Global Box Office 2025: Still Struggling to Recover Pre-Pandemic Levels

North American theatrical revenue barely surpasses $9 billion; franchise tentpoles expected to drive 2026 recovery

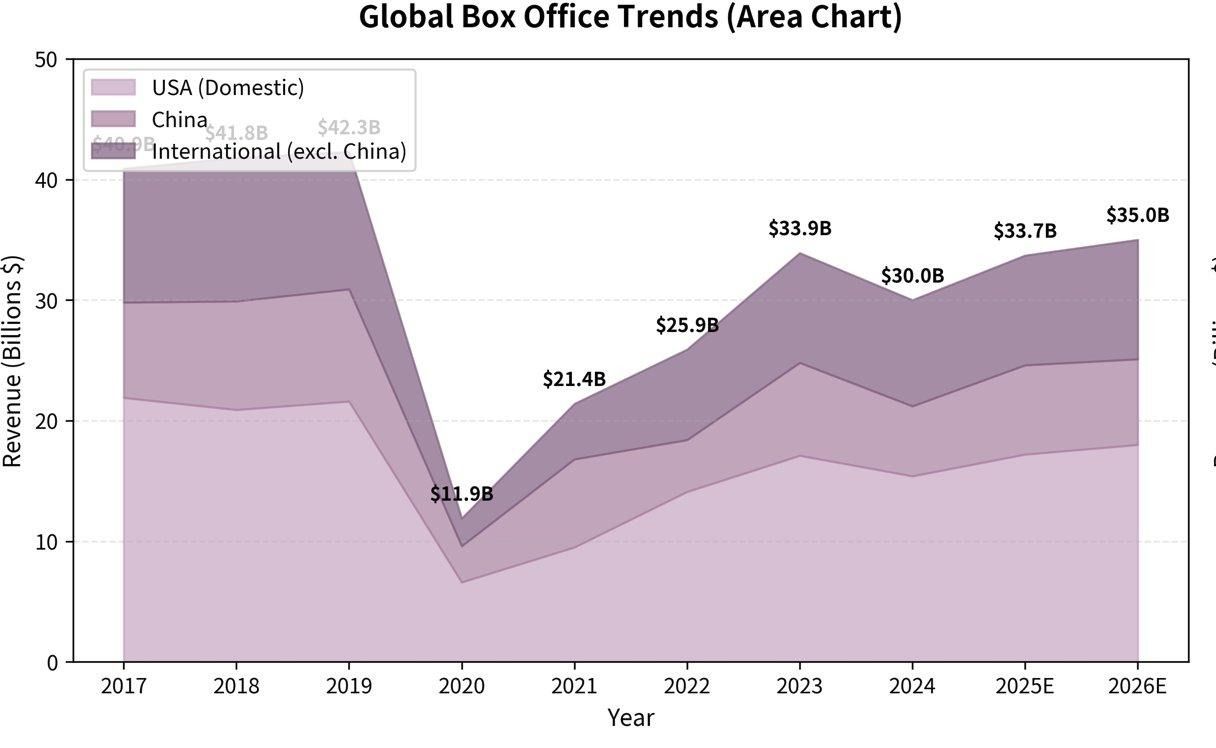

The global theatrical market continued to struggle in 2025, falling short of its pre-COVID heyday. According to analysis from Comscore and Gower Street Analytics, North American box office revenue barely exceeded $9 billion, missing the post-pandemic high of approximately $9.1 billion set in 2023. This represents only marginal improvement over 2024's $8.8 billion, a year hampered by Hollywood strike-related production delays.

The summer 2025 season notably failed to reach $4 billion, standing in stark contrast to 2023's "Barbenheimer" phenomenon. A weak spring and underperforming tentpoles including Furiosa weighed on overall results.

China Market Dynamics and Streaming Competition

China's selective release policies for Hollywood films continue to pressure studios' international revenue streams. The 2025 Chinese box office is estimated at approximately $7.4 billion, still well below its 2019 peak of $9.3 billion.

Meanwhile, as SVOD platforms like Netflix and Prime Video have scaled back original film production, major studios are accelerating theatrical-to-streaming pipelines. This trend continues to shorten theatrical windows, with films moving to TVOD platforms faster than ever.

2026 Outlook: Franchise Films to Drive Recovery

Industry observers project 2026 as potentially the strongest post-pandemic year for box office, driven by a slate packed with franchise tentpoles across all major studios.

Gower Street Analytics forecasts the 2026 global box office at approximately $35 billion, comprising $18 billion from North America, $7.1 billion from China, and $9.9 billion from other international markets. While still short of the all-time high of $42.3 billion in 2019, this would represent continued post-pandemic recovery.

However, given 2025's top performers, some analysts suggest this target may prove challenging.

