U.S. Streaming Hits 47.5%, Cable's $1 Billion 'Zombie Channel' Massacre Looms

2026: Year One of the American Media Big Bang

Nielsen's December Data × U.S. Cable Restructuring Forecasts Herald a Seismic Shift

Executive Summary

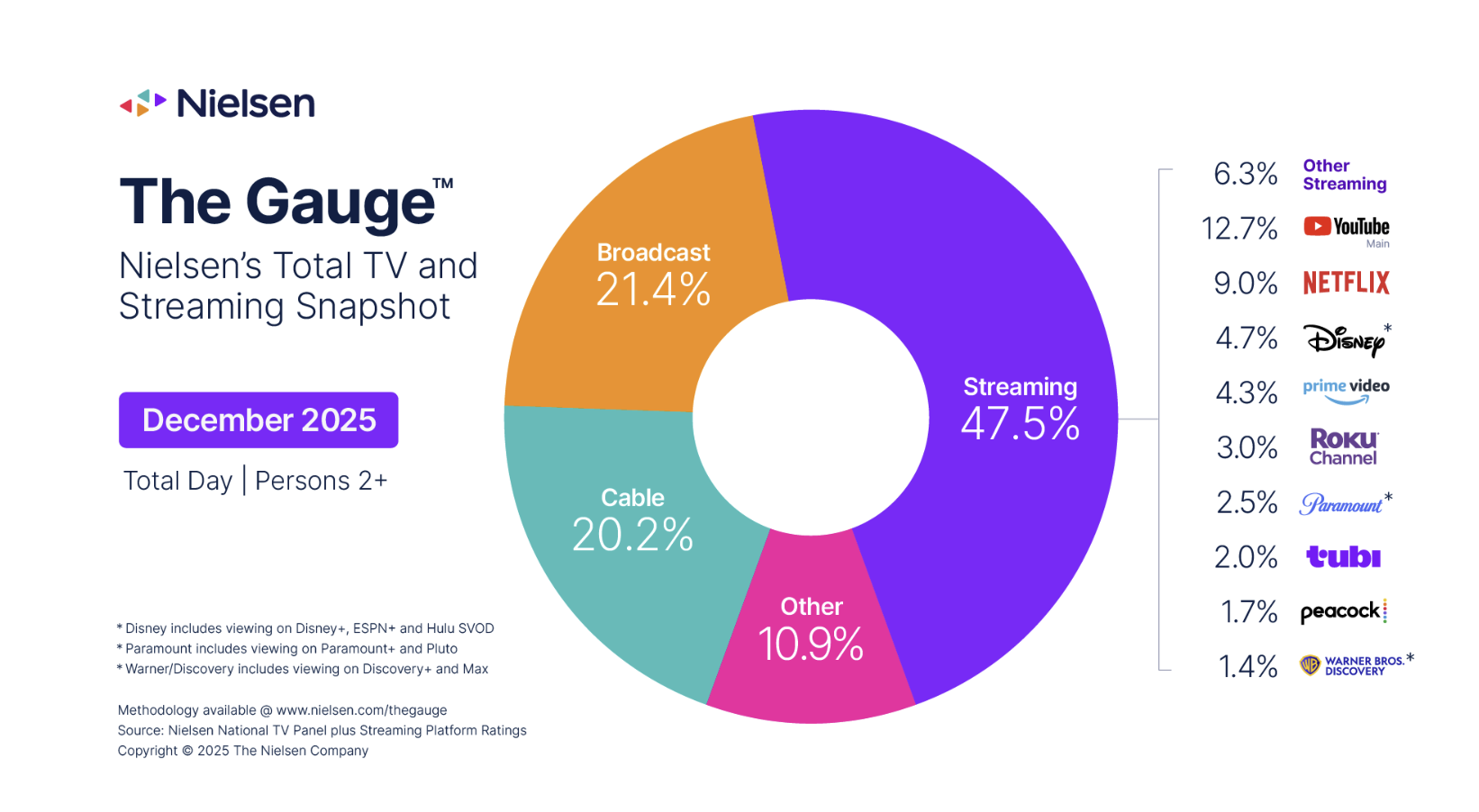

In December 2025, streaming captured 47.5% of all TV viewing—an all-time high. On Christmas Day, it crossed the 50% threshold for the first time in history. Simultaneously, the cable industry is bracing for a $1 billion 'zombie channel' purge.

