Gen AI Disrupts the News Ecosystem — Subscription Revenue Emerges as the Lifeline of Journalism

Bloomberg, The New York Times, Vox among global publishers reshaping their subscription strategies

Gen AI is upending the very order of news consumption. As referral traffic from search engines and social media declines, the advertising revenues that once sustained newsrooms are drying up. With recommendation algorithms increasingly prioritizing AI-generated content, traditional news exposure is shrinking while audience engagement shifts toward closed, platform-dominated systems.

Amid this upheaval, global media companies are betting on subscription models as a survival strategy. They are moving from traffic-driven monetization to so-called “relationship revenue,” redesigning subscription pricing, bundles, and member benefits to strengthen direct ties with readers.

This shift is comprehensively tracked in Digiday’s 2025 Subscription Index, the outlet’s third annual report analyzing 14 major global publishers — including Bloomberg, The New York Times, Vox, The Washington Post, and The Wall Street Journal. The study assesses changes in pricing, subscription models, exclusive content, and value-added services.

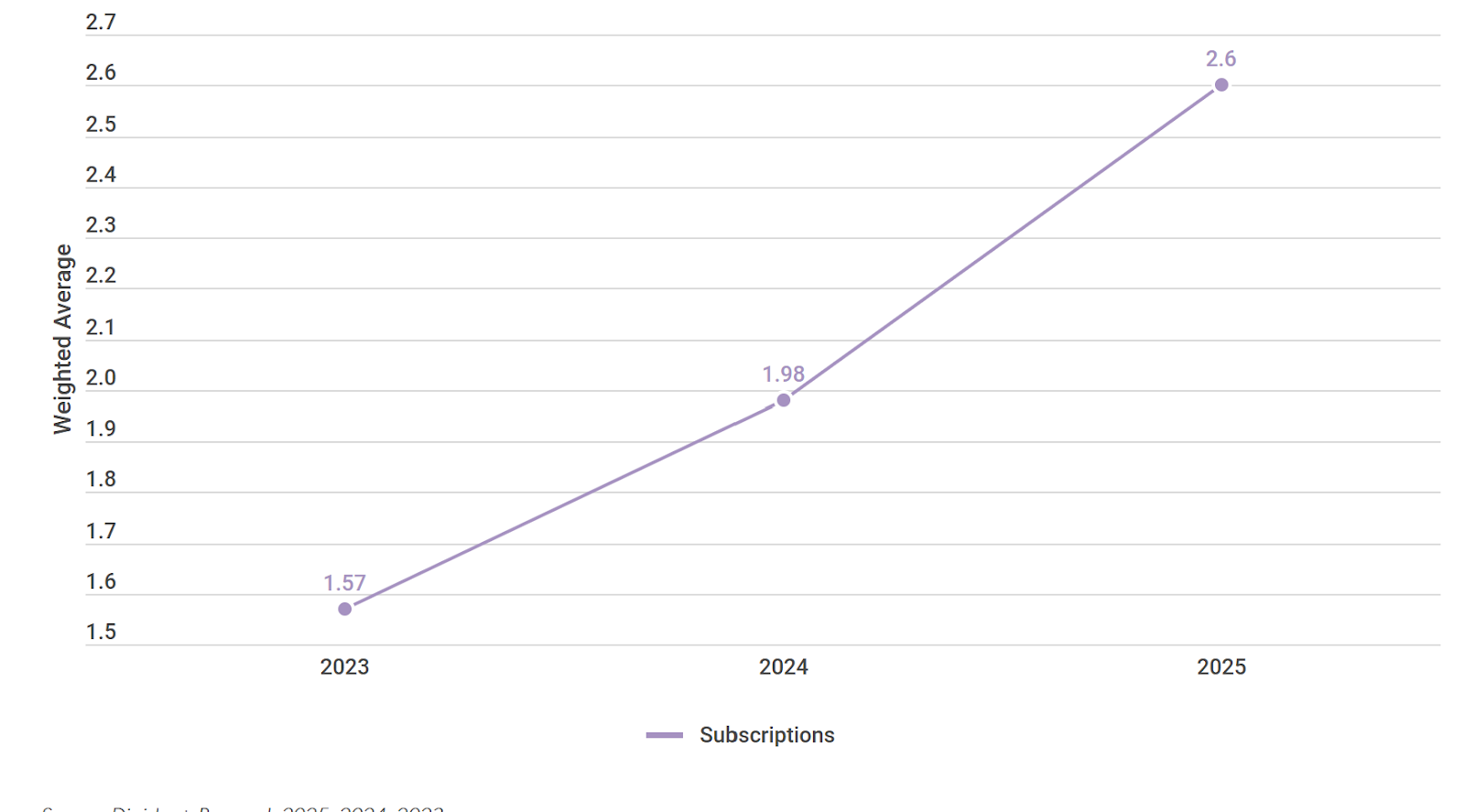

All indicators point in one direction: subscriptions continue to grow, establishing themselves as the media industry’s core revenue pillar. Digiday’s data shows that the weighted average revenue share from subscriptions rose from 1.57 in 2023 to 1.98 in 2024, and then to 2.60 in 2025. At the same time, publishers’ internal prioritization of subscription expansion — measured by Digiday’s survey index — climbed from 2.24 in 2023 to 3.26 in 2025, underscoring that subscriptions are now more than a long-term experiment; they are the industry’s financial backbone.

As a result, 2025 is shaping up as an inflection point — the year that determines whether subscriptions plateau or accelerate into a new growth phase. Digiday cites several emblematic strategies:

- Bloomberg’s ultra-premium pricing,

- bundling models from The New York Times and The Wall Street Journal,

- game-based engagement strategies at the Boston Globe and The Guardian, and

- Vox’s major shift from a donation-supported model to paid subscriptions.

Even amid the uncertainties of the generative AI era, publishers’ expectations for subscription-based sustainability have never been higher. The key question is no longer “Who has the largest subscriber base?” but rather “Who can design the most durable reader relationships in an AI-driven news economy?”

Methodology

The Digiday Subscription Index 2025 draws data from a cross-section of 14 news organizations — assessing their pricing, access models, and subscription priorities. The survey, conducted in Q3 2025 with 38 media professionals, provides insight into the evolving balance of revenue streams across the global press.

The publishers covered include:

Bloomberg, The Boston Globe, BuzzFeed, Chicago Tribune, Forbes, The Guardian, Insider, Los Angeles Times, The New York Times, Salon, USA Today, Vox, The Wall Street Journal, and The Washington Post.

