Nevada Launches NEDA, Its First-Ever Statewide Economic Development Association

[US Economy / Regional Development]

Nevada Launches NEDA, Its First-Ever Statewide Economic Development Association

EDAWN, LVGEA, and GOED Join Forces — 'For the First Time in 30 Years, Northern Nevada Outpaces Clark County'

$550M VC Inflows, 41 Startups Founded, Talent Ranking #5 Nationally — What It Means for K-Content & Entertainment tech Companies

February 8, 2026 | K-EnterTechHub

A Historic First: Nevada Creates a Statewide Economic Development Association

Nevada has launched the first statewide economic development association in its history.

The Economic Development Authority of Western Nevada (EDAWN), the Las Vegas Global Economic Alliance (LVGEA), and the Nevada Governor’s Office of Economic Development (GOED) have jointly established the Nevada Economic Developers Association (NEDA).

Announced via PR Newswire on November 10, 2025, the initiative fills a structural gap: Nevada was one of the few US states lacking a statewide economic development professional body.

NEDA will be formally incorporated as a 501(c)(6) nonprofit by March 31, 2026, with EDAWN and LVGEA co-managing operations for the initial three years. The February 5 EDAWN annual ‘State of the Economy’ event at Reno’s Peppermill Resort drew over 1,600 attendees from more than 300 companies, underscoring the momentum behind Nevada’s new economic chapter.

Why NEDA: 'We’re Not Reinventing the Wheel'

EDAWN CEO Taylor Adams told Vegas Inc: “Most US states already have a statewide economic development association — Nevada didn’t. When I arrived two and a half years ago, I was stunned.”

A 20-year economic development veteran with experience in Virginia Beach and Starkville, Mississippi, Adams benchmarked NEDA against established models such as the Virginia Economic Development Alliance (VEDA), the Mississippi Development Authority (MDA), and the Arizona Association for Economic Development.

LVGEA CEO Danielle Casey, who agreed to the NEDA concept within months of her appointment, emphasized: “We’re not reinventing the wheel. We’re applying already established industry best practices to Nevada.” Casey is the former president of the Arizona Association for Economic Development, serves on the University of Oklahoma Economic Development Institute board, and is the incoming chair of the International Economic Development Council (IEDC). She plans to bring six decades of economic development training know-how to NEDA.

IEDC President Nathan Ohle described NEDA’s launch as “critical for the future of economic development in Nevada.” GOED Director Tom Burns added that “when EDAWN and LVGEA collaborate, it strengthens the reputation and expertise of economic development efforts statewide.”

NEDA’s three core objectives are: launching Nevada’s first statewide education program aligned to economic development goals by Q2 2026; partnering with IEDC to offer nationally accredited certification and professional training; and building a unified platform connecting economic development agencies, utilities, elected officials, and state legislators across Nevada.

'A First in 30 Years': Northern Nevada Outperforms Las Vegas

Behind NEDA’s launch lies a structural transformation of Nevada’s economy. Brian Bonnenfant, director of the Center for Regional Studies at the University of Nevada, Reno (UNR), delivered a striking assessment in Nevada Business Magazine’s 2026 Economic Forecast: “Clark County grew about 2% in taxable sales, while the statewide average was 6%. Northern Nevada is leading the state in diversification.” He added: “In 30 years of doing this, I’ve never seen Clark County not be the driver of economic growth for the state.”

The root cause is structural. Nevada’s top industries in 2025 were goods/retail, wholesale, manufacturing, and technology services — a departure from leisure and hospitality dominance. Andrew Woods, director of UNLV’s Center for Business and Economic Research (CBER), noted that Las Vegas is the least diversified metro in the US after Silicon Valley. He attributed Northern Nevada’s outperformance to what he called the ‘Tesla Effect’: “There was a big win with Tesla, and it attracted other manufacturers and startups that developed into a full ecosystem capable of self-sustaining expansion.” This is precisely the model NEDA aims to scale statewide.

