K-Content Enters a New Stage: Immersive Venues Reshape Global Entertainment

K-Content Enters a New Stage: Immersive Venues Reshape Global Entertainment

Phoenix, Arizona — Dec 2025

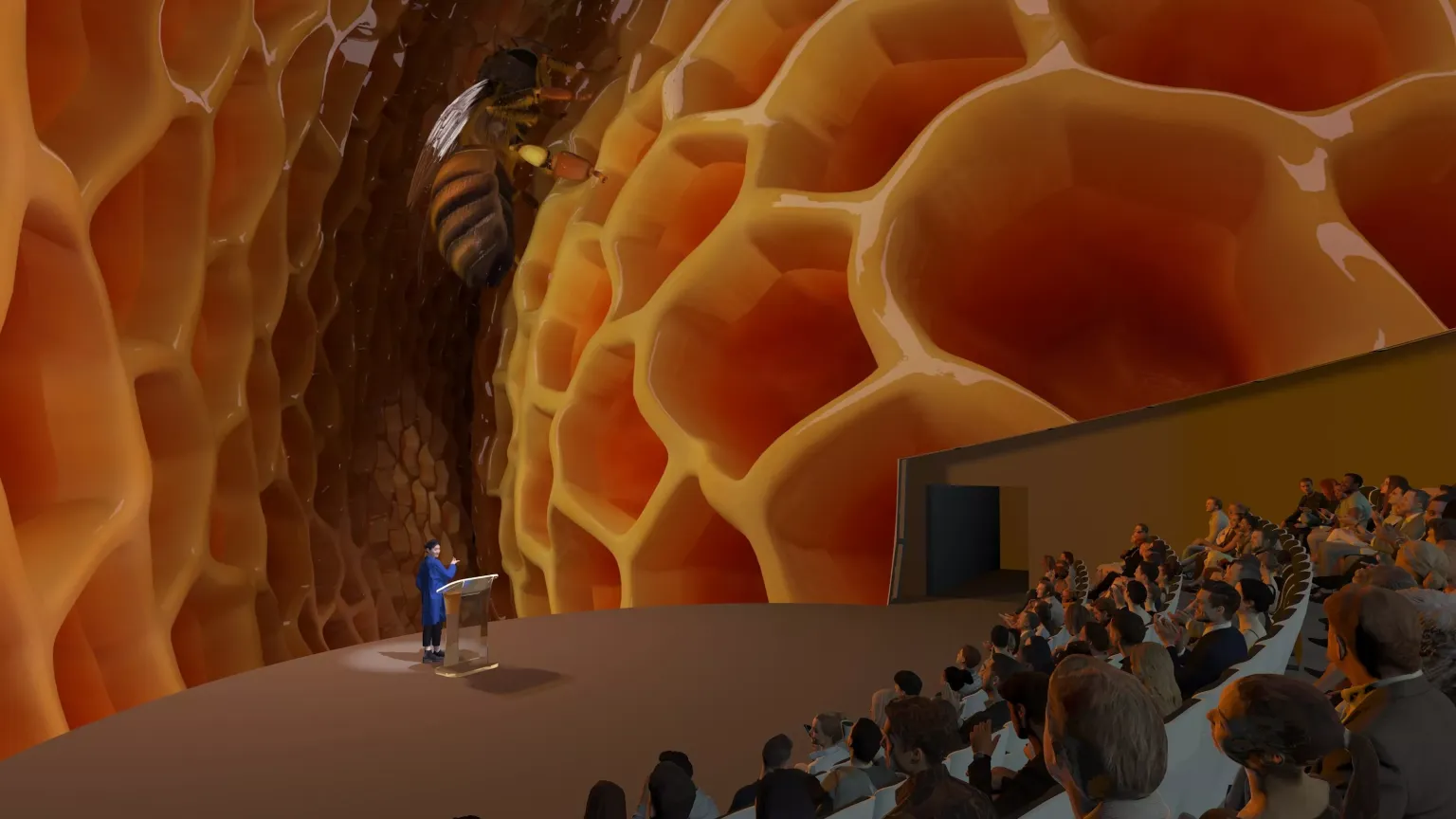

Neither a traditional cinema nor a conventional planetarium, a new generation of entertainment venues is emerging across the global landscape. The entire space becomes the screen, and audiences no longer remain seated as passive observers.