Price Changes: Bloomberg Breaks Away

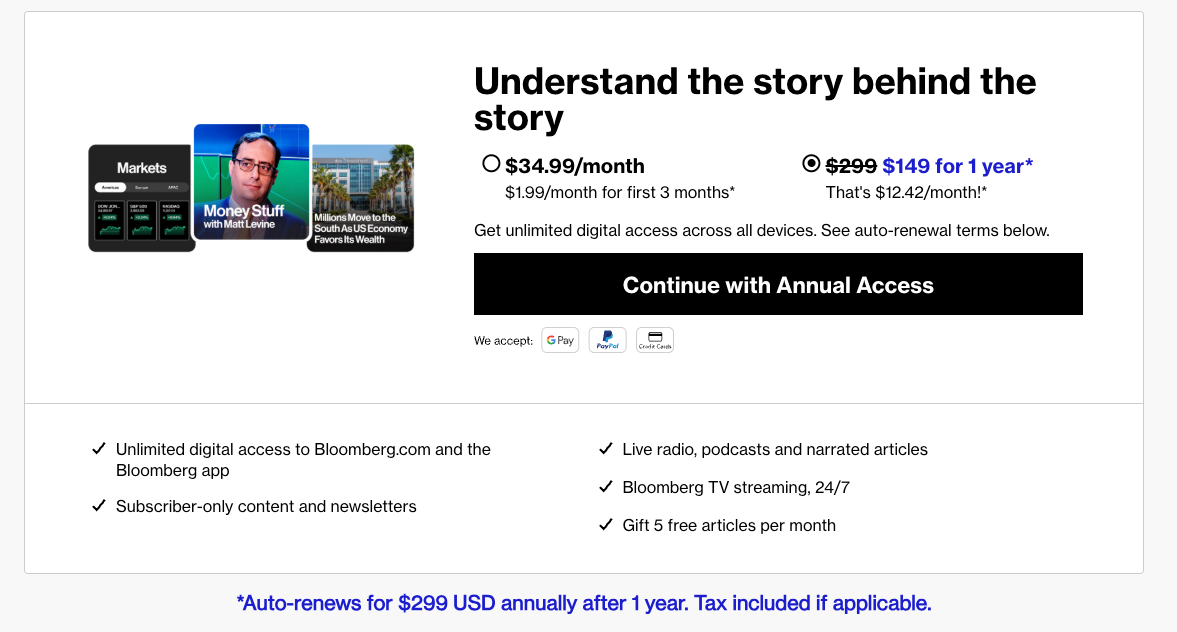

While subscription prices across the sample were largely stable year-over-year, Bloomberg was the outlier. It raised its annual subscription from $299 in 2024 to $399 in 2025 — a 33% increase, skewing the group’s average upward. Excluding Bloomberg, the collective price hike among the others was only 2%.

The adjustment aligns with Bloomberg’s October 2024 announcement of a 6.5% increase in Bloomberg Terminal fees for 2025, attributed to global inflation. As Bloomberg News content is tightly integrated with real-time financial data from the Terminal, analysts suggest this price linkage reflects the brand’s confidence in the intrinsic value of its premium information ecosystem.

Interestingly, even with the higher price, Bloomberg did not expand subscriber perks. Instead, it reinforced user engagement through gamified features, such as the free Pointed and AlphaDots puzzle games — designed to deepen habit formation and brand affinity rather than directly drive revenue.

Bundles Boost Perceived Value

Digiday identified three pricing tiers among publishers — donation-based (nonprofit), low-cost, and premium — and found that bundled subscriptions dominate the high-end group. The New York Times, The Wall Street Journal, and Chicago Tribune all offer bundles combining news with add-ons like podcasts, games, or newsletters.

The New York Times’ core plan remains priced at $325 per year, unchanged from 2024, with deeper promotional discounts for new subscribers (46.46% off, up from 42%). In September 2025, the Times introduced a family plan allowing up to four users per account, including access to its non-news products like Games and Cooking, for $360 annually.

Meanwhile, The Wall Street Journal’s “WSJ+” and the Chicago Tribune’s “Premium” packages are priced higher than their basic plans — $715 and $363.48 respectively — leveraging exclusive multimedia and newsletters to justify the premium.

Games Drive Engagement in High-Tier Publishers

Puzzle and word games are also becoming core tools for reader retention. Many outlets, including Bloomberg, The Guardian, BuzzFeed, and The Wall Street Journal, now offer games freely accessible to non-subscribers to encourage habitual visits.

The Boston Globe and The New York Times treat games as subscriber-only perks, positioning them as engagement anchors. “Games provide a refreshing, interactive break from the news cycle,” said Michelle Micone, SVP of Innovation at Boston Globe Media, citing Reuters Institute data that 21% of U.S. news subscribers pay primarily for access to puzzles and games.

Newsletters as Premium Drivers: Bloomberg’s Unique Two-Tier Model

Across global publishers, subscriber-only newsletters have become a central premium tier, yet few outlets restrict all their newsletters behind paywalls. Content differentiation, rather than format, is the key strategy. Vox, for example, offers in-depth explainers for paying members, while The Wall Street Journal delivers investor-focused briefings.

Bloomberg, however, stands apart: it not only offers subscriber-exclusive newsletters but also sells standalone newsletter bundles. The Bloomberg Technology Newsletter Bundle, priced at $142.88/year, provides access at approximately 64% less than the full $399 news subscription, targeting readers specifically interested in technology and finance.

Digiday interprets this as a micro-targeted monetization model, allowing Bloomberg to reach professionally segmented audiences without diluting its core premium brand.

