YouTube TV Enters 'Skinny Bundle' War as Venu Sports Collapse Reshapes U.S. Pay-TV Market

Following the demise of Disney, Fox and Warner Bros. Discovery’s Venu Sports venture, YouTube TV announces 10 genre-specific packages for 2026, joining competitors in race to offer cheaper, smaller channel bundles

YouTube TV’s Strategic Shift: Embracing the Skinny Bundle Revolution

In a significant departure from traditional cable-style packaging, YouTube TV—Alphabet’s virtual MVPD platform—announced plans to launch more than 10 genre-specific subscription packages in early 2026. This strategic pivot comes as the service grapples with subscriber churn following a controversial 13.7% price increase that pushed its base plan to $82.99 per month in January 2025.

The announcement, made via blog post on December 10, marks YouTube TV’s entry into the increasingly competitive “skinny bundle” market—a space already occupied by DirecTV, Fubo, and Comcast. While specific pricing remains undisclosed, the company emphasized these packages will offer “more affordable options” than the current 100+ channel bundle.

The Sports Bundle: A Key Battleground

The centerpiece of YouTube TV’s new offering is the YouTube TV Sports Plan, which will include:

- FS1 and NBC Sports Network

- All ESPN linear networks

- ESPN Unlimited (ESPN’s new direct-to-consumer app launched in August 2025)

- Optional add-ons: NFL Sunday Ticket and RedZone

This sports-focused package directly competes with similar offerings from rivals, though YouTube TV benefits from its exclusive NFL Sunday Ticket rights—a major differentiator in the crowded streaming sports market CNET.

The Venu Sports Saga: How Antitrust Concerns Changed Everything

The catalyst for this industry-wide shift toward skinny bundles was the spectacular collapse of Venu Sports—an ambitious joint venture between Disney (ESPN), Fox, and Warner Bros. Discovery announced in February 2024. The streaming service was designed to bundle major sports content at a projected price of around $42.99 per month.

Legal Roadblock and Settlement

In August 2024, U.S. District Judge Margaret Garnett granted streaming competitor Fubo TV a preliminary injunction, blocking Venu Sports’ launch on antitrust grounds. The judge found that the joint venture likely violated antitrust law by giving the three media giants excessive control over live sports distribution.

Key developments in the Venu saga:

- August 16, 2024: Fubo wins preliminary injunction

- December 2024: Disney, Fox, and WBD fail to overturn ruling

- January 6, 2025: After settling with Fubo (Disney agreed to acquire Fubo as part of the deal), the three companies officially abandon Venu Sports

Industry Impact

The Venu collapse had profound implications for the pay-TV ecosystem:

Power shift from content owners to distributors: With content companies unable to directly bundle sports, virtual MVPDs and cable operators gained leverage in package design

Regulatory clarity: Platform-curated bundles face less antitrust scrutiny than content-owner joint ventures, creating a safer path for skinny bundle development

Strategic flexibility: Content providers became more willing to participate in distributor-led genre packages rather than insisting on proprietary bundling arrangements

As media analyst Michael Nathanson of MoffettNathanson noted, the Venu decision fundamentally altered the negotiating dynamics between content suppliers and distribution platforms Reuters.

The Price-Subscriber Equation: YouTube TV’s Growing Pains

YouTube TV’s decision to pursue skinny bundles wasn’t purely strategic—it was also a response to mounting subscriber pressures following aggressive price increases.

Q1 2025: The Damage from Price Hikes

According to MoffettNathanson estimates:

- Q1 2025: Lost 500,000 subscribers following the January price increase

- Q3 2025: Added 750,000 subscribers—down from 1 million in Q3 2024

“That price increase likely exacerbated Q1 losses and suppressed the Q3 rebound,” analyst Michael Nathanson told reporters.

Contentious Carriage Negotiations

YouTube TV’s recent carriage renewals added further complexity:

NBCUniversal deal (2025): Reached multi-year agreement with relatively smooth negotiations

Disney deal (2025):

- Resulted in unprecedented two-week blackout of Disney channels

- YouTube TV secured key “content ingestion” rights

- Likely agreed to designated rate increases for Disney networks

- Highlighted increasing tension between rising content costs and price-sensitive consumers

These negotiations underscore the financial pressures driving the shift toward tiered, flexible pricing models.

Competitive Landscape: The Skinny Bundle Arms Race

YouTube TV enters a market where competitors have already staked significant territory:

