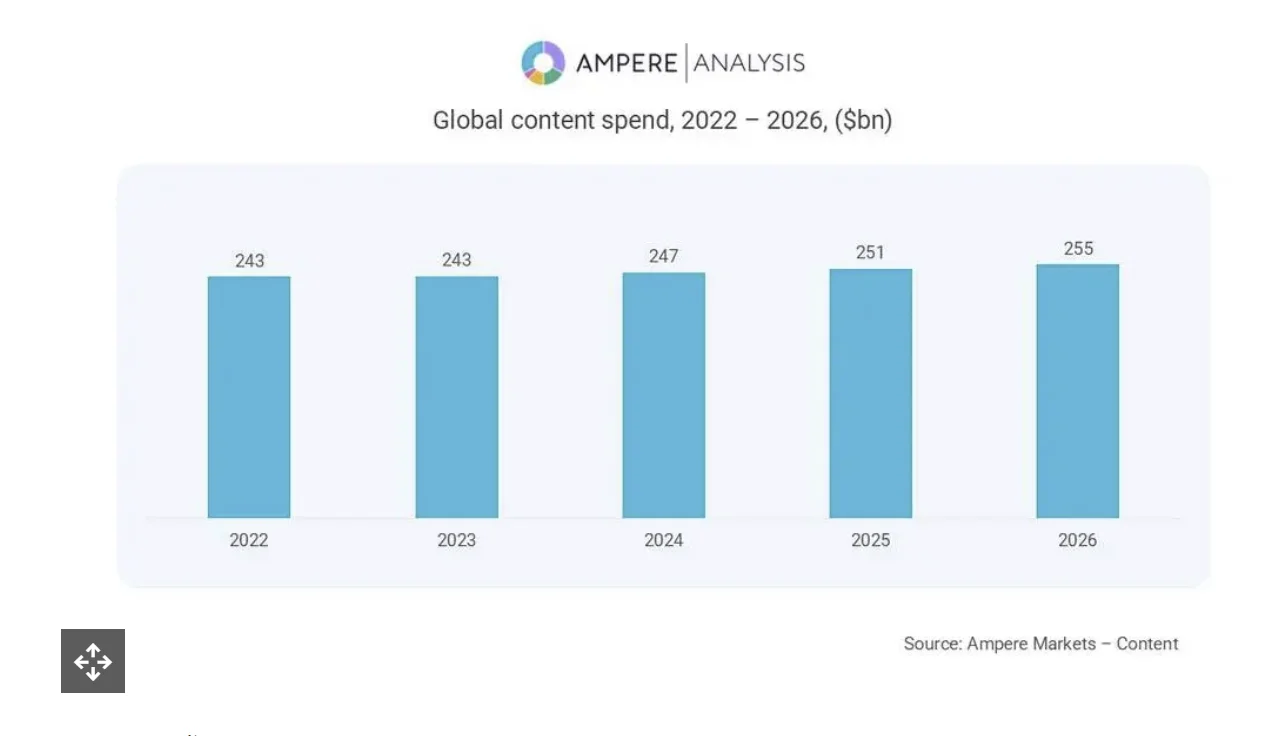

Global Media Content Investment to Reach $255 Billion in 2026

Streaming Dominance Reshapes the Industry: Strategic Implications for Korean Media

An Analysis of Ampere Research on Market Restructuring and Challenges for K-Content

Global media content investment is projected to reach $255 billion in 2026, representing a modest 2% year-over-year growth. However, beneath this surface-level figure lies a fundamental structural transformation. Streaming platforms are set to account for $101 billion—approximately 40% of total investment—growing at 6%, while traditional broadcasting enters a period of stagnation or decline. Following streaming's historic overtaking of commercial broadcasters in 2025, the gap is expected to widen further in 2026.

This structural shift carries significant implications for the Korean media industry. While global platforms continue to demand K-content, imbalances in negotiating power and revenue distribution are intensifying. As new variables emerge—including the rise of FAST channels, intensified competition for sports broadcasting rights, and AI-driven production innovations—Korean content providers face a critical moment requiring strategic realignment.