The 'Big Bundle' model that dominated American television for two decades is collapsing, while FAST (Free Ad-Supported Streaming TV) emerges as the third pillar of video distribution. Roku Channel at 3.0%, Paramount Streaming at 2.5%—a window of unprecedented opportunity is opening for K-Content providers.

Part 1. U.S. Streaming at 47.5%: The End of Traditional TV

1.1 Record Share, Record Day

According to Nielsen's 'The Gauge' December 2025 report, streaming accounted for 47.5% of total TV viewing—a new all-time high. Broadcast television claimed 21.4% while cable held 20.2%, meaning traditional TV combined (41.6%) trailed streaming by more than 6 percentage points.

December 25th shattered records: streaming logged 55.1 billion minutes (up 8% year-over-year), capturing 54% of daily viewing—the first time streaming has ever crossed the 50% threshold in a single day.

[Table 1] U.S. TV Viewing Share, December 2025

Source: Nielsen, 'Streaming Shatters Multiple Records in December 2025,' January 2026

1.2 Christmas Winners: Live Sports × Original IP

Netflix broadcast its NFL doubleheader (Pittsburgh Steelers vs. Kansas City Chiefs; Baltimore Ravens vs. Houston Texans), then dropped new episodes of 'Stranger Things.' Combined with Prime Video's late-night NFL game, the two platforms captured 22.5% of all Christmas Day TV viewing.

[Table 2] Streaming Platform Performance, December 2025 (Four Platforms Hit All-Time Highs)

Source: Nielsen, January 2026

Part 2. U.S. Cable's 'Zombie Massacre': A $1 Billion Restructuring

2.1 The 'Charter Model': Big Bundle Collapse

In September 2023, the Charter-Disney dispute rewrote the rules of the cable business. Charter agreed to drop eight low-rated Disney channels—Freeform, Disney XD, National Geographic Wild, among others—in exchange for the right to bundle Disney+ at no extra cost to subscribers.

FASTMaster Intelligence's Gavin Bridge: "Pruning the dead wood to save the tree." This became the founding principle of the 'Charter Model.'

