"Selling Culture, Not Just Channels": How Roku and TelevisaUnivision Are Redefining FAST Advertising Through Cultural Audience Packaging

A groundbreaking partnership combines platform data with content expertise to unlock premium advertising value in the $10+ billion Hispanic market

December 11, 2025 — In the rapidly evolving landscape of streaming television, where advertising revenue is the lifeblood of free content, two industry giants have just rewritten the playbook. Roku, America's number-one connected TV platform with 90 million households, and TelevisaUnivision, the world's largest Spanish-language media company, have unveiled a partnership that fundamentally shifts how advertisers reach Hispanic audiences in the United States.

The answer to maximizing advertising revenue in FAST (Free Ad-Supported Streaming TV) isn't about selling more channels—it's about packaging cultural audiences as premium advertising products. This partnership transforms scattered viewers across multiple platforms into a unified "US Hispanic audiences across CTV" segment, creating what may become the new standard for audience-based advertising in the streaming era.

The FAST Revenue Equation: Advertising Is Everything

Unlike subscription streaming services like Netflix or Disney+, FAST platforms have exactly one revenue stream: advertising. No subscriptions, no pay-per-view, no premium tiers. Every dollar earned comes from commercials shown to viewers consuming free content.

This singular dependency makes the core question brutally simple yet existentially critical: "Who can you show ads to, and how valuable is that audience?"

In traditional broadcast and cable television, audiences were naturally aggregated by channel. Advertisers targeting Hispanic viewers could simply buy spots on Univision or Telemundo. But the connected TV revolution shattered this simplicity. Today, Hispanic viewers are scattered across hundreds of apps, thousands of channels, and multiple platforms. An advertiser seeking to reach this demographic faces a fragmented landscape where targeting efficiency plummets and ad spending becomes a guessing game.

The Roku-TelevisaUnivision partnership addresses this fragmentation head-on by fundamentally changing the unit of competition from "which channels do you have?" to "which cultural audiences can you package and monetize?"

Platform Data Meets Content Expertise: The Architecture of the Partnership

At its core, this collaboration represents the marriage of two complementary superpowers: Roku's data infrastructure and TelevisaUnivision's cultural intelligence.

Roku's Contribution: Scale and Data

Roku brings to the table its massive footprint across American living rooms:

- 90 million households using Roku devices

- 125 million active users streaming content

- Comprehensive viewing data through Roku Data Cloud

- Platform-level insights into viewing behavior, preferences, and engagement patterns

Dylan Moorhead, Roku's Director of Global Publisher Business Development and Strategic Ad Partnerships, explained the platform's role: "We have data points. We have supply. Those are products that Roku is positioned to support. It's finding partners that will leverage them in privacy-compliant ways that are complementary to their business and ours."

TelevisaUnivision's Contribution: Cultural Understanding and Audience Definition

TelevisaUnivision contributes decades of expertise in serving Hispanic audiences:

- The TelevisaUnivision Household Graph, proprietary technology covering nearly 100% of Spanish-speaking households in the U.S.

- Deep cultural knowledge of Latino identity, viewing preferences, and advertising receptivity

- Established relationships with Hispanic-focused content creators and advertisers

- Exclusive reseller status for Roku's Spanish-language advertising inventory

Dan Riess, Executive Vice President and Chief Operating Officer of U.S. Advertising Sales at TelevisaUnivision, emphasized the partnership's goal: "The point is to make it really easy for [advertisers] to understand that they're reaching and connecting with actual Hispanics."

The Technical Integration: Unified Hispanic Audience Segment

By combining Roku Data Cloud with TelevisaUnivision's Household Graph, the partnership creates a unified Hispanic audience segment that identifies Latino viewers across all of Roku's platform—whether they're watching English-language sitcoms, Spanish telenovelas, or multilingual content.

This segmentation allows advertisers to:

- Target precisely: Reach Hispanic audiences without needing to specify individual channels or apps

- Measure accurately: Track campaign performance across the entire Hispanic viewing footprint

- Optimize efficiently: Adjust campaigns in real-time based on engagement data

- Scale confidently: Access the full breadth of Hispanic CTV viewers through a single advertising buy

Critically, TelevisaUnivision becomes the exclusive reseller of Roku's Spanish-language inventory, effectively controlling the gateway to Hispanic CTV advertising across America's largest streaming platform.

