At the Crossroads of Sports Rights Wars and the Streaming Transition

INDUSTRY ANALYSIS

At the Crossroads of Sports Rights Wars and the Streaming Transition

Structural Shifts in the Global Media Industry Through the Lens of Disney FY2026 Q1 Earnings

The Walt Disney Company’s fiscal year 2026 first-quarter results, released on February 2, laid bare the paradox of ‘growing revenue vs. shaking profitability’ that encapsulates the structural transformation underway in the global media landscape.

Revenue rose 5% year-over-year to $26 billion, yet segment operating income fell 9% to $4.6 billion, exposing cracks in the earnings structure.

The recent chain of events surrounding ESPN clearly demonstrates that the global sports media market has entered the eye of three massive structural shifts: surging rights costs, a streaming-centric D2C transition, and a fundamental power realignment between content owners and platforms.

Last fall’s carriage fee negotiation breakdown between ESPN and YouTube TV—and the resulting 15-day blackout—went far beyond a simple platform dispute, symbolically revealing that the entire pay-TV ecosystem’s revenue structure is under stress. Disney recorded approximately $110 million in operating income losses in its Sports segment alone from the incident, a data point that proved linear-based sports channels are no longer the stable ‘cash cows’ they once were.

At the same time, the fact that Disney’s Entertainment streaming division—particularly the SVOD segment—posted operating income growth well above 70% strongly suggests that sports, too, will ultimately be restructured atop streaming and direct-to-consumer (D2C) models. As the value of premium sports content that was once bundled within traditional channel packages is increasingly disaggregated and repriced on a per-service and per-title basis, leagues, platforms, and broadcasters alike have entered a phase of searching for new revenue-sharing formulas.

Against this backdrop, the NFL’s agreement to acquire a 10% equity stake in ESPN—in exchange for ESPN gaining operational control of NFL Network and NFL RedZone—represents an unprecedented ‘equity swap’ deal. Its significance lies in the fact that sports leagues are now ascending beyond mere content suppliers to become equity-holding co-operators of major media platforms.

Should ESPN’s full D2C transition proceed with NFL content integrated and distributed within the same ecosystem, the very nature of rights negotiations could shift from ‘platform vs. league’ to ‘internal coordination among co-stakeholders’—potentially redrawing the power map of the global sports rights market from its foundations.

Disney’s quarterly results extend well beyond U.S. market issues: they serve as a signal flare that preemptively demands Korean broadcasters, platforms, and content companies to rethink their pricing negotiation structures, direct distribution and subscription models, and IP-based equity partnership strategies. The Q1 results crystallize three macro trends in the global media industry—surging sports rights costs, accelerating D2C transformation, and the content–platform power realignment—while delivering direct implications for the Korean content industry.

■ 1. Overall Results Summary

Disney reported its FY2026 Q1 results for the quarter ending December 27, 2025. Total revenue grew 5% year-over-year to $26 billion, but total segment operating income declined 9% to $4.6 billion. Adjusted earnings per share (EPS) came in at $1.63, down 7% from $1.76 in the prior-year quarter.

The 77% year-over-year plunge in operating cash flow was driven by the temporary deferral of approximately $1.7 billion in FY2024–FY2025 federal tax payments related to California wildfire disaster relief, combined with expanded content and theme park capital expenditures. While largely one-time in nature, the critical question is whether these large-scale capital investments will translate into future revenue streams.

By segment, Experiences delivered the most stable performance, posting an all-time quarterly revenue record of $10 billion and $3.3 billion in OI. Entertainment and Sports, by contrast, saw sharp operating income declines despite revenue growth, squeezed by cost pressures. This divergence sharply illustrates the structural profitability gap between content businesses and IP-driven experience businesses.

■ 2. Sports Segment: The Impact of the YouTube TV Blackout

The single largest variable in this quarter’s Sports segment was the carriage blackout with YouTube TV. Just before midnight on October 30, 2025, ESPN and Disney-affiliated channels went dark on YouTube TV, and were not restored until November 14. The 15-day dispute cost ESPN’s Sports segment approximately $110 million in operating income.

The blackout went beyond a simple pricing dispute, laying bare the structural tension within the sports media industry. As sports rights costs surge, content holders like Disney/ESPN demand higher affiliate fees that reflect their content’s value, while distribution platforms like YouTube TV resist due to consumer price sensitivity—a dynamic that keeps repeating.

The critical takeaway is that ESPN pushed through its pricing demands despite absorbing a substantial $110 million loss over 15 days. This reflects a strategic calculation that securing long-term affiliate fees outweighs short-term losses, and it proves the negotiating leverage of premium sports content.

