The Era of 'Re-Cord Cutting': Consumers Abandon Paid Streaming

Ditched Cable for Netflix, Now Netflix Costs as Much as Cable — Viewers Flee to Free Streaming

Consumers who once cut the cord on cable TV and migrated to streaming are now cutting ties with paid streaming services altogether. Exhausted by successive price hikes from major platforms, viewers are flocking en masse to free ad-supported streaming TV (FAST) — a phenomenon now being called "Re-Cord Cutting."

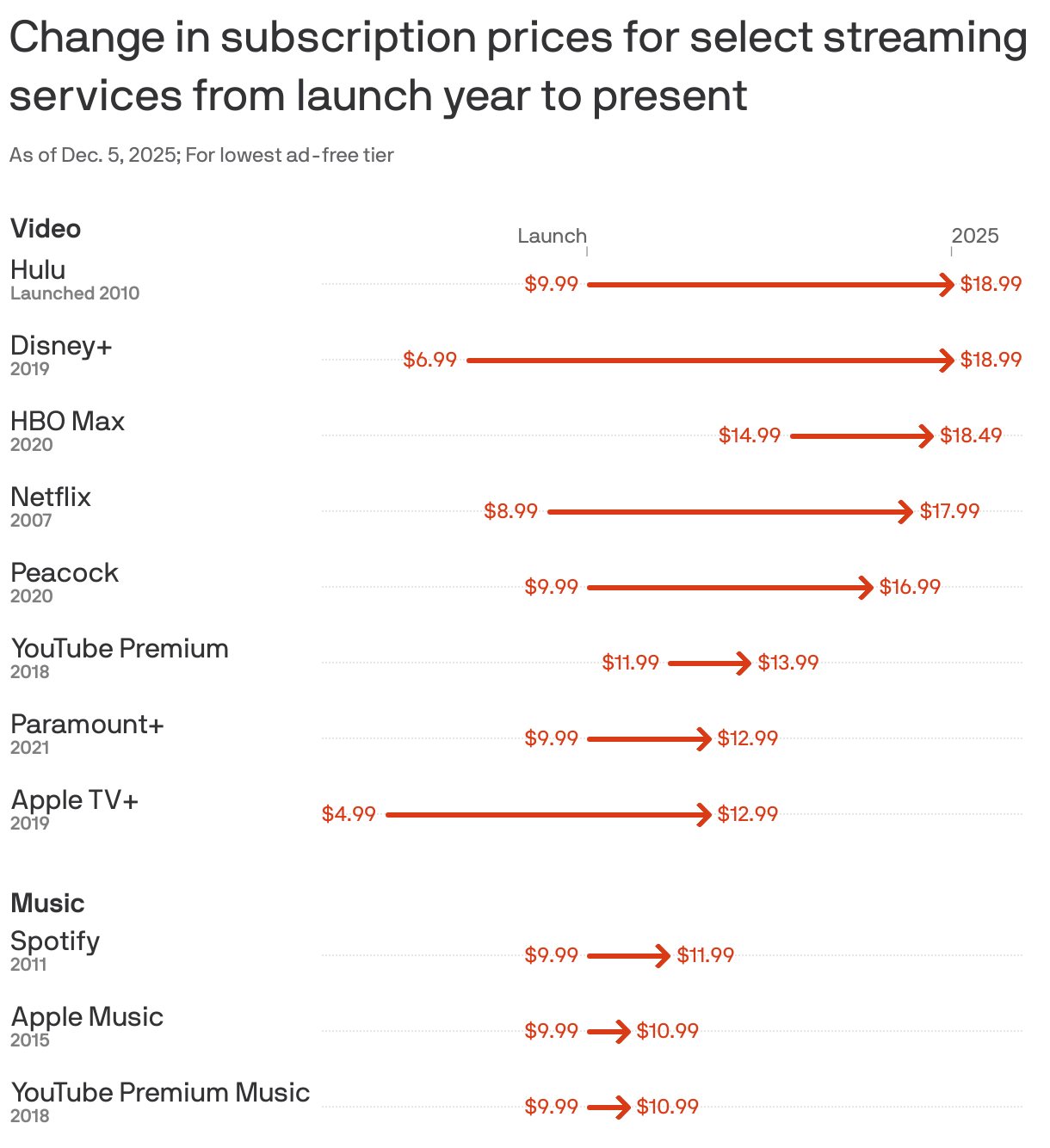

According to a recent analysis by U.S. media outlet Axios, the lowest-priced ad-free tiers of major streaming services have increased by an average of $6.69 since launch. Industry insiders are calling this trend "Streaming Inflation."

