In the Age of AI, Reno Overtakes Silicon Valley

INDUSTRY ANALYSIS/K-EnterTech Hub | Northern Nevada Economic Report

In the Age of AI, Reno Overtakes Silicon Valley

AI, Data Centers, and Battery Value Chains Are Building the New Tech Hub of the American West.

A Structural Analysis of the Opportunities Opening for Korean Deep-Tech Companies.

On-Site Coverage: EDAWN 2025 State of Economy · Northern Nevada Industry Analysis

February 6, 2026 | Peppermill Resort, Reno, NV

EDAWN’s State of Economy in Northern Nevada — Economic Update Luncheon | Title Sponsor: Plumas Bank | Photo: K-EnterTech Hub

February 5, 2026, 11:00 a.m., Reno, Nevada. Fifteen hundred executives, investors, and government officials packed the Peppermill Resort ballroom for the Economic Development Authority of Western Nevada’s (EDAWN) annual State of Economy report.

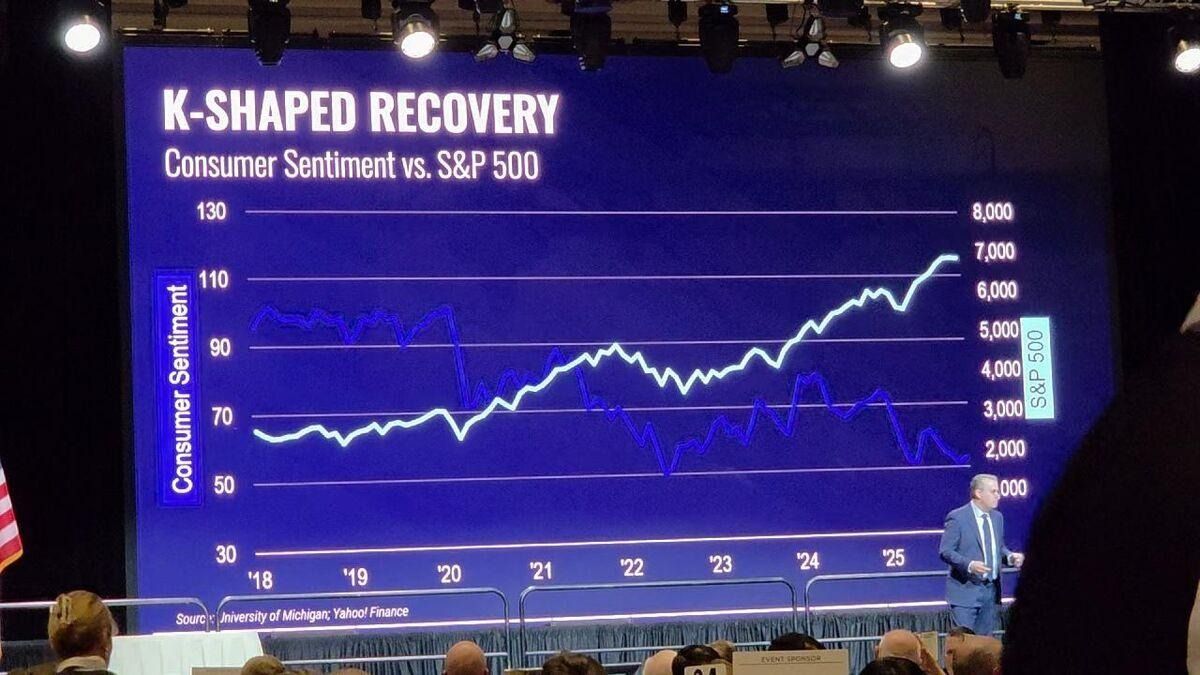

When CEO Taylor Adams declared that “opportunity outweighs challenge,” the audience’s reaction was telling: enthusiastic applause for a $26 billion development pipeline and Positron’s unicorn milestone—yet the University of Michigan Consumer Sentiment Index had sunk to 52.9, lower than at any point during 9/11, the Great Recession, or the pandemic.

This is the landscape of Reno in 2026. Macro indicators are at all-time highs while consumer sentiment scrapes historic lows—a structural paradox dubbed the “K-shaped recovery.” Within this contradiction, Reno is shedding its legacy as a casino town and rapidly transforming into the new tech hub of the American West.

A surge in AI infrastructure investment, a data-center construction boom, and battery-manufacturing reshoring are creating structural entry opportunities for Korean deep-tech companies. Drawing on on-site EDAWN coverage, economic data, and the activities of a Korean investment delegation, this report analyzes why Reno may be the next destination for Korean industry.

● ● ●

1 | Reno’s Transformation — From Casino Town to Tech Hub

For decades, the name “Reno” conjured images of casinos and ski resorts. Today, entirely different keywords define the city: Tesla Gigafactory, data centers, AI infrastructure, lithium batteries. EDAWN CEO Taylor Adams summarized three years of organizational transformation as “Planning → Execution → Operationalizing.” EDAWN has redefined itself not as a bureaucratic agency but as a “marketing services platform.”

The change is visible in hard numbers. Business leads have surged from just 34 eighteen months ago to more than 130. Over 175 annual site visits—averaging 14-plus per month—place EDAWN in the top 1% of economic development agencies nationwide. A development pipeline exceeding $26 billion is underway, manufacturing jobs have doubled over the past decade, and population growth ranks 9th nationally at 1.5–2% annually.