Vox: From Donation to Subscription

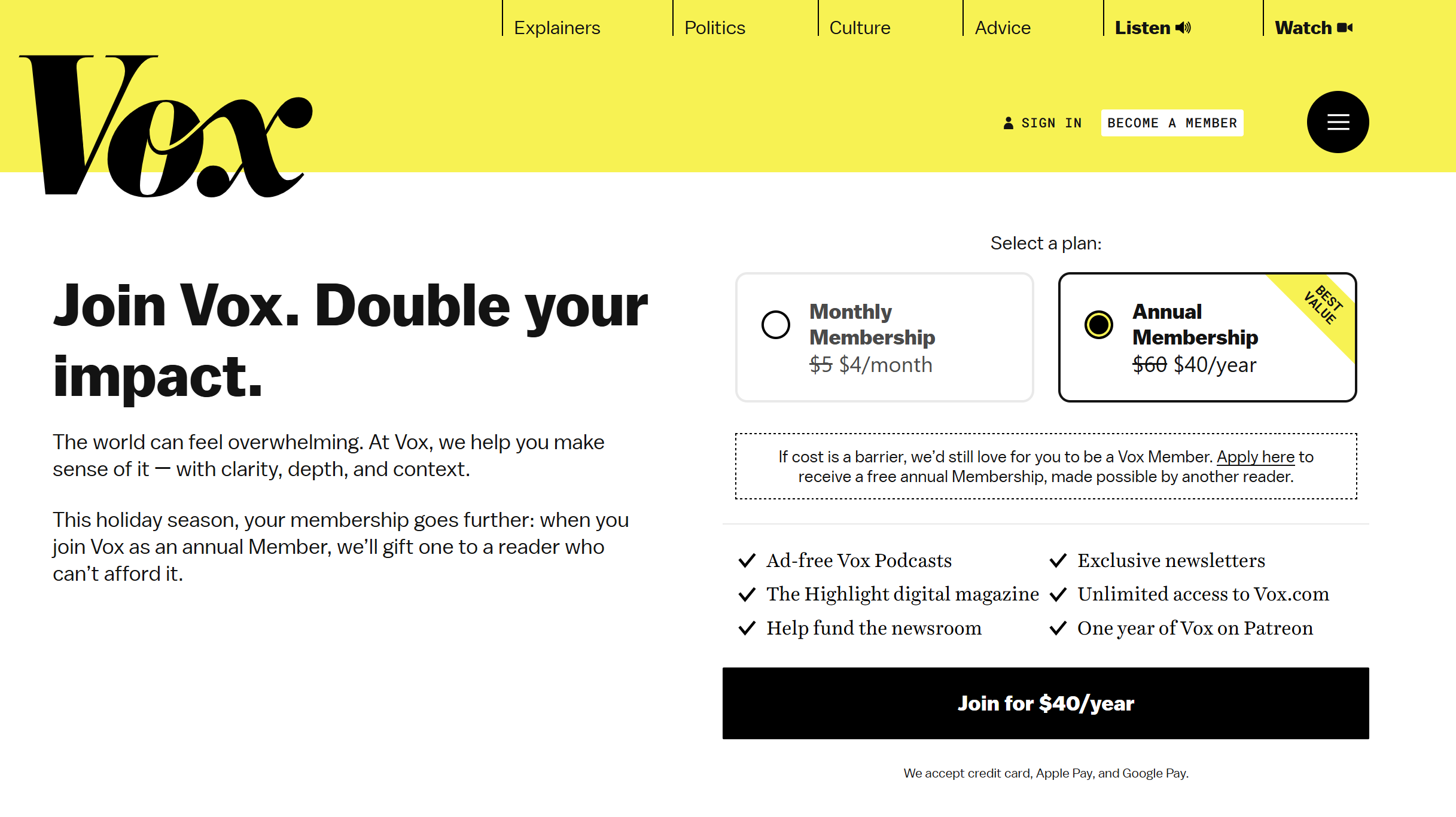

Among all publishers in the 2025 Index, Vox Media undertook the most significant strategic transformation. Since 2020, the outlet had operated on a donation-based open-access model. In January 2025, Editor-in-Chief and Publisher Swati Sharma announced its transition to a paid membership system.

“Readers will now encounter a paywall after a limited number of stories each month,” Sharma said in the press release. “We hope this model encourages investment in our journalism and deeper participation in our member community.”

Vox’s annual subscription is set at $60, up from the previous $50 suggested donation, with a promotional rate of $40 for new members. Paying subscribers gain access to exclusive newsletters and a digital magazine. Industry observers speculate that Vox may eventually expand its offerings into game-based or bundled benefits, echoing trends seen in other major publishers.