US Macro Economy: A K-Shaped Recovery

Applied Analysis CEO Brian Gordon, co-presenter at the SOE event, painted a dual picture of the US economy. The University of Michigan Consumer Sentiment Index stands at 52.9 — approaching historic lows below the 2008 financial crisis, the pandemic, and the 2022 inflation spike. Gordon told 2News: “There’s no question consumers are feeling the squeeze. Reno’s median household income is around $93,000, which is decent, but cost of living is the problem.”

Yet macroeconomic indicators are booming. US GDP and corporate profits are at all-time highs. The S&P 500 crossed 7,000 for the first time. Over 75% of US homes exceed affordability thresholds, grocery prices rose 0.5% month-over-month (the largest increase since 2022), and job gains were just 50,000 last month (the lowest since the pandemic). Recession probability over the next 12 months sits at roughly 20–25%, down significantly from two-thirds a few years earlier.

On tariffs, Adams stated: “In the short term, tariffs are concerning, but if they ultimately drive domestic manufacturing, Northern Nevada is uniquely positioned to benefit.” Gordon added: “Nevada has a pro-business environment that we hope will weather any storms on the horizon.”

Northern Nevada 2024–2025: Consecutive Record-Breaking Years

Northern Nevada’s economic growth has set records for two consecutive years. According to NNBW, EDAWN recruited 22 companies in 2024, generating approximately $3 billion in investment and 1,900 jobs (average wage: $85,000). Adams told NNBW: “We’ve become a global destination for scalable advanced manufacturing. Silicon Valley companies are coming to us when they see Bay Area real estate costs.” More than $15 billion in public and private development was planned or underway.

The momentum continued in 2025. At the February 5 SOE event, Adams reported 11 new companies relocating from eight states, plus four expansions — totaling 15 announcements. These generated roughly 600 new jobs averaging $77,000 in annual wages, with capital investment exceeding $530 million. 2News reported EDAWN-supported companies “creating over 1,200 new jobs at record wages,” noting that Northern Nevada’s business base has diversified into “advanced manufacturing, technology, logistics, and exports.”

At EDAWN’s second annual COBINN (Celebration of Business & Industry in Northern Nevada) in December 2025, 26 new or expanding Primary companies brought $327 million in capital expenditure and over 600 jobs. Recruitment leads surged from just 34 eighteen months ago to over 130, with more than 100 projects in the pipeline. Gordon noted that total tracked development projects across Northern Nevada exceed $50 billion, spanning education facilities, tech companies, and infrastructure.

Key 2025 Investment Cases

Buckeye Corrugated (Ohio → Reno, packaging): 50+ high-wage manufacturing jobs, $14M capital investment, first western US greenfield facility. Bitdeer Industrial (Asia → Sparks, FDI): Approximately 40 new tech positions at ~$32/hr, 100% employer-paid health insurance, SEALMINER manufacturing hub in a 187,000 sq.ft facility. Amperesand (next-gen power conversion tech): 60+ high-wage engineering jobs at ~$55/hr, $18.4M+ equipment investment, solid-state transformer startup with roots in Singapore’s NUS/Temasek ecosystem.

Vantage Data Centers committed approximately $254 million to Story County for a 100MW data center campus with $60+/hr jobs. GOED approved hundreds of millions in tax incentives for multiple data center and manufacturing projects throughout 2025, including the PRTX 100MW data center.

Startup Ecosystem: $550M in Venture Capital and the Rise of an AI Hub

2025 was a landmark year for Northern Nevada’s startup ecosystem. Adams announced at the SOE event: “More than 41 companies were founded in the Reno-Sparks metro area, attracting approximately $550 million in venture capital investment. We expect this trend to accelerate in 2026.”

Notable Venture Funding

Positron (AI inference hardware): A Reno-based AI hardware manufacturing startup that EDAWN promoted as an “Nvidia rival.” Raised $23.5 million from Flume Ventures (co-founded by Sun Microsystems co-founder Scott McNealy). Manufactures semiconductors at Intel’s Ocotillo foundry and is transferring server assembly to Northern Nevada.