The Insight That Changes Everything: Language vs. Culture

Perhaps the most revolutionary aspect of this partnership is the research backing its strategy. A joint study by TelevisaUnivision and Civic Science revealed a stunning statistic:

85% of Hispanic consumers are comfortable seeing Spanish-language ads while watching English-language content.

This finding overturns decades of conventional wisdom in multicultural advertising. The assumption had always been simple: Spanish speakers watch Spanish content and respond to Spanish ads, while English speakers watch English content and respond to English ads.

The reality is far more nuanced. Cultural identity transcends language preference.

What This Means for Advertisers

Hispanic viewers who consume content primarily in English—second-generation immigrants, bilingual millennials, acculturated professionals—still identify strongly with Latino culture. They respond positively to culturally authentic advertising regardless of the language in which they're consuming content.

This creates enormous opportunities:

- Advertisers can run Spanish-language creative across English channels without diminishing effectiveness

- Campaigns can reach bilingual audiences more efficiently by focusing on cultural resonance rather than language matching

- The addressable Hispanic market expands dramatically beyond Spanish-language-only channels

Dan Riess highlighted the strategic implications: "When we looked at the streaming landscape, it looked like brands really needed a bigger reach in premium content, an accurate way to connect with this audience without waste, but in culture and authentically in a way that was bigger than what is being offered in the market currently."

The Numbers That Make Hispanic Audiences Unmissable

Dan Riess outlined three compelling reasons why Hispanic audiences have become essential for growth-minded advertisers:

1. Demographic Growth and Youth

The U.S. Hispanic population is approximately 10 years younger on average than the general population. This youth advantage translates into:

- Higher lifetime customer value

- Greater adoption of new technologies and platforms

- Longer-term brand building opportunities

- Emergence as the next generation's primary consumer segment

With 65 million Hispanics in the U.S. (nearly 20% of the population), this demographic represents not just today's market but tomorrow's economic engine.

