Disney's Next Century: The IP Flywheel Strategy and Opportunities in K-Content

"The Best is Yet to Come"

Dana Walden on competing with Netflix, AI-era storytelling, and the significance of K-content

K-EnterTechHub will host the "NEXT K-WAVE EnterTech@CES2026" forum in Las Vegas(1/7 14:30PM)

An exclusive look inside Disney's strategic transformation through an interview with Disney Entertainment Co-Chairman Dana Walden

This article is based on Bloomberg Originals' exclusive interview "Where Disney Is Heading In Its Next Century | The Circuit" with Disney Entertainment Co-Chairman Dana Walden, conducted by Emily Chang and published December 11, 2024. Analysis incorporates data from Luminate Intelligence's December 2025 U.S. streaming market report and industry research.

Watch the Full Interview: Where Disney Is Heading In Its Next Century | The Circuit with Emily Chang

While Netflix's stock has surged 80-fold since the streaming boom began, Disney's has merely doubled—leaving its market capitalization at roughly half that of the streaming giant. Yet Disney's trajectory suggests a fundamentally different strategic path. As a century-old entertainment empire generating $90 billion in annual revenue, Disney is charting an independent course through the streaming era's inflection point.

"The entertainment golden age hasn't passed. The best is yet to come," Dana Walden, Disney Entertainment Co-Chairman, declared in her December 11 Bloomberg interview with Emily Chang. With projected 2025 revenues of $94.4 billion, Disney is positioning itself not as a follower, but as a different kind of player altogether.

The Streaming Deceleration: From Boom to Maturity

As streaming growth decelerates and mega-mergers reshape the landscape, the global media industry is entering turbulent waters. Disney's self-definition as an "entertainment tech content company" and its $1 billion investment in OpenAI signal a declaration: rather than being swept along by technology, Disney intends to be the architect of an AI-powered IP and platform strategy.

