[In-Depth]Netflix-WBD $83 Billion Mega Deal: Hollywood's Earthquake and K-Content's New Frontier

Netflix's $83 Billion Gamble: Acquiring Warner Bros. Discovery

- Self-Disruptive Innovation Reaches Its Ultimate Test

- From DVD Rentals to Owning Batman: A Company That Never Stops Pivoting

- Hollywood Fury, LA Anxiety, and Why Korean Content Could Be the Unexpected Winner

A Century-Defining Deal

On 5 Dec , 2025, Netflix announced its acquisition of Warner Bros. Discovery's film studio and HBO Max streaming service for $83 billion—approximately 115 trillion Korean won. This isn't just the largest deal in Netflix's history; it's a transaction that fundamentally redefines the global media and entertainment landscape.

The world's largest streaming platform has absorbed a studio with a century of Hollywood history. The boundary between traditional media and digital streaming has effectively dissolved. But the significance runs deeper: Netflix, the company that built its empire on the philosophy of "build what you need internally" while avoiding major acquisitions, has executed a complete strategic pivot.

Co-CEO Greg Peters emphasized during the announcement: "We understand the business we're acquiring, and this decision wasn't made out of desperation." This signals a calculated "big move" to secure dominance in an increasingly saturated streaming market, not a survival measure.

Rahul Telang, a digital media expert at Carnegie Mellon University, captured Netflix's strategic DNA: "They're always going to move with the wind." The company's ability to read market currents and act decisively made this deal possible.

Part 1: The History of Strategic Pivots

Netflix's Superpower: Self-Disruptive Innovation

To understand this acquisition, you must first understand Netflix's unique DNA. If Netflix has a superpower, it's the ability to abandon long-held certainties when the market shifts. Whether it's cracking down on account sharing or embracing advertising after years of resistance, Netflix's biggest leaps have come from reconsidering what it once deemed nonnegotiable.

Ross Benes, senior analyst at EMARKETER, told Business Insider: "After throwing cold water on large media mergers publicly, they moved to acquire one of the world's largest content investors. This follows the same pattern as their reversals on advertising, live sports, and account sharing." Netflix is betting once again that reinvention beats rigidity.

Pivot 1: DVD to Streaming (2007)

Netflix's first major transformation came in 2007 when it launched video streaming beyond its mail-order DVD rental business. Initially populated with licensed content, the service eventually expanded into original productions. This fundamentally changed Netflix's business model and set the template for future pivots.

Pivot 2: Password Sharing Crackdown (2023)

For years, Netflix tacitly permitted password sharing—a rational approach during its hypergrowth phase. But in 2023, as subscriber growth slowed, Netflix began charging $8 per month for out-of-household users. Competitors like HBO Max and Disney+ followed suit.

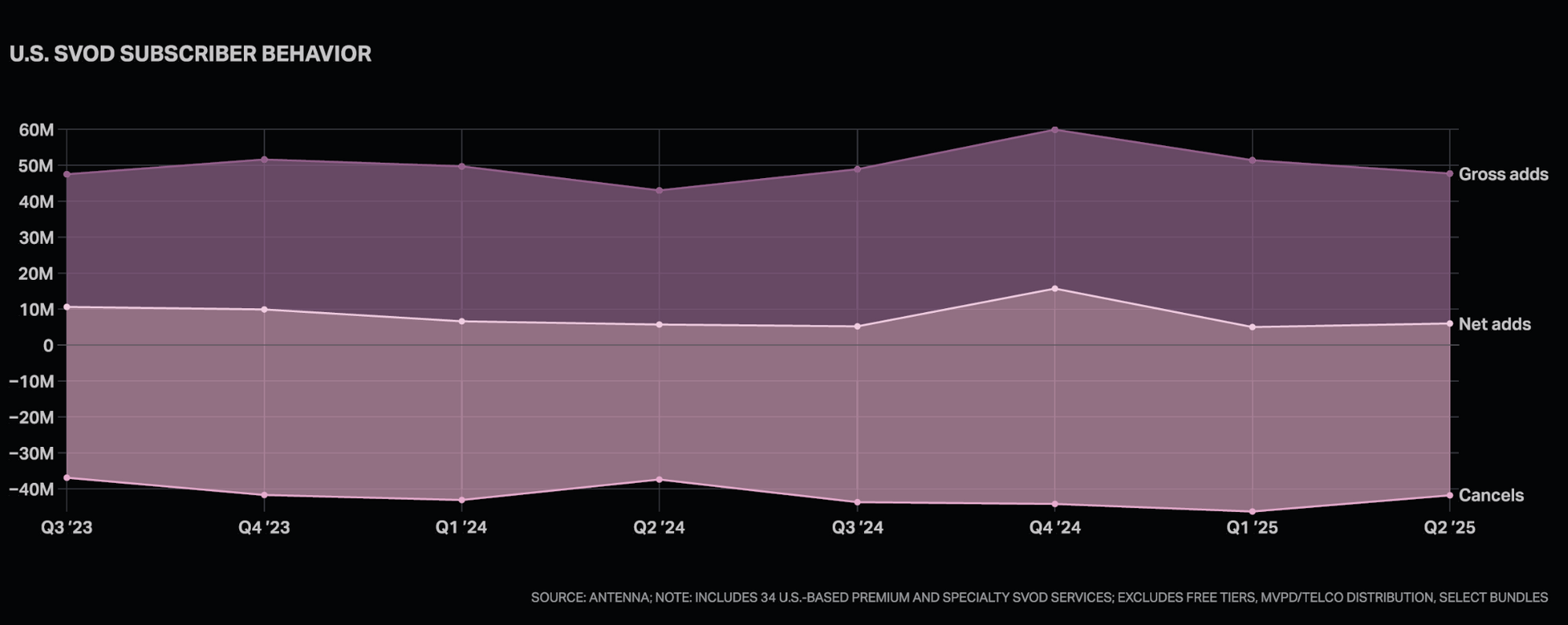

The policy shift worked. Subscriptions surged after the crackdown. However, this growth is approaching its limits. According to Luminate analysis, net subscriber additions across global streaming services have been declining since Q4 2024. Markets are saturating.