2.2 Carriage Dispute Timeline

[Table 3] Major Carriage Disputes, 2023–2025

Source: FASTMaster Intelligence, Gavin Bridge, January 18, 2026

2.3 The 2026 Exit List: 'Ghost' and 'Zombie' Networks

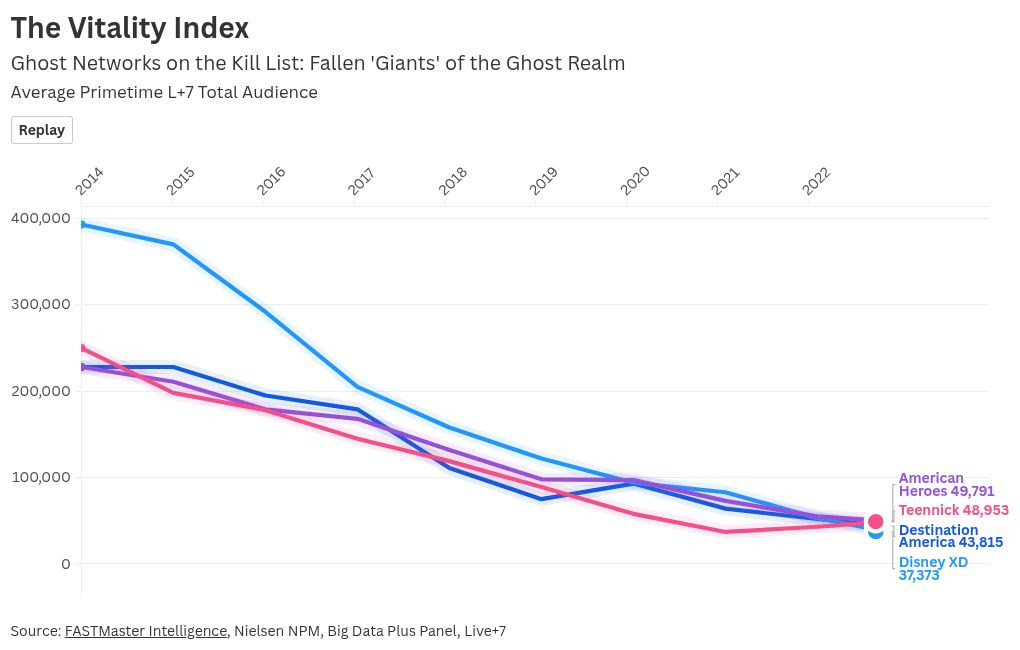

2.3.1 Ghost Networks: Under 30,000 Primetime Viewers

FASTMaster: "At this point, we're past niche—it's remarkable these channels are still operating at all."

A. Former Glory Channels

[Table 4] Ghost Network Viewership Decline (2014 → 2025)

Source: FASTMaster Intelligence

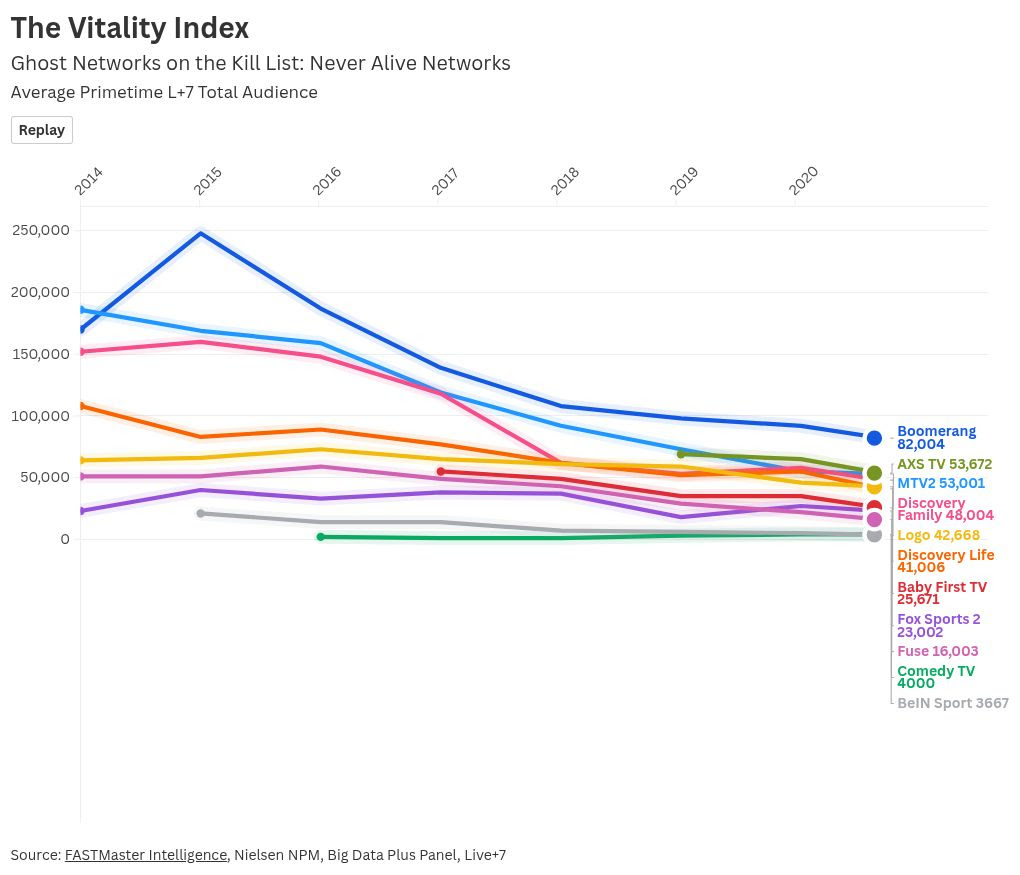

B. Never-Haves: Channels That Never Found an Audience

• Rerun specialists: Boomerang, MTV2, Discovery Family, Discovery Life, Logo

• Ultra-niche: Fuse, ComedyTV, AXS TV, beIN Sports, FS2

[Financial Impact] Based on MoffettNathanson's 65M pay-TV household estimate, eliminating Ghost Networks could save ~$500 million annually.