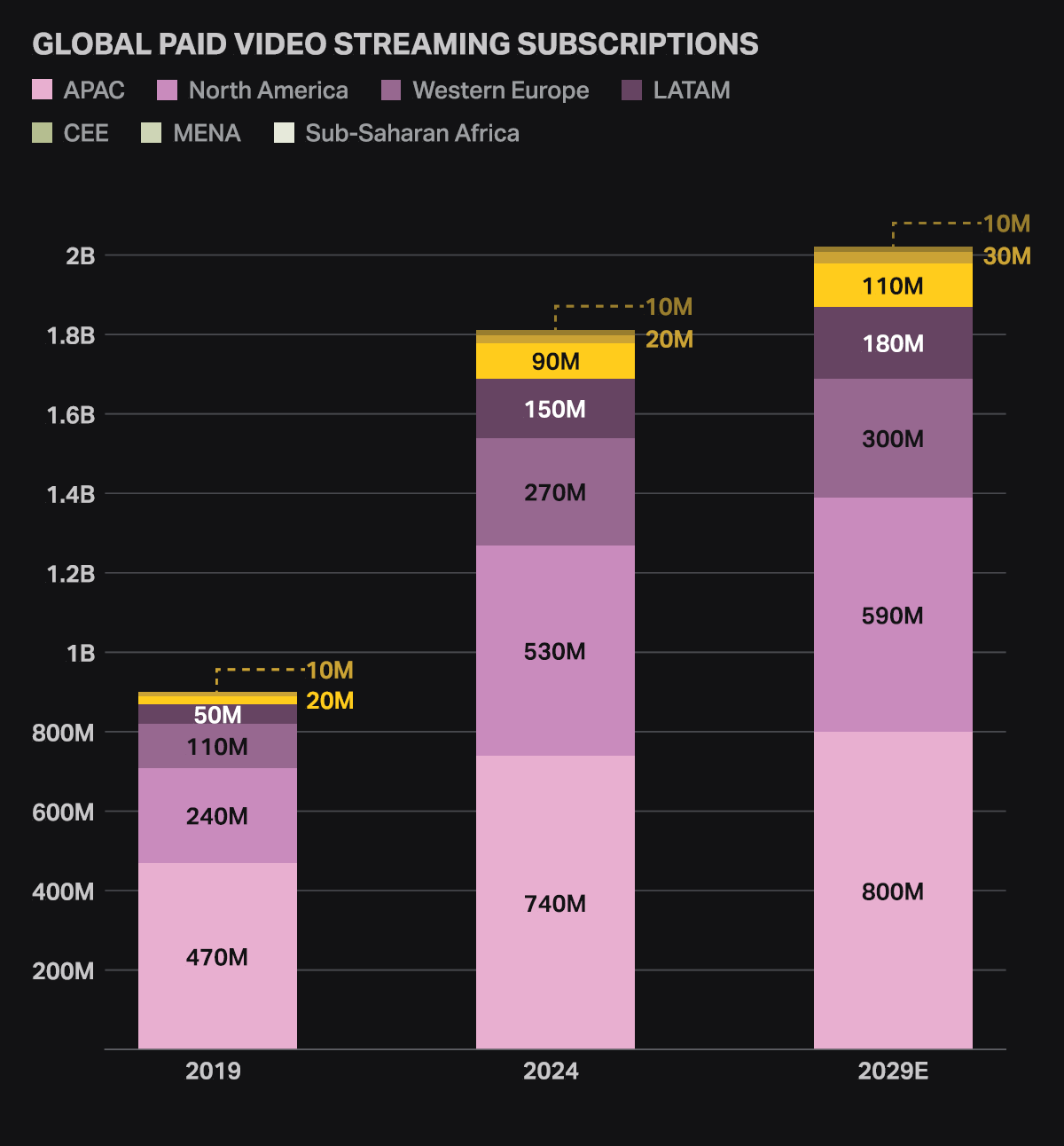

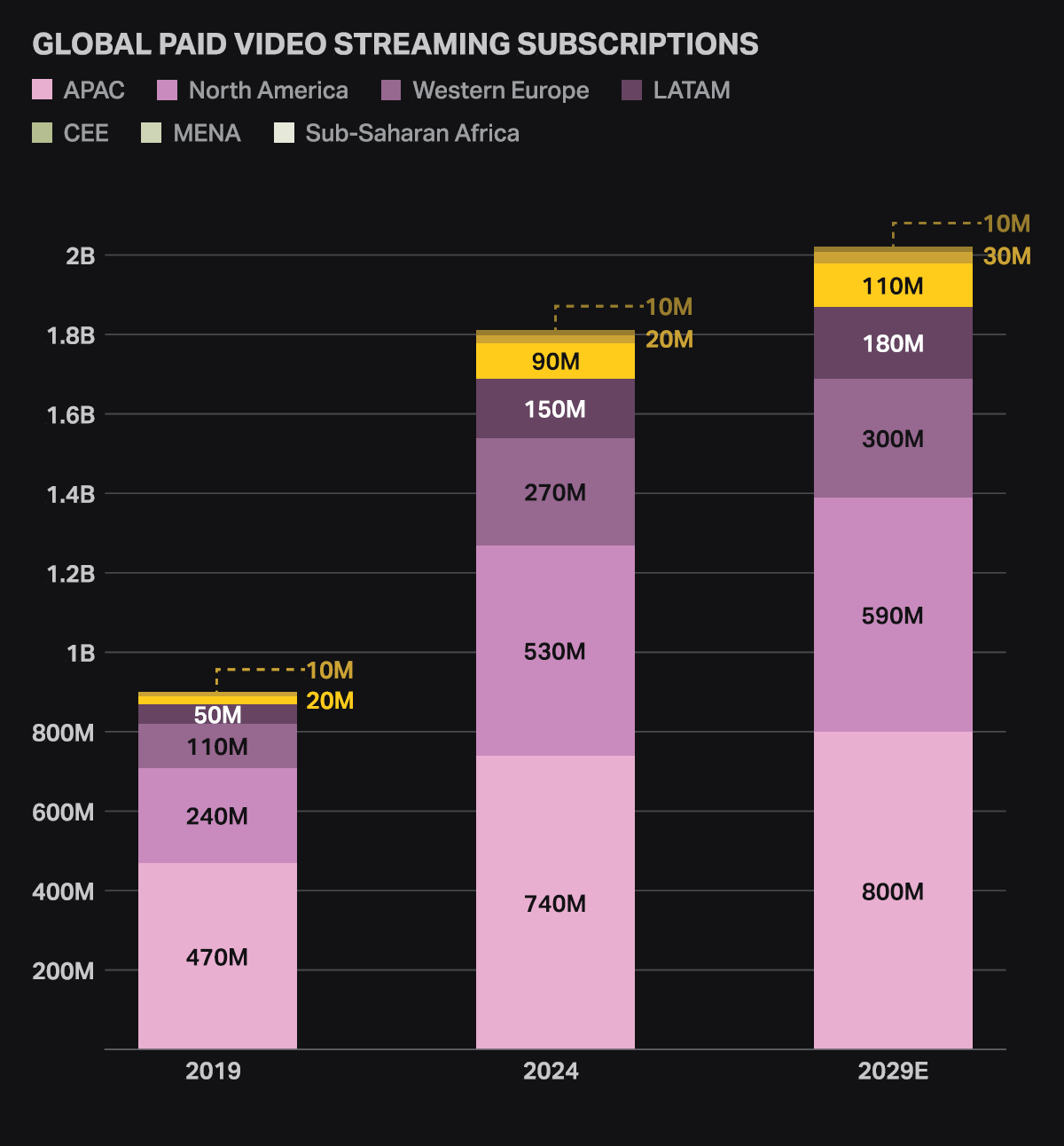

According to Luminate Intelligence's December 2025 report, the U.S. SVOD market doubled between 2019 and 2024, but growth is projected to plateau at just 11% over the next five years—signaling the end of the "quantitative growth era."

Key Market Metrics

| Metric | Value |

|---|---|

| U.S. SVOD Subscribers (End of 2024) | ~238 million |

| Growth Since 2019 | 2x+ |

| Projected Growth 2024-2029 | 11% |

| Average Streaming Services per U.S. Household | 4 |

The Price Increase Era

Major SVOD platforms have implemented aggressive price increases over the past three years:

| Platform | Early 2024 | End 2025 | Change |

|---|---|---|---|

| Netflix Standard | $15.49 | $17.99 | +$2.50 |

| Netflix Premium | $22.99 | $24.99 | +$2.00 |

| Disney+ Premium | $13.99 | $17.99 | +$4.00 |

| Max Ad-Supported | $9.99 | $10.99 | +$1.00 |

| Peacock Premium | $5.99 | $7.99 | +$2.00 |

Disney+ has raised its ad-free premium tier price by approximately 80% since introducing its ad-supported tier in 2022.

Subscriber Churn Comparison

| Platform | Churn Rate |

|---|---|

| Netflix | 2.1% |

| HBO Max | 3.6% |

| Disney+ | 4.2% |

| Apple TV+ | 4.7% |

| Paramount+ | 5.1% |

| Peacock | 5.5% |

Dana Walden: The Woman Behind Disney's Strategy

Dana Walden serves as Co-Chairman of Disney Entertainment. Growing up just four miles from Los Angeles, she watched extensive television with her mother, a musical theater performer.

"When I was 12, my parents got a new TV for the living room. I somehow convinced my mother to let me have the old one in my bedroom. I didn't come out for about five years."