Pivot 3: Advertising (2022)

Netflix also reversed course on advertising. Founder and former CEO Reed Hastings stated in 2020 that entering the ad business would be "a costly undertaking" with "regulatory risks" that would "exploit users."

Yet in 2022, as Hastings stepped down as CEO amid slowing subscription growth, Netflix launched a cheaper ad-supported tier. The company justified the move by claiming it would give subscribers more options for accessing content—a complete reversal of their previous logic.

The launch wasn't smooth. Advertisers initially criticized Netflix's offerings as overpriced and basic, and the company cycled through several advertising executives. Nevertheless, Netflix expects advertising to be a major growth lever for years to come.

Netflix is emerging as a late-entry powerhouse in the US ad-supported streaming (AVOD) market, growing approximately 50% in a single year. Industry projections estimate Netflix's 2025 US AVOD ad revenue at approximately $1.5 billion, up significantly from roughly $1 billion in 2024.

While Hulu (approximately $3 billion), Prime Video, and Peacock (each around $2 billion) still dominate the US AVOD market, Netflix has positioned itself as a mid-tier platform within just 2-3 years of launch—comparable to Tubi, Pluto TV, WBD DTC, Paramount+, and Disney+.

This suggests that Netflix's diversification from subscriptions into advertising could accelerate additional revenue streams including live sports, FAST channels, and bundle strategies.

Pivot 4: Sports and Live Events

Over time, Netflix evolved from focusing exclusively on movies and TV shows into a broad-based entertainment platform. Sports and live events became central to this expansion—another strategic reversal.

Netflix had previously stated it wouldn't enter live sports programming, preferring "content with long-term viewing value." Experts never believed this. Media companies can rarely resist sports, which attract big, attentive audiences and significant advertising dollars.

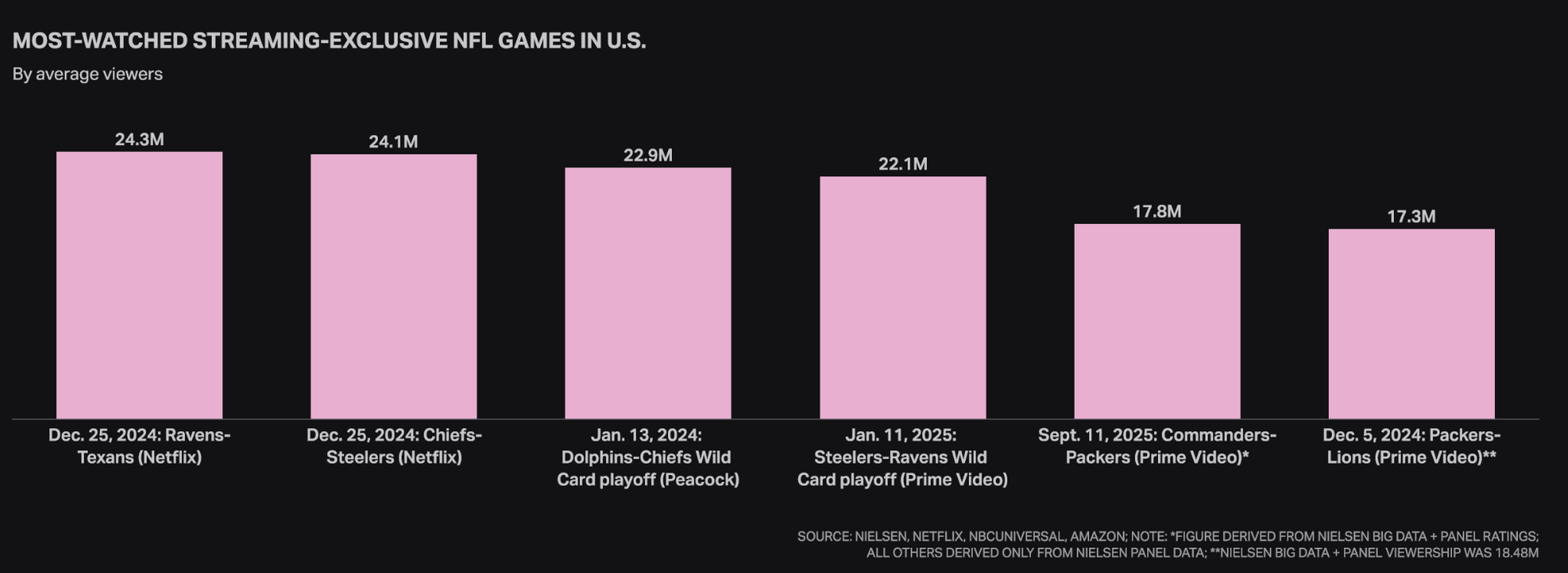

As industry observers predicted, Netflix eventually entered sports—not by pursuing full-season rights from major leagues, but by streaming live events. This strategy is paying off. Events like Jake Paul vs. Mike Tyson and NFL games have driven millions of new subscription signups.

Part 2: The Strategic Rationale—Solving Franchise Scarcity

The Crisis Signal: Stagnant Hours of Consumption

The WBD acquisition directly addresses Netflix's viewing time plateau. Matthew Ball, CEO of VC firm Epyllion, told Business Insider: "Despite subscriber growth, Netflix has shown minimal expansion in must-watch intellectual property over the past two years. The WBD acquisition could help increase viewing hours."

Media consultant Peter Csathy added: "This acquisition gives Netflix the most storied IP library and characters. It solved its franchise scarcity problem."