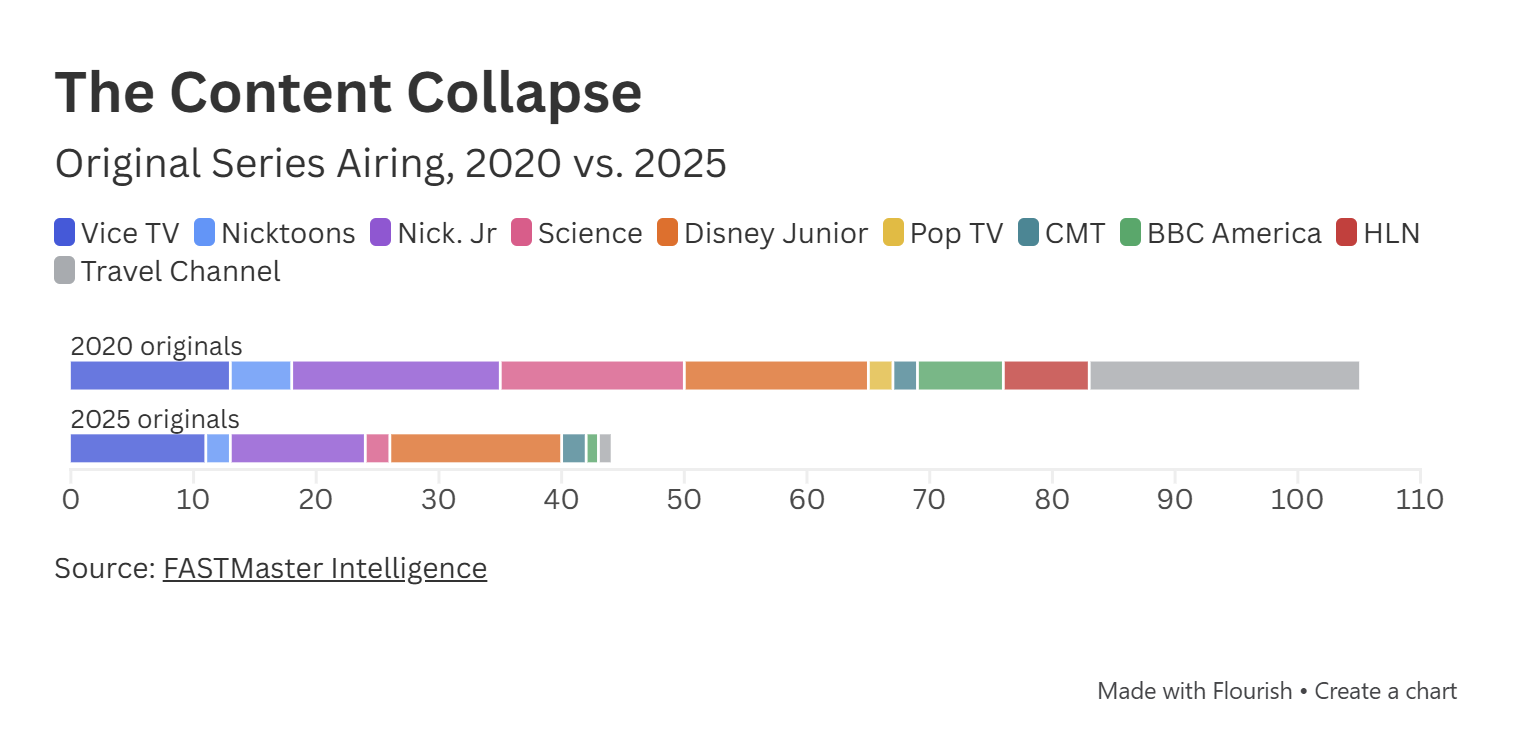

2.3.2 Zombie Networks: Original Content Collapse

A. Original Programming Implosion

[Table 5] Zombie Network Original Series (2020 → 2025)

Source: FASTMaster Intelligence

Total Financial Impact

• Ghost Networks: ~$500M annual savings

• Never-Haves + Zombies: ~$500M additional

→ Total potential carriage fee savings: ~$1 billion/year

Part 3. The Rise of FAST & K-Content's U.S. Market Opportunity

3.1 FAST vs. Zombie Cable: Fortunes Reversed

As zombie cable networks fade into irrelevance, FAST platforms are posting historic gains. Roku Channel's 3.0% share exceeds the combined viewership of dozens of pay-TV channels.

