U.S. Demand for Foreign Content Hits All-Time High—K-Content Leads the Charge

As Non-English Content Consumption Surges, South Korea Emerges as Global Streaming's Core Supplier

Korea ranks No. 1 in local original production, No. 2 as U.S. TV offshore filming hub; Netflix commits $2.5B investment

Hollywood's era of dominance is fading. One in four Americans now seeks content made outside the United States. And at the center of this shift is K-content.

Hollywood's era of dominance is fading. One in four Americans now seeks content made outside the United States. And at the center of this shift is K-content.

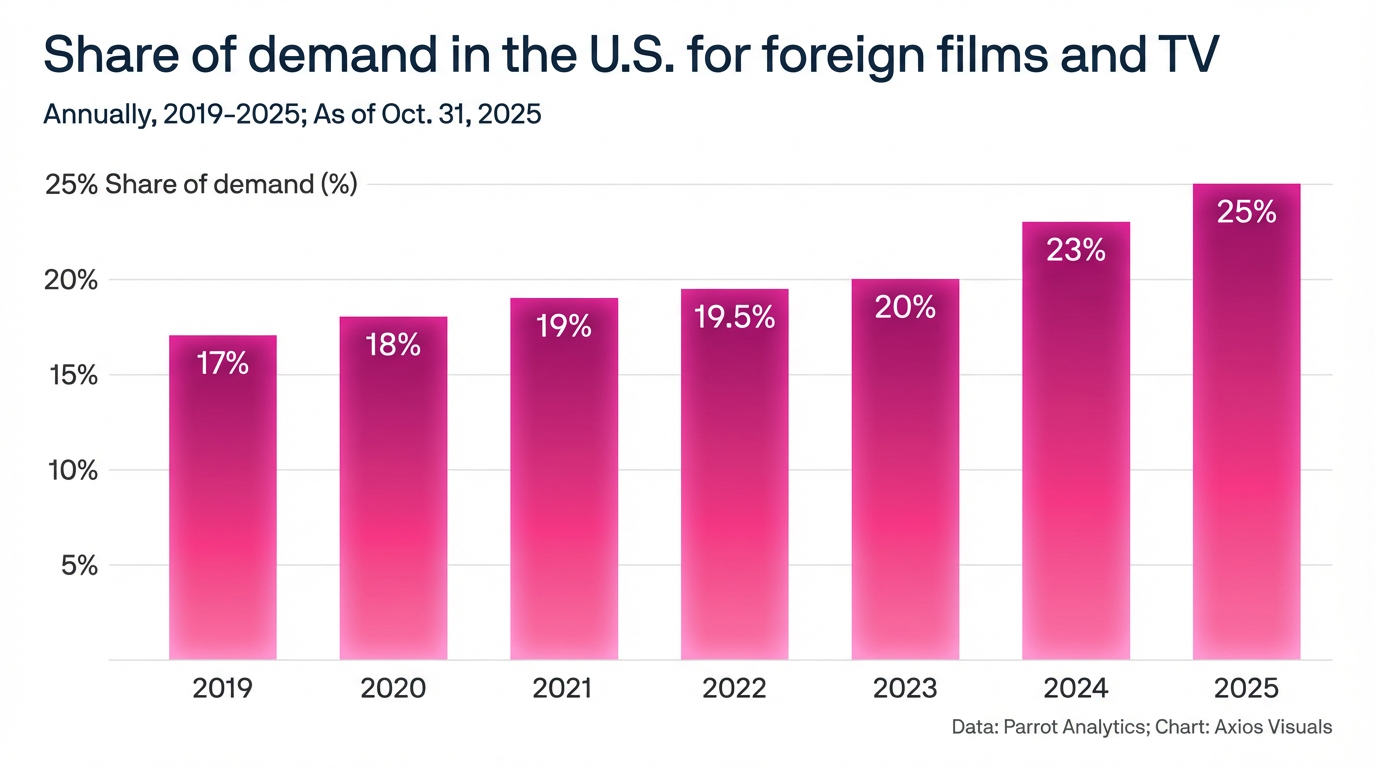

According to Parrot Analytics, the U.S. demand share for non-American content surged from 17.1% in 2019 to 25.3% in October 2025—an 8 percentage point jump in just six years. Streaming has torn down the barriers of language and borders.