WBD owns premium franchise content including DC Comics and Harry Potter—properties with dedicated superfans who follow the content across platforms.

This premium IP shifted Netflix's strategy from building content internally to acquiring it. Ball noted: "The decision to acquire rather than build shows Netflix is willing to change in response to market shifts."

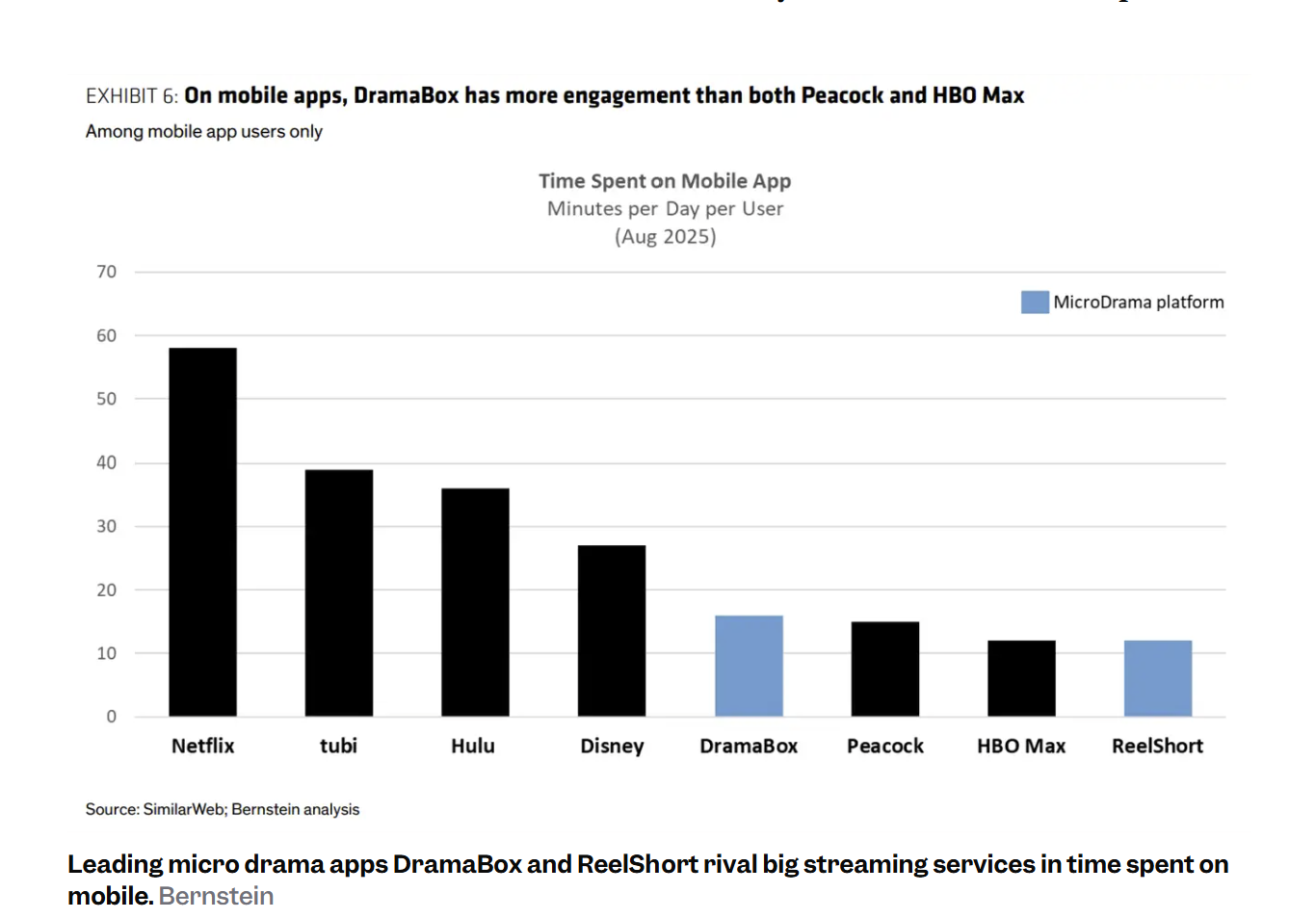

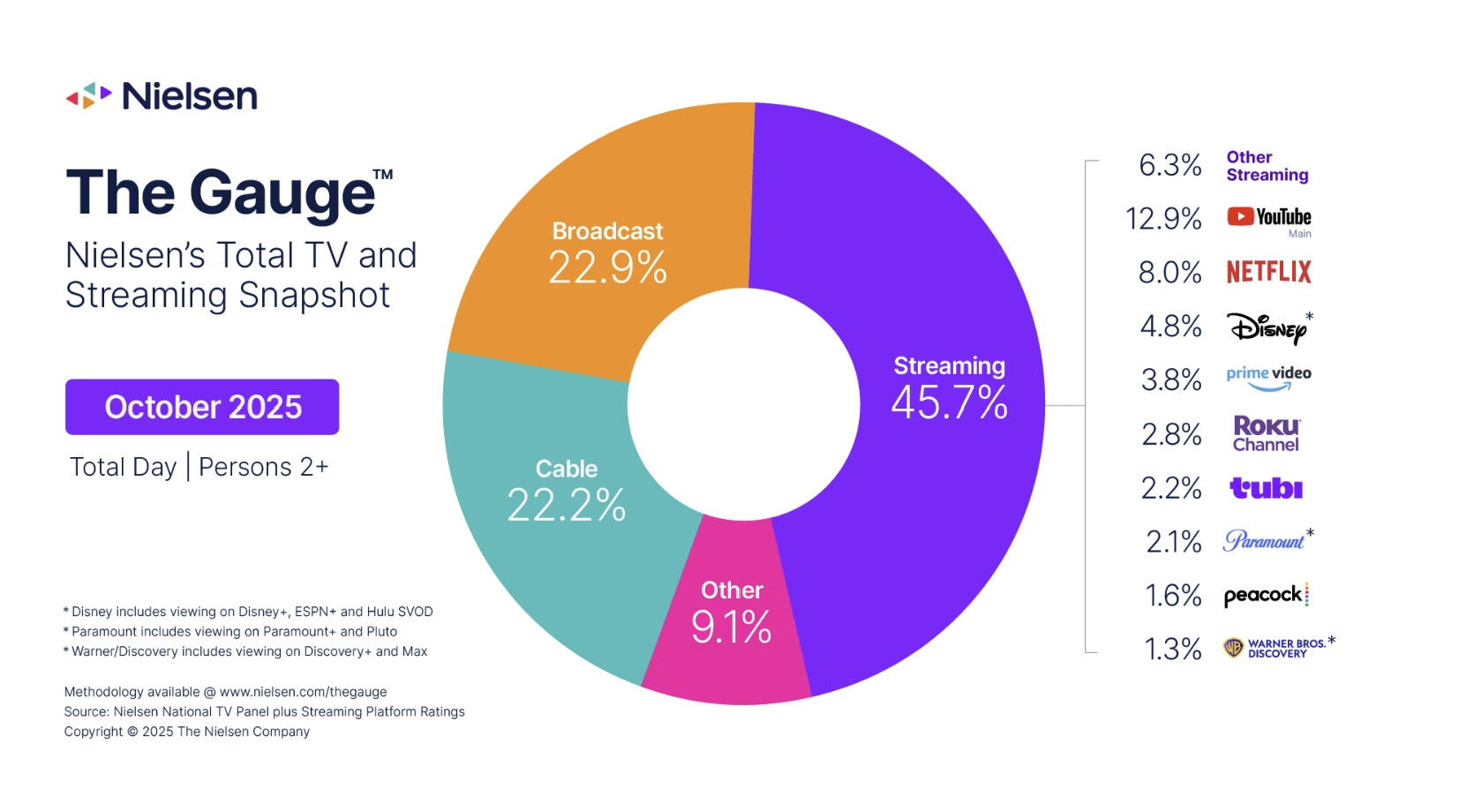

According to Nielsen and Parrot Analytics data, Netflix's share of TV viewing and engagement per subscriber have remained relatively flat while YouTube has widened the gap. Watching this stagnation likely changed the company's perspective on growth strategies. While YouTube expanded share, Netflix faced pressure from FAST services like Tubi and short-form platforms.

Ball argued: "Netflix is acting from a position of strength. In the most recent quarter, they recorded their highest-ever share of TV time in both the US and UK. They see this acquisition as an opportunity to accelerate their evolution."

Increasing viewing hours requires superfans.

Christopher Vollmer, Partner and Managing Director at UTA MediaLink, put it bluntly: "You're never going to get another chance to own Batman."

Part 3: The Challenges Ahead

Cultural Clash Risk

Acquiring WBD's core assets transforms Netflix from a company that distributed only its own content on its own platform to one absorbing a traditional media company that distributes content through multiple buyers. Netflix must also integrate thousands of employees unfamiliar with the "radical honesty" culture the company considers essential to its success.

Peter Csathy warned: "The consolidation and integration of culture is always the biggest risk when it comes to M&A. Netflix studios and Hollywood studios have very different DNA."

Wall Street Skepticism

Wall Street received the news skeptically, with Netflix stock dropping approximately 3% on Friday, December 5. Media analyst Evan Shapiro noted: "The market has always been cautious about Netflix's timing on strategic pivots like advertising or account sharing." Like some other analysts, he expressed concerns about the price Netflix is paying.

Regulatory Hurdles