“This region is transitioning from stabilization to acceleration. It didn’t happen overnight, and it’s not without challenges, but we have momentum built on real activity.”

— Taylor Adams, CEO, EDAWN

▶ EDAWN Key Performance Indicators

Reno’s first tech unicorn, Positron. With an additional $230 million in funding, Positron’s total investment surpassed $1 billion (approximately KRW 1.48 trillion).

The significance extends beyond valuation: it proves to the market that Reno is evolving from a logistics backyard for Silicon Valley into a tech hub with its own circulating venture capital.

● ● ●

2 | Anatomy of a K-Shaped Recovery — Record GDP, Record-Low Sentiment

Brian Gordon, principal of Applied Analysis, delivered a 30-minute data presentation dissecting both sides of the growth story. GDP and corporate profits are at all-time highs, yet consumer sentiment sits at a historic nadir. The S&P 500 broke through 7,000 for the first time, while the Michigan Consumer Sentiment Index registered 52.9. Gordon’s diagnosis: “This is the essence of the K-shaped recovery.”

The median home price in the Reno-Sparks area stands at $600,000. A stable housing affordability threshold requires an annual household income of $153,710, yet the median income is just $92,317. For a family of four, the cost of a stable lifestyle reaches $238,500 per year. The gap reveals exactly where the fruits of growth are flowing.

“A recession is always coming—that is an absolute truth. The question is not ‘when’ but ‘how do you prepare.’”

— Brian Gordon, Principal, Applied Analysis

▶ Northern Nevada Economic Snapshot

From an industrial-analysis perspective, the critical observation is that this K-shaped structure itself creates entry opportunities for external technology firms. Enormous infrastructure demand outstrips local technology supply. That gap is the entry space for Korean deep-tech.

● ● ●

3 | Growth Engine — 20GW in the Power Queue: Nevada’s ‘Happy Problem’

The most powerful growth driver in the Reno economy is AI infrastructure investment and a data-center construction boom. Adams described AI’s impact as “a paradigm shift comparable to the introduction of the PC in the early 1980s.”

EDAWN 2025 State of Economy Luncheon (Peppermill Resort, Reno, NV)

