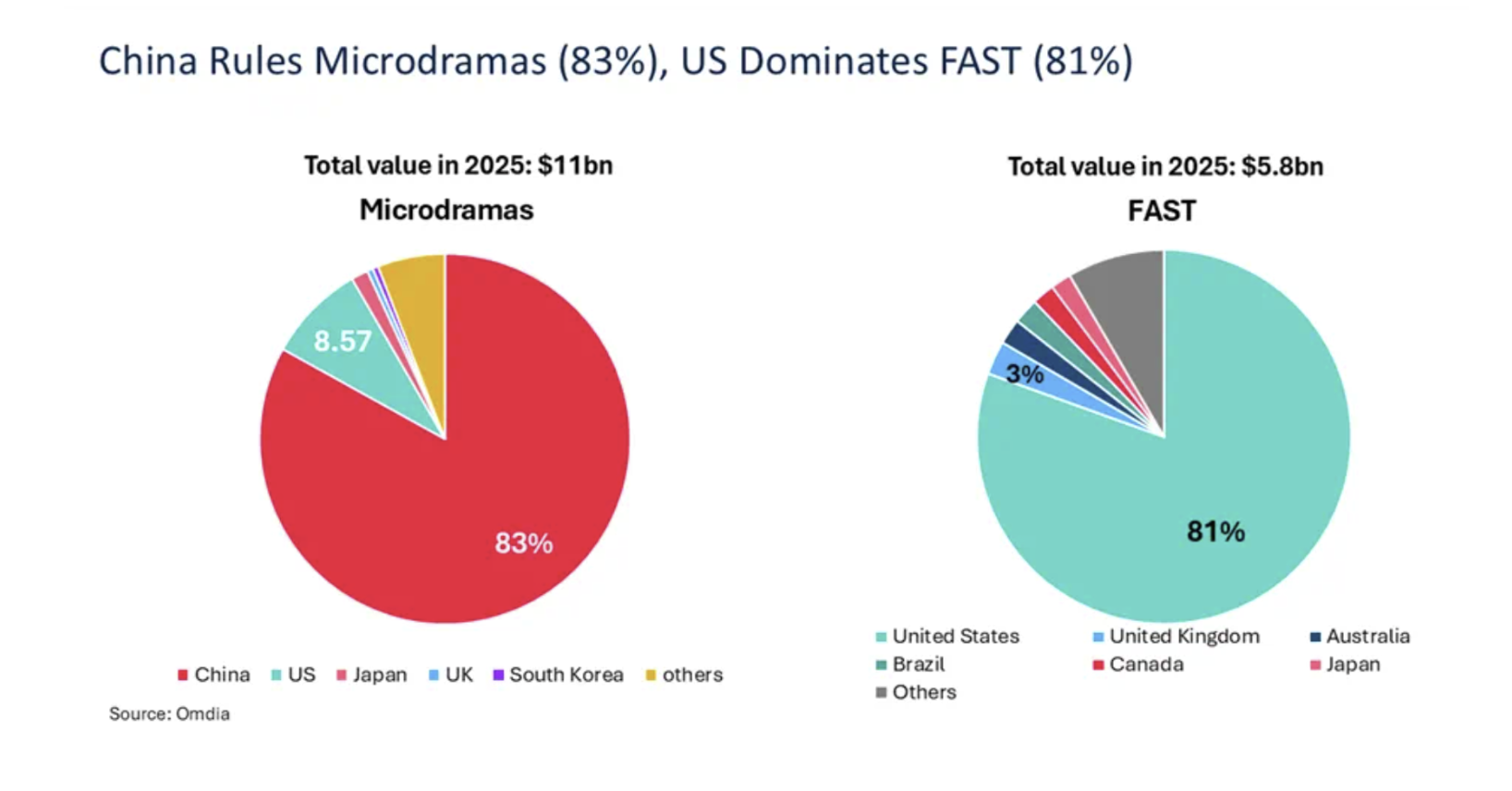

According to Omdia, the global microdrama market reached $11 billion by the end of last year—twice the size of the rapidly expanding Free Ad-Supported Streaming TV (FAST) market ($5.8 billion). While the US dominates FAST, China is the heartland of microdramas, commanding 83% market share.