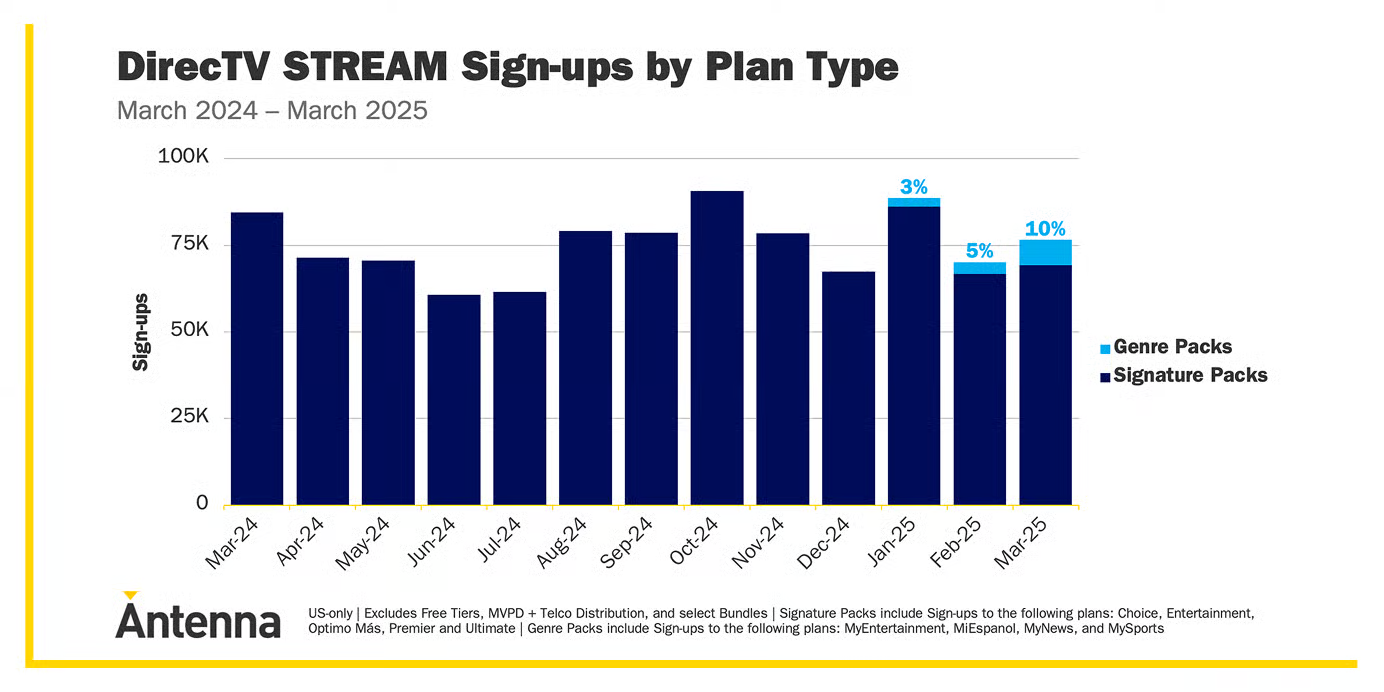

DirecTV: Genre Packs Pioneer

MySports Package: $70/month (launched January 2025)

- ESPN family, FS1, NBC Sports, TNT

- Local channels included

- MyEntertainment: $70/month alternative for non-sports viewers

DirecTV’s early entry into genre-based packaging positioned it as a market leader, offering consumers the ability to “build your own” TV experience at lower entry points than traditional bundles SportsPro.

Fubo: The Sports-First Disruptor

Fubo Sports: $55.99/month (launched September 2025)

- 26 channels focused on sports and news

- Includes ESPN Unlimited integration

- First-month promotional pricing: $45.99

- Sacrifices entertainment channels for core sports content

Fubo’s positioning as a sports-first platform—and its successful antitrust lawsuit against Venu—gives it credibility with sports fans seeking affordable alternatives to bloated cable packages.

Comcast: Cable Giant Joins the Party

Xfinity Sports & News TV: $70/month (requires Xfinity Internet)

- 50 networks

- Positioned as bundle discount for existing internet customers

- January 2025 launch reflects cable industry’s defensive response to streaming competition

ESPN + Fox: The Standalone Alternative

ESPN Unlimited + Fox One Bundle: $39.99/month

- 23 combined channels (ESPN networks, Big Ten Network, Fox News, Fox Sports)

- Standalone direct-to-consumer option

- Lower price point than vMVPD bundles but narrower channel selection

Strategic Implications: The Future of Pay-TV Bundling

YouTube TV’s three-tier strategy—full bundle + genre bundles + premium add-ons—represents a fundamental rethinking of the pay-TV business model.

Consumer Benefits

✅ Lower entry barriers: Price-sensitive viewers can access core content without paying for unused channels

✅ Increased flexibility: Genre-based selection aligns with viewing preferences (sports vs. entertainment vs. news)

✅ Premium optionality: Add-ons like NFL Sunday Ticket remain available for superfans

Business Challenges

⚠️ ARPU pressure: Average revenue per user likely declines as subscribers opt for cheaper packages

⚠️ Complex cost recovery: Recovering escalating sports rights costs becomes more difficult with fragmented revenue streams

⚠️ Channel negotiation complexity: Content providers may demand higher per-subscriber fees for smaller bundles

⚠️ Churn management: Lower switching costs could increase subscriber volatility

The Regulatory Angle

The Venu Sports case established an important precedent: distributor-led genre packages face less antitrust risk than content-owner joint ventures. This regulatory reality makes platform-curated bundles the “safer” path forward for the industry, potentially accelerating the transition away from traditional cable-style mega-bundles.

Market Restructuring Accelerates: What’s Next?

YouTube TV’s 2026 rollout will serve as a critical test case for the skinny bundle model’s viability. Several key questions remain:

Pricing dynamics: Will genre packages cannibalize full bundle subscriptions or attract new cord-cutters?

Sports rights economics: Can vMVPDs profitably offer sports content at lower price points given escalating rights fees (NFL, NBA, MLB)?

Content fragmentation: As bundles splinter, will consumers end up paying more by subscribing to multiple services?

Competitive response: How will cable providers like Charter Spectrum and Cox respond to accelerating vMVPD competition?

Conclusion: The Cable Bundle’s Long Goodbye

The convergence of legal setbacks (Venu Sports), subscriber resistance (YouTube TV’s Q1 losses), and competitive pressure (DirecTV, Fubo) has created a perfect storm accelerating the U.S. pay-TV industry’s transformation. The traditional “cable-style full bundle” is no longer the default option—it’s becoming a premium tier for consumers who want everything.

For YouTube TV, with over 5 million subscribers and the largest vMVPD market share, the 2026 genre package launch represents both opportunity and risk. Success could cement its position as the market leader in the post-cable era. Failure could expose the limits of the skinny bundle model and trigger further industry consolidation.

One thing is certain: the skinny bundle wars have only just begun, and consumers will be watching—and voting with their wallets—as the battle unfolds.

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)