Starting in 1992 at 20th Century Fox in public relations, Walden learned storytelling from legends like Chris Carter (The X-Files) and Jim Brooks (The Simpsons). Over 26 years at Fox, she produced hits like Glee and Empire, elevating the network from fourth to first place. She's now considered among the leading candidates to succeed Bob Iger as CEO.

Disney's Streaming Launch: 10 Million in 24 Hours

Six years after Netflix ignited the streaming boom, Disney launched Disney+ in 2019. Walden recalls:

"Bob Iger was very interested in the Fox asset acquisition because they had multiple seasons of the types of shows that built Netflix's subscriber base. Disney Plus launched with I think 10 million subscribers in the first 24 hours."

The Disney Flywheel System

The Disney empire comprises three pillars working in perfect synchronization:

- Entertainment: TV shows, films

- Experiences: Theme parks, cruises

- Sports: ESPN

"All of Disney's pieces work together. Popular IP from Entertainment converts into Experiences and products, forming the 'Disney Flywheel'—a unique and powerful system that generates revenue across the entire company."

Utility vs. Curation: The Netflix Distinction

Emily Chang: "Netflix is clearly the one to chase. How are you different?"

Dana Walden: "Netflix has done an extraordinary thing and they really have developed into a utility. In many situations, that is the place you go when you don't know what you want to watch."

Chang: "Is there also a quality versus quantity difference?"

Walden: "Oh, without a doubt. We have never been about volume. We're not trying to create a fire hose of content. We're trying to curate."

The Numbers Tell a Story

Since the streaming boom began, Netflix stock has risen 80-fold while Disney's has roughly doubled. Netflix's market cap is approximately double Disney's.