China: Integration Is Everything

China is the originator and global blueprint for the microdrama industry. Over 830 million viewers currently consume this format, with approximately 60% making content payments or transactions. The industry is built around three major players: ByteDance's Red Fruit, Tencent's WeChat Video Accounts, and Kuaishou's Xi Fan.

Adrian Tong, senior analyst at Media Partners Asia, explained the strategic differences in a Variety interview: "ByteDance and Kuaishou have built standalone discovery ecosystems based on algorithmic personalization, while Tencent has embedded microdramas within its super-app WeChat's mini-programs, creating a seamless loop of discovery, payment, and social sharing."

These platforms leverage vast IP pipelines from online literature platforms including COL, China Literature, and Tomato Novel, converting blockbuster web novels into serialized vertical dramas. By 2030, 56% of Chinese microdrama revenue is projected to come from advertising, 39% from subscriptions, and 5% from commerce.

Timothy Oh Jia Wei, General Manager at COL, shared a key insight: "Vertical content has existed since TikTok and Instagram Stories launched. The question was whether people would pay for it. The golden question we answered was: 'What content is worth paying for?'"

The Rise of S-Class Productions

The Chinese market is entering a new phase with the rise of "S-Class Productions"—premium microdramas with budgets of $400,000-$600,000, featuring cinematic quality, professional cast, and franchise potential. These flagship titles are redefining quality standards while expanding monetization possibilities.

