The Super Bowl's First AI-Generated Ad Arrives on a $10 Million Stage—And K-Pop Follow

INDUSTRY ANALYSIS

The Super Bowl's First AI-Generated Ad Arrives on a $10 Million Stage—And K-Pop Follows

Svedka's AI-made commercial, record-breaking ad prices, and a K-pop artist's Big Game debut signal a structural shift in global advertising

Sometime in mid-January, a 23-year-old woman in Nashville named Jessica Rizzardi filmed herself dancing to a remix of Rick James's "Super Freak" and posted the clip on TikTok. A few weeks later, her exact choreography will be performed by a metallic-skinned robot on the most expensive advertising canvas in history—a 30-second Super Bowl slot that costs north of $8 million.

The robot is a creation of artificial intelligence. So is the entire commercial. And the brand behind it, Svedka vodka, is betting that a viewing audience of more than 120 million Americans won't mind.

When the ad airs just after halftime on Feb. 8 at Levi's Stadium in Santa Clara, Calif., it will mark the first time a primarily AI-generated commercial has appeared during the Super Bowl—a milestone that arrives in the same year the Big Game's 30-second ad rate crossed $10 million for the first time, a K-pop artist made a meaningful appearance in game-day advertising, and more than 60 brands signed up for what has become the world's most concentrated annual marketing event.

Taken together, the developments at Super Bowl 60 amount to more than incremental change. They represent a series of structural shifts—in how ads are made, how they are sold, and who gets to participate in American pop culture's biggest night.