South Korea stands as both the biggest beneficiary and driving force of this transformation, now ranking as the No. 1 country for local original production among global streamers including Netflix and Prime Video. K-content, the game changer of global entertainment, is rewriting the Hollywood-centric world order.

English-Language Content Retreats as Non-English Surges

According to Axios, while British content still holds the largest share of foreign content demand in the U.S., its share has fallen from 33% in 2019 to approximately 24% as of November 2025.

The combined share of English-speaking countries—the UK, Canada, Australia, and New Zealand—also dropped from 47% to 37% over the same period. American viewers are looking beyond subtitles, turning their attention to non-English programming.

K-Content: Top Priority for Global Streamers

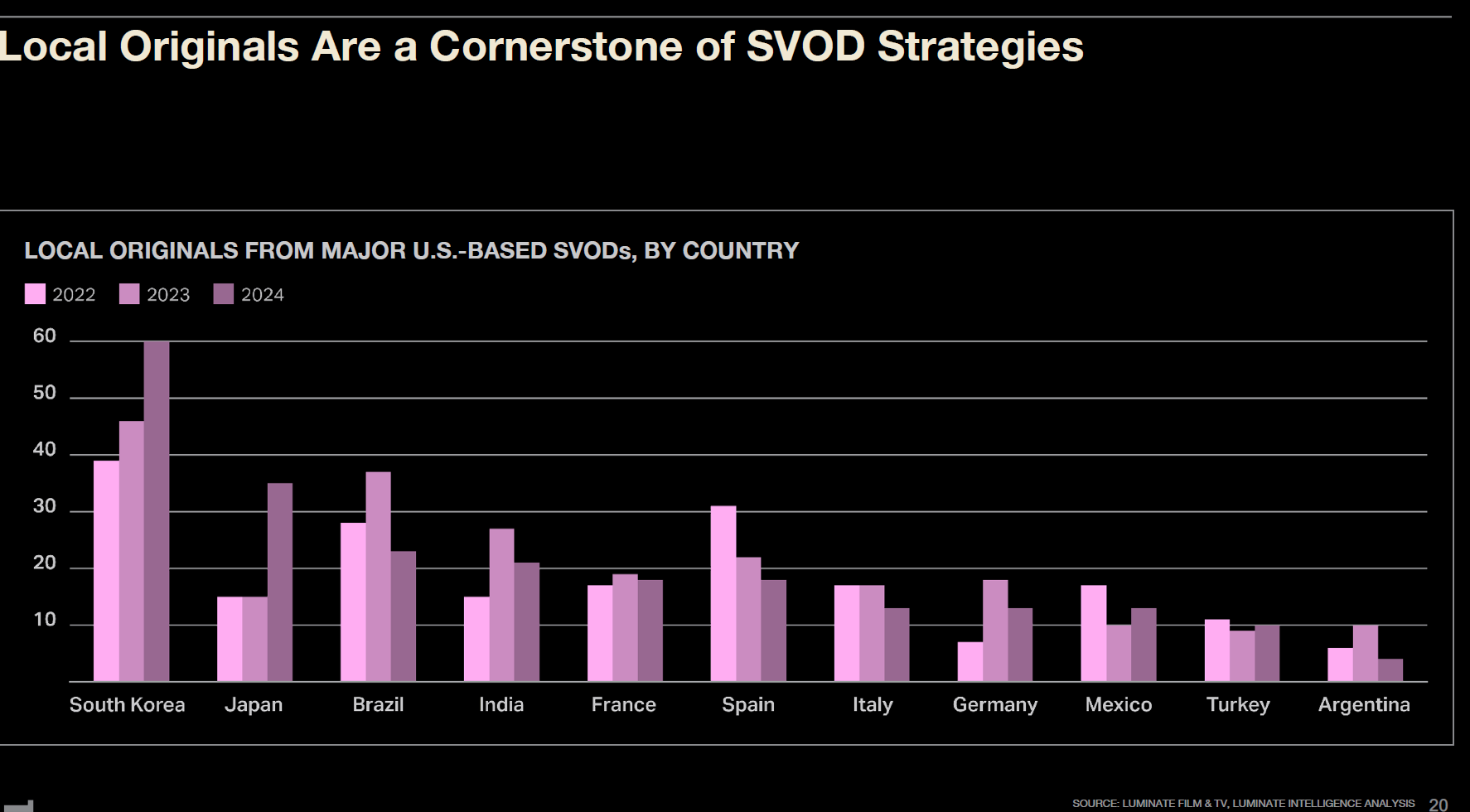

Luminate's "Global Entertainment Trends" report, released at MIPCOM 2025, quantifies Korea's rising stature. In 2024, major streamers including Netflix, Prime Video, Disney+, Hulu, Max, and Apple TV+ produced approximately 60 local originals in South Korea—a 58% increase from 38 titles in 2022. This dwarfs second-place Japan (35 titles) and third-place Brazil (22 titles).

Netflix announced in 2023 a commitment to invest $2.5 billion in Korean film and TV production over four years—double its investment since 2016. This is 2.5 times the €1 billion earmarked for Spain, underscoring Korea's strategic value in the global streaming market.

