U.S. Pay-TV Scores First Net Subscriber Gain Since 2017: Is This a 'Reversal Signal' in the Cord-Cutting Era?

Traditional Cable Operators Fight Back with Aggressive SVOD Bundling Strategy

The U.S. pay-TV market has recorded an unexpected reversal with its first net subscriber growth in eight years. In Q3 2025, total pay-TV subscribers entered positive territory for the first time since 2017, even as cord-cutting acceleration had made the demise of traditional TV seem inevitable. At the center of this turnaround lies an aggressive repositioning strategy: traditional cable operators have reverse-engineered the rules of the streaming era to create "all-in-one SVOD bundles."

The Numbers Behind the Comeback

Q3 2025 Marks Historic Subscriber Growth After Years of Decline

According to MoffettNathanson's "Cord-Cutting Monitor Q3 2025", the entire U.S. pay-TV market—including virtual MVPDs (vMVPDs) like YouTube TV—added approximately 303,000 net subscribers in Q3 2025.

Michael Nathanson, the report's lead analyst, noted this marks "the first time since 2017 that we can say there are more pay-TV subscribers than three months ago." He characterized this as the first detection of "signs of life" in a structurally declining industry. The fact that the total subscriber pool grew despite ongoing cord-cutting suggests that strategic experiments reshaping bundle structures—rather than simple price cuts—are beginning to show results.

Charter's 'All-in-One Bundling' Changes the Game

Spectrum Packages Include Disney+, Hulu, HBO Max, and More at No Extra Charge

The decisive driver behind this rebound is Charter Communications' aggressive SVOD bundling strategy. Following its 2023 retransmission negotiation with Disney, Charter's Spectrum has progressively incorporated major premium streaming apps—including Hulu, Disney+, ESPN Unlimited, HBO Max, Peacock, Paramount+, and Fox One—into its cable packages "at no additional charge."

MoffettNathanson estimates that the retail value of these apps alone exceeds $100 per month, and by embedding them into basic or expanded tier packages, Charter has "fundamentally redefined the value perception of the traditional cable TV bundle."

The Bundling Revolution: What Consumers Want

Disney Bundle Leads the Market with 20% Adoption Rate

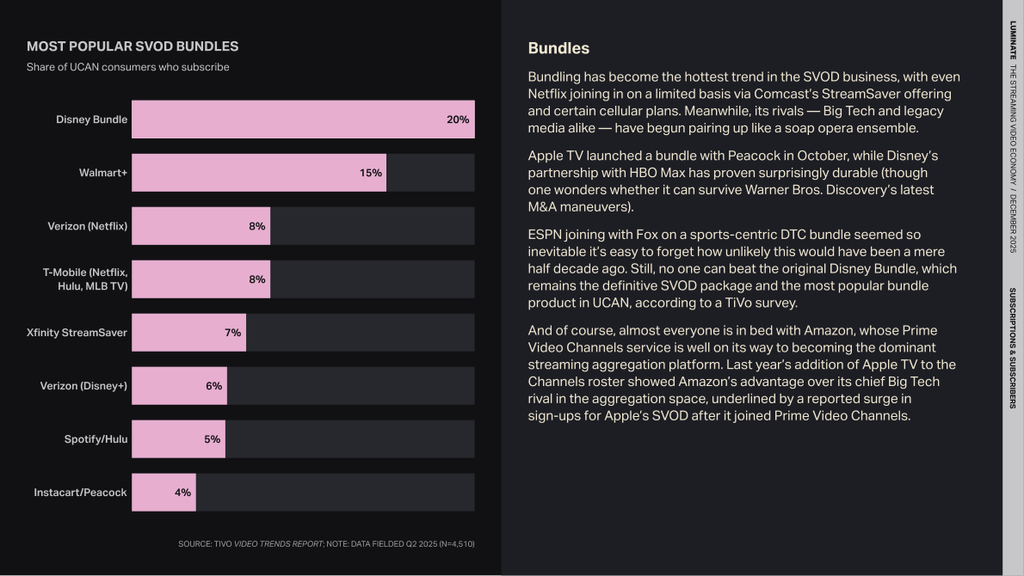

According to recent industry data, bundling has become the hottest trend in the SVOD business. The Disney Bundle leads with a commanding 20% share among U.S. consumers, followed by Walmart+ (15%) and various telco partnerships. This data validates Charter's strategic bet: consumers increasingly value comprehensive packages that eliminate the need to juggle multiple subscriptions.

The chart above shows that bundled offerings from major providers—including Verizon, T-Mobile, and Xfinity—are capturing significant market share, demonstrating that the integrated approach is resonating with subscribers tired of subscription fatigue.