I. The Robot in the Room

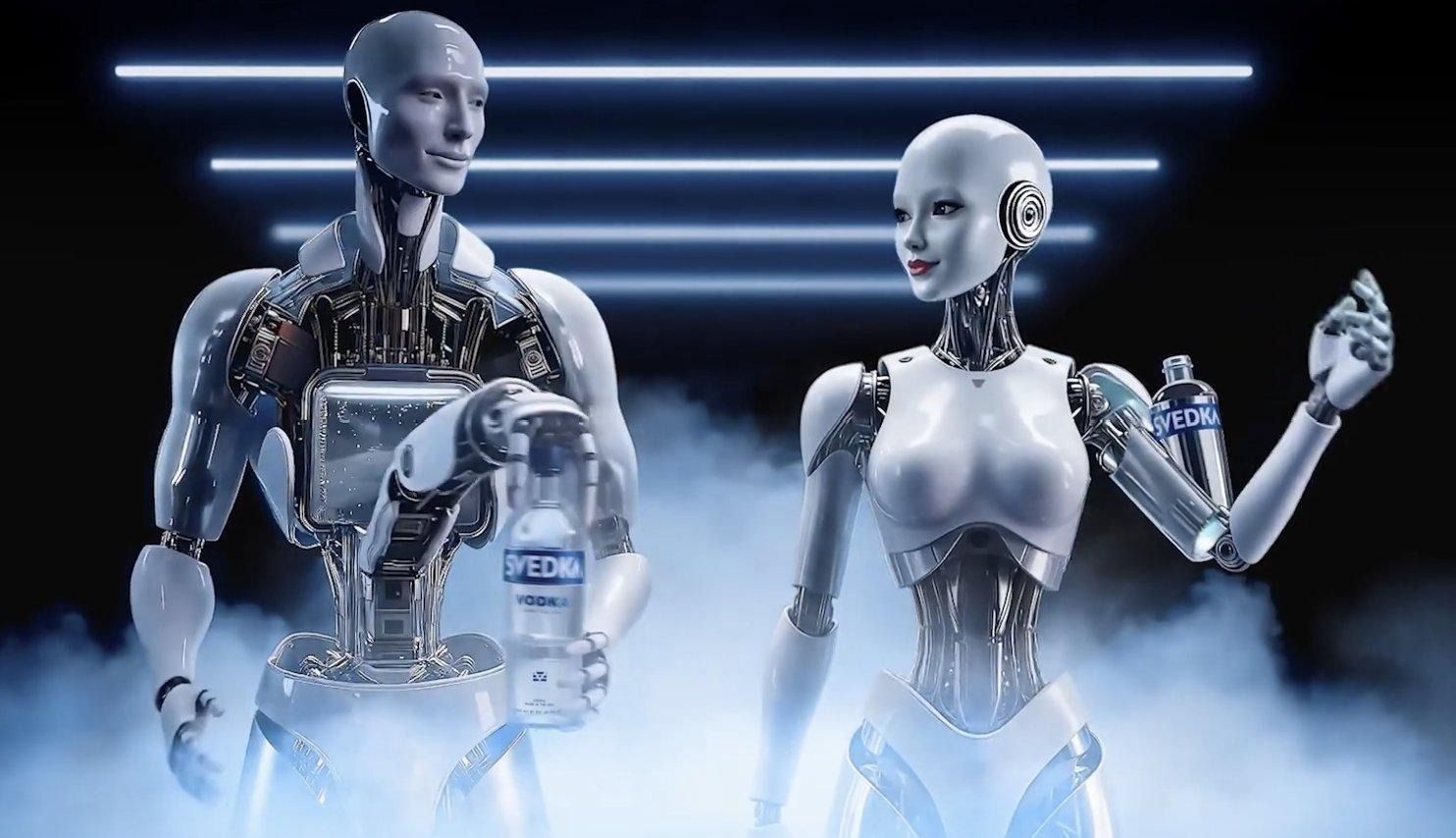

Svedka's AI-generated Super Bowl ad 'Shake Your Bots Off' featuring Brobot (left) and Fembot (right) | Sazerac/Silverside AI

The ad, titled "Shake Your Bots Off," features Svedka's Fembot mascot—a chrome-plated, stiletto-heeled android that was the brand's calling card from 2005 to 2013 before vanishing for more than a decade. The Fembot returns alongside a new companion, Brobot, in a 30-second spot produced almost entirely by generative AI.

The production house is Silverside AI, the same studio behind Coca-Cola's polarizing AI holiday ads in 2024 and 2025. Sara Saunders, chief marketing officer at Sazerac, Svedka's parent company, acknowledged the risk head-on. "We expect criticism and we welcome it," she told ADWEEK. "The human-versus-technology conversation is one we should be having."

The ad simultaneously achieves three firsts: the first primarily AI-generated Super Bowl commercial, the first vodka brand in the Big Game in roughly 30 years, and the first Super Bowl ad for Sazerac, which acquired Svedka from Constellation Brands in 2024.

The Creative Process—and Its Paradox

Saunders was careful to distinguish this project from a cost-cutting exercise. "AI, for us, isn't an efficiency play—it's a storytelling play," she said. "There has always been a strong human hand on the keyboard."

PJ Pereira, co-founder of Silverside AI, described the real advantage as workflow flexibility. Traditional production requires each stage—filming, editing, post-production—to be locked sequentially. With AI, the team was making substantive revisions a week before airtime. "Previously you had to lock every step of the creative process," Pereira said. "This process allowed us to keep revising every decision, and paradoxically, it led to a more human result than ever."

Contest winner Jessica Rizzardi's TikTok dance (left) recreated by AI as the Fembot (right) | ADWEEK/Sazerac

That flexibility also enabled an unusual consumer-participation element. Svedka ran a TikTok dance contest; the winning routine, submitted by Rizzardi, was fed into the AI system and mapped onto the Fembot's movements. The hybrid of user-generated content and AI production is a model the advertising industry will be watching closely.

The deepest irony, though, may be the message itself. A commercial made entirely by AI urges viewers to put down their devices and connect with other humans. When Brobot takes a sip of Svedka and short-circuits, the subtext is clear: even the robots think you should go outside. "The whole idea is that the robots come back to remind humans to be more human," Saunders said. "Our message is ultimately pro-human."

The 'Slop' Question

The advertising industry's unease with AI-generated imagery has not faded. Coca-Cola's AI holiday commercial—also produced by Silverside—drew sustained criticism in both 2024 and 2025 for what detractors called an uncanny, plasticky aesthetic. The Hollywood Reporter noted the irony of "slop"—the industry's shorthand for low-quality AI output—appearing on the most premium advertising stage in existence.

Yet the fact that an AI ad has reached the Super Bowl at all may matter more than whether this particular execution wins creative awards. Several other advertisers this year are deploying AI in supporting roles: Xfinity uses it for Jurassic Park character transformations, Bosch for visual effects on Guy Fieri, and Ring for its AI-powered lost-dog feature. OpenAI itself is back with a second consecutive 60-second spot. But Svedka alone has staked the entire visual production on the technology.

II. The $10 Million Slot

If the AI ad represents a creative frontier, the price tag represents a commercial one. For the first time in broadcast history, a handful of 30-second Super Bowl ad slots sold for more than $10 million, according to Mark Marshall, chairman of global advertising and partnerships at NBCUniversal.

Super Bowl Ad Pricing Trajectory (30-second basis)

The trajectory is striking. NBCU's opening ask at the start of 2025 was around $7 million. By midsummer, with Olympic bundling in the mix, prices had climbed past $8 million. By close-out, a select few slots had breached the eight-figure mark.

Marshall attributed the surge to demand rather than strategy. "I'd love to say it was brilliant execution," he told ADWEEK. "The truth is, the market was just that strong." NBCU announced a sellout in September 2025—a full month earlier than Fox had sold out Super Bowl 59.