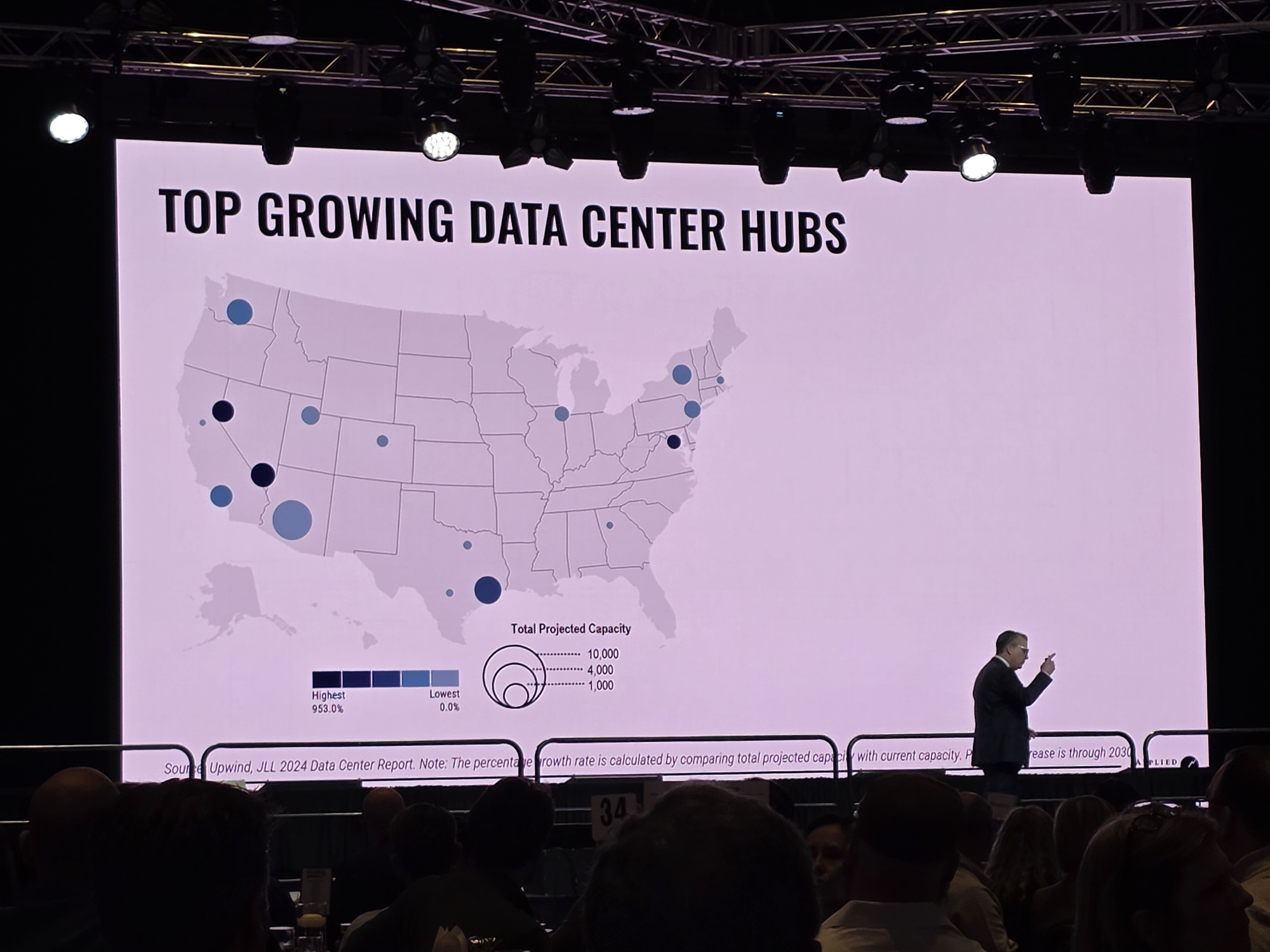

▶ Data-Center Construction Boom

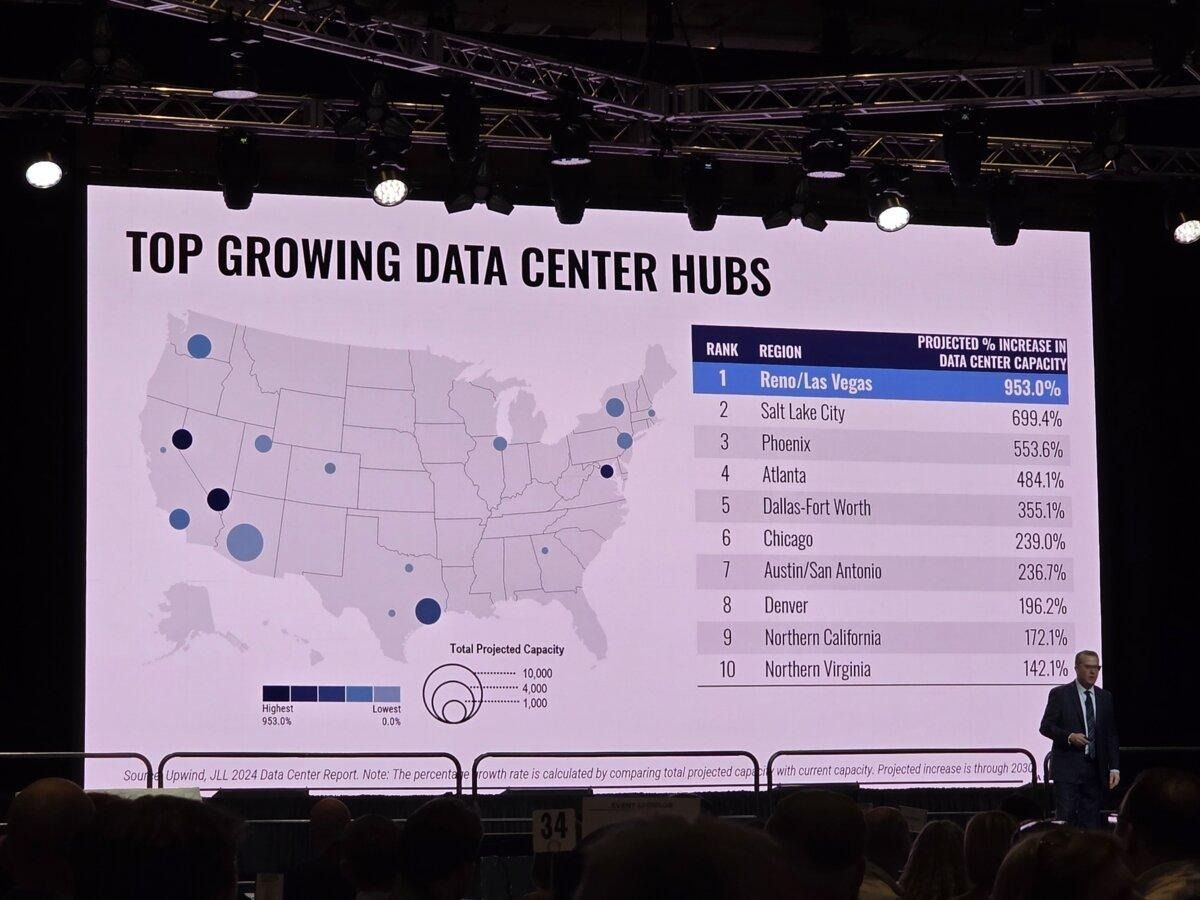

Nevada leads the nation in data-center capacity growth rate. Within the Tahoe Reno Industrial Center (TRIC) alone, 25 data centers are either operating or under construction, with global operators including Tract, Vantage, EdgeCore, Novva, and Google investing heavily. Construction investment in 2026 is projected to grow 23% year-over-year.

The scale of the boom is best measured in power demand. According to NV Energy, Nevada’s current peak electrical load is approximately 10 GW, yet pending new power requests already total roughly 20 GW. More than double the current operating capacity is waiting in line to connect to the grid.