Digital manufacturing platform Send Cut Send surpassed $100 million in annual revenue. Sparks-based Future Foreign Manufacturing tripled production capacity with a new 150,000 sq.ft facility to meet data center infrastructure demand. EDAWN joined 'America the Entrepreneurial' as a founding partner, with Nevada, Washoe County, Reno, and Sparks all signing on as founding communities — building on AB 77 (2023 startup support legislation) and the establishment of the Office of Entrepreneurship.

Demographics, Talent, and Housing: Structural Challenges and Opportunities

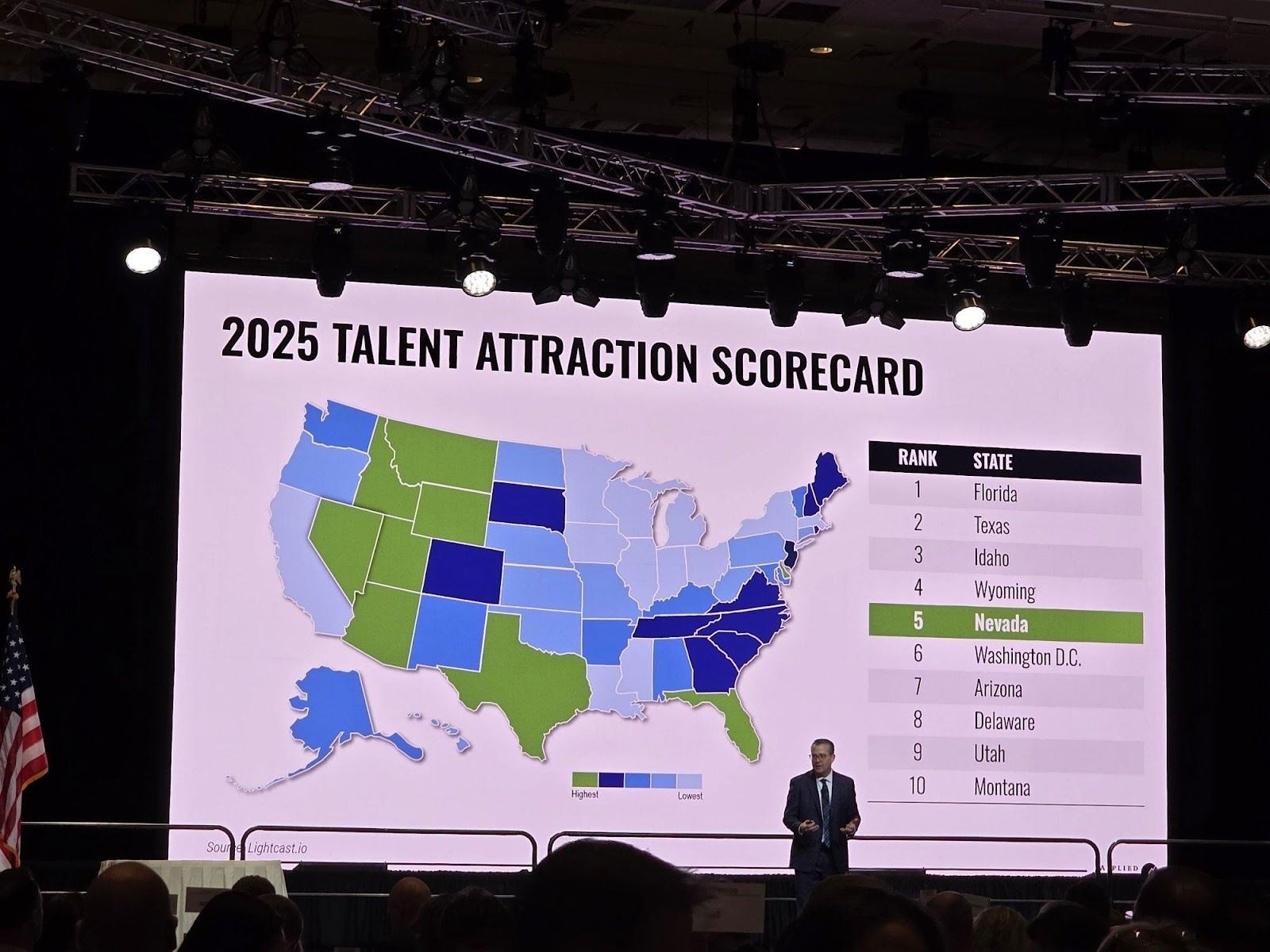

The 2025 Talent Attraction Scorecard (Lightcast.io) ranks Nevada #5 in talent attraction nationwide — behind Florida, Texas, Idaho, and Wyoming, but ahead of Washington D.C. and Arizona. This reflects the combined effect of Nevada’s zero state income tax, pro-business environment, above-average wages, and quality of life.