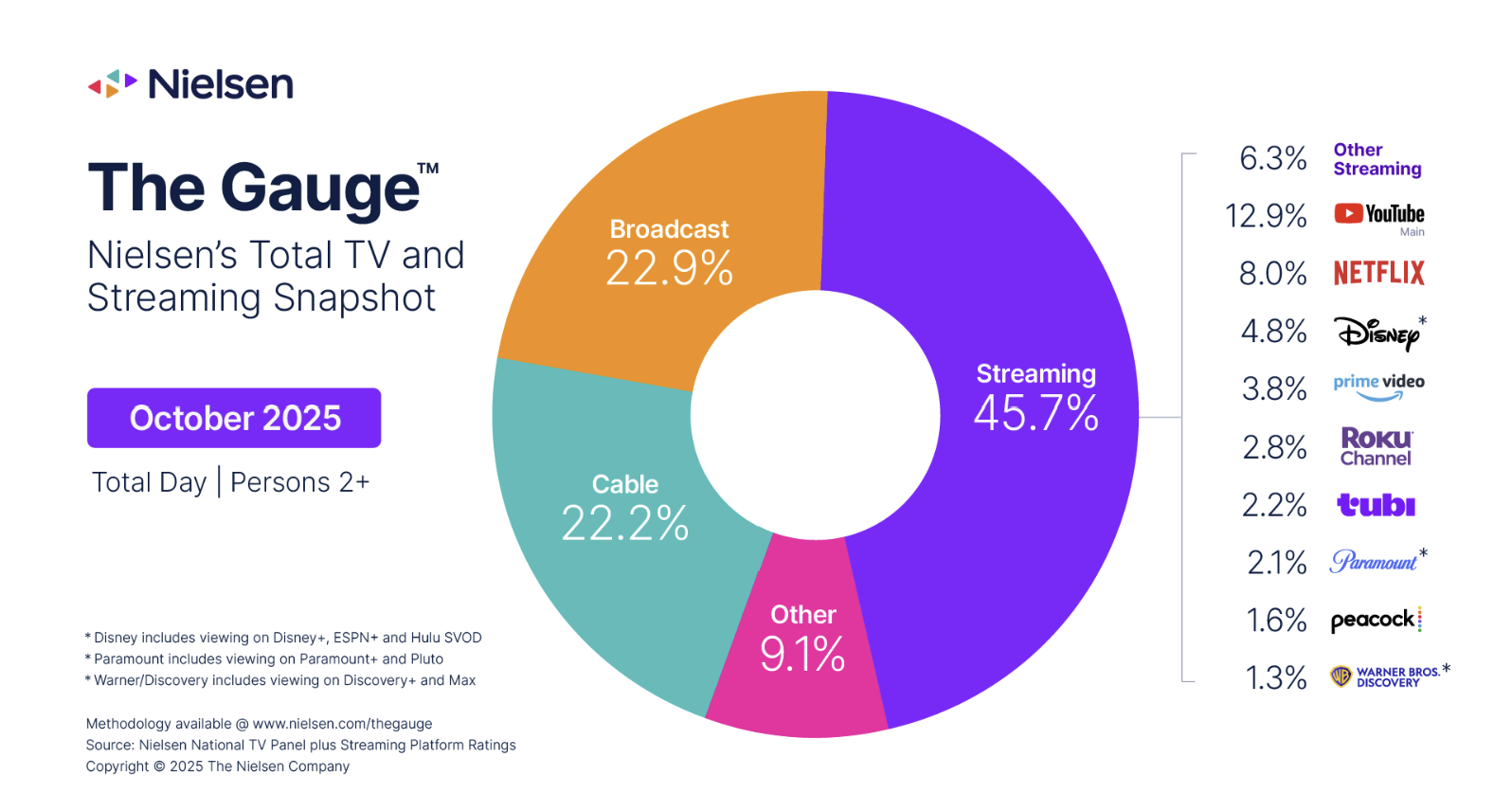

2. CTV Penetration Dominance

According to Nielsen data, 93% of Hispanic households own connected TV devices—matching or exceeding general market penetration rates. This makes FAST the optimal channel for reaching Latino audiences, particularly younger cohorts who have largely abandoned traditional cable.

3. Cultural Influence Explosion

Perhaps most significantly, Latin culture has achieved unprecedented mainstream influence over the past five to six years:

- Music: Latin artists dominate U.S. charts, with reggaeton, Latin trap, and regional Mexican music becoming pop culture staples

- Sports: Bad Bunny headlining the 2025 Super Bowl halftime show represents Latino culture's arrival at America's biggest entertainment stage

- Content: Spanish-language shows and films regularly top streaming platform rankings

- Consumer trends: Latin food, fashion, and lifestyle preferences increasingly define American mainstream culture

Riess was unequivocal: "Whether it's a politician, personal care, or pet food, you can't win without this audience. If a brand wants to grow, they need to engage with Hispanic consumers."

From Content Acquisition to Audience Monetization: The Evolution of FAST Competition

The Roku-TelevisaUnivision partnership illuminates a fundamental shift in how FAST platforms compete and create value.

The Old Model: Channel-Based Aggregation

In the broadcast and cable eras, competitive advantage came from:

- Acquiring popular content and channels

- Negotiating exclusive distribution rights

- Building channel packages that attracted subscribers

- Selling advertising on a channel-by-channel basis

Audiences were naturally aggregated by their channel choices, making targeting straightforward.

The New Model: Audience-Based Monetization

In the CTV era, viewers are fragmented across hundreds of destinations. The new competitive dynamics favor players who can:

- Identify audiences across platforms using first-party data

- Aggregate scattered viewers into coherent demographic or psychographic segments

- Package these audiences as premium advertising products

- Deliver measurement and attribution to prove campaign effectiveness

This partnership exemplifies this evolution. Rather than selling "spots on Channel X," they're selling "comprehensive reach against the U.S. Hispanic audience across all connected TV touchpoints."