The bulk of this queued demand comes from hyperscale data centers for AI training and inference, as well as expansion projects by Tesla, Switch, Bitdeer, and other blockchain and advanced-manufacturing companies. The entry of these enterprises—each consuming thousands of megawatts—has sent load projections soaring exponentially.

◆ Transmission Grid Expansion — Permitting Speed Is the Bottleneck

NV Energy is accelerating transmission-grid expansion through its Greenlink project, including a new 525 kV line linking Las Vegas and Yerington and a 345 kV line connecting the northern data-center cluster. The Sierra Solar project—NV Energy’s first self-owned large-scale facility featuring 400 MW of solar generation plus 400 MW of battery storage—aims to bolster supply capacity.

“Construction is shifting to digital infrastructure. What is happening in Nevada right now is at an unprecedented level.”

— Brian Gordon, Principal, Applied Analysis

[Reference] NV Energy Power Infrastructure & Supply Status

Gordon noted that “the axis of the construction industry is shifting from housing to digital infrastructure” and called what is happening in Nevada “an unprecedented transformation.” Experts note, however, that beyond physical grid construction, administrative permitting speed will be the decisive factor. A “supplier’s market” in which power supply cannot keep pace with corporate investment is expected to persist.

▶ Advanced Manufacturing Hub — The Weight of Tesla Gigafactory

“Welcome to Giga Nevada” — Inside Tesla Gigafactory, Sparks, NV | Photo: K-EnterTech Hub

Tesla’s Gigafactory occupies 5.4 million square feet within TRIC and employs approximately 8,000 workers, with a $3.5 billion expansion underway. Semi truck production lines, 4680 cell plants, and LFP battery factories are being built in parallel. Including the 4,000-strong Panasonic JV workforce, total TRIC employment reaches 22,000.

Redwood Materials (battery recycling), CIQ (enterprise Linux), and Dragonfly Energy (LiFePO4 batteries, dry-electrode technology) round out this ecosystem.

A critical observation for industry analysts: Major Asian manufacturers—LG, Samsung, TSMC—have not yet established a presence in this value chain. This represents a first-mover opportunity.

● ● ●

4 | Why Reno — Why Korean Companies Should Take Notice

Korean deep-tech companies’ U.S. market-entry paths have traditionally converged on Silicon Valley (VC access), Texas (manufacturing costs), or the East Coast (market scale). Reno puts a new dot on the map for structural reasons.

“The core objective is to redirect the flow of Korean companies away from Silicon Valley and toward Nevada. In Nevada, you can do the same FDI—with less competition, lower costs, and equal proximity. Positron achieving $1 billion in Reno is proof.”

— Heather Wessling Grosz, Vice President, EDAWN

Nevada’s business community is showing strong interest in industrial cooperation with Korea. Last November, Nevada Economic Development Director Tom Burns visited Korea, touring the Incheon Free Economic Zone, MBC, and LG Science Park. At the State of Economy event, Adams publicly referenced K-EnterTech Hub and The Way Company—cross-border networking platforms connecting Korea and global markets—and announced plans to pursue an MOU, formalizing the commitment to collaboration.

EDAWN VP Heather Wessling Grosz personally accompanied and coordinated the three-day visit of K-EnterTech Hub and The Way Company representatives. She arranged VIP seating at the Tesla table during the luncheon (1,500+ attendees) and brokered business meetings with NV Energy, Dragonfly, and Renown Health. EDAWN subsequently signed MOUs with both K-EnterTech Hub and The Way Company, launching a dedicated support system for Korean companies.

The reasons behind EDAWN’s focus on Korea are clear: the breadth of Korea’s venture ecosystem, its proven innovation capacity as a top-3 CES exhibiting nation, and massive government-level AI R&D investments. Nevada views Korea not merely as an FDI target but as a strategic partner capable of contributing technologically to the data-center, battery, and AI infrastructure boom.

● ● ●

5 | Reno’s Collaborative Ecosystem & Urban Transformation

▶ Support Network for Korean Companies

▶ Physical Transformation

The Nevada Tech Hub secured $3.9 million from the U.S. EDA for Lithium Loop workforce training. Subsequently, ~$21 million was mobilized with $15.5 million more across 17 projects to strengthen the lithium battery supply chain. For Korean battery and materials companies, this represents a new avenue for technology collaboration and local market entry.

The flagship project is the Reno Experience District (RED)—a $502.4 million mixed-use development targeting 2027 completion. With $26B+ in pipeline projects running simultaneously, growth is reshaping the city’s physical form.