Northern Nevada has absorbed over 90,000 new residents since 2013, with an additional 61,500 projected by 2033. However, aging demographics and slowing in-migration present challenges. Median home prices have exceeded $600,000, squeezing housing affordability. Gordon noted on KOLO-TV: “There are demographic shifts. Aging is progressing, in-migration is declining. This impacts housing, healthcare — everything.”

Notably, while US manufacturing employment has halved since the 1990s, Reno’s manufacturing share has doubled relative to its economic base — a clear indicator of differentiated competitiveness. UNR’s Bonnenfant emphasized: “When Tesla moved in, they pushed certification programs hard. Advanced manufacturing, 3D printing, AI — all critical.” Career and Technical Education (CTE) and higher education partnerships (UNR, UNLV) are expanding statewide.

EDAWN’s Organizational Evolution: 'The Opening Act Is Over — This Is the Main Show'

EDAWN itself is undergoing a significant organizational transformation. Now in his third year, Adams has moved from ‘Year 1: planning, Year 2: execution’ to ‘Year 3: operationalization.’ Katie Block was appointed Director of Entrepreneurial Development, Veronica Chavez was promoted to the newly created role of VP for Talent & Strategic Partnerships, and EDAWN is pursuing AI-driven internal systems innovation alongside a comprehensive rebrand.

Adams told NNBW: “I’ve directed the team to engage 600 companies per year for the next three years — a threefold increase. We need to fully understand what’s happening in the business world and become an organization that delivers real-time data.”

Implications for Korean Companies: NEDA’s 'Single Window' for K-Content & Tech

NEDA’s launch creates tangible opportunities for Korean companies exploring the Nevada market. Previously, Northern Nevada (EDAWN) and Southern Nevada (LVGEA) operated independently, creating unclear entry points. NEDA unifies these into a ‘single window’ for engagement. As Casey emphasized: “When economic developers speak with one voice, they can help the state understand what’s possible.”

Nevada offers Korean companies a multi-layered strategic footprint. Northern Nevada’s Reno-Sparks region, anchored by Tesla’s Gigafactory, has evolved into an advanced manufacturing, data center, and AI hardware hub. Southern Nevada’s Las Vegas is a global entertainment technology and MICE (Meetings, Incentives, Conferences, Exhibitions) powerhouse.

The ‘Tesla Effect’ that Bonnenfant analyzed — where a single anchor company draws in suppliers, startups, and an entire ecosystem — provides a cluster model accessible not only to Korea’s semiconductor, battery, and Physical AI companies, but also to K-content and entertainment technology firms.

Several indicators demand attention: manufacturing employment doubling in Reno while halving nationally; AI hardware startups like Positron rising as NVIDIA alternatives; Nevada’s #5 national talent ranking; and over $50 billion in tracked development projects. EDAWN’s own adoption of AI tools and the deepening skilled labor shortage also raise the potential for Korean companies to export technology and talent to this market.

K-Nevada Gateway 2026

KNevada Gateway 2026 will take place from September 28 to October 2. Korean participants include MedionTech, Pacemakers, Zenaxis, and Mission Law Firm. The program is designed to assist leading Korean startups in fields such as medical, content, sports, AI, energy, semiconductors, and environmental tech in entering the Nevada market.

The University of Nevada, Reno's Ozman Center for Entrepreneurship has prepared special lectures for Korean companies entering Nevada and the U.S. The schedule includes pitching at 'Reno Startup Week' (Nevada's largest startup festival), one-on-one or networking meetings with local companies, and meetings with venture investors. Starting this year, the itinerary also includes experiencing the Las Vegas startup ecosystem, beginning in Reno.