The Olympic Bundle

The key mechanism was bundling. Beginning in the fall of 2024, NBCU pitched advertisers on combined Super Bowl and Winter Olympics packages. Marshall cited 2022 data—the last year NBCU held both properties simultaneously—showing that advertisers who bought only the Olympics missed 30 million incremental viewers from the Super Bowl, while those who bought only the Super Bowl forfeited 42 million from the Olympics.

The pitch worked. Approximately 70% to 75% of Super Bowl 60 advertisers also purchased Winter Olympics inventory. NBCU's February 2026 portfolio—the Super Bowl, the Winter Olympics, and the NBA All-Star Game—is sold out across all three tentpoles, with a Spanish-language World Cup on Telemundo following in June.

"Marketers started asking, 'If I'm in the World Cup, and I'm in the Olympics, and I'm in the Super Bowl, how do I stitch these together?'" Marshall said. "We're no longer just selling ad units. We're designing comprehensive plans."

The implications for global media are considerable. The shift from event-by-event ad sales to calendar-spanning bundled packages is likely to reshape how broadcasters worldwide—including those in fast-growing Asian and Latin American markets—monetize their sports rights.

III. 60-Plus Brands and the New Super Bowl Economy

According to ADWEEK's running ad tracker, updated through Feb. 2, more than 60 brands have committed to advertising during Super Bowl 60. The lineup reveals several category-level shifts that speak to broader market dynamics.

Tech and AI: The Dominant Category

At least 13 technology and AI brands are advertising this year, making it the game's most represented category. OpenAI returns for a second year with a 60-second spot.

Oakley Meta, the smart-eyewear joint venture between Meta and Oakley launched in July 2025, makes its Super Bowl debut. Wix returns after a seven-year hiatus with its AI web-creation platform, Wix Harmony, while also running a separate ad for Base44, the AI app-building startup it acquired—an unusual two-ad strategy from a single company.

Amazon promotes Alexa+ with Chris Hemsworth. Google confirms its return. Salesforce is back for a second year. Enterprise software firms Ramp and Rippling both debut in the Big Game, joining Squarespace, which is making its 12th Super Bowl appearance with Emma Stone and director Yorgos Lanthimos.

Healthcare: The GLP-1 Invasion

The pharmaceutical and healthcare category is experiencing its most aggressive Super Bowl push in memory, driven by the GLP-1 weight-loss drug boom.

Novo Nordisk, maker of Ozempic and Wegovy, makes its Big Game debut with a celebrity-laden spot featuring DJ Khaled, Danny Trejo, and others. Ro, the direct-to-consumer telehealth company, enlists Serena Williams to promote GLP-1 accessibility. Eli Lilly is preparing a Peacock-exclusive Zepbound campaign. Novartis returns for a second year with a prostate-cancer awareness ad featuring NFL tight ends.

The entry of trillion-dollar-market-cap GLP-1 players into Super Bowl advertising signals the sector's transition to consumer-facing, direct-to-patient marketing at scale.

Food, Beverage, and Alcohol: Still the Heavyweight

Anheuser-Busch remains the game's single largest advertiser, with 2.5 minutes across Budweiser, Bud Light, and Michelob Ultra. Budweiser celebrates its 150th anniversary with its 48th Super Bowl spot—a Clydesdale-and-bald-eagle narrative set to Lynyrd Skynyrd's "Free Bird."

PepsiCo fields three brands simultaneously: Pepsi Zero Sugar (which provocatively features Coca-Cola's polar bear mascot, directed by Taika Waititi), Poppi (with Charli XCX), and Lay's.

The delivery wars continue: Grubhub debuts with George Clooney and director Lanthimos; Uber Eats returns for a sixth year with Matthew McConaughey and Parker Posey; Instacart is back with Ben Stiller and Spike Jonze.

Fashion, Motorsport, and Nonprofits

Levi's returns after a 20-year absence—fortuitous timing, given the game is played at Levi's Stadium. Cadillac F1, the first American-registered Formula 1 team in a decade, will use its fourth-quarter ad to unveil its car livery.

Nike, which ended a 27-year Super Bowl hiatus just last year, is sitting this one out. Stellantis is redirecting its budget to the U.S. semiquincentennial.

Blue Square Alliance (formerly the Foundation to Combat Antisemitism) returns for a third straight year. Come Near's "He Gets Us" campaign runs for a fourth consecutive Super Bowl.

The Rise of Streaming-Only Spots

A structural development worth watching: several brands are opting for Peacock streaming-only ad placements rather than—or in addition to—the NBC broadcast. Oikos is running its seventh consecutive Super Bowl ad exclusively on Peacock. Tecovas, the western-wear brand, chose streaming-only for its debut. Eli Lilly is running a hybrid strategy with broadcast pre-game ads and streaming-only in-game spots. The emergence of premium streaming-only Super Bowl inventory suggests the event's advertising ecosystem is bifurcating along platform lines.