Why This Model Works Better

For advertisers, the benefits are substantial:

- Simplified buying: One deal reaches the entire target audience instead of negotiating with dozens of channels

- Reduced waste: Precise targeting eliminates paying for viewers outside the desired demographic

- Better measurement: Unified data tracking provides clearer ROI metrics

- Premium inventory access: TelevisaUnivision's exclusive reseller status gives advertisers priority access to high-value Spanish-language placements

For platforms and content owners, the model creates sustainable competitive advantages:

- Higher CPMs: Audience-targeted inventory commands premium pricing compared to run-of-network advertising

- Advertiser loyalty: Brands return to partners who deliver proven results against key demographics

- Data moats: Proprietary audience graphs become increasingly valuable and difficult to replicate

- Revenue predictability: Premium audience segments attract upfront commitments from advertisers

Implications for K-Content and Asian Market FAST Players

Korean media companies operating FAST channels in the United States—including NEW ID, CJ ENM, Samsung Electronics (Samsung TV Plus), and LG Electronics (LG Channels)—face a critical strategic question in light of this partnership: How do we transform K-content fandom into premium advertising revenue?

The Current State: Channel-Level Presence

Most Korean FAST operators currently operate at the channel level:

- Individual K-drama channels on Roku, Samsung TV Plus, and Amazon Fire TV

- K-pop music video channels

- Korean variety show channels

- Korean film channels

While these channels aggregate Korean content effectively, they struggle to capture the full advertising value of their audiences for several reasons:

- Fragmentation: K-content fans are scattered across multiple platforms and channels

- Data limitations: Individual channel operators lack platform-level viewing data

- Advertiser friction: Brands must negotiate with multiple Korean content providers separately

- Measurement challenges: Proving campaign effectiveness across disconnected properties is difficult

The TelevisaUnivision Playbook: What K-Content Can Learn

The Hispanic audience partnership offers a clear roadmap:

Step 1: Define the Audience Beyond Language

Just as TelevisaUnivision defined their audience by cultural identity rather than Spanish language use, K-content operators should recognize that their audience is "consumers engaged with Korean culture" rather than simply "Korean-language viewers."

Research could likely reveal that K-content fans are comfortable seeing Korean-language or Korean-culturally-inflected advertising even while watching English-language content, similar to the Hispanic findings.

Step 2: Aggregate Data Across Platforms

Korean media companies need to create or participate in a unified K-content audience graph that tracks viewer engagement across:

- Multiple FAST platforms (Roku, Samsung, Amazon, Vizio)

- Various K-content channels (drama, music, variety, film)

- Both Korean-language and English-language content with Korean cultural elements

This would require collaboration among competitors—a challenging but potentially lucrative undertaking.

Step 3: Partner with Major CTV Platforms

Following TelevisaUnivision's example, Korean content aggregators should pursue data-sharing partnerships with Roku, Samsung, Amazon Fire TV, and other major platforms to:

- Access platform-level viewing data

- Enable cross-platform audience targeting

- Unlock precision measurement and attribution capabilities

Step 4: Package as Premium Advertising Product

Instead of selling individual channel sponsorships, offer advertisers "comprehensive reach against Korean culture enthusiasts across all CTV platforms." This audience segment would include:

- Korean-Americans and Korean immigrants

- K-drama and K-pop fans of all ethnicities

- Consumers interested in Korean food, beauty, and lifestyle products

- Travelers planning visits to Korea

The Challenges

Implementing this strategy faces significant obstacles:

- Corporate competition: Korean media companies traditionally compete rather than collaborate

- Platform relationships: Building data partnerships requires scale and negotiating leverage

- Market size: The Korean cultural audience, while growing, is smaller than the Hispanic market

- Advertiser education: Brands need to be convinced of Korean culture's influence and reach

The Opportunity

Despite these challenges, the potential rewards are substantial. The global Korean Wave (Hallyu) has created a passionate, engaged, and growing audience. Advertisers in categories like:

- Consumer electronics

- Beauty and cosmetics

- Fashion and apparel

- Travel and hospitality

- Food and beverage

...are already investing heavily in Korean celebrity endorsements and content sponsorships. A unified, data-driven approach to reaching Korean culture enthusiasts could unlock significantly higher advertising revenue than current channel-by-channel approaches deliver.