The deal may face political opposition and regulatory scrutiny. Morgan Stanley wrote in a report last month that Netflix likely faces "perhaps the toughest regulatory path" among potential WBD acquirers.

Complications could intensify if President Trump intervenes. Paramount Skydance, another WBD bidder, is owned by longtime Trump allies Larry Ellison and his son David Ellison.

Despite the risks, Netflix clearly sees more potential upside in making a move than in standing still.

Vollmer observed: "They've been winning, largely through volume of content. Now they seem to have realized they can further expand their ability to shape attention through culturally relevant IP, and they'll go from strength to strength."

Part 4: Hollywood's Anger

From Grief to Rage

When Warner Bros. Discovery put itself up for sale last October, Hollywood mourned. The move signaled the complete end of the studio era and the dawn of the streaming age. Mega-producer Larry Gordon compared the feeling to "a death in the family" in an interview with The New York Times. Screenwriters' group WhatsApp chats filled with words like "heartbreaking" and "tragic."

Now that the sale has been announced—with Netflix securing an $83 billion deal for Warner Bros. Studios and HBO Max—a different emotion has gripped the entertainment capital.

Hollywood is mad.

Jane Fonda's Fierce Criticism

Actress Jane Fonda published an open letter to the industry through The Ankler, expressing outrage at the end of an independent Warner Bros. She called it "an alarming escalation in a consolidation crisis" that threatens "the entire entertainment industry, the public it serves, and potentially the First Amendment itself."

Industry Organizations Fight Back

Michael O'Leary, CEO of Cinema United (representing 30,000 US movie theaters), called the Netflix acquisition "an unprecedented threat" and vowed to block it.

In an interview, he stated forcefully: "Theaters will close, communities will suffer, jobs will be lost."

O'Leary pointed to Netflix's policy of providing only "token" theatrical releases for films. Indeed, on Friday, shares of publicly traded theater chains including AMC Entertainment, IMAX, and Cinemark fell as much as 8%.