1. Global Content Investment: Current State and Outlook

1-1. Understanding the $255 Billion Figure

According to Ampere Analysis, worldwide media content production investment will reach $255 billion in 2026—a 2% increase from the previous year. This suggests the industry has entered a stabilization phase following the explosive growth period triggered by the pandemic. However, more significant than the overall growth rate is the shift in investment sources. Most growth is coming from streaming platforms, while traditional broadcasting is effectively contracting.

[Figure 1] Global Content Investment Trends (2022-2026, USD Billions) / Source: Ampere Analysis

1-2. Streaming vs. Traditional Broadcasting: An Accelerating Reversal

Peter Ingram, Research Manager at Ampere Analysis, noted that "2025 marked the first time streamers overtook commercial broadcasters in overall contribution to the content spend landscape," adding that "in 2026, we expect streamers to further build on this, seeing 6% growth in expenditure." This represents not merely a shift in market share but a structural rebalancing. The center of gravity in content production is moving from broadcasting to streaming—an irreversible trend.

1-3. Traditional Broadcasting's Triple Challenge

Traditional broadcasters face multiple constraints preventing them from increasing content investment. First, advertising revenue pressure: as budgets continue shifting to digital advertising, the TV advertising market is stagnating or shrinking. Second, rising production costs: inflation, increasing labor costs, and talent competition with global platforms are driving up production expenses. Third, changing viewing habits: streaming consumption patterns solidified during the pandemic continue to structurally erode traditional broadcasting's reach and viewing time.

2. Regional Divergence: Decoupling of US and Non-US Markets

2-1. United States: Strategic Reallocation by Studio Groups

A distinctive phenomenon is emerging in the US market. Commercial broadcasters are sharply reducing content expenditure—not due to simple market contraction, but as a strategic choice by parent studio groups. Major US broadcasters—Disney (ABC), Warner Bros. Discovery (CNN, TNT), NBCUniversal (NBC), and Paramount (CBS)—all operate their own streaming platforms. These conglomerates are reallocating budgets from broadcasting to streaming divisions, manifesting as reduced broadcast content investment. The streaming wars in America are essentially an internal conflict among Hollywood major studios, with broadcasting and streaming engaged in zero-sum competition within the same corporate groups.

2-2. Non-US Markets: Relative Resilience

Ampere forecasts that broadcasters outside the US will maintain relatively stable investment levels through 2026. In non-US markets, demand for local-language content remains strong. In European and Asian markets with robust public broadcasting systems, license fee-based stable funding continues to support content investment. However, this does not equate to "safety." Non-US broadcasters are likely to face the same structural pressures over the medium to long term.

3. Sports Broadcasting Rights: Streaming's Final Frontier

3-1. Impact of 2026 Mega Sporting Events

The year 2026 will see the FIFA World Cup co-hosted by three North American countries (USA, Canada, Mexico) and the Milan-Cortina Winter Olympics in Italy. The 2026 World Cup, in particular, will be the first to feature 48 participating nations, significantly increasing the number of matches and broadcast content volume. This is expected to drive up broadcasting rights fees and investment in supplementary content production.

3-2. Amazon's NBA Rights Acquisition and Its Significance

Another key development highlighted in the Ampere report is streaming platforms' full-scale entry into sports markets. Amazon Prime Video has secured major NBA game broadcasting rights starting in 2026, symbolizing a paradigm shift in sports broadcasting. Sports has long been considered traditional broadcasting's last stronghold—live viewing is essential, advertising effectiveness is high, and it serves as "anchor content" preventing subscription cancellations. Separate market research projects global sports broadcasting rights spending to exceed $78 billion by 2030, with streaming's share continuing to expand.

4. Implications for the Korean Media Industry

4-1. Structural Challenges for Terrestrial and Cable Broadcasters

Korean terrestrial and general programming broadcasters exemplify the "non-US market broadcasters" analyzed by Ampere. Korea's TV advertising market has stagnated at approximately 3 trillion won, while digital advertising continues growing beyond 8 trillion won. Prime-time ratings for the three major terrestrial networks have fallen to less than half of levels from a decade ago, with younger demographics' TV abandonment particularly severe.