Sports advertising revenue grew 10%, but higher rights contract costs, new sports rights expenses, and the YouTube TV blackout-driven decline in subscriber and affiliate fees offset that growth. In particular, the new NBA deal’s restructured cost profile weighed on results. Despite these headwinds, ESPN maintained its industry-leading position with over 30% sports viewership share across all its networks including ABC.

▸ ESPN Unlimited Launch and D2C Transition

Launched in August 2025, ESPN Unlimited is ESPN’s first standalone streaming product integrating all its networks and services, and a cornerstone of Disney’s D2C strategy. At launch, Disney offered a three-service bundle of Disney+, Hulu, and ESPN Unlimited at $29.99/month, and 80% of subscribers in the September 2025 quarter chose this bundle. The bundle now starts at $35.99/month.

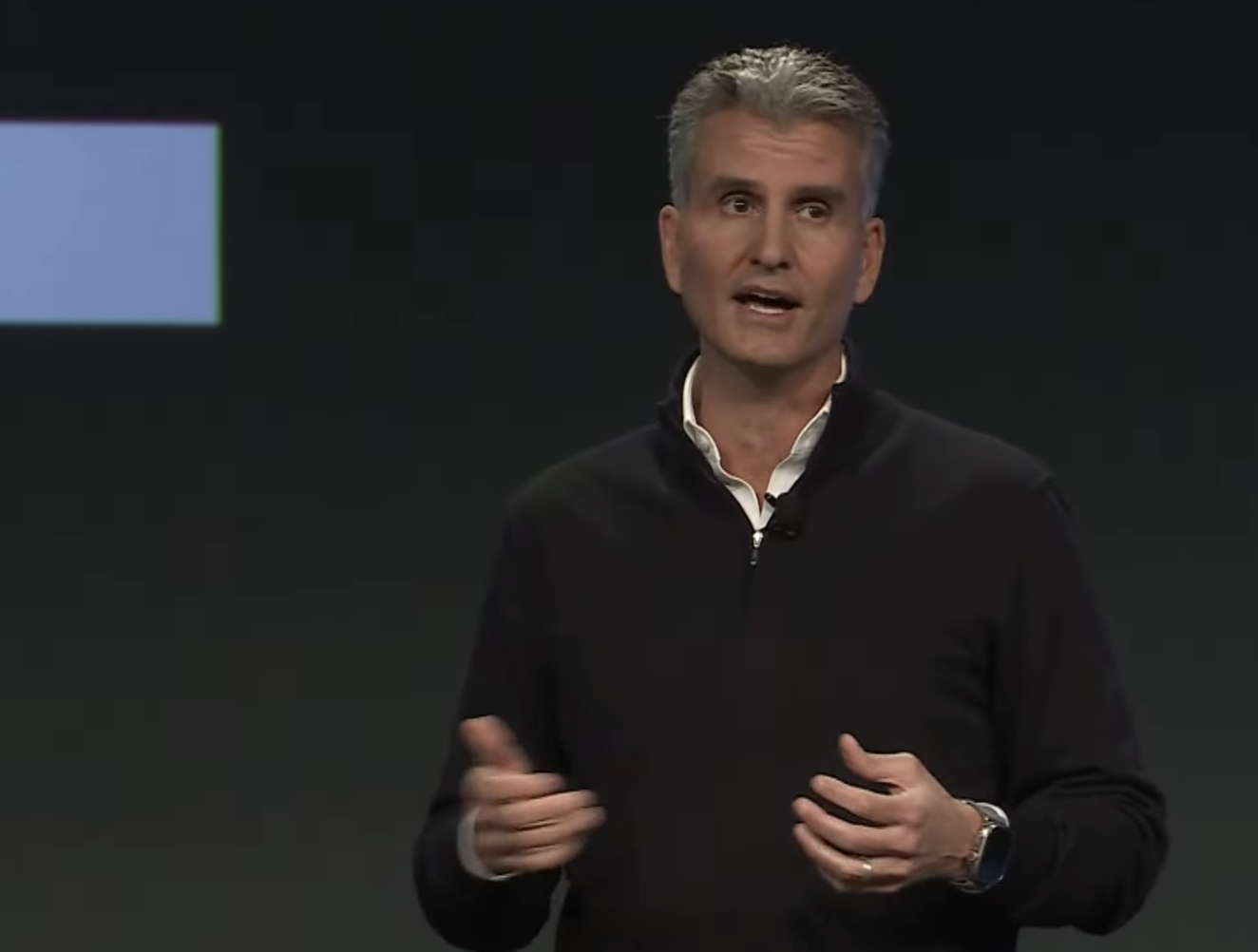

During the YouTube TV blackout, some subscribers may have migrated to ESPN Unlimited. Disney CFO Hugh Johnston noted that while blackout losses occurred, incremental revenue was generated from subscriber migration. However, Disney has not disclosed specific ESPN Unlimited subscriber counts or revenue, leaving the actual offset effect opaque.