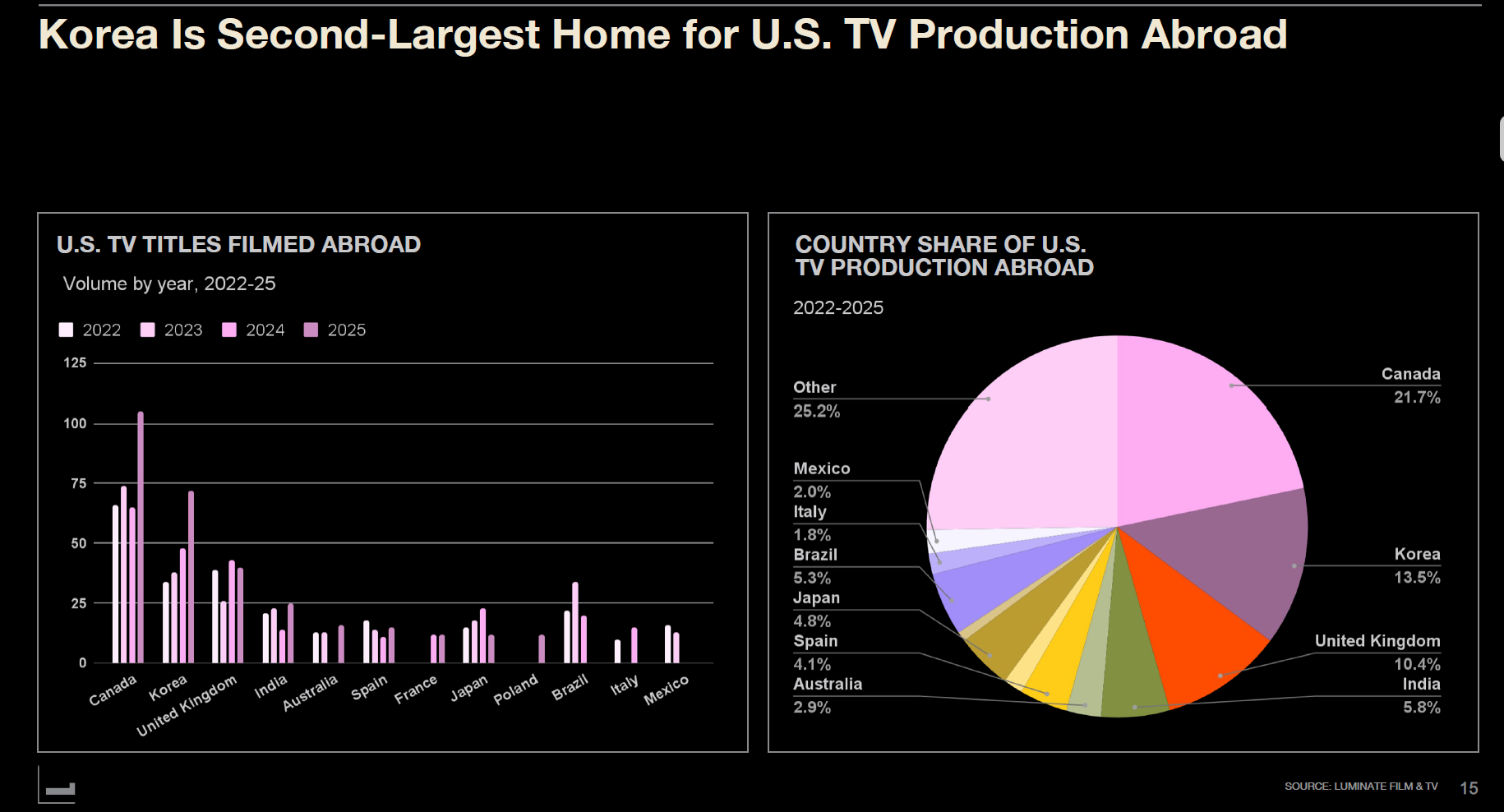

Korea: Second-Largest Offshore Production Hub for U.S. TV

K-content's influence extends beyond Korean productions. According to Luminate data, South Korea accounted for 13.5% of overseas filming locations for U.S. TV titles from 2022 to 2025, ranking second only to Canada (21.7%). The UK (10.4%), India (5.8%), and Brazil (5.3%) followed. Hollywood studios are now choosing Korea as a strategic production base.

Non-English Content Share Expanding Across All Platforms

Global streamers are rapidly increasing their non-English content portfolios. Netflix's share of non-English series jumped from 46% in 2022 to 64% in Q1 2025. Prime Video (44%→46%), Hulu (20%→38%), and Max (18%→50%) show similar trends. Disney+ (21%→20%) and Apple TV+ (9%→9%), however, maintain their focus on English-language premium content.