[Table 6] FAST vs. Zombie Cable Comparison

For K-Content providers, zombie cable represents a declining market on the way out, while FAST offers a rising market with room to grow.

3.2 K-Content's FAST Opportunity

• Content Vacuum: Thousands of programming hours being vacated → FAST demand surging

• Ad Budget Migration: Advertising dollars fleeing exiting channels → flowing to FAST

• Dedicated K-Content Channels: First-mover opportunity on Roku, Tubi, Pluto TV

Conclusion: 2026, Year One of the U.S. Media Big Bang—K-Content's New Highway Opens

December 2025 will be recorded as a pivotal turning point in U.S. media history. Three mega-trends reached critical mass simultaneously. Each alone would have reshaped the industry landscape; their convergence at this moment creates a shockwave unlike anything we've seen before.

Trend #1: Streaming at 47.5%—The Majority Era Begins

Streaming captured 47.5% of all TV viewing—an all-time record. What makes this even more significant is that combined traditional TV (broadcast + cable) managed only 41.6%. Streaming now leads traditional TV by more than 6 percentage points, a gap that has become structurally entrenched.

On Christmas Day, streaming logged 55.1 billion minutes (+8% YoY), capturing 54% of daily viewing—the first time in history that streaming crossed the majority threshold in a single day. Netflix's NFL doubleheader followed by new Stranger Things episodes, plus Prime Video's late-night NFL game, drove this historic milestone. The 'Majority Era' has officially begun.

Trend #2: FAST Breaks 3%—The Subscription Fatigue Solution

Roku Channel broke the 3.0% barrier for the first time—a share exceeding the combined viewership of dozens of pay-TV channels. Paramount Streaming (including Pluto TV) hit 2.5%, also an all-time high.

The rise of FAST (Free Ad-Supported Streaming TV) is not a niche phenomenon. In an era of subscription service proliferation that has led to 'subscription fatigue,' demand for free, high-quality content is exploding. Market projections estimate FAST will grow from $5.8 billion in 2025 to $10.6 billion by 2030. A new content distribution channel has officially arrived.

Trend #3: Cable's $1 Billion Restructuring—The End of the Big Bundle

The 'Big Bundle' model that dominated American pay-TV for two decades is collapsing. Starting with the 2023 Charter-Disney dispute, MVPDs have established the 'Charter Model': aggressively dropping low-rated channels in exchange for streaming app bundling rights.

According to FASTMaster Intelligence analysis, the mass exodus of 'Ghost Networks' (under 30,000 primetime viewers) and 'Zombie Networks' (original content down 90%+) will accelerate in 2026. The scale: approximately $1 billion annually. FASTMaster Intelligence's Gavin Bridge warns: "There will be blackouts. There will be blood. But most of all, there will be change."

At the Intersection of Three Trends: K-Content's U.S. Market Opportunity

The content vacuum and ad budget migration from U.S. cable channel exits, the explosive growth of FAST, and the surge in demand for live content—all of this is creating new pathways for K-Drama, K-Variety, and K-Pop content to enter the U.S. mainstream directly. Exiting cable channels are leaving behind thousands of programming hours annually. That gap needs to be filled. Simultaneously, the ad budgets once directed at those channels are seeking new destinations. FAST platforms are capturing both that content and ad demand—and K-Content is positioned to ride this wave.

From the First Highway to the Second Highway

If Netflix was the 'first-generation highway' for K-Content globalization, FAST and the restructured pay-TV ecosystem can become the 'second-generation highway.'

The first highway put K-Content on the global stage. 'Squid Game' becoming a worldwide phenomenon, 'The Glory' breaking non-English series records—these achievements rode that highway. But the toll (licensing negotiation power) and the traffic rules (algorithms, programming decisions) were controlled by the platform. Content producers gained global exposure but experienced structural dependency in revenue sharing and IP utilization.

The second highway offers different possibilities: operating dedicated K-Content channels, securing EPG slots for direct reach into American homes, directly participating in ad revenue sharing, and building viewing habits through live events (K-Pop concerts, award shows, fan meetings). This is an opportunity to reduce platform dependency and strengthen independent distribution capabilities.