The streaming services that once emerged as alternatives to cable TV — heralding the "cord cutting" era — have now become the very culprits squeezing consumers' wallets. The promise of the mid-2010s — "cut the cord and save money" — has faded into an empty slogan.

Disney+, Netflix, Hulu: The Price Hike Triumvirate

Disney+ leads the pack in price increases. When the service launched in November 2019 as a latecomer to the streaming market, it debuted at an aggressive $6.99. Today, its lowest ad-free tier costs $18.99 — a roughly 172% increase, nearly tripling the original price.

Disney+'s initial low-price strategy was a deliberate move to capture market share. Armed with powerful intellectual properties including Marvel, Star Wars, and Pixar, the company rapidly amassed over 100 million subscribers before entering an aggressive monetization phase. As Wall Street pressure for profitability intensified, the pivot from "growth over profits" to "profits over growth" was directly reflected in the price tag.

Netflix and Hulu have been similarly aggressive, with both services raising their lowest ad-free tiers by $9 each since launch. Netflix, as the streaming market leader, has consistently increased prices over the years. The company's streaming-only plan debuted at $7.99 in 2011; its standard tier now costs $17.

Netflix's pricing strategy has served as the industry benchmark. Leveraging its market dominance, whenever Netflix raises prices, competitors follow suit using the justification that "Netflix did it first." In essence, Netflix has been the pioneer of streaming inflation.

HBO Max, by contrast, saw relatively modest increases — just $3.50 since launch. However, this is because the service launched in 2020 at a premium price point of $14.99, higher than competitors. Banking on premium original content like "Game of Thrones" and "The Last of Us," HBO adopted a high-price strategy from the start. Having begun at the top, it simply had less room to climb.

The Era of Re-Cord Cutting

"Re-Cord Cutting" means "cutting the cord again." It describes the phenomenon of consumers who abandoned cable for streaming now abandoning paid streaming for free streaming.

If the "cord cutting" of the 2010s was a rebellion against the outdated order of cable TV, the "Re-Cord Cutting" of the mid-2020s is a consumer exodus that the streaming industry brought upon itself.

Consumers who chose streaming to escape expensive cable bundle packages now face a situation where the combined cost of streaming subscriptions exceeds their old cable bills. In the United States, subscribing to four or five major services — Netflix, Disney+, HBO Max, Hulu — can easily surpass $70–80 per month. Add sports streaming, and the total can exceed $100 — matching or even exceeding basic cable TV packages of the past.

"In the past, the trend was 'cut cable and switch to streaming,'" notes one industry analyst. "Now we're seeing a new cord-cutting phenomenon: 'cut paid streaming and switch to free streaming.'"

FAST Services: The Biggest Beneficiaries of Streaming Inflation

The direct impact of streaming inflation is visible in changing consumer behavior. Cost-conscious viewers are migrating en masse to free ad-supported streaming services — FAST platforms like Tubi, Roku Channel, and Pluto TV.

FAST services offer free content in exchange for watching ads. They've become an attractive alternative for viewers who want diverse video content without subscription fees. While they feature library content rather than the latest originals and require ad viewing, many consumers are willing to compromise for the powerful appeal of "free."