The 2nd Korean Night in RENO

The 2nd 'Korean Night' will also be held, featuring not only Korean AI tech companies but also entertainment, culture, and cultural enterprises, in collaboration with K-Nevada Gateway. This year, the event is being planned and hosted jointly by K-Entertech Hub and The Way Company (CEO Kim Min-kyung).

This year, the program will host the 2nd Korean Night, co-organized with The Way Company Inc. (CEO Michelle Minkyung Kim), a Toronto-based North America market entry accelerator with over 20 years of global brand launch experience spanning LG Electronics, Karrot (Danggeun Market), and other Korean enterprises.

The event expands beyond AI-tech companies to include entertainment, culture, and lifestyle firms, featuring K-pop dance performances, K-food and K-beauty company showcases, and business matchmaking sessions for Korean Entertainment tech firms.

Professor Ko Samseog of Dongguk University, currently a member of the Presidential National AI Strategy Committee (and former Korea Communications Commission Commissioner), will unveil a co-evolution project linking entertainment technology ecosystems across Asia — including Korea and emerging digital hubs such as Malaysia — and the United States (Nevada and beyond).

With Las Vegas emerging as a global stage for K-pop live shows, K-drama immersive experiences, and K-game MICE expansions, the simultaneous availability of Reno-Sparks’ tech ecosystem and Las Vegas’ entertainment infrastructure creates a compelling dual-cluster opportunity for K-content partnerships.

▲ Professor Ko Samseog (Dongguk University) delivering a keynote on 'Korea-US Tech Co-Evolution' at the Next K-Wave Entertainment & Tech Forum, CES 2026, January 7. (Photo: K-EnterTech Hub)

Expert Commentary

“NEDA’s launch demonstrates that US regional economies are building new growth axes around technology, content, and culture industries — and that linkages with Asia, particularly emerging digital hubs such as Malaysia, are becoming increasingly critical. Korean K-content and entertainment technology companies now face a realistic opportunity to simultaneously enter America’s inland entertainment, manufacturing, and data center clusters through the Las Vegas–Reno-Sparks corridor.

The Reno-Sparks ecosystem, forged by the Tesla Effect, represents a nexus where Korean storytelling, IP, and character businesses can converge with tech and platform companies from the United States, Malaysia, and other Asian markets. Las Vegas, meanwhile, is the global stage where K-pop, K-drama, and K-games are expanding into MICE, live shows, and immersive experiences.

Korea-US tech and content cooperation must now evolve beyond government-to-government agreements into Korea-US-Asia (including Malaysia) private, city-level, and cluster-level K-content partnerships connected directly to regional economic development networks like NEDA.”

— Mr. Samseog Ko| Distinguished Professor, Dongguk University; Member of the Presidential National AI Strategy Committee; Former Commissioner, Korea Communications Commission

Outlook: 'We’re Focused on Nevada Winning'

Adams closed his presentation by declaring: “Northern Nevada’s economy is strong. Every American community faces challenges, but I prefer to see them as opportunities. The good far outweighs the challenges.”

With NEDA’s launch, Nevada is pursuing a strategy of maximizing synergy across its Northern advanced manufacturing, data center, and AI cluster and its Southern entertainment and MICE industry — all under one unified voice. As Adams told Vegas Inc: “We’re focused on Nevada winning.” UNR’s 30 years of data confirm that Northern Nevada’s economic model has already become the state’s growth engine. For Korean companies, the time to engage this emerging ecosystem — and explore strategic partnerships — is now.

Organization Profiles

EDAWN (Economic Development Authority of Western Nevada): Founded 1983, 501(c)(6) nonprofit. Northern Nevada (Reno-Sparks-Tahoe) economic development. CEO: Taylor Adams. 2024: 22 companies recruited, ~$3B investment, 1,900 jobs. 2025: 26 companies, $327M capex, 600+ jobs. 130+ active projects.