Privacy, Compliance, and the Future of Audience-Based Advertising

A critical element of the Roku-TelevisaUnivision partnership is its emphasis on privacy-compliant data usage. Dylan Moorhead explicitly noted: "We at Roku, through the Roku Data Cloud, pride ourselves on supporting high-fidelity, deterministic, privacy-compliant data made available through partnerships like this."

Balancing Precision with Privacy

The partnership navigates several key privacy considerations:

- First-party data foundation: Both companies use data from their own user relationships rather than purchasing third-party data

- Aggregate audience segments: Rather than targeting individuals, the system creates demographic cohorts

- Opt-in mechanisms: Users agree to data usage through platform terms of service

- No personal information sharing: Advertisers receive audience reach and performance metrics without accessing individual viewer identities

The Post-Cookie Advertising Landscape

As web browsers phase out third-party cookies and privacy regulations like GDPR and CCPA restrict data collection, CTV platforms with first-party data become increasingly valuable. The Roku-TelevisaUnivision model demonstrates how:

- Logged-in streaming environments create persistent user identities without cookies

- Device-level tracking (with consent) enables measurement across sessions

- Deterministic matching proves more accurate than probabilistic cookie-based approaches

- Walled garden ecosystems maintain data quality and control

This architecture positions CTV advertising as potentially more targetable and measurable than digital advertising as privacy restrictions tighten across the web.

Market Reaction and Industry Impact

Since the announcement, advertising industry observers have noted several significant implications:

Immediate Effects

- CPM pressure: Other platforms may face pricing pressure as advertisers shift budgets toward this integrated solution

- Competitive responses: Expect similar partnerships between other content companies and CTV platforms

- Measurement standard-setting: The partnership's measurement methodologies may become industry benchmarks

Long-term Transformation

- Cultural audience packaging may extend beyond Hispanic to other identity-based segments (Asian-American, LGBTQ+, etc.)

- Platform-publisher partnerships become the dominant model for premium CTV advertising

- Traditional media companies that can't build similar data capabilities face accelerating margin pressure

Conclusion: The First Textbook in Cultural Audience Monetization

The Roku-TelevisaUnivision partnership represents more than a business deal—it's a methodological blueprint for how media companies can convert cultural influence into advertising revenue in the streaming age.

By recognizing that cultural identity transcends language, by combining platform data with content expertise, and by packaging scattered audiences into coherent premium segments, the partnership creates value that neither company could achieve independently.

For the global FAST market, this is lesson one in a new textbook. The question for every content provider with a passionate cultural audience—whether Korean, Japanese, Indian, African, or any other—is simple:

Can you articulate your audience's cultural identity, aggregate their viewing across platforms, and package them as a premium advertising product?

Those who answer "yes" will thrive in the advertising-funded streaming era. Those who remain stuck thinking in terms of channels rather than cultures will watch their audiences fragment and their revenue decline.

The first chapter is being written in the U.S. Hispanic market. The rest of the story remains to be written—by you.

Key Takeaways

✅ FAST revenue depends entirely on advertising, making audience monetization the core competitive capability

✅ Cultural identity matters more than language for audience targeting and ad receptivity

✅ Platform data + content expertise creates more value than either alone

✅ Unified audience segments command premium pricing compared to fragmented channel inventory

✅ Privacy-compliant first-party data is becoming the foundation of effective CTV advertising

✅ K-content and other cultural content producers should study this model for their own audience monetization strategies

Sources:

- Adweek: TelevisaUnivision and Roku Launch CTV Ad Offering

- TelevisaUnivision and Civic Science joint research

- Nielsen CTV household penetration data

- Roku corporate information

About the Partnership: The Roku-TelevisaUnivision advertising solution launched in December 2024, combining Roku Data Cloud with the TelevisaUnivision Household Graph to create unified Hispanic audience targeting across connected TV. TelevisaUnivision serves as the exclusive reseller of Roku's Spanish-language advertising inventory.