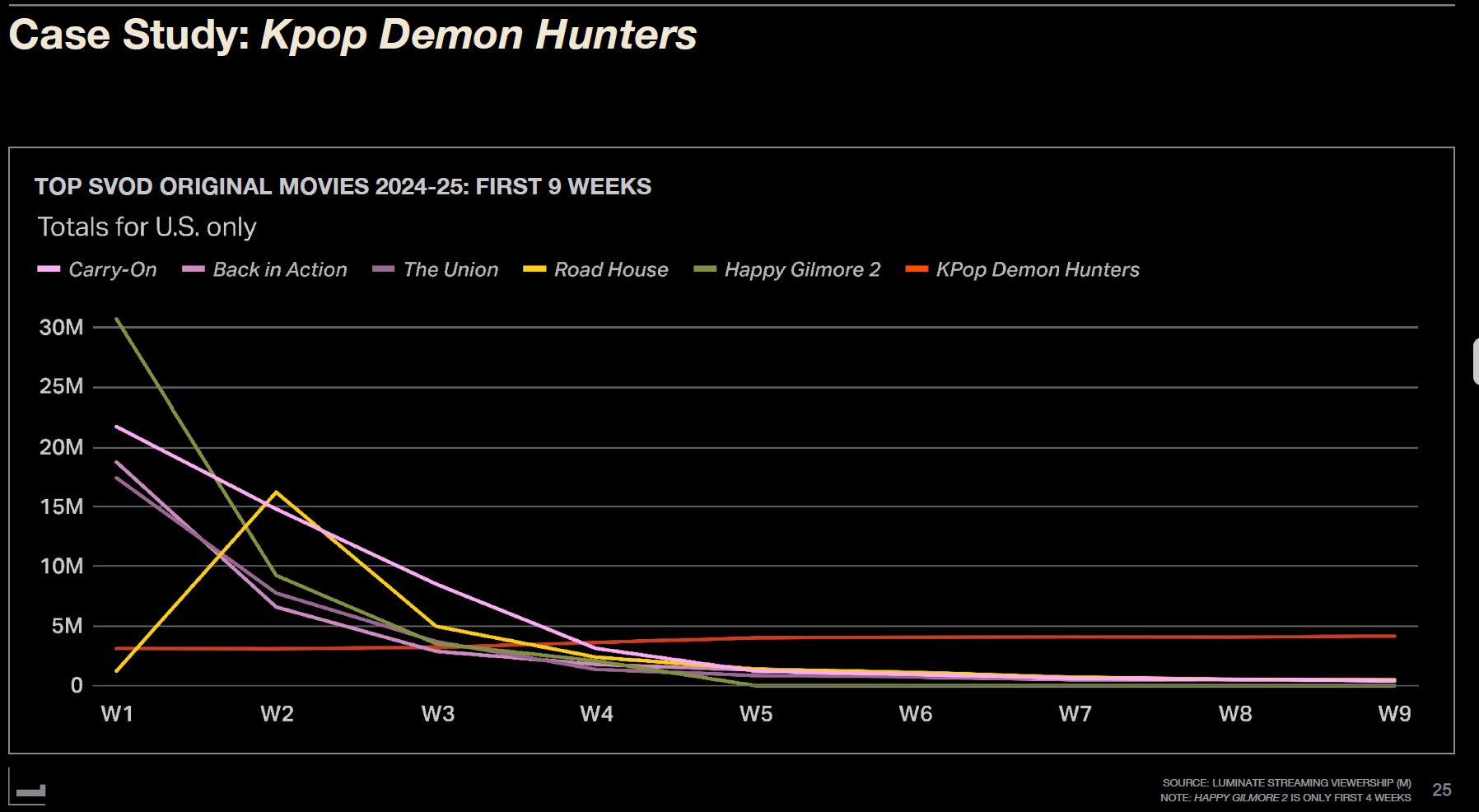

'KPop Demon Hunters': A Transmedia Success Model

K-content's global competitiveness was proven once again with the Netflix original film "KPop Demon Hunters." While most streaming films peak in their first week and decline sharply, this title maintained steady viewing hours for nine consecutive weeks—a distinctive consumption pattern. The audience skewed young (31% under 18) and female (54%), mirroring the K-pop listener demographic.

The soundtrack "Golden" saw sustained growth in global streaming after the film's release. The Spanish version "Dorada" captured new listeners in Latin America, while the French version "Briller" expanded the audience in Europe—a textbook case of film-music transmedia synergy.

K-Content Breaks Into Mainstream U.S. Music Market

According to Spotify, Bad Bunny's Spanish-language album "Debí Tirar Más Fotos" ranked as the third most popular album in the U.S. this year, with the "KPop Demon Hunters" soundtrack claiming fourth place. Non-English content is ascending to the mainstream of American music, with K-pop leading the way.

In a Stabilizing Streaming Market, K-Content's Strategic Value Grows

According to Luminate's "The Streaming Video Economy" report, the U.S. SVOD market in 2025 has entered a phase of stabilizing churn rates and improving financial health, even amid M&A frenzy. But the golden age of growth is over. While global SVOD subscriptions doubled between 2018 and 2024, growth through 2029 is projected at just 11%.

In an era of slowing growth, the battle shifts to subscriber retention. This is why investment in local original content has become a core strategy in price-sensitive Asian markets. Korean content enjoys overwhelming popularity not just domestically but across Asia, earning its reputation among global streamers as "the key to the Asian market."

Luminate forecasts that "content globalization will continue" and that "transmedia collaboration across TV, film, music, and gaming will become an increasingly important growth driver."

As the Hollywood-centric world order falters and streaming growth decelerates, K-content's strategic value is only rising.