LVGEA (Las Vegas Global Economic Alliance): Southern Nevada economic development. GOED-designated RDA. CEO: Danielle Casey (former Arizona Assoc. for Economic Development president, incoming IEDC chair).

GOED (Nevada Governor’s Office of Economic Development): Statewide economic development policy. Director: Tom Burns.

NEDA (Nevada Economic Developers Association): Announced November 10, 2025. 501(c)(6) incorporation by March 2026. EDAWN-LVGEA co-managed for 3 years. IEDC partnership. First education program: Q2 2026.

IEDC (International Economic Development Council): President Nathan Ohle. Partnering with NEDA for certification and professional training.

Applied Analysis: Northern Nevada economic research firm. CEO: Brian Gordon. EDAWN SOE co-presenter. Tracking $50B+ in development projects.

The Way Company Inc.: Toronto-based North America market entry accelerator. CEO: Michelle Minkyung Kim. 20+ years of global brand launch experience (LG Electronics, Karrot/Danggeun Market). Specializes in helping Korean startups and companies enter North American markets via Canada as a strategic gateway. Co-organizer of the 2nd Korean Night at K-Nevada Gateway 2026.

Sources

[1] EDAWN/LVGEA, “EDAWN and LVGEA Launch Nevada Economic Developers Association,” PR Newswire, Nov. 10, 2025

prnewswire.com/news-releases/edawn-and-lvgea-launch-nevada-economic-developers-association-302610660.html

[2] Vegas Inc, “Economic developers: ‘We’re focused on Nevada winning,’” Dec. 1, 2025

vegasinc.lasvegassun.com/news/2025/dec/01/economic-developers-were-focused-on-nevada-winning/

[3] Nevada Business Magazine, “What Nevada Businesses Can Expect This Year: Economic Forecast 2026,” Jan. 2026

nevadabusiness.com/2026/01/what-nevada-businesses-can-expect-this-year-economic-forecast-2026/

[4] KOLO-TV, “EDAWN hosts annual State of the Economy conference,” Feb. 5, 2026

kolotv.com/2026/02/06/edawn-hosts-annual-state-economy-conference/

[5] 2News (KTVN), “EDAWN hosts 2026 State of the Economy in Northern Nevada,” Feb. 5, 2026

2news.com/news/edawn-hosts-2026-state-of-the-economy-in-northern-nevada/

[6] MyNews4 (KRNV), “EDAWN highlights economic growth and challenges in northern Nevada,” Feb. 5, 2026

mynews4.com/news/local/edawn-highlights-economic-growth-and-challenges-in-northern-nevada

[7] Fox Reno, “Experts: State of economy in northern Nevada is strong, but challenges persist,” Feb. 13, 2025

foxreno.com/news/local/experts-state-of-economy-in-northern-nevada-is-strong-but-challenges-persist

[8] NNBW, “‘Economy is strong’ and ‘firing on all cylinders’ Adams says,” Feb. 24, 2025

nnbw.com/news/2025/feb/24/economy-is-strong-and-firing-on-all-cylinders-adams-says/

[9] EDAWN, “Celebrates Northern Nevada’s 2025 Economic Momentum at COBINN,” Press Release, Dec. 5, 2025

edawn.org/edawn-celebrates-northern-nevadas-2025-economic-momentum-at-second-annual-celebration-of-business-industry/

[10] EDAWN (edawn.org) | LVGEA (lvgea.org)

[11] EDAWN, “Reno-Based ‘Nvidia Rival’ Positron Raises $23.5M,” Press Release, Feb. 11, 2025

edawn.org/tag/board-members/

[12] K-EnterTech Hub, EDAWN ‘State of the Economy in Northern Nevada’ on-site coverage, Feb. 5, 2026

[13] K-EnterTechHub, “Reno: Emerging as the Second Silicon Valley,” Jan. 27, 2026

kentertechhub.com/rino-tekeu/

![[글로벌 테크 동향] 美 서부, ‘초광역 자율항공 테스트 허브’ 부상... 네바다-캘리포니아 ‘규제 프리존’ 맞손](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/vbrh50_202602021546.png)