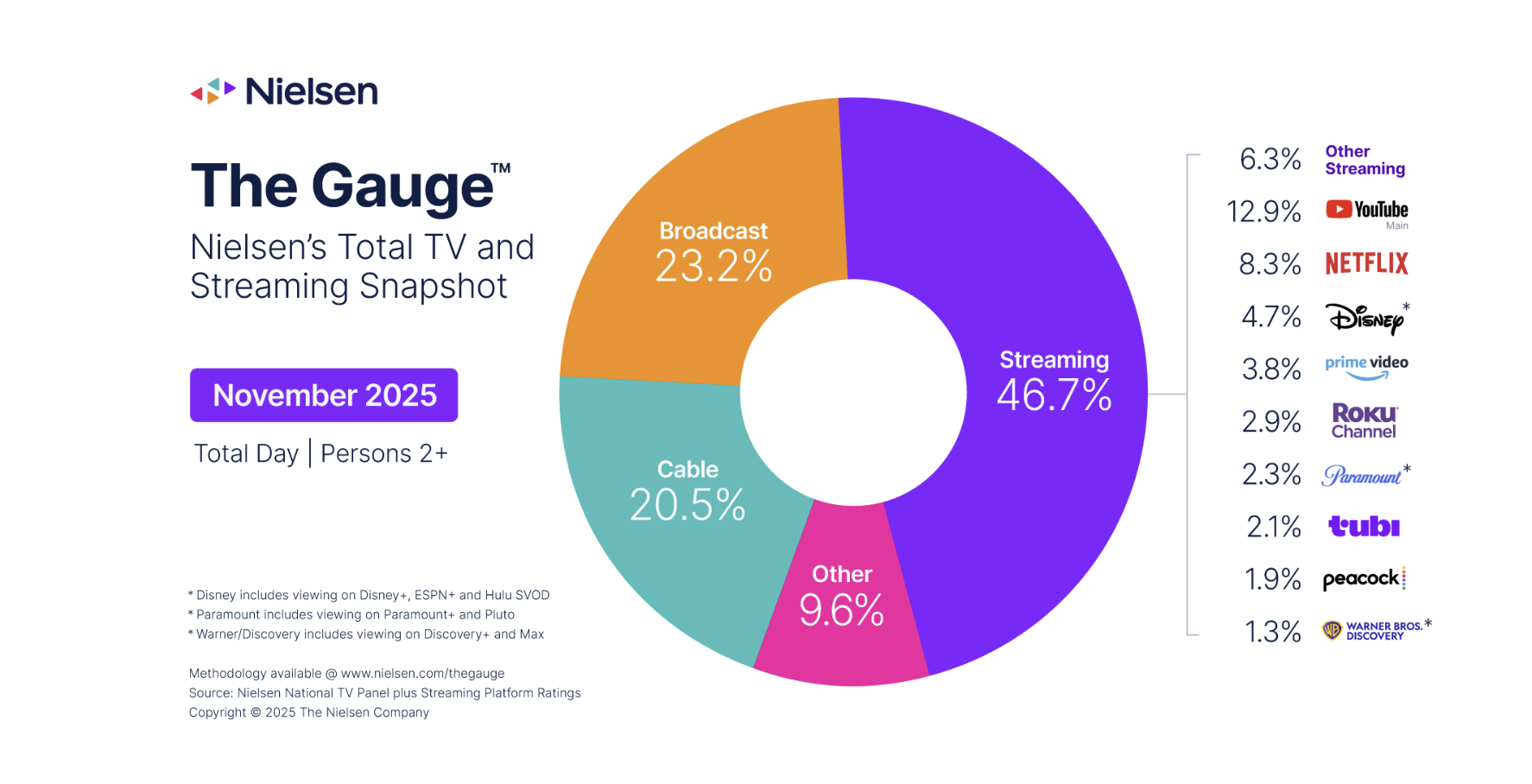

Tubi, in particular, has seen monthly active users surge recently, emerging as a new streaming powerhouse. Owned by Fox, Tubi secured a top-tier position in U.S. streaming viewership share in 2024 and has been marketing aggressively, even running Super Bowl ads.