▶ A Maturing Startup Ecosystem

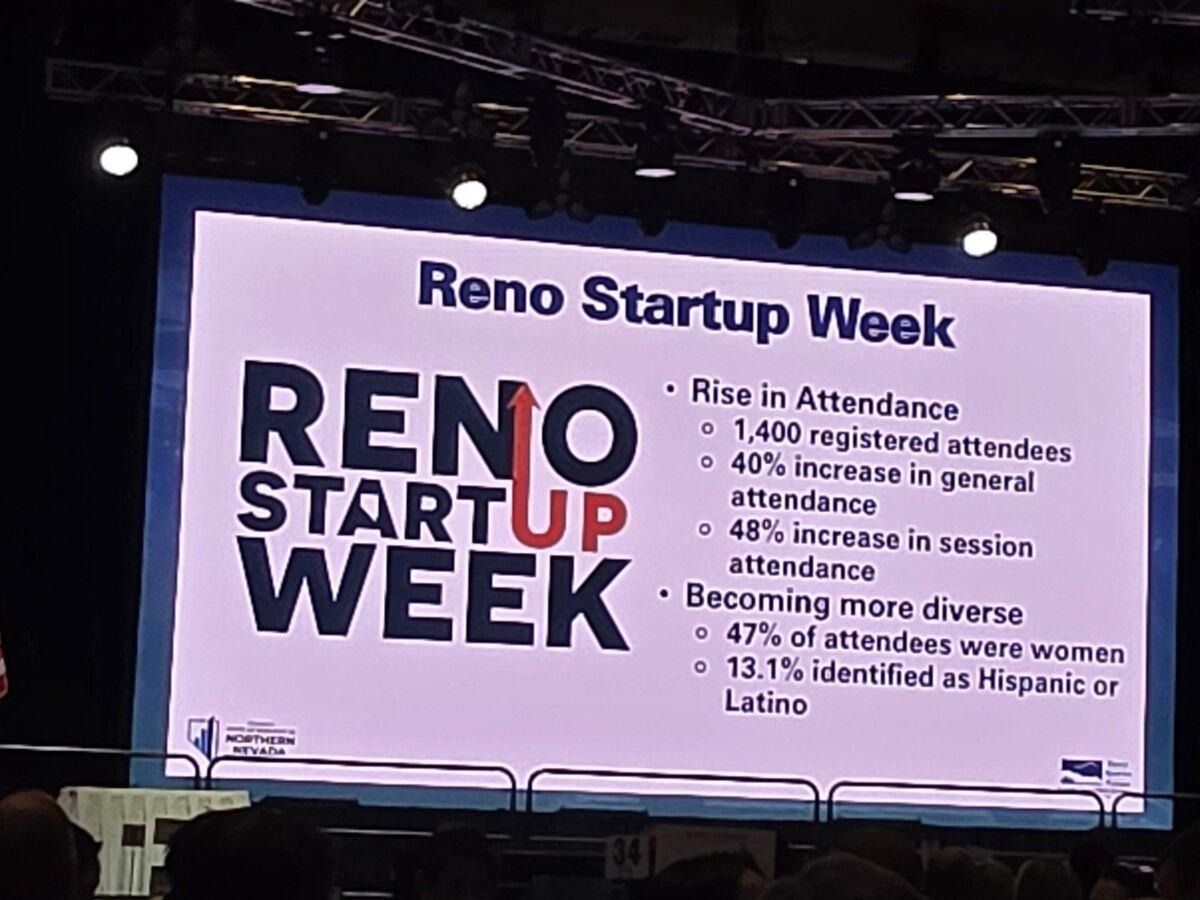

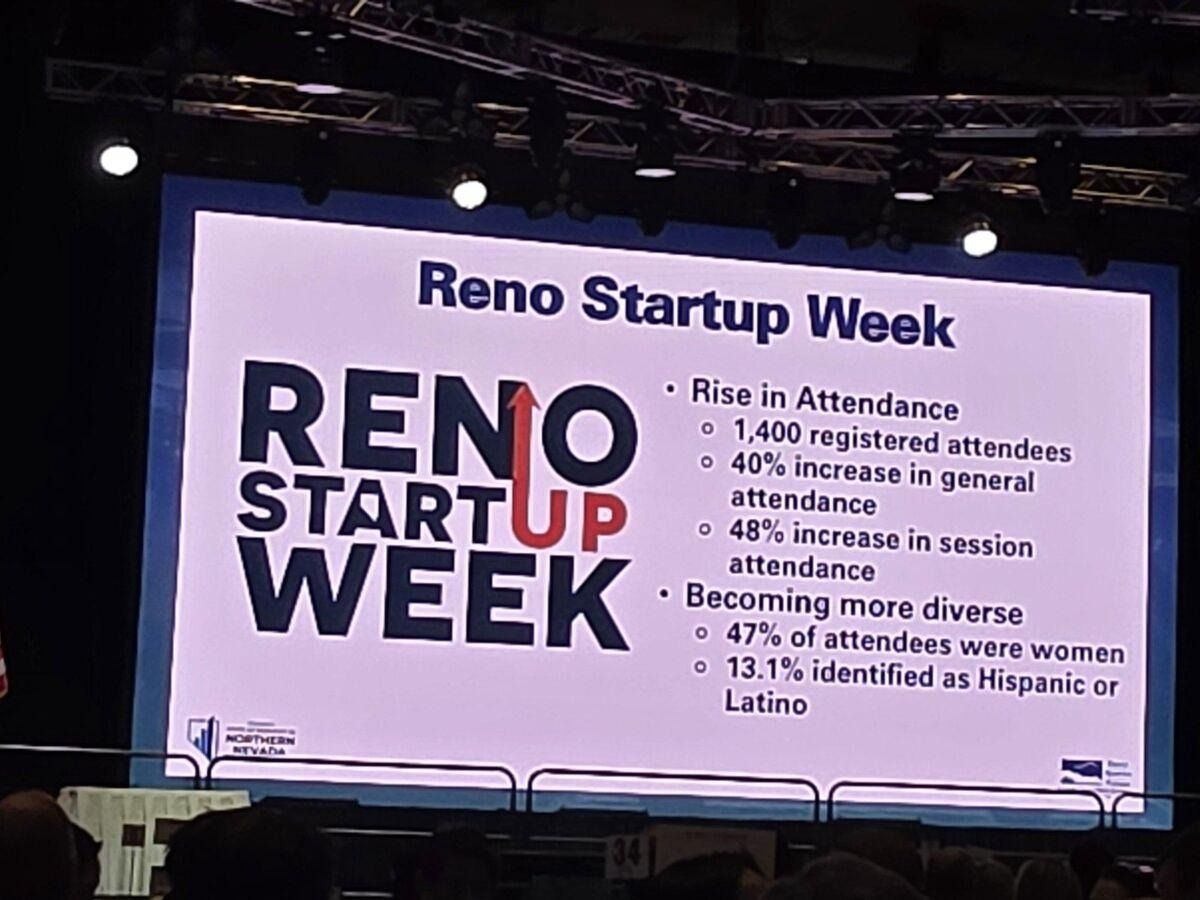

Reno Startup Week: 1,400 Registrants, 40% YoY Attendance Growth | Photo: K-EnterTech Hub

Last year’s Reno Startup Week attracted 1,400 registrants (+40% attendance, +48% per-session participation). 47% female attendees and 13.1% Hispanic/Latino representation marked significant diversity gains.

“America was built not by spectators, but by startups. By people with ideas, guts, and the courage to act.”

— Taylor Adams, CEO, EDAWN

▶ Newly Recruited Companies

EDAWN unveiled three major recruitments. Adams declared the economy has entered “acceleration phase,” attracting high-wage, high-benefit employers. SendCutSend surpassed $100M annual revenue; Future Form Manufacturing tripled production capacity with a 150,000 sq ft expansion.

● ● ●

6 | Shadows of Growth — What to Factor In Before Entry

Behind the spectacular growth lie structural challenges. Gordon addressed them candidly; Adams acknowledged tariff uncertainty. EDAWN’s 2026 economic report distills to two words: “growth” and “pain.”

■ Bright Side: Solid Fundamentals & Accelerating Recruitment

New recruitment and existing-company expansion are feeding a virtuous cycle. High-value industries are replacing low-wage logistics. Local startups are achieving scale-ups. Nevada remains top 10 for population inflow and employment growth.

■ Dark Side: Seven Risks to Evaluate Before Entry

“Tariffs are a concern in the short term, but if tariffs ultimately bring more manufacturing back to the U.S., northern Nevada is uniquely positioned to benefit.”

— Taylor Adams, CEO, EDAWN

The Reno-Nevada market is a complex environment where accelerated growth coexists with infrastructure bottlenecks. Entrants should leverage tax and geographic advantages while hedging structural cost-escalation in housing, workforce, and power.

● ● ●

7 | The Coordinates of Reno

Reno is changing. GDP hit an all-time high while consumer sentiment plunged to its lowest ever. Even within this distorted K-shaped recovery, the city no longer relies on the fading shadow of “casino town.” Instead, it is rewriting its industrial architecture from the ground up.