IV. What It Means for K-Content

K-Pop Enters the Super Bowl Ad Game

For the Korean entertainment industry, the most directly consequential development at Super Bowl 60 may be the quietest. Liquid I.V., the electrolyte drink brand making its Big Game debut with a 30-second first-half spot, cast Ejae from K-pop group K-Pop Demon Hunters in its teaser campaign. In the clip, Ejae sings Phil Collins's "Against All Odds" in a bathroom—part of the brand's "wake-up call" hydration messaging.

It is, in practical terms, the first meaningful appearance of a K-pop artist in Super Bowl advertising. Coming alongside Bad Bunny's halftime performance—the first for a Latin artist since Shakira and Jennifer Lopez in 2020—Ejae's casting reflects a broader pattern: non-English-language cultural IP is penetrating the Super Bowl's historically Anglo-American core.

For Korean entertainment companies, this opens a new revenue channel—celebrity endorsement and brand partnership deals tied to the single most-watched advertising event on Earth.

AI Production and the Hallyu Marketing Machine

Svedka's AI production model carries specific implications for the Korean content export industry. The ability to revise marketing assets up to the last minute—a capability Pereira emphasized—could dramatically accelerate the localization cycle for K-drama, K-pop, and K-film promotional campaigns across global markets.

If a production team can rework an AI-generated trailer or teaser in hours rather than weeks, the cost and speed calculus of multi-market content marketing shifts fundamentally.

The AI-plus-UGC hybrid model demonstrated by Svedka's TikTok dance contest is equally relevant. K-pop's global fandom is already the world's most active producer of user-generated content—fan-made dance covers, edits, and art that routinely generate hundreds of millions of views. Feeding that content into AI systems to create official brand activations is a natural next step, and one that Korean entertainment companies are well positioned to pioneer.

Multi-Sport Bundling: A Model for Korean Media

NBCU's multi-sport bundling strategy—linking Super Bowl, Winter Olympics, NBA All-Star, and World Cup inventory into unified packages—offers a direct playbook for Korean broadcasters and OTT platforms. Korean media companies hold rights to the Olympics, the World Cup, K-League, and KBO baseball, alongside a deep library of K-drama and K-pop content. Packaging these into integrated advertising bundles for global advertisers—particularly in Asian, Latin American, and European markets where K-content has strong traction—could create differentiated ad products that no Western competitor can replicate.

FAST Channels and the Streaming Ad Premium

The emergence of streaming-only Super Bowl ads validates a broader thesis: that ad-supported streaming is becoming a premium, not a discount, product. For K-content's growing network of FAST (Free Ad-Supported Streaming TV) channels—a market projected to grow from $5.8 billion in 2025 to $10.6 billion by 2030—this is encouraging. If Peacock can sell Super Bowl ad slots as standalone streaming products, K-content FAST channels can aspire to premium ad pricing tied to cultural tentpole moments, supplementing the license-fee model that has dominated Korean content exports to date.

V. The Five Shifts

Super Bowl 60 foreshadows five structural changes in the global advertising and content industries:

First, AI has crossed from ad subject to ad production tool. Svedka's spot puts AI-generated creative on the most premium stage in advertising—though consumer acceptance, as Coca-Cola's experience suggests, remains unproven.

Second, live premium sports advertising continues to appreciate. A $10 million 30-second slot demonstrates that in a fragmented media landscape, the scarcity value of mass simultaneous viewership is rising, not falling.

Third, multi-sport bundling is becoming the default sales model. NBCU's cross-property packages are reshaping how advertisers plan annual spending and how broadcasters monetize their portfolios.

Fourth, the Super Bowl's advertising ecosystem is expanding from broadcast to streaming. Peacock-only placements suggest a future in which the Big Game supports parallel ad markets across platforms.

Fifth, non-English-language cultural content is penetrating the Super Bowl's core. Bad Bunny's halftime show, a K-pop artist in game-day advertising, and expanded Spanish-language distribution collectively signal that the Super Bowl is evolving from an American cultural event into a global cultural platform—one with growing room for K-content.

Whether Svedka's AI-generated Fembot delights or repels the 120-million-plus viewers who see her dance just after halftime on Feb. 8 will be the first real test of whether generative AI can clear the consumer-acceptance bar in premium advertising. The Korean content industry, sitting at the intersection of AI production, global ad markets, and streaming platforms, has every reason to watch closely.

Sources

The Hollywood Reporter, "The First Mainly AI-Generated Super Bowl Ad Is Here, For Better or Worse" (Feb. 3, 2026); ADWEEK, "Svedka Bets on AI and Its Fembot to Make Super Bowl History" (Feb. 3, 2026); ADWEEK, "How NBCU Scored the First $10 Million Super Bowl Ads" (Jan. 30, 2026); ADWEEK, "Super Bowl 60 Ad Tracker" (updated Feb. 2, 2026).