Walden's message to investors:

"Both services can coexist. We continue to see quarter-over-quarter growth in revenue, NOI, subscribers, and engagement. Virtually impossible to start from scratch and it's also really difficult to do it without that IP."

The Bundle Wars and FAST's Rise

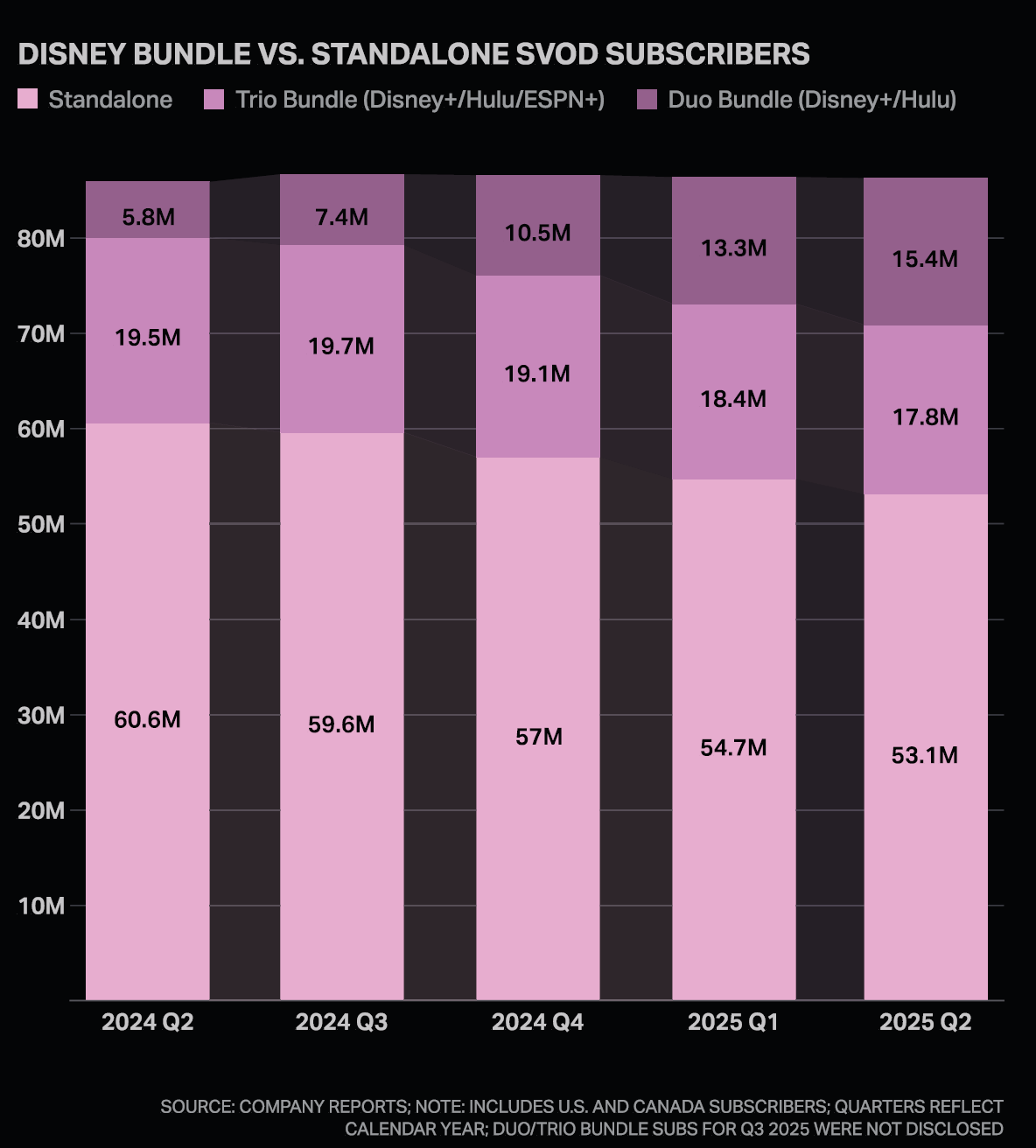

According to Luminate, the Disney Bundle (Disney+ + Hulu + ESPN+) is the most popular SVOD bundle product in the United States.