▸ NFL–ESPN Equity Deal: A New Industry Model

The quarter’s most significant industry event was the NFL acquiring a 10% equity stake in ESPN, with ESPN in return gaining operational control of NFL Network and NFL RedZone through 2033.

This illustrates that the relationship between sports leagues and media platforms is evolving beyond simple rights transactions into equity swaps and strategic partnerships. The NFL, by holding equity in a premium media brand, can now directly capture media revenue, while ESPN strengthens ESPN Unlimited’s content competitiveness by operating the NFL’s dedicated channel and highlight service.

■ 3. Entertainment Segment: Streaming Profitability Gains vs. Cost Pressures

▸ SVOD (Streaming): Operating Income Up 72%

The Entertainment SVOD segment (Disney+ and Hulu subscription VOD) posted revenue of $5.3 billion (+11%) and operating income of $450 million (+72%) this quarter, continuing the profitability improvement trajectory. SVOD operating margin reached 8.4%, and Disney has guided for a 10% full-year FY2026 margin target.

The 13% growth in subscription revenue reflects a combination of pricing adjustments (effective rate increases), the FuboTV merger impact, and subscriber growth. However, the Star India joint venture transition created a 1 percentage point year-over-year headwind. Advertising revenue growth decelerated due to reduced political advertising and lower CPMs, partially offset by increased impressions.