2025 Hit Analysis: Disney and China Dominate

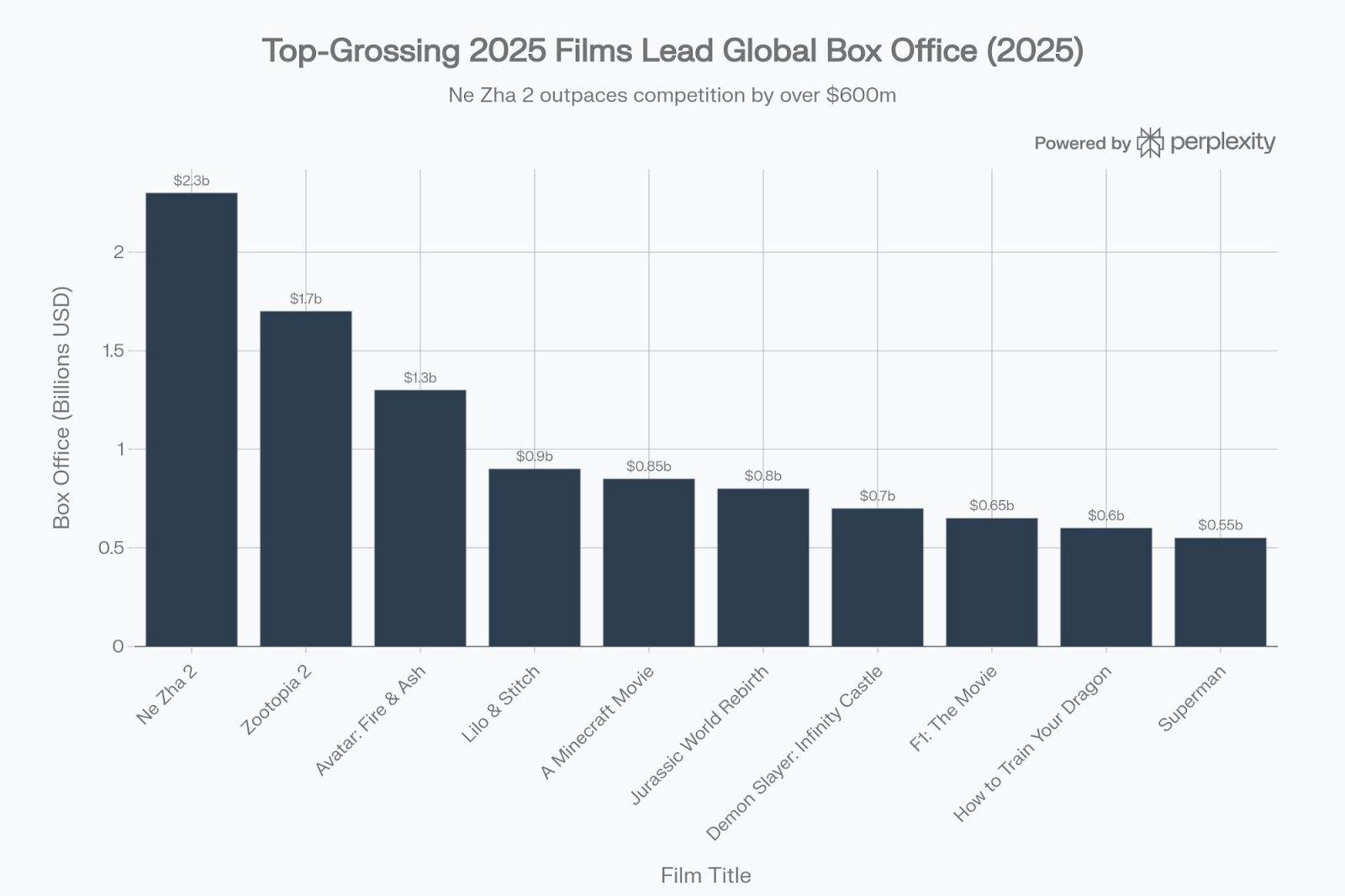

The most striking phenomenon in 2025's global box office was the rise of Chinese animation. China's Ne Zha 2 claimed the year's top spot with approximately $2.3 billion in revenue, leading second-place Zootopia 2 ($1.7 billion) by over $600 million. Remarkably, this achievement came with minimal U.S. audience support beyond a limited release and A24's English-dubbed version.

Disney once again dominated the upper ranks, placing Zootopia 2 and Lilo & Stitch ($900 million) in the top five. However, in a surprising turn, three Marvel films failed to crack the top 10. Warner Bros.' Superman claimed the superhero genre's best performance at $550 million for 10th place, notably performing better domestically than internationally.

Avatar: Fire and Ash secured third place with $1.3 billion but achieved only half of its predecessor The Way of Water's $2.3 billion haul. Universal's Jurassic World Rebirth took sixth place with $800 million, marking the first time a new entry in the franchise failed to reach $1 billion. Meanwhile, A Minecraft Movie successfully launched a new video game-based franchise, earning $850 million for fifth place.

Japanese anime Demon Slayer: Infinity Castle grossed $700 million for seventh place, becoming the highest-grossing anime film ever and validating Sony's Crunchyroll acquisition. F1: The Movie ($650 million) and How to Train Your Dragon ($600 million) rounded out the top 10 at eighth and ninth place respectively.

Key Takeaways

The 2025 box office reveals several important trends in the global film market. First, Chinese domestic films have grown competitive enough to challenge Hollywood. Ne Zha 2's success proves China is no longer merely a consumption market for Hollywood blockbusters.

Second, the Marvel Cinematic Universe's brand power is weakening. Marvel films, once dominant in box office rankings, failed to place a single title in the top 10—reflecting superhero fatigue and audiences' increasingly critical evaluation of content quality.

Third, the "dormancy strategy" for proven IP has proven effective. The success of Zootopia 2 and Inside Out 2 demonstrates that allowing sufficient time between sequels can trigger audience nostalgia while capturing new generational audiences.

Fourth, game and anime IP adaptations are establishing themselves as new revenue streams. The performance of A Minecraft Movie and Demon Slayer suggests that cross-platform IP expansion strategies can contribute to theatrical industry vitalization.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Sources: Comscore (2025), Gower Street Analytics (2026), Luminate Film & TV (as of Jan. 20, 2026), MPA

![[보고서]CES2026 엔터테크 보고서](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/pkmea9_202601250121.jpeg)

![[CES2026]미디어 기업 업프론트(광고 설명회) 장소로 변신](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xjbio9_202601222334.png)

![[CES 2026]레딧, 구글 메타 도전장 '맥스 캠페인 진행'](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/o4o2vj_202601220249.jpg)

![[CES 2026] AI, 스트리밍 전쟁, 마이크로드라마](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/nf0b2a_202601210349.png)