This trend is confirmed in the latest viewership data. According to Nielsen's "The Gauge" November report released December 16, Roku Channel grew 9% month-over-month to reach a record 2.9% of TV viewing share. Growth was particularly strong among the 25–34 demographic, surging 23%. This signals that young adults — traditionally the core target of paid streaming — are migrating to FAST.

The FAST market itself is expanding rapidly. According to market research firms, the global FAST market is projected to grow from approximately $5.8 billion in 2025 to over $10.6 billion by 2030 — a high-growth market with a compound annual growth rate (CAGR) exceeding 12%.

The Bundle Paradox: Reassembling What Was Once Unbundled

Streaming inflation is also reshaping the industry landscape. Major entertainment companies are actively pursuing consolidation and rebundling strategies to retain cost-sensitive consumers.

A prime example is Disney's bundle offerings. Disney offers a bundle combining Disney+, Hulu, and ESPN+ at significant discounts compared to individual subscriptions. Recently, the company has been strengthening its price competitiveness by offering an ad-supported trio bundle at $16.99 per month.

Warner Bros. Discovery (WBD) has also pushed to integrate Max and Discovery+, and recently announced a joint venture with Disney and Fox for the sports-focused streaming service "Venu Sports." However, this joint venture faces legal challenges over antitrust concerns.

Ironically, the streaming industry that grew by dismantling the cable TV era's "bundle" model is now returning to bundle strategies for survival. Consumers wanted the freedom to "pick and choose channels," but when that freedom became too expensive, they returned to seeking "bundle discounts."

Some experts call this the "cable-ification of streaming." Individual services hold their killer content hostage to demand subscriptions, and consumers end up subscribing to multiple bundled services — a structure remarkably similar to cable TV bundles of the past.

Music Streaming Is No Exception

The price hike trend isn't limited to video streaming. Major music streaming services including Spotify, Apple Music, and Amazon Music have each raised monthly subscription fees by an average of $1 since launch.

Spotify, in particular, drew controversy by implementing price increases in the U.S. market in both 2023 and 2024. Its Premium tier, which had long held at $9.99, now costs $11.99. The music streaming industry's unwritten rule of maintaining the psychological price point of "$9.99" for over a decade has been broken.

The music streaming industry cites rising artist royalty payments, investment in new content like podcasts and audiobooks, and pressure to improve profitability as reasons for price increases. In Spotify's case, after years of losses, the company only recently turned profitable — a turnaround in which price increases played a key role.

However, music streaming sees less "multi-homing" than video streaming — that is, subscribers rarely maintain multiple services simultaneously. Since most users subscribe to just one music streaming service, the impact of price increases on total subscription costs is relatively smaller than in video streaming.

The Rise of Ad-Supported Tiers: A New Middle Ground

Paid streaming services are also rolling out countermeasures to avoid losing consumers entirely to FAST services: ad-supported low-cost tiers.

Netflix launched its ad-supported tier at $6.99 in November 2022. For Netflix, which had long insisted on ad-free premium service, this marked a major strategic shift. Other major services including Disney+, Max, and Peacock also operate similar ad-supported tiers.

Ad-supported tiers target the middle ground between completely free FAST services and expensive ad-free plans. They offer an alternative for consumers who want the latest original content but find ad-free prices too burdensome.

Netflix's ad-supported tier subscribers have been growing rapidly. According to Netflix, ad-tier users are posting double-digit monthly growth rates, and ad revenue has reached meaningful levels. This demonstrates that in the era of streaming inflation, consumers are clearly willing to tolerate ads to reduce costs.

2026 Outlook: A Pause to Regroup or the Calm Before the Storm?

Forecasts suggest price increase pressure may ease somewhat next year, as five of eight major U.S. video streaming services have already raised prices this year. Consecutive price hikes could accelerate consumer churn, leading analysts to expect services will adopt a more cautious stance in 2026.