Charter's Results Speak Volumes

Video Subscriber Losses Drop 70% Year-Over-Year

The results have been dramatic. Charter's video subscriber losses, which reached approximately 290,000-294,000 in the year-ago quarter, shrank to just 60,000-70,000 in Q3 2025—an improvement of more than 70%. Company filings confirm that video customer losses dropped from around 400,000 in Q2 2025 to just 64,000 in Q3.

Nathanson observed that "Charter's strategy has made cable TV operators believe in video service again," noting that the model works by using video not as a growth business per se, but as "glue" to lock in broadband and mobile subscribers.

Half-Activated Bundle: Hidden Growth Potential

Only 50% of Subscribers Have Activated Their Included Streaming Services

Intriguingly, only about half of Charter's subscribers have actually activated the SVOD services included in their bundles.

Charter CEO Chris Winfrey explained in recent earnings calls that "customers have become accustomed to various promotions, so it takes time for them to understand that this bundle is not a temporary discount or trial, but a permanently included benefit." This suggests that as onboarding and education progress, the bundle's perceived value and lock-in effects remain substantially latent.

As activation rates increase, customers become entangled not just with the cable box, but with each streaming app's account, viewing history, and personalized recommendations—naturally raising switching costs (both psychological and practical). This is why Charter's strategy focuses less on recovering video revenue and margins, and more on using SVOD bundles as a vehicle to maintain and expand broadband and mobile bundled products.

vMVPD Growth Helps, But Can't Carry the Load Alone

YouTube TV and Other Virtual Providers Show Moderating Growth

Virtual MVPDs like YouTube TV also contributed meaningfully to the net gain. According to MoffettNathanson, total vMVPD net additions reached approximately 1.429 million in Q3 2025, up from 1.361 million in the year-ago period. The strong seasonality of Q3, coinciding with the NFL season kickoff, continues to play a significant role, with vMVPDs serving as a "second bundle" for cord-cutters seeking sports, news, and cable channels.

However, YouTube TV—the market leader—saw its net additions moderate to around 750,000 in Q3, down from approximately 1 million the previous year, following a price increase to $83 per month in January 2025.

MoffettNathanson emphasized that "without Charter's improvement, vMVPD growth alone would have been insufficient to push the entire pay-TV industry into positive territory."

A 'Less Bad' Cable Market—But the Narrative Has Changed

Industry Shift: From 'Declining Asset' to 'Restructuring Platform'

That said, context matters. Year-over-year, pay-TV is still declining. The annual subscriber decline rate improved from -6.7% in Q3 2024 to -5.8% in Q3 2025, while traditional pay-TV (cable and satellite) saw its annual churn rate improve from -12.4% to -10.2%.

Pay-TV is now adhesive.

Nevertheless, this quarter's performance demands a narrative shift. Where pay-TV was once explained solely as a "peaked, declining industry" hemorrhaging millions of subscribers each quarter, it's now more accurate to view it as a "restructuring subscription platform" capable of controlling its rate of decline by redesigning bundle structures.

Netflix–Warner Bros. Discovery: A Delicious Irony

Streaming Giant Considers Acquiring Legacy Media While Cable Embraces Streaming

This shift forms an intriguing contrast with reports that Netflix, in pursuing its potential acquisition of Warner Bros. Discovery, sought to exclude cable channel assets as much as possible from the deal structure. Netflix—the poster child for streaming-first strategy—appears to view cable TV channels as "legacy assets from a bygone era."

Yet as Charter's case demonstrates, traditional U.S. cable is proving its value to subscribers and investors once again through SVOD bundling. Cable TV remains an attractive bundle centerpiece.

What This Means for Other Markets

Korean IPTV Operators Face Similar Strategic Choices

For markets like South Korea, where IPTV penetration already exceeds 70% and terrestrial/cable channels are tightly integrated with the three major telcos, directly replicating Charter-style Disney and Warner mega-deals would be challenging.

Instead, Korean operators could realistically pursue: ①building diverse bundle combinations with global streamers (Netflix, Disney+, etc.); ②creating local super bundles combining Korean content, news, sports, and FAST channels to grow advertising and data businesses; or ③maximizing LTV defense through integrated long-term packages combining broadband, mobile, and streaming services.

The Real Battle: Who Designs the Bundling Rules?

Welcome to the Hybrid Bundle Era

This small reversal is just the beginning. Before the rules change completely, whoever first designs the bundling rules in their domestic market and becomes the "default choice" will become the decisive variable shaping the pay-TV and streaming landscape for the next decade.

Ultimately, this surprising U.S. cable TV rebound reveals a reality: "Neither cable nor streaming is in a winner-take-all fight to completely kill the other." Traditional pay-TV wields live assets like sports, news, and local channels, while streaming services leverage global IP, personalization, and user experience as weapons—beginning bundling experiments that patch each other's weaknesses.

The most balanced conclusion available now is that we've entered not "the end of pay-TV," but rather "the early stage of a hybrid bundle era where pay-TV and streaming intermingle."