U.S. Consumer SVOD Subscription Rates (September 2025)

| Platform | Subscription Rate |

|---|---|

| Netflix | 65% |

| Amazon Prime Video | 54% |

| Disney+ | 43% |

| Max | 32% |

| Hulu | 31% |

| Apple TV+ | 23% |

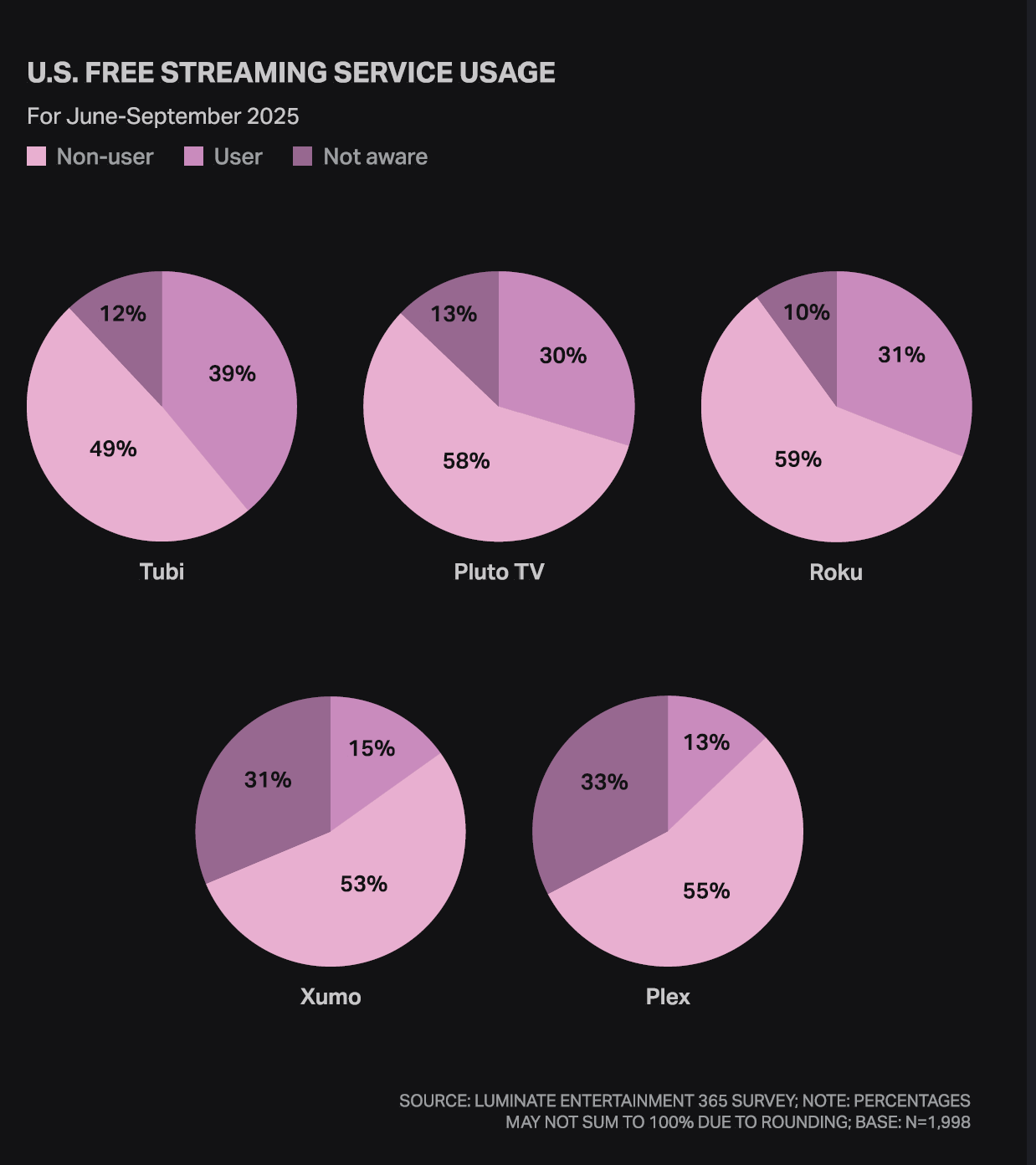

FAST's Explosive Growth: Tubi's Advance

FAST (Free Ad-Supported Streaming TV) platform Tubi achieved approximately 50% U.S. consumer penetration as of September 2025—matching HBO Max and Paramount+ levels. Tubi made history in February 2024 by becoming the first to stream the Super Bowl, recording the largest streaming audience ever.