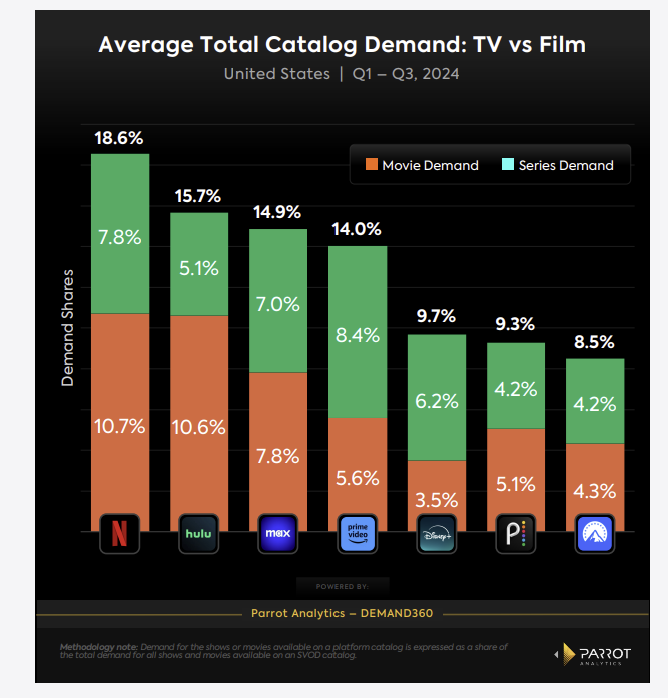

Netflix's influence in the film market continues to grow. According to Parrot Analytics, Netflix films commanded a 10.8% demand share as of December 2024. While this measures demand within Netflix's content library, demand on a platform with over 300 million subscribers effectively represents the broader market.

The Writers Guild of America, representing more than 12,000 screenwriters, stated: "This merger must be blocked. The world's largest streaming company swallowing one of its biggest competitors is exactly what antitrust laws are meant to prevent."

The Teamsters union's film division demanded that "all levels" of government "reject this deal."

Can Netflix's Theatrical Release Promises Be Trusted?

Netflix claimed Friday that it would respect Warner Bros.' business model, continuing to release films in theaters during exclusive theatrical windows.

Ted Sarandos, Netflix Co-CEO, said during an investor conference call: "It's not like we have this opposition to movies into theaters. Right now, you can expect everything planned for theatrical release through Warner Bros. to continue going to theaters."

However, many in Hollywood viewed his statement with extreme skepticism. The key words are "right now."

This April at the Time100 Summit, when asked about declining overall box office, Sarandos said: "What are consumers telling us? They'd like to watch movies at home." He called theaters "an outmoded idea" for most people.

