Microdramas Step Into the Spotlight

From Fox to Kim Kardashian: Hollywood and Silicon Valley bet big on vertical storytelling

One in ten Netflix subscribers now also uses a microdrama app. 72% of Americans express interest in watching microdramas. Mobile-first dramas comprising 1-3 minute episodes are reshaping the U.S. entertainment landscape.

The ghost of Quibi—which burned through $1.75 billion before shutting down in 2020—no longer haunts Hollywood. Built on the viewing habits of the TikTok generation, short-form storytelling has finally become a 'working business.'

The Ultimate Convergence of Hollywood and Creator Economy

Microdramas represent the ultimate synthesis of legacy media and social media. They borrow the emotional grammar of traditional TV melodrama while being engineered for the rhythms of social video. Tightly plotted narratives, cliffhangers at every episode's end—this format is designed for binge-watching on vertical video platforms.

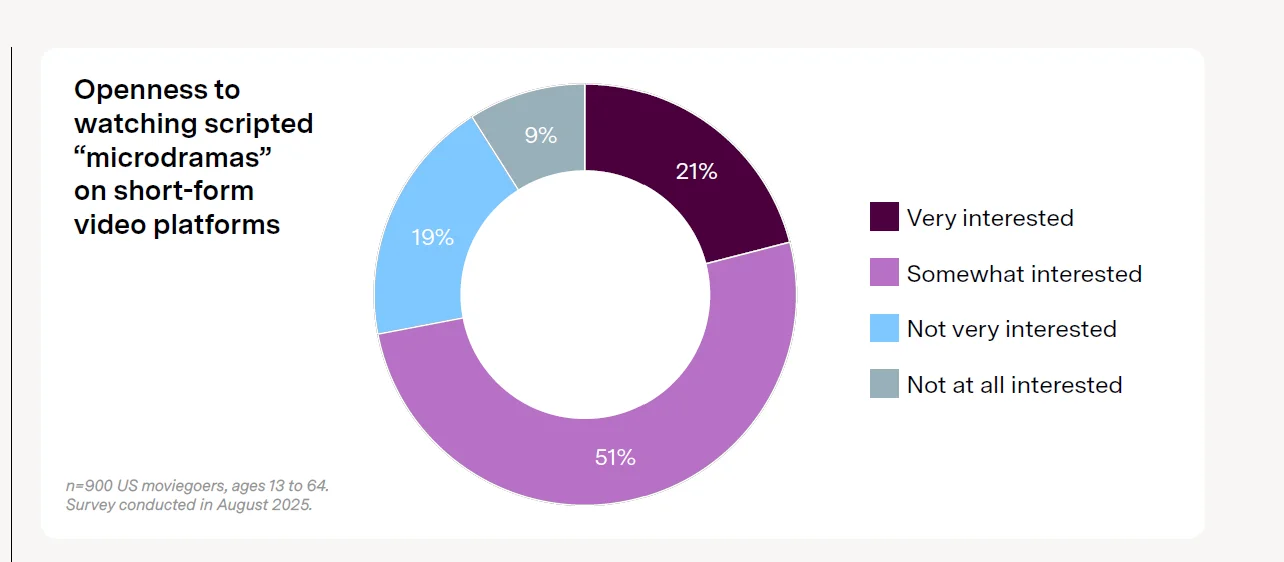

[Chart] Openness to watching scripted microdramas on short-form video platforms (n=900 US moviegoers, ages 13-64, August 2025)

According to the survey, 21% of Americans are 'very interested' in watching microdramas, while 51% are 'somewhat interested.' Only 28% expressed no interest. Dedicated platforms like ReelShort and DramaBox have already topped U.S. app charts, proving the appetite exists—and that American audiences are increasingly willing to explore narrative formats that sit somewhere between TV and TikTok.