Talent Management: The Kardashians and Ryan Murphy

Bringing the Kardashians to Hulu

Bringing the Kardashian family to Hulu was among Walden's early Disney successes. The Kardashians became one of Hulu's biggest hits in 2020.

Kris Jenner on negotiating:

"I think I'm strong but determined. Direct. Sometimes when offers come in, I laugh. When I can double it and say 'See, Mom still might have it.'"

Kim Kardashian entered dramatic series with Ryan Murphy's legal drama All's Fair.

Kim's philosophy:

"I really do enjoy growing and learning. When I stop is like when life will get a little boring. I love a little chaos."

The Ryan Murphy Partnership

Ryan Murphy ranks among the most influential showrunners in American television over recent decades. After building his reputation at Fox working closely with Dana Walden, he moved to a major production deal with Netflix before Walden persuaded him to return to Disney.

Murphy on working with Walden:

"In the case of All's Fair, she read every script. She gave me a lot of notes, which you know, I love a note. Well, I really don't. We did like seven different cuts of that pilot for her because her thing with talent is 'Don't give up. It can always be better.'"

Walden's talent management philosophy:

"Saying no is very difficult. These are people I not only respect but care about. But in many cases, a fast no is the second best thing to a yes because it enables great partners to move on and find the thing that is going to be explosive."

Grey's Anatomy: 22 Seasons and Counting

ABC's Grey's Anatomy enters its 22nd season this year. Lead actress Ellen Pompeo explained the secret to its enduring popularity:

"There's so much to watch now, whether it's TV or TikTok. So it's really hard to capture an audience. But Grey's Anatomy had such a huge early success that it established itself. We had such a head start and we had such a built-in audience that we've been able to sustain even through all the noise."

Global Content Strategy: From Shogun to Moving

Shogun: The 70% Japanese Dialogue Gamble

FX's Shogun became the biggest hit in FX history. Lead actor and producer Hiroyuki Sanada led production faithful to Japanese culture.

Chang: "Did it feel like a risk?"

Sanada: "Yes, of course. Our show had 70% Japanese dialogue. That's risky. And Disney was a brave company."

On whether Shogun's success will change studio risk-taking:

Sanada: "I hope so. Streaming services have also changed viewers. They want to watch real story, drama, authenticity."

Moving and K-Content's Strategic Value

Chang: "Shogun was a huge success and you're leaning into more global and localized content. What markets are you targeting?"

Walden: "Disney Plus is currently in over 150 countries. We're not making local originals everywhere. We are picking key countries in each of the regions and developing original content there."

Chang: "Squid Game and The Crown are massive hits. Netflix seems way ahead in this space. Can you catch up?"

Walden's response:

"I think we can. You mentioned two shows. We had a massive hit in Korea with a show called Moving that signed up millions of subscribers. The value of a hit continues to be very meaningful."

This statement carries profound implications for the K-content industry. Until now, global K-content distribution has centered on Netflix. When Squid Game became Netflix's most-watched series ever, the equation "K-content equals Netflix" seemed established.

However, Walden's statement that Disney is "picking key countries in each of the regions and developing original content there" with Korea among those key countries demonstrates that K-content's global distribution channels are diversifying.

AI and the Future of Storytelling

The 100-Year-Old Company Meets AI

Chang: "I wanted to talk about AI. It's clearly the next big disruption. This is a company that has prided itself on storytelling for a hundred years, and now computers are getting scarily good at doing a lot of things."

Walden: "We're approaching everything with our partners—actors, writers, directors—on how AI can help premium stories lower the cost curve or make things faster and more efficient. They have very strong opinions about what is a uniquely human story and how to protect the contributors in that process."

Chang: "Bob Iger expressed excitement about AI-generated content potential on Disney Plus, user-generated videos. If AI makes it, is it still Disney magic?"

Walden:

"Disney magic is storytelling. It doesn't have to be any one form. If the story fundamentals are Disney, I think it's Disney magic. The technology has evolved rapidly throughout the history of the company."

Disney has invested $1 billion in OpenAI and signed AI-related licensing agreements, positioning itself not as a victim of technological disruption but as a strategic architect of AI-powered entertainment.

The Jimmy Kimmel Crisis: Navigating Political Turbulence

In September 2024, ABC's Jimmy Kimmel became embroiled in controversy over Trump administration-related comments. Walden and Bob Iger suspended Kimmel before reinstating him days later, raising industry concerns about press freedom protection.

Chang: "What happened and what were the conversations between you and Bob and Jimmy?"