Part 5: LA Entertainment Industry Crisis

Hollywood Workers Already Suffering

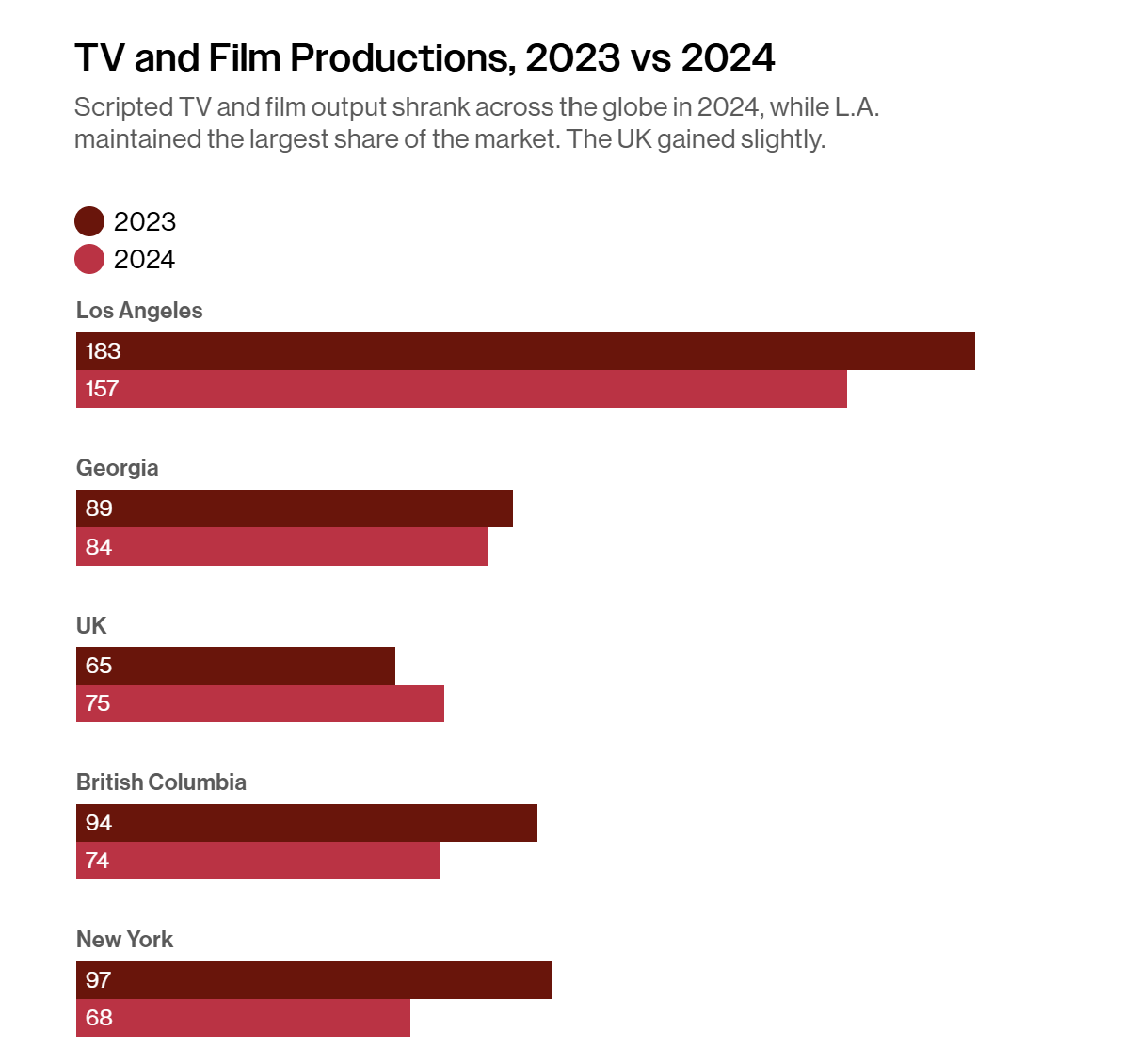

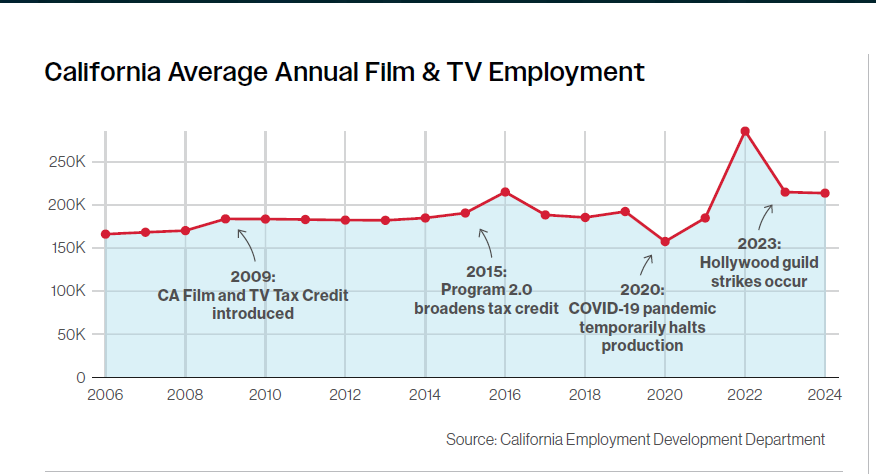

LA's entertainment workers—camera operators, producers, hairstylists, writers, actors, set designers—have already been struggling with a contracting job market. Since 2020, tens of thousands have been laid off from Hollywood companies due to the COVID-19 pandemic, two union strikes, production flight to cheaper locations, and the rise of AI tools. In 2024 alone, film and TV production in LA dropped by approximately 26 projects. Employment has been declining sharply.

Many recognize that "consolidation" is another word for "job loss." The same pattern played out when Disney acquired 21st Century Fox assets from Rupert Murdoch for $71.3 billion in 2019. This year, when Skydance Media led by David Ellison acquired Paramount as part of an $8 billion merger, massive layoffs followed. In October, Paramount began laying off more than 2,000 employees across its film and TV business to cut $3 billion in costs.

LA Political Reactions

Politicians are also stirring. Democratic Representative Laura Friedman, whose district includes Burbank, said of the Netflix acquisition: "Repeated consolidation in this industry has already taken too many film and TV jobs. Every merger must be evaluated for its impact on competition and employment. I will closely monitor this transaction to ensure this merger supports LA workers."

Burbank is home to major Southern California film studios.

The LA area is overwhelmingly Democratic and pro-labor. Mayor Karen Bass issued a measured statement: "LA's diverse production studios contribute to its status as the shining creative capital of the world. While fostering an environment where LA continues to lead our signature industry, we will revitalize local production and create more jobs and small business opportunities right here."

LA City Councilmember Katy Yaroslavsky, whose district includes the Writers Guild, SAG-AFTRA actors union, and several production studio offices, said she's focusing on what this transaction means for production in LA: "Netflix has been a strong partner for our city, and the entertainment industry supports tens of thousands of good jobs here. But LA's entertainment sector is in crisis, and the question is whether this deal will strengthen production here or send more work elsewhere."

Austin Beutner, a strong challenger to Mayor Bass's reelection bid and longtime civic organization leader, said in a media interview: "I'm concerned about the impact additional consolidation will have on jobs in our community."

California film and TV employment has been declining since peaking in 2022.

According to The New York Times, privately, LA City Hall officials feel relief. In this progressive city, there's satisfaction that longtime Trump supporter Larry Ellison and his son won't be acquiring another Southern California landmark studio in Warner Bros. The Ellisons competed with Netflix to acquire Warner Bros. and HBO Max. They also wanted to acquire CNN from Warner Bros. Discovery, but the cable news channel will remain a separate corporate entity for the time being.

On the other hand, officials noted that the deal requires federal regulatory approval, and the Trump administration will likely be involved in all reviews. A senior aide to one city council member told The New York Times about the merger: "Netflix has a lot of jobs here. But the FCC has to approve this deal, and I'm worried about what Netflix might have to do to appease President Trump."

Part 6: The Future of Independent Film and Creativity

In LA's Westside—the core entertainment industry hub—inquiries and discussions reportedly surged immediately after news of the acquisition emerged. An entertainment lawyer at a firm primarily representing independent film and documentary producers said: "Client calls have been nonstop the past few days," conveying the local industry's anxiety. Inside and outside the industry, analysts view this transaction as a "game changer" that could reshape the entire content investment structure.

The lawyer's primary concern is that reduced buyer numbers could narrow the space for independent and experimental films. If a structure where a few major platforms and studios oligopolize the market becomes entrenched, capital will inevitably concentrate on safer, less controversial projects. As a result, independent and experimental films that have pushed boundaries in terms of budget, format, and subject matter could be deprioritized for programming and investment, potentially damaging overall creative diversity.