Surging User Numbers

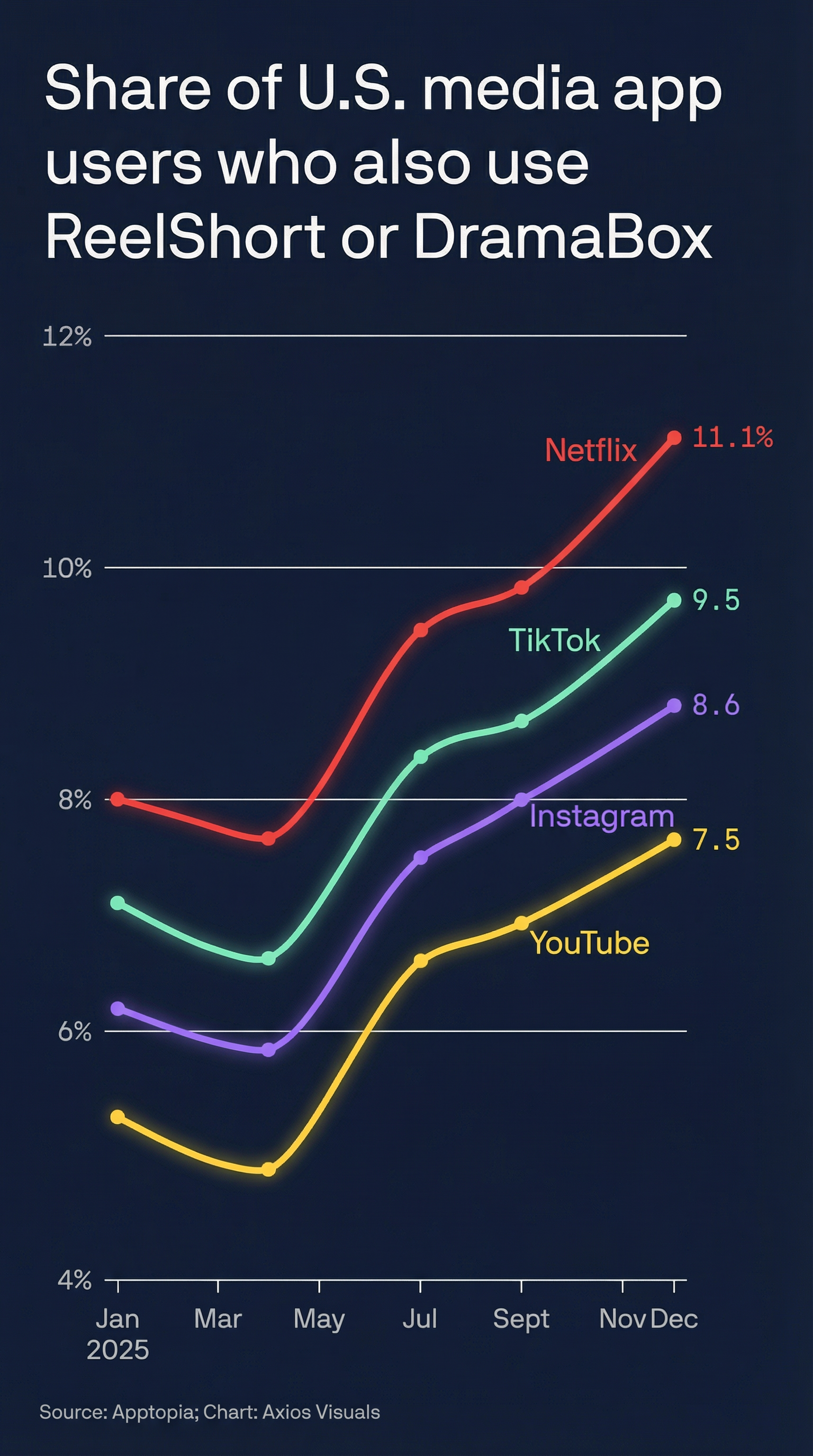

According to exclusive data from Apptopia provided to Axios, the percentage of major U.S. media app users who also use microdrama apps ReelShort and DramaBox surged across all platforms in 2025.

[Chart] Share of U.S. media app users who also use ReelShort or DramaBox (Jan-Dec 2025) / Data: Apptopia, Chart: Axios Visuals

Microdrama App Co-Usage by Platform (Jan → Dec 2025)

Notably, Netflix users show the highest co-usage rate, suggesting that even premium streaming subscribers are actively interested in short-form content. This is evidence that American audiences are willing to explore new narrative formats that exist somewhere between TV and TikTok.

China's Proven Model

China is the birthplace of microdramas. More than 830 million viewers already consume microdramas there, making it a multi-billion dollar content category. This growth has been enabled by hyper-efficient production pipelines—modular sets and AI-assisted workflows can take a series from development to release in under two months.

This efficiency—and the format's proven ability to hook audiences—has begun to attract serious interest from U.S. studios. The industry remembers Quibi's failure, but this time there's a proven template to follow.