Walden:

"When we made the decision right before the show was set to go back on air Wednesday, we only thought about one thing—the situation was extremely heated. We wanted to lower the temperature. It didn't seem possible that night. So we paused to talk with Jimmy. We wanted to resolve the situation in a specific way while protecting our employees and thinking about our audience."

Chang: "Did President Trump call you or Bob? Was there White House pressure?"

Walden: "He did not. We did not hear from them."

Chang: "There were reports of Disney Plus and Hulu subscription cancellations surging after the incident."

Walden: "I think those reports were highly exaggerated. You saw the subscriber numbers we reported in earnings. It was a very strong quarter. I think that this issue is firmly in our past."

CEO Succession: The Elephant in the Room

Chang: "Disney has clearly struggled with succession planning. What's the succession plan? Any progress? Internal or external?"

Walden: "It'll be someone great."

Chang: "The biggest story in Hollywood right now is who will be Disney's next CEO. Pundits position you and colleagues as competitors. How does it feel inside?"

Walden:

"I don't appreciate being positioned as competing with colleagues. We have incredible relationships. We are a very tight organization, but I have enormous faith in where this company's going. We have world-class teams pioneering the path to the future."

The Disney Super App Vision

Chang: "You have three separate apps—Hulu, Disney Plus, ESPN. Is there a Disney super app coming?"

Walden:

"Yes, we're on the path to delivering that experience all in one place. Making Disney Plus a personalized, specialized environment. Ultimately to make it easier and reduce the friction."

ESPN's Flagship Service

ESPN plans to launch ESPN Flagship (aka ESPN Unlimited), a new SVOD service designed to lead the network into a post-cable future.

Major Sports Rights Deals:

| Rights | Platform | Annual Cost |

|---|---|---|

| NFL Thursday Night Football | Amazon | $1.5 billion |

| NBA | NBC | $2.5 billion |

| NBA | Amazon | $1.8 billion |

| NFL Christmas Games | Netflix | $75 million |

| Formula One | ESPN | $90 million/year |

Entertainment's Golden Age: The Best is Yet to Come

Ellen Pompeo's reflection:

"We have been very traumatized by the pandemic and by the strikes and by the political climate. I sort of feel that everybody is unifying in a really beautiful way and trying to make products that uplift and unite."

Chang: "You've been at the center of so many reinventions—TV, streaming, now AI. What does it take to lead a 100-year-old company into the next century?"

Walden:

"I think it's a lot of what we're doing right now. Understanding the consumer, being able to personalize experiences, building out our technology, product, creating features that are unique to this IP that will delight people the same way they are delighted when they go to our parks."

Chang: "Has entertainment's golden age passed, or is the best yet to come?"

Walden:

"Oh, I don't think it's behind us at all. Even in a world of AI, more premium are the best stories and the best live experiences. We're going to keep doing that. That will be meaningful to future generations, especially parents who want to pass that experience on to their children."

Chang: "So the best is yet to come?"

Walden: "I think so. Absolutely."

Strategic Implications for K-Content Industry

The Diversification Opportunity

Walden's direct mention that "we had a massive hit in Korea with Moving that signed up millions of subscribers" carries significant implications for the K-content industry. Until now, global K-content distribution has centered on Netflix. When Squid Game became Netflix's most-watched series ever, the equation seemed simple: K-content equals Netflix.

However, Disney's statement that it's "picking key countries in each of the regions and developing original content there" with Korea among those key countries demonstrates that K-content's global distribution channels are diversifying.

The Disney Flywheel and K-Content IP

Disney's "flywheel" has effectively become both a reference model and competitive pressure for K-content IP business design. It's a virtuous cycle structure where content hits lead to theme parks, cruises, merchandise, games, and licensing, which in turn boost demand and brand loyalty for the original content.

Key Flywheel Elements:

- Content Hit → Disney+/Theatrical Release

- Theme Park Experience → Disney Parks/Cruises

- Merchandise → Licensed Products/Apparel

- Games/Interactive → Mobile/Console Games

- Music/Live Events → Concerts/Stage Shows

- Revenue Reinvestment → New Content Development

K-content IP must also secure such "experience pillars" to escape revenue structures overly concentrated in advertising, production fee pre-sales, and platform minimum guarantees.

Curation vs. Fire Hose

Walden's emphasis that "we're not trying to create a fire hose of content. We're trying to curate" reads as Disney's declaration that it will maintain brand strategy centered on select IP rather than Netflix-style "mass supply platform."