▸ Disney Bundle: Subscriber Structure Shifts

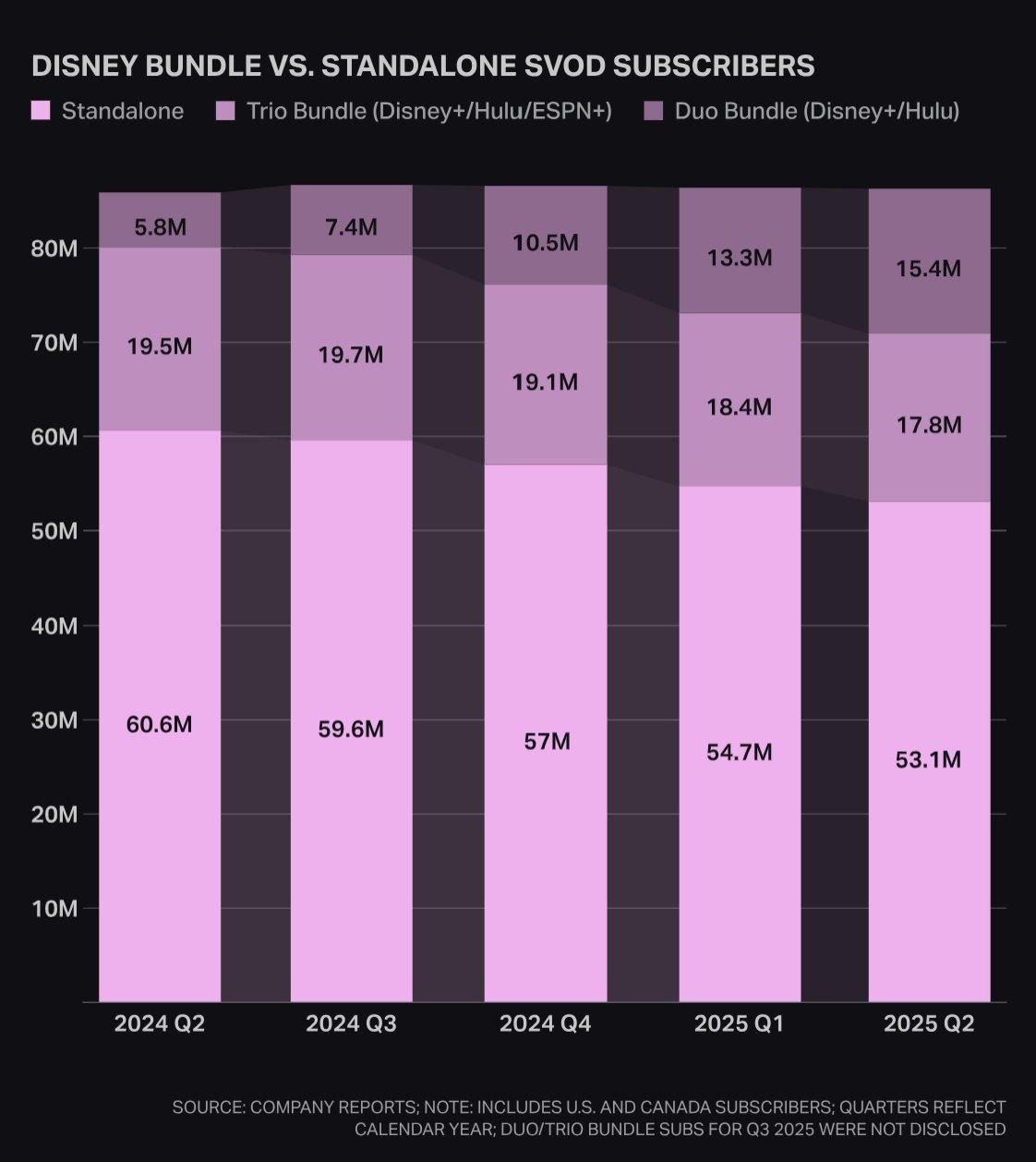

Disney has cultivated the multi-service SVOD bundle as the cornerstone of its streaming strategy. Since Hulu was officially integrated into Disney+ in Q1 2024, the Duo Bundle (Disney+ and Hulu) has been adding an average of 2.1 million subscribers per quarter, making it the fastest-growing SVOD product in Disney’s portfolio.

Disney Bundle vs. Standalone SVOD Subscribers (U.S. & Canada)

* Source: Company Reports. U.S. & Canada subscribers, calendar year basis. Trio Bundle: Disney+/Hulu/ESPN+, Duo Bundle: Disney+/Hulu. Q3 2025 bundle subs not disclosed.

Three key trends emerge from this data. First, standalone subscribers have been declining steadily, from 60.6 million in 2024 Q2 to 53.1 million in 2025 Q2. Second, Trio Bundle (Disney+/Hulu/ESPN+) subscribers are also falling—from 19.5 million to 17.8 million—as consumers migrate to the Duo Bundle amid price hikes. Third, the Duo Bundle (Disney+/Hulu) has surged from 5.8 million to 15.4 million over five consecutive quarters, becoming Disney’s fastest-growing product.

This also explains why Disney is continuing to push the full integration of Hulu into Disney+. Hulu’s hit original content has consistently outperformed Disney+’s flagship programming, and by enhancing content accessibility across both services, Disney aims to boost engagement on the less adult-oriented Disney+ platform.

Meanwhile, the launch of ESPN Unlimited could re-accelerate the declining Trio Bundle (the legacy three-service bundle including ESPN+). While the limited content on the former ESPN+ (now ESPN Select) had put a ceiling on the service, ESPN Unlimited—offering unfettered streaming access to all ESPN programming—is expected to capture sports fan demand more aggressively.

▸ Theatrical and Content Sales: Blockbuster Franchise Effect

The quarter saw the release of major franchise titles including Zootopia 2, Avatar: Fire and Ash, Predator: Badlands, and Tron: Ares, driving strong theatrical distribution results. CEO Bob Iger cited Zootopia 2 and Avatar: Fire and Ash as $1 billion-grossing films for calendar year 2025, emphasizing IP value creation across multiple business segments.

However, total Entertainment segment operating income fell 35% to $1.1 billion. Higher theatrical and streaming marketing costs, FuboTV integration expenses, and rising content licensing fees combined to pressure profitability. While large content investments create short-term cost burdens, their long-term IP utilization value—across theme parks, consumer products, and streaming libraries—must be considered.

▸ FuboTV Integration and vMVPD Strategy

On October 29, 2025, Disney completed the transaction combining Hulu Live TV assets with FuboTV, retaining a 70% stake in the merged entity. FuboTV is a sports-focused virtual multichannel video programming distributor (vMVPD) similar to YouTube TV, delivering a range of live channels via internet streaming much like traditional cable TV. This move is part of Disney’s strategy to strengthen its position in the vMVPD market. As the YouTube TV blackout demonstrated, Disney is simultaneously pursuing both enhanced carriage negotiation leverage and direct D2C channel expansion.

Notably, Disney’s decision to stop separately reporting linear TV (traditional pay-TV) revenue and operating income starting this quarter symbolically signals the declining strategic importance of the traditional broadcast model.