A Writers Guild of America representative criticized the merger structure as "risking stronger subordination of production and distribution structures to the interests of platforms that maximize content consumption." With viewers already spending considerable time on streaming platforms, additional major consolidation could prioritize market dominance over user benefit. Notably, these big deals always tout "efficiency" and "synergy," but actual results repeatedly show reduced competition, wage depression, and job cuts for creators and production staff.

If this transaction closes, the pace of global streaming and studio market restructuring will accelerate. Economies of scale-driven consolidation may help with cost reduction and content supply stability in the short term, but could lead to concentrated buying power and weakened negotiating leverage for production companies and creators in the long term. How US antitrust regulators will review the transaction, and how much labor and creator concerns will factor into regulatory discussions, will be key points to watch.

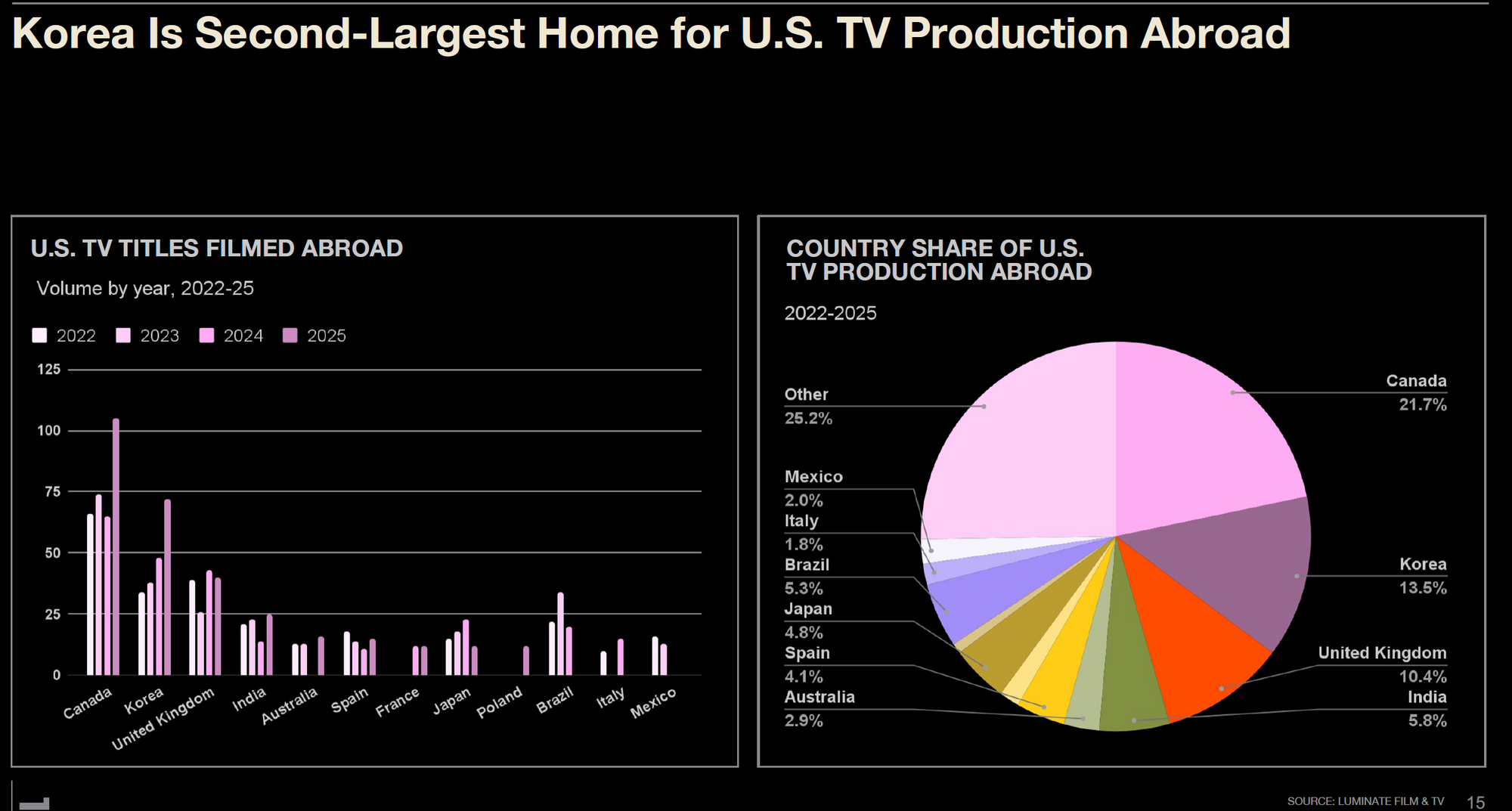

As a core hub for the global video and entertainment industry, LA will see the outcome of this big deal directly impact its regional economy and employment. Given the significant influence of major platform decisions on global production and investment portfolios, independent production companies and creators overseas—including in Korea—increasingly need to reassess their medium-to-long-term strategies. Particularly for companies pursuing global collaboration and co-production of K-content, the strengthening coordination among a few major players could serve as both a risk and a variable demanding new negotiating structures.