Beyond Quibi's Failure

Quibi's collapse after raising $1.75 billion in 2020 cast a long shadow over the short-form content market. Unlike Quibi's high-budget, celebrity-driven strategy, today's microdramas thrive on low-budget, high-volume production.

Ben James, Chief Innovation Officer at agency GALE, notes: "The ability to use one's own voice to script, shoot, direct and edit a story has become more accessible than ever. This creates endless opportunity to test more narratives—and much more quickly."

Key Players and Industry Moves

New apps are entering the market with strategies proven in China—faster and cheaper production, easier content discovery, and monetization through ads and micropayments. Singapore-based StoryMatrix's DramaBox participated in Disney's accelerator program in 2025 and is seeking $100 million in funding at a $500 million valuation.

[Image] GammaTime: Premium Verticals backed by Hollywood veterans and celebrity investors including Kim Kardashian

GammaTime, led by former Miramax CEO Bill Block, launched in October 2024 after raising $14 million from vgames, Pitango, Reddit co-founder Alexis Ohanian, Kris Jenner, Kim Kardashian, and Traverse Ventures. The platform positions itself as 'Premium Verticals. Anytime. Anywhere.'—signaling Hollywood's serious bet on the format.

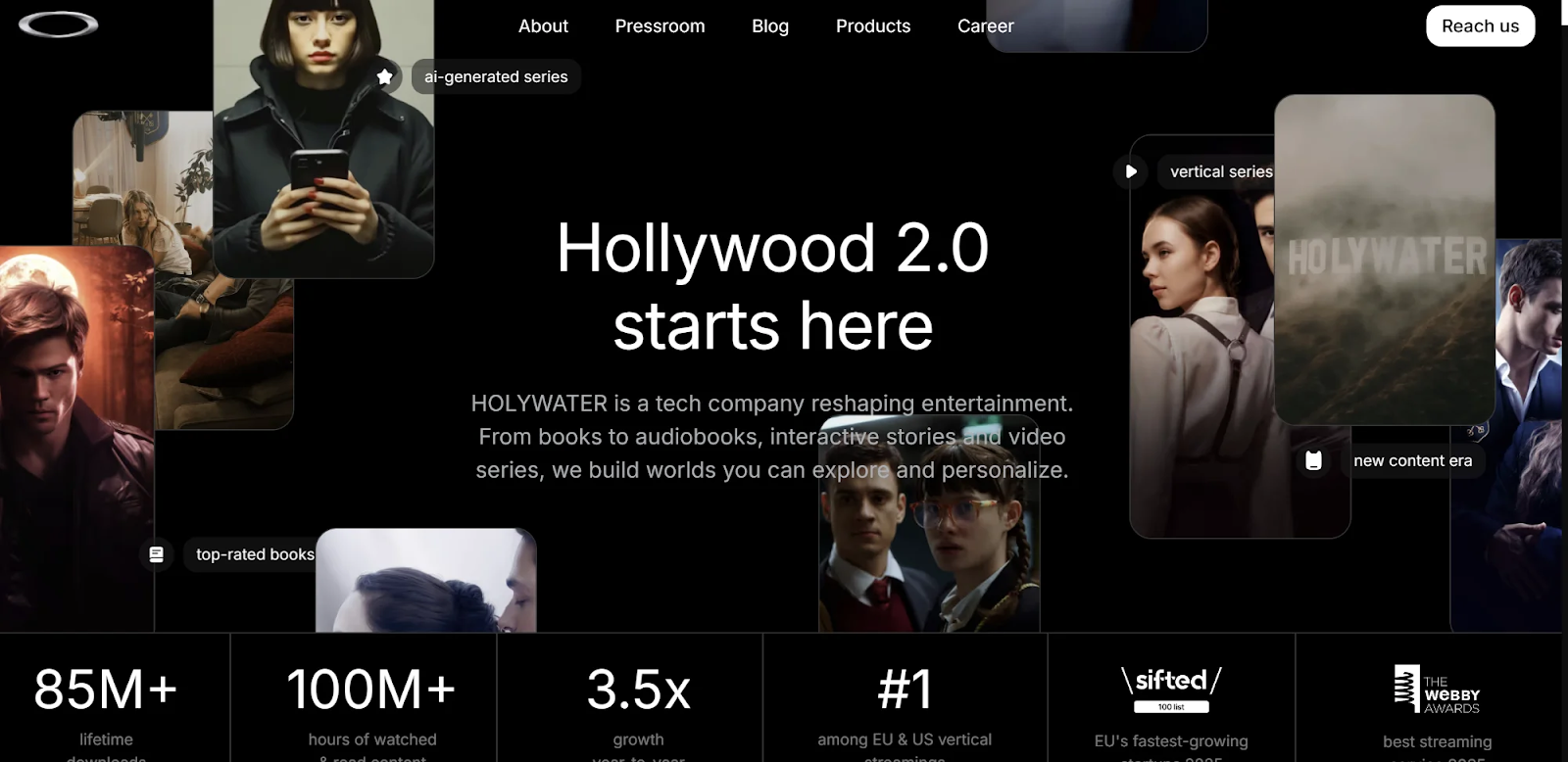

[Image] Holywater: 85M+ lifetime downloads, 100M+ hours watched, 3.5x YoY growth, #1 among EU & US vertical streamings

Fox's recent investment in Holywater, a Ukrainian vertical-video production studio, is particularly noteworthy. It represents one of the first major attempts by a Hollywood player to treat short-form video as an important content format in its own right, rather than merely a marketing channel. Meanwhile, SAG-AFTRA's newly announced Verticals Agreement explicitly prepares performers for a future in which vertical storytelling becomes a core part of America's entertainment landscape.

Beijing-based COL Group's ReelShort leads the market with $130 million in in-app revenue in Q1 2025. TelevisaUnivision has also debuted microdramas on its Spanish-language streaming platform ViX, with plans to release 100 titles in 2026.

TikTok has also joined the fray, launching a 'Minis' section last month that samples episodes from apps like SnackShort, Stardust TV, and HoneyReels.

A $3 Billion Market Is Born

According to Owl & Co, microdramas generated approximately $3 billion in revenue globally in 2025, excluding China—nearly triple the prior year. The U.S. leads as the largest market at $1.3 billion.