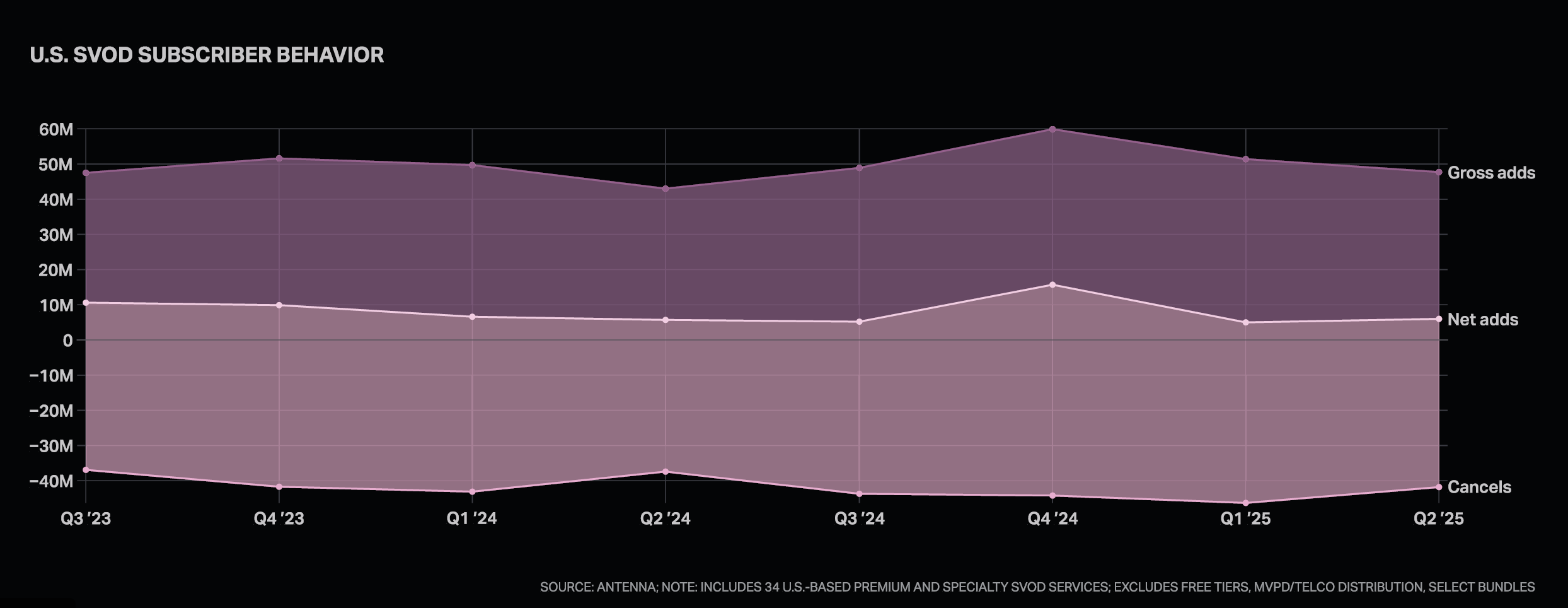

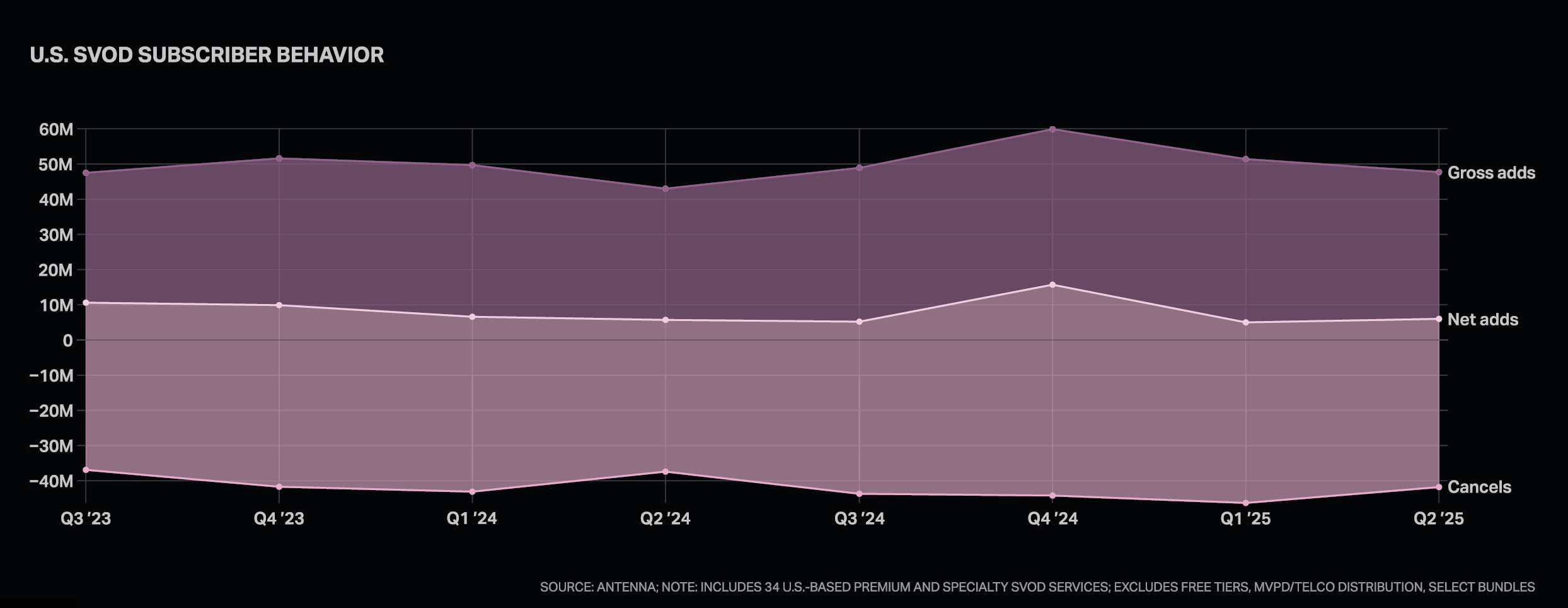

With growing uncertainty in the U.S. economy, aggressive price increases could boomerang back as surging churn rates. Multiple surveys already show the spread of "subscribe-watch-cancel" behavior among American consumers — subscribing briefly when desired content appears, then canceling immediately after viewing.

However, some predict the price-hike trend won't stop entirely. Rising content production costs, soaring sports broadcast rights fees, and continued Wall Street pressure for profitability are all exerting combined pressure.

Sports broadcast rights, in particular, are a double-edged sword for streaming services. Rights fees for major leagues — NFL, NBA, MLB — have skyrocketed. Amazon Prime Video reportedly pays over $1 billion annually for NFL Thursday Night Football rights. Such cost burdens will inevitably be reflected in subscription prices.

Consumer Choice: The Era of 'Selection and Concentration'

How should consumers respond in the era of streaming inflation? Industry experts advise "selection and concentration" — maintaining only one or two services rather than subscribing to many simultaneously, or employing rotation strategies.

For example, subscribing to a specific service only when a particular series releases, canceling after viewing, then moving to another service. Using ad-supported low-cost tiers or family plans, and treating FAST services as supplementary options, are also effective strategies.

For service providers, streaming inflation is also a double-edged sword. In the short term, they've achieved ARPU (Average Revenue Per User) growth and improved profitability. But long-term, they face risks of consumer churn and declining brand trust.

The spread of "rotation subscriptions" signals weakening customer loyalty — shaking the fundamental premise of subscription-based streaming business: maintaining a stable subscriber base.

Ultimately, streaming operators face the challenge of finding a delicate balance between "raising prices" and "retaining subscribers." Reckless increases will accelerate migration to FAST, while price freezes will weaken content investment capacity. Survival will hinge on demonstrating "value for money" through various combinations: bundle strategies, expanded ad-supported tiers, and strengthened exclusive content.

Streaming inflation poses a question to consumers: "How many services do I really need?" And to operators: "Does our service deserve to be among those 'needed few'?"

The streaming revolution that began by unbundling cable TV has now evolved into a new game of "selection and concentration."

Analysis based on Axios reporting and Nielsen's "The Gauge" dat