The K-content industry also needs choices between two paths:

- Short-term: "Quantitative expansion" to meet platform demand sustains production ecosystems

- Long-term: Flywheel design centered on a small number of globally impactful IP may prove more advantageous for corporate value and negotiating power

AI as Entertainment Tech Game-Changer

Disney's $1 billion OpenAI investment and Walden's statements show that major studios have already entered strategic competition phase over "how" to utilize technology, beyond debates surrounding technology adoption itself.

Disney's AI Principles:

- AI as tool for amplifying creative capacity, not replacing it

- Protecting "uniquely human story" essence

- Collaborating with creators (actors, writers, directors) on AI implementation

- Maintaining creator rights and IP control

Implications for K-Content:

K-content's global competitiveness has been based on storytelling that delicately unfolds emotion, character, and social-cultural context. To maintain this advantage in the AI era, AI must be designed not as an engine replacing narrative but as essential infrastructure that:

- Improves development, research, post-production, and marketing efficiency

- Increases creators' "focused time" on storytelling

- Enables higher quality production at lower costs

- Facilitates global localization (dubbing, subtitles, cultural adaptation)

NEXT K-WAVE EnterTech@CES2026

Amid this global entertainment landscape transformation, K-EnterTechHub will host the "NEXT K-WAVE EnterTech@CES2026" forum during CES 2026.

Event Details

- Date: January 7, 2026, 2:30 PM

- Location: Caesars Palace – Milano Ballroom I, Las Vegas, NV

- Organizers: K-EnterTech Hub,

- Sponsor: Sinclair, Nevada GOED, KSEA, Kocowa, SBS, Mega Exhibition

- Inquiries: existen75@kentertechhub.com

Featured Speakers

Distinguished Professor Samseog Ko - "Next Hallyu Initiative" keynote on K-content global strategy for AI/XR era

Del Parks - President of Technology, Sinclair Broadcast Group, on cloud, AI, broadcasting, and K-content's future

June Park - CEO of NEW ID, on Korea's #1 FAST platform global expansion

Hyunjin Shin - CEO of Hudson AI, on performance AI voice tech and creator economy

Seunghan Shin- Korea Communications Commission, on Korean broadcasting policy in AI era

First: Real-time AI interpretation (Korean-English) throughout the event, powered by Hudson AI(Human Sounding AI Audio Tech)—the first Korean entertainment tech event to offer this capability.

Professor Ko emphasizes:

"For Hallyu to continue into the next generation, we must create new Hallyu concepts from a co-evolution perspective of giving and receiving through AI and entertainment tech utilization, not just one-way giving. Through this, we can build a Korea with strong cultural power."

Conclusion: The Next K-Wave Decade

As Walden said, "the entertainment golden age hasn't passed," K-content's golden age may not yet have arrived. If "the best stories and the best live experiences" remain premium's core even in the AI era, then K-content—which proved storytelling power in global markets over the past decade—occupies the most advantageous position in that competition.

The question is how to leverage platform diversification and IP expansion opportunities while riding technology's innovation wave.

Just as Disney invested $1 billion in OpenAI and allowed its character usage, the K-content industry must accept AI as a tool rather than an object of fear. Simultaneously, as Walden posed "what is a uniquely human story and how to protect the contributors" as core questions, balance between technology and creation must be found.

Will we destroy ourselves, or be destroyed?

The K-content industry now stands at that crossroads. The future of K-content lies not in being swept along by technological waves, but in strategically riding them while preserving the uniquely human storytelling that has made Korean content a global phenomenon.

The future belongs to those who can balance technological innovation with timeless storytelling—a challenge that Disney is embracing, and one that K-content must master to claim its place in entertainment's next century.

Sources and Methodology

Primary Sources:

- Bloomberg Originals Interview: "Where Disney Is Heading In Its Next Century | The Circuit" with Dana Walden, conducted by Emily Chang (December 11, 2024)

- YouTube: https://www.youtube.com/watch?v=8lfBScCk6R0

Data Sources:

- Luminate Intelligence: U.S. Streaming Market Report (December 2025)

- Marks Associates: SVOD Subscriber Pricing Analysis

- Disney Corporate Financial Reports

- Industry Analysis: Streaming platform metrics and market positioning

Additional Context:

- Professor Sam Ko, "Next Hallyu Initiative"

- K-EnterTechHub analysis of global content strategy implications