The transformation shows in the numbers: a $26 billion development pipeline, a 20 GW power queue, Positron’s unicorn ascent, and $3.5 billion pouring into Tesla Gigafactory expansion. These converge on one conclusion: Reno is no longer Silicon Valley’s rear guard but an advance base for next-generation industry.

For Korean deep-tech companies, Reno represents “structural timing.” Zero corporate and personal income tax, access to a comparable industrial ecosystem at one-third of Silicon Valley’s cost, and an untapped market where major Asian manufacturers have yet to establish a meaningful presence. AI-based infrastructure inspection, ESS, digital twins, floating solar—Korea’s deep-tech strengths align precisely with Nevada’s infrastructure needs.

Risks exist: soaring housing costs, tariff uncertainty, skilled-labor shortages, power bottlenecks. Yet the “Triple Advantage”—tax, geography, demand—provides sufficient incentive to absorb these risks.

EDAWN’s actions make this clear. At a 1,500-person forum, Korea was publicly named a strategic partner. The VP accompanied the delegation for three full days. MOUs with K-EnterTech Hub and The Way Company followed. This is less diplomatic gesture than industrial choice driven by supply-chain realignment and technology diversification.

Reno’s door is already open. But walking through it requires not a “tourism-style visit” but a “pilot-style proof of concept”—demonstrating capability in local projects and earning the market’s trust.

“Opportunity outweighs challenge. And the state of our economy is—strong.”

— Taylor Adams, CEO, EDAWN — Closing declaration, 2025 State of Economy

Nevada Launches First Statewide Economic Developers Association

Nevada has launched its first-ever statewide economic development association, marking a new phase in how the state coordinates growth and investment.

The Nevada Economic Developers Association (NEDA) brings together three key organizations: the Economic Development Authority of Western Nevada (EDAWN), the Las Vegas Global Economic Alliance (LVGEA), and the Governor’s Office of Economic Development (GOED). Announced in November 2025, NEDA will be formally established as a 501(c)(6) nonprofit by March 31, 2026, with EDAWN and LVGEA jointly managing its first three years.