■ 4. FY2026 Guidance and Outlook

Disney guided for double-digit adjusted EPS growth, $19 billion in operating cash flow, and $7 billion in share repurchases for full-year FY2026. Sports segment OI is expected to decline by $100 million in Q2 due to rising rights costs, but low-single-digit growth is projected for the full year. The NFL equity deal’s financial impact was not included in the guidance and will be reflected separately going forward.

The Experiences segment is expected to see only modest growth in Q2 due to upfront costs from new investments such as the opening of World of Frozen at Disneyland Paris and the Disney Adventure cruise ship’s maiden voyage, but meaningful revenue contribution is anticipated from the second half of the fiscal year onward.

■ 5. Implications for the Korean Content & Media Industry

Disney’s quarterly results carry significant implications for Korean broadcasters as well. They represent a landmark case study in the shifting landscape of global media, broadcasting, and entertainment. The structural transformation of the global media industry is compressed within these numbers. We identify five key takeaways for the Korean content and media industry.

▸ 1) Premiumization and Negotiating Power of Sports Content

The ESPN case demonstrates that premium sports content retains formidable negotiating power even in the streaming era. The willingness to absorb $110 million in losses over 15 days to push through pricing demands proves the irreplaceability of sports content. A similar premiumization approach is needed for the global distribution strategies of K-sports content, including KBO (Korean professional baseball) and esports.

▸ 2) D2C Transition and FAST (Free Ad-Supported Streaming TV) Opportunity

Disney’s decision to discontinue separate linear TV reporting symbolizes the shifting strategic position of the traditional broadcast model. The pay-TV market centered on cable is inevitably shrinking. Korean broadcasters urgently need to secure diverse D2C channels including FAST channels, global OTT platforms, and YouTube channels. With the FAST market projected to grow from $5.8 billion in 2025 to $10.6 billion by 2030, K-content’s entry into FAST channels represents a significant growth opportunity.

▸ 3) Universalization of Bundling Strategies

The 80% selection rate for the Disney+/Hulu/ESPN Unlimited bundle confirms that consumers want diverse content packaged into a single offering. In the Korean streaming market, the value of comprehensive bundles spanning drama, variety shows, sports, and music is becoming increasingly apparent. This has direct implications for bundling strategies at Korean OTT platforms such as TVING, Coupang Play, and Wavve.

▸ 4) Expansion of the IP-Driven Experience Economy

Disney’s Experiences segment posting an all-time quarterly revenue record of $10 billion validates the model of extending IP into theme parks, cruises, and consumer products. While Hallyu IP-based experience businesses are still in their early stages, the potential for expansion into K-pop– and K-drama–themed parks, experiential tourism, and immersive content is substantial. As CNBC put it, “Disney is a theme park company. It does make dramas and movies, though.”

▸ 5) Content–Platform Power Realignment and the Equity Swap Model

The NFL–ESPN equity deal shows that the relationship between content owners and distribution platforms is evolving beyond simple transactions into equity exchanges.

Korean broadcasters and production companies need to explore deeper partnerships with global platforms that go beyond simple license sales to include equity investments, co-production, and revenue sharing. As the global value of K-content rises, redesigning cooperation structures with platforms such as Netflix and Amazon Prime Video is a strategic imperative.

■ 6. Conclusion

Disney’s FY2026 Q1 results demonstrate that the global media industry faces the dual challenge of ‘revenue growth amid profitability compression.’

In Sports, the YouTube TV blackout materialized as a concrete $110 million loss, yet simultaneously revealed the negotiating power of premium sports content and introduced a new industry model through the NFL equity deal. In Entertainment, SVOD profitability is improving rapidly, but large content investments and platform integration costs are pressuring near-term margins. Only the Experiences segment proved the viability of IP-based revenue diversification with its all-time record performance.

For the Korean content and media industry, the message from these results is clear.

First, the D2C transition is not optional—it is essential. Building or partnering on global digital content distribution platforms is a necessity. Securing diverse distribution channels through FAST channels and global streaming expansion is urgent.

Second, content’s negotiating power must be leveraged as a strategic asset. Beyond simple license sales, deeper partnership models involving equity investment and revenue sharing should be explored.

Third, IP must be extended into experiences beyond content. Disney’s Experiences success serves as a benchmark for expanding K-content IP into theme parks, experiential tourism, and immersive content.

At the crossroads where two massive currents—the sports rights wars and the streaming transition—converge, the winners in the content industry will be those enterprises capable of simultaneously pursuing premium content acquisition, D2C channel diversification, and IP experience expansion.

For the Korean content industry to remain competitive in the global market, it must read the structural shifts that Disney’s results illuminate and respond preemptively.