Part 7: K-Content Strategy Post-Acquisition—A Long-Tail and Fandom Laboratory

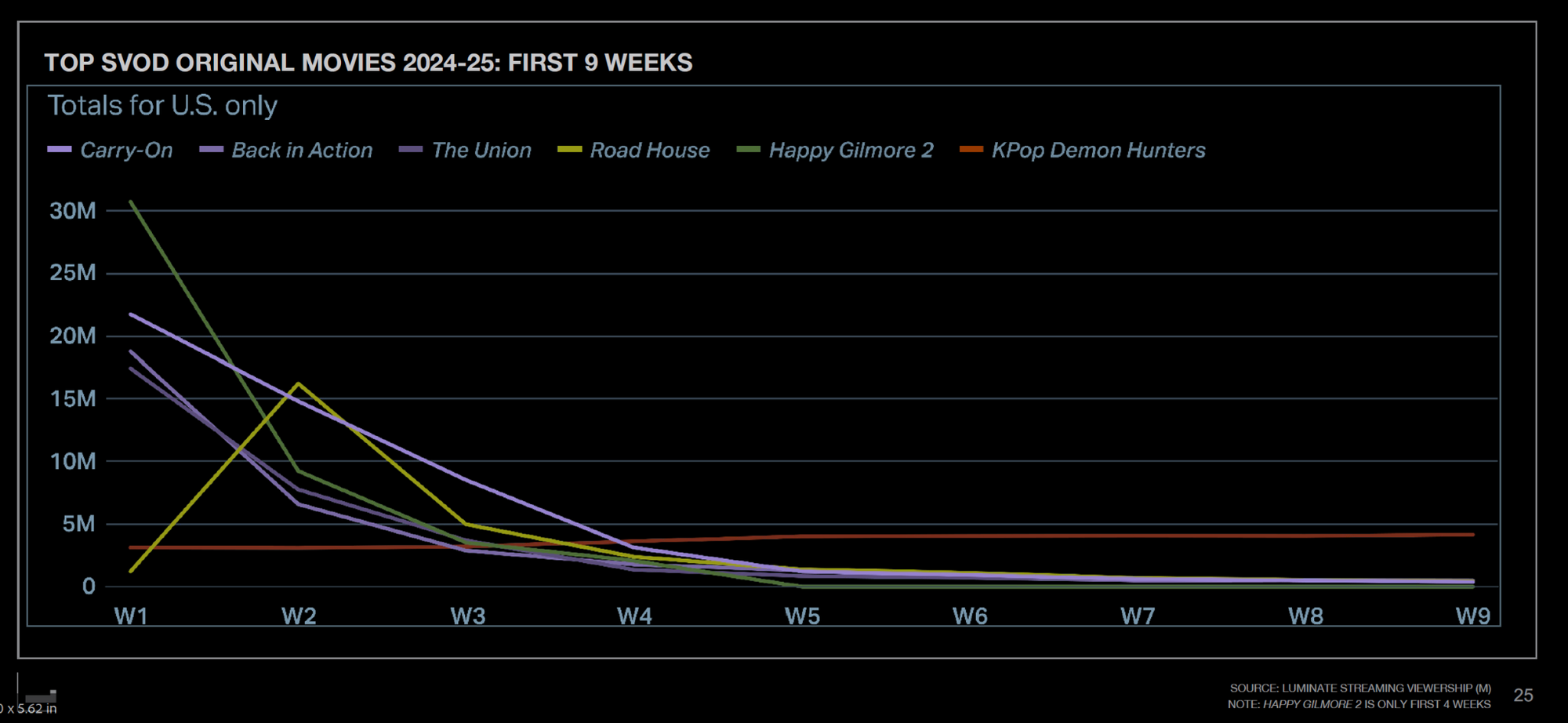

Netflix expects WBD's vast franchise IP and superfan base to boost viewing hours and alleviate its "franchise scarcity" problem. How significant the effect will be remains difficult to verify. At this juncture, long-tail performance of K-content like K-Pop Demon Hunters emerges as an important experimental case.

According to Luminate analysis, this title showed a pattern of sustained demand extending longer in subsequent weeks than during its initial release across global markets including North America. This suggests K-pop and K-drama fandoms can generate long-term consumption through word-of-mouth and community engagement.

Analysis suggests that post-acquisition, Netflix is likely to attempt combining WBD franchises with K-content—pairing Hollywood IP that drives initial hits with K-content that generates long-tail engagement within a single catalog. For example, a dual strategy could use major series like DC, Harry Potter, and Game of Thrones to gather "entry traffic" while driving fandom-based long-term viewing with K-animation, K-drama, and K-movies including K-Pop Demon Hunters.

When general fans are combined with superfans and general fans convert to superfans, demand becomes prolonged and intensified. In this case, there's ample room for impact on subscriber retention, advertising revenue, and even related merchandise and tourism businesses.

However, whether this combination will actually resolve viewing time stagnation and improve profitability, or merely increase regulatory and integration risks while falling short of expectations, remains uncertain.

What's clear is that if this acquisition settles successfully, the combination of WBD franchises and K-content long-tail strategy could open possibilities for Netflix to pursue a new position as "Hollywood Major + Global Culture Hub." This is certainly an opportunity for K-content as well.

If it fails, it could become a case proving that self-disruptive innovation isn't always the answer. Here, we must ask again: "Is Netflix the only answer?" Once more for emphasis: a "K-content platform ecosystem" strategy utilizing FAST (Free Ad-Supported Streaming TV) and other alternatives is essential.

Conclusion: Between Risk and Reward

Despite the risks, Netflix clearly sees more potential for upside in making a move than in standing still.

Christopher Vollmer, UTA MediaLink Partner, observed: "They've been winning, largely through volume of content. But now they seem to have realized they can further expand their ability to shape attention through culturally relevant IP, and they'll go from strength to strength."

Netflix's previous pivots have largely succeeded. DVD to streaming, licensed content to originals, ad rejection to ad acceptance, sports avoidance to live event dominance—all hit their mark. Netflix has repeatedly read market changes and pivoted boldly.

However, the WBD deal presents an entirely different dimension of challenge in terms of scale and nature. The $83 billion price tag, integration of thousands of traditional Hollywood employees, formidable regulatory hurdles, and the need to reset relationships with the theater industry create a complex situation.

Many point out that Netflix's DNA of self-disruptive innovation is now truly being tested.

As Vollmer said: "You're never going to get another chance to own Batman."

But how high the price of seizing that chance will be—nobody knows yet.