NEDA’s mission goes beyond simple networking. Its core goals include launching Nevada’s first statewide training program for economic developers by Q2 2026, partnering with the International Economic Development Council (IEDC) to offer nationally recognized certifications, and creating a unified platform where agencies across the state can participate as founding or general members.

LVGEA CEO Danielle Casey, a former president of the Arizona Association for Economic Development and incoming IEDC chair, will bring six decades of U.S. economic-development training know-how into Nevada’s system. GOED Director Tom Burns welcomed the initiative, noting that the collaboration between EDAWN and LVGEA will raise both the visibility and professionalism of Nevada’s economic development efforts.

The launch of NEDA coincides with strong but uneven economic signals revealed at EDAWN’s “State of the Economy in Northern Nevada” event at the Peppermill Resort in Reno. While U.S. GDP and corporate profits are at record highs and the S&P 500 has surpassed 7,000, the University of Michigan Consumer Sentiment Index has fallen to 52.9—lower than during the global financial crisis, the pandemic, or the 2022 inflation spike—highlighting a tense “K-shaped recovery.” Despite these headwinds, northern Nevada continues to rank in the national top 10 for population growth and is attracting high-value projects, including Buckeye Coordinator ($14 million investment, 50 high-wage jobs), Bitdeer Industries (100 jobs with double the national entry-level salary and full employer-paid healthcare), and Ampersand (over $18 million investment, 60+ high-wage jobs in next-generation waste-to-energy technology).

Northern Nevada’s startup ecosystem is also maturing rapidly. Recent major funding rounds for companies such as Redwood Materials, CIQ, and Positron demonstrate that founders can start, scale, and raise significant capital without leaving the region, while digital manufacturing platform SendCutSend has surpassed $100 million in annual revenue. Against this backdrop, NEDA is positioned as the integrator that can align statewide training, policy, and industry collaboration—creating a more coherent ecosystem for both domestic projects and foreign investors, including Korean companies evaluating Nevada as a strategic U.S. entry point.

8 | Korean Deep-Tech Builds a ‘365-Day Accompaniment System’ in Nevada

Tesla Gigafactory, a massive data-center cluster, and a parade of global big-tech investments. As AI and clean-energy industries surge, Nevada is rapidly emerging as a new global deep-tech stronghold. With zero corporate and personal income tax and geopolitical advantages as a western U.S. logistics hub, Nevada is capturing Korean deep-tech attention as the “next base camp” beyond Silicon Valley.

At the center of this momentum, a year-round accompaniment system has been established. Not a short-term program but a long-term partnership model that walks alongside companies 365 days a year. With an official EDAWN MOU providing institutional foundation, the program delivers results from the moment Korean companies set foot in Nevada.

The Way Company (CEO: Michelle Minkyung Kim) and K-EnterTech Hub (CEO: Jung Han) designed a phased growth program: March webinars (market understanding) → year-round PoC (tech validation) → September main event (investment & networking) → CES 2027 (global expansion). The program is now fully operational.

▶ Phase 1: [March] ‘Why Nevada’ Webinar Series

“Nevada is not just a market-entry point—it is the ideal place for Korean companies to directly partner with American universities and research institutes for joint technology development.”

— Prof. Jeongwon Park, UNR / KSEA Nevada Chapter

“DRI possesses world-class research capabilities in climate, energy, and environment. Korean deep-tech companies entering Nevada will find tremendous synergy opportunities with DRI’s research infrastructure.”

— Dr. Yeongkwon Son, Desert Research Institute

▶ Phase 2: [Year-Round] 365-Day PoC — The Program’s Core

PoC operates year-round. Companies participate whenever ready, enabling entry tailored to each firm’s timeline.

▶ Phase 3: [September] Nevada Gateway & Korea Night

▲ Reno Startup Week: 1,400 registrants, 40% YoY growth (EDAWN data)

3-1. K-Nevada Gateway Program

3-2. Korea Night 2026

“K-Tech meets Nevada Industry & K-Culture.” K-pop, premium K-food & K-beauty showcase, VIP networking dinner with local government and business leaders. The 'Next K-Wave conference' hosted by Mr. Samseog Ko, Distinguished Professor at Dongguk University ( a member of the Presidential Committee on AI, former member of the Korea Communications Commission), will also be held on-site.

▶ Execution Team — ‘Field’ Meets ‘System’

▶ Field Report: Feb 3–6 — On-Site Collaboration & MOU Signing

The Korean delegation visited Reno Feb 3–6 for relay meetings with Tesla, Renown Health, Dragonfly Energy, NV Energy, SNWA, and EDAWN. VIP-seated at the Tesla table during the 1,500-person EDAWN luncheon, the team secured a dedicated Korean-company incentive track.