[Comparison] First vs. Second Generation Highway

The risks are higher, but so are the rewards.

The Emergence of Third-Generation Infrastructure: ATSC 3.0 (NextGen TV)

If streaming and FAST represent the 'software-based' future of content distribution, another axis of 'infrastructure-based' innovation is advancing: ATSC 3.0, also known as NextGen TV.

A December 2025 study by ONE Media Technologies (a Sinclair subsidiary), titled "ATSC 3.0: Efficient, Scalable, Sustainable Wireless Capacity," analyzed this technology's potential in detail. The key insight: ATSC 3.0 is designed to broadcast native IP streams rather than video streams. This means advances in internet technology can be immediately applied to broadcasting.

According to the study, early ATSC 3.0 implementations in Korea and the United States achieved a 5x improvement in video delivery efficiency. Even more promising is the hybrid IP system capability: integrating telecom, terrestrial broadcast, and satellite spectrum to dynamically move content between networks according to usage patterns. ATSC President Madeleine Noland called this "the most efficient use of spectrum."

Sinclair SVP Mark Aitken: "ATSC 3.0 is more than a TV upgrade: it's the foundation for scalable, resilient, spectrum-conscious wireless delivery worldwide. ATSC 3.0 upgrades a broadcast station's output from a single-purpose TV signal into a versatile digital pipe through which multiple streams can be customized for entertainment, information, and commercial data services."

From a K-Content provider perspective, ATSC 3.0 represents a strategic option distinct from FAST. Notably, Korea—along with the United States—is an early implementer of ATSC 3.0, creating potential synergies between technical standards expertise and content. As Brazil's government pursues TV 3.0 (based on ATSC 3.0), this technology is going global. Partnerships with ATSC 3.0-based NextGen TV platforms like Sinclair deserve consideration alongside FAST channel expansion.

K-Content's Three Highways: A Summary

[Summary] Evolution of K-Content Global Distribution Pathways

In 2026, three pathways are open simultaneously. Understanding each and executing a portfolio strategy is key.

The Golden Time Won't Last Forever

In 2026, multiple entry points are opening simultaneously. The first-generation highway (Netflix) built K-Content's global awareness. Building on that foundation, the second-generation highway (FAST + restructured pay-TV ecosystem) offers opportunities to strengthen independent distribution capabilities. And the third-generation infrastructure (ATSC 3.0) signals a new transmission pathway where broadcasting and broadband converge.

But this window of opportunity won't stay open forever.

Once cable restructuring concludes and a new equilibrium settles, barriers to entry will rise again. Once FAST platforms finalize their channel lineups, space for latecomers will shrink. Right now, the board is shaking—and that's precisely why the opportunity exists.

Those who move first will be the beneficiaries of the new media order. The Golden Time won't last forever.

Sources

1. Nielsen, "Streaming Shatters Multiple Records in December 2025 with 47.5% of TV Viewing, according to Nielsen's The Gauge™," January 2026

2. FASTMaster Intelligence, "The TV Networks That Will Be Dropped in 2026 (And Why)" by Gavin Bridge, January 18, 2026

3. ONE Media Technologies (Sinclair), "ATSC 3.0: Efficient, Scalable, Sustainable Wireless Capacity," December 2025

K-EnterTech Hub Industry Analysis Team

This analysis is based on Nielsen's 'The Gauge' December 2025 report, FASTMaster Intelligence's '2026 Cable Network Exit' analysis, and ONE Media Technologies' ATSC 3.0 research. Nielsen data reflects U.S. TV viewing from December 1–28, 2025.

![[CES 2026] "모노컬처는 죽었다"

투비(Tubi)·삼성 TV 플러스(Samsung TV Plus)가 이끄는 무료 스트리밍의 미래](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xe6byc_202601212355.png)

![[보고서]CES2026 엔터테크 보고서](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/pkmea9_202601250121.jpeg)

![[CES2026]미디어 기업 업프론트(광고 설명회) 장소로 변신](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xjbio9_202601222334.png)

![[CES 2026]레딧, 구글 메타 도전장 '맥스 캠페인 진행'](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/o4o2vj_202601220249.jpg)