Owl & Co founder Hernan Lopez, who hosted a summit on the format last month, notes: "That's small next to Netflix or YouTube, but it marks something we've never had before: a functioning market for short-form scripted storytelling."

Outlook: The Vanishing Boundary Between TV and TikTok

Currently, microdrama platforms are heavily dominated by romantic dramas, many of which are adaptations of web novels or online comics. But that could shift as investment flows into this content category, bringing in new audiences and broadening the range of stories on offer. As more creators experiment with serialized vertical storytelling, and as more studios take an interest, microdramas look poised to become another important bridge between creator culture and Hollywood.

GALE's Ben James expects brands to explore creating microdramas as brand-funded entertainment continues to rise—a new revenue model where the boundary between advertising and storytelling dissolves.

The industry is now focused on the emergence of a 'killer content.' Lopez emphasizes: "Streaming had 'House of Cards,' podcasting had 'Serial' and 'Dirty John.' Microdramas need their own iconic work that shifts public perception."

In a media landscape defined by shrinking attention spans and rising production costs, microdramas offer something rare: a format that can deliver cinematic punch at the speed of social video. And they may be the clearest sign yet that there's no longer a meaningful boundary between Hollywood and the creator economy.

$3 billion is just the beginning. As Gen Z—raised on short-form video—emerges as a major consumer force, and as AI-powered production tools drive content costs even lower, microdramas are poised to leap from niche to mainstream. If Quibi was a future that arrived too early, ReelShort and DramaBox are a present that arrived right on time.

─────────────────────────────────────────────

Sources: Axios, Deloitte Digital Media Trends 2025

![[CES2026]소셜미디어의 거실 쟁탈전과 K콘텐츠의 다음 수](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/fby4pm_202512260354.png)

![[2026엔터테크] 윤리적 AI 스튜디오 종합 보고서](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/ylqs2w_202601040723.png)

![[심층분석] 디즈니-OpenAI 10억 달러 딜이

K-콘텐츠 산업에 던지는 시사점](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/qz7dim_202512301210.jpeg)

![[CES2026]엔터테크 전문 투어&트렌드 현장 리포트(무료)](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/5x46lj_202512261120.png)

![[보고서]디즈니의 IP 플라이휠, 1957년 메모에서 시작된 100년 전략](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/vtekpo_202512140501.png)

![[리포트]글로벌 스트리밍 대전환과 FAST 시장의 부상](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/7jw8up_202512120304.png)

![[보고서]K-콘텐츠, 몰입형 공간 새로운 경험](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/je15hi_202512061434.png)