4-2. The Gap Between K-Content's Global Status and Revenue Structure

While K-content like Squid Game and The Glory continues to achieve global success on Netflix, questions remain about whether the Korean content industry is capturing proportional benefits. Netflix's annual global content investment stands at approximately $17 billion, of which Korean content investment is estimated at $500-600 million annually—merely 3-4% of the total. A significant gap exists between K-content's prominence in generating buzz and its actual share of investment. Furthermore, IP ownership for content produced as global platform originals typically belongs to the platforms, meaning long-term returns from hits don't flow back to Korean production companies.

4-3. FAST Channels: A Window of Opportunity

The FAST (Free Ad-Supported Streaming TV) market is projected to grow from $5.8 billion in 2025 to $10.6 billion by 2030, representing over 12% annual growth. Korean broadcasters, with their vast archives of dramas and variety shows, possess advantageous assets for the FAST era. Genre-specific channels for K-drama, K-variety, and K-pop are possible, with Korean content channels already performing well on platforms like Samsung TV Plus. Unlike SVOD (subscription-based), FAST allows content providers to directly share advertising revenue, enabling sustainable earnings linked to viewership rather than relying on one-time licensing fees.

4-4. Platform Strategy Reassessment

Korean domestic OTT platforms (TVING, Wavve, Coupang Play, Watcha) are each exploring survival strategies. Ampere's emphasis on "scale and reach" applies to Korean OTT as well. The TVING-Seezn merger and TVING-Wavve integration discussions can be understood in this context. Even for those who may lose in the scale competition, strategies focusing on distinct identities through sports, specific genres, or local content remain viable. However, global expansion of Korean OTT platforms themselves has shown limited results—focusing on content export, co-production, and format sales may be more realistic than platform-level global expansion.

5. Strategic Recommendations

5-1. For Content Providers

Diversify IP revenue beyond simple licensing through global remakes, franchise development, and adjacent businesses (games, merchandising). Proactively establish K-content specialty channels on major FAST platforms in North America and Europe. Consider consortiums or collective negotiation frameworks among content providers to overcome individual bargaining limitations.

5-2. For Broadcasters

Transition from linear broadcast-centric models to content strategies suited for digital consumption—VOD, clip content, and short-form. Pursue production cost efficiency through technological innovation including AI-based production tools and virtual production. Invest in developing new advertising products such as digital advertising, addressable TV advertising, and branded content.

5-3. For Platform Operators

Rather than direct competition with global majors, secure clear differentiation points. Actively consider M&A or strategic alliances to achieve economies of scale. Focus on achievable global strategies such as content export, co-production, and format sales rather than platform-level global expansion.

5-4. For Policymakers

Establish regulatory frameworks including domestic content investment obligations and revenue disclosure requirements for global platforms like Netflix. Diversify policy direction from production support toward IP development, global distribution, and technology innovation support. Invest in improving working conditions for production personnel and developing next-generation talent to ensure the industry's sustainability.

6. Conclusion: Survival Strategies in a Period of Structural Transition

Ampere Analysis's 2026 forecast demonstrates that the global media market has moved beyond simple growth into a period of structural realignment. Streaming's overtaking of broadcasting is not a temporary phenomenon but an irreversible transformation.

The criteria separating survivors from casualties in this transition are clear: secure scale and reach, or if that proves difficult, target niches through distinct differentiation. Remaining in the middle ground is the most dangerous choice.

The Korean content industry is advantageously positioned with globally competitive content. However, content competitiveness does not automatically guarantee business sustainability. Innovation in business models to convert content competitiveness into revenue, industry solidarity to strengthen negotiating power, and cost efficiency through technological innovation must be pursued simultaneously.

2026 will be the year when the success or failure of these strategic choices begins to materialize. For those who move proactively, opportunities await; for those content with the status quo, crisis looms.

─────────────────────────────────────────

This analysis is based on Ampere Analysis's Global Content Investment Forecast Report (2026).

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)