The US Market: Profitability vs. Scale

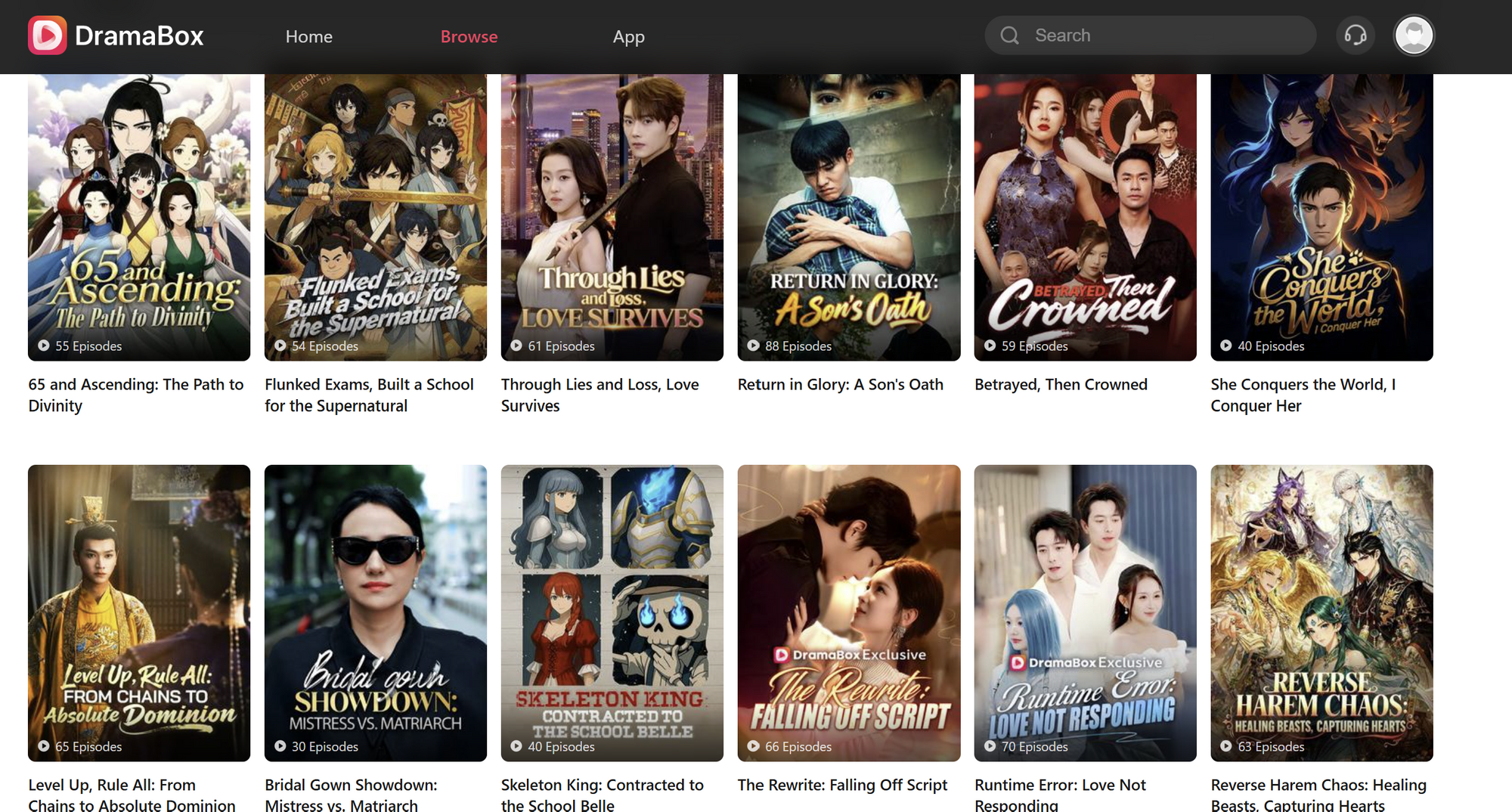

The United States has emerged as the most profitable market outside China, with revenue projected to grow from $819 million in 2024 to $3.8 billion by 2030. The core audience consists of affluent urban women aged 30-60, drawn to romance, CEO stories, and revenge narratives.

Two platforms dominate the market: DramaBox and ReelShort. According to Media Partners Asia, DramaBox has proven profitability is achievable—recording $323 million in revenue and $10 million in net profit in 2024 through a model combining subscriptions, episode-by-episode unlocks, and advertising. ReelShort achieved larger scale at approximately $400 million but remains in the red due to massive marketing expenses and amortization.

US Microdrama Platform Comparison (2024)

The Customer Acquisition Cost Challenge

Customer acquisition cost remains a critical challenge. Traffic marketing agency QianFan spends over $50 million across global advertising networks including Meta, Instagram, and TikTok. QianFan's analysis indicates that 3-minute marketing materials outperform shorter formats, with ROI varying between 0.7 and 1.6 depending on title.

"Deep research into daily data and responses, and immediate reaction from data to action, is the key to winning," QianFan emphasizes. This demonstrates that the microdrama business requires data-driven performance marketing capabilities, not just content production skills.

Advertising Spend Distribution

According to eMarketer citing Sensor Tower, 68% of total U.S. microdrama apps ad spending came from social media between January and September 2025. Facebook took the biggest chunk (25%), followed by TikTok (19%), Snapchat (16%), and Instagram (8%). Despite YouTube's push into Shorts, it accounted for only 2% of U.S. microdrama ad spend.

Max Willens, principal analyst at eMarketer, noted: "Micro dramas are catching on in the U.S. because their stories' outsized emotions, sharp plot twists and short run times are structurally optimized for sharing on social networks."

Southeast Asia and Emerging Markets

Southeast Asia and Latin America are emerging as promising growth regions. Myat Pan Phyu, analyst at Media Partners Asia, told Variety: "Southeast Asia is becoming really important in the microdrama market. Thailand is standing out with a 360-degree model—distributing microdramas through streaming service apps and mobile networks while pursuing dual monetization through both advertising and subscription layers."

India remains in the exploration phase. However, given its population size and smartphone penetration, it is assessed as a market with explosive growth potential in the future.

The LA City Council's unanimous vote signals more than local policy—it acknowledges that the future of filmed entertainment may be vertical, brief, and optimized for the smartphone screen.

Sources

1. Scanlon, K. (2025, November 4). In Graphic Detail: The rise of micro dramas that are attracting big ad dollars. Digiday. https://digiday.com/marketing/in-graphic-detail-the-rise-of-micro-dramas-that-are-attracting-big-ad-dollars/

2. Frater, P., & Roxborough, S. (2025). Global Microdrama Market Report. Variety / Media Partners Asia.

3. Omdia. (2025). Global Microdrama Market Analysis. Research Report.

4. Owl & Co. (2025). Q3 2025 Microdrama Revenue Report. Media & Entertainment Consulting.

5. eMarketer / Sensor Tower. (2025). US Microdrama Apps Ad Spending Analysis. Market Intelligence Report.

6. Los Angeles City Council. (2026, January 28). Motion for Microdrama Production Grant Program. Council File.

7. Ampere Analysis. (2025). Mini Drama Viewership Demographics. Consumer Research.

8. Fabric Software & Data Solutions. (2025). Microdrama App Ecosystem Analysis. Platform Research.