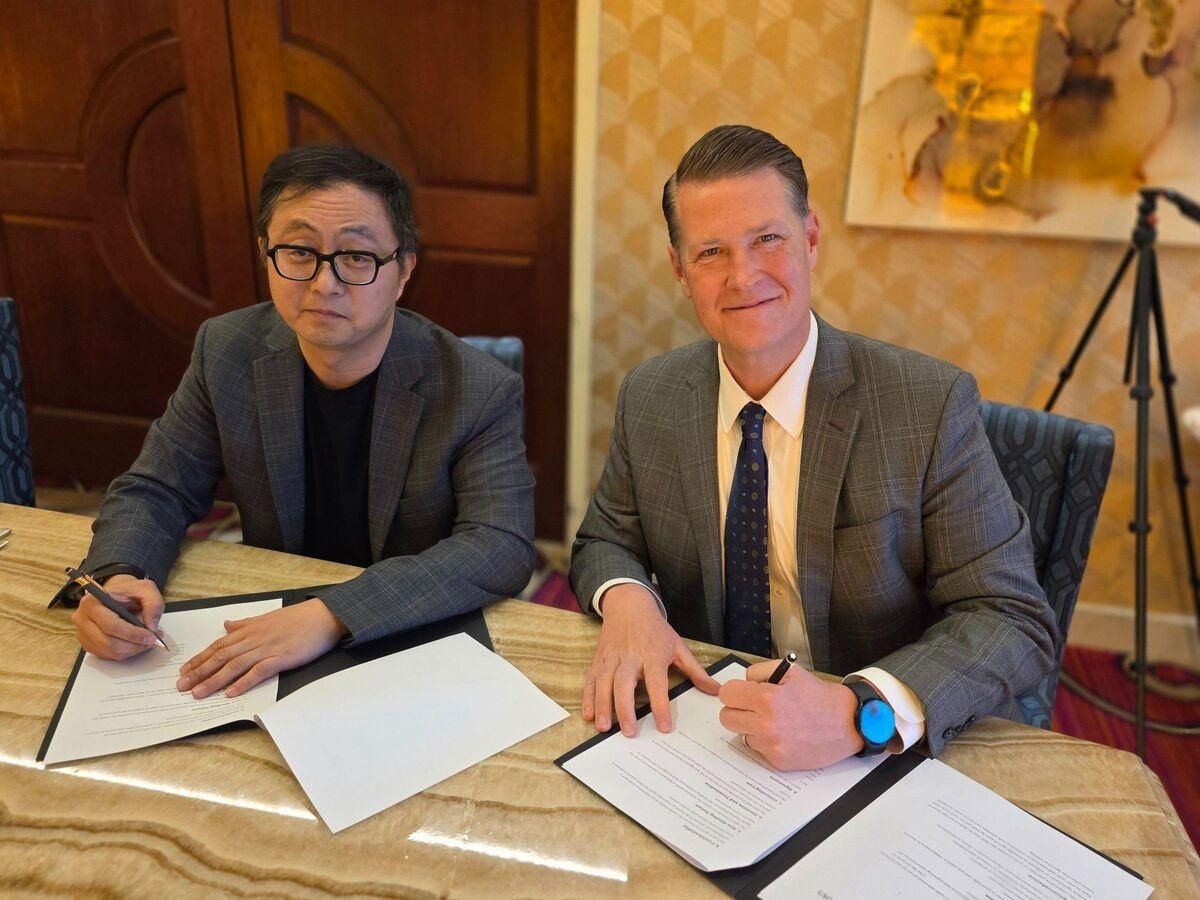

Official MOU with EDAWN

The Way Company and K-EnterTech Hub signed an official MOU with EDAWN—agreeing on Korean company entry support, joint programs, and investment cooperation—establishing the K-Nevada Bridge Program’s formal foundation.

▲ K-EnterTech Hub CEO Jung Han (left) signs MOU with EDAWN (Feb 5, Reno, NV)

▲ The Way Company CEO Minkyung Kim (left) completes MOU signing with EDAWN (Feb 5, Reno, NV)

▶ Interview: Minkyung Kim, CEO, The Way Company

Q. What differentiates this program?

“It’s a year-round accompaniment system—from March webinars through year-round PoC, September main event, and January CES. Each phase connects so Korean companies generate real results from the moment they arrive.”

— Minkyung Kim, CEO, The Way Company

Q. What’s unique about the content?

“Through a ‘hybrid curriculum’ combining Brian Gordon’s economic analysis and Alex’s business modeling, we first identify local market demands, then connect Korean technology to that demand.”

— Minkyung Kim, CEO, The Way Company

Q. Long-term goals?

“February’s on-site meetings laid the groundwork with Tesla, Renown Health, and NV Energy. The EDAWN MOU provides an official framework. Our goal is for K-Nevada Bridge to become a trusted platform helping Korean deep-tech companies establish lasting roots in Nevada.”

— Minkyung Kim, CEO, The Way Company

▶ Roadmap — From March’s First Step to January 2027

Nevada is no longer ‘the tourism state.’ As Tesla Gigafactory and global data-center clusters attest, Nevada is the new center of AI, clean energy, and advanced manufacturing. The K-Nevada Bridge Program is designed to place Korean deep-tech companies at the heart of this enormous opportunity.

From the EDAWN MOU, to DRI and UNR academia channels, to operational connections with Tesla and Renown Health—this is a full-cycle partnership platform for “long-term settlement,” not “short visits.” The 365-day journey has begun.

Reporting & Analysis: K-EnterTech Hub | Photography: K-EnterTech Hub | Partner: The Way Company

Sources: EDAWN, Applied Analysis, NV Energy, Reno Gazette Journal, News 4 & Fox 11

Compiled from on-site EDAWN State of Economy coverage (Feb 5, 2026), Korean investment delegation activities, and publicly available press materials.