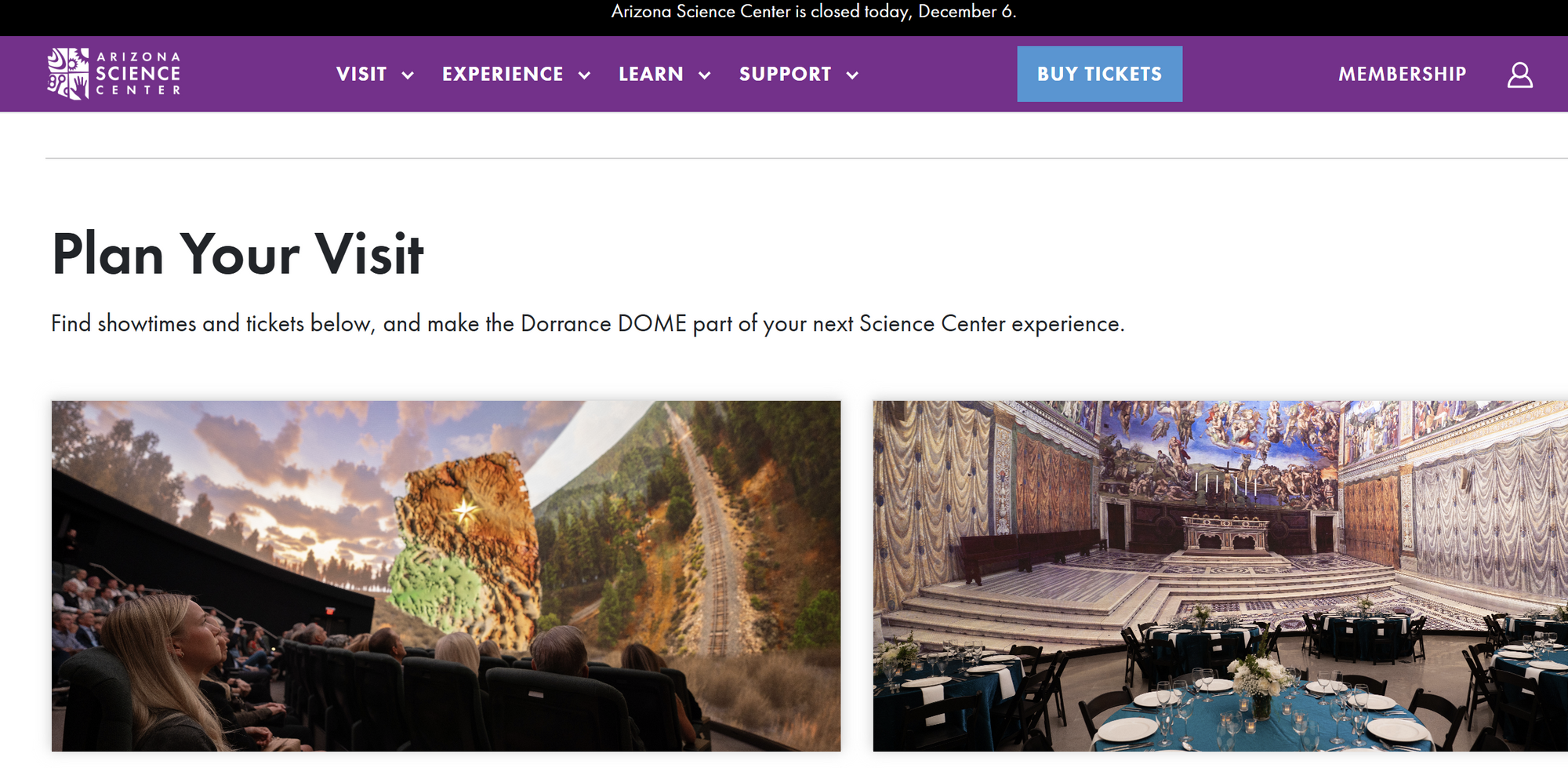

Immersive theatre—where space itself becomes narrative—has become reality. The Dorrance Dome at the Arizona Science Center stands as a defining symbol of this transformation, representing the convergence of technology, content, and public infrastructure in what may be called the post-screen era.

Originally designed as an educational planetarium, the Dorrance Dome has been reimagined as a multi-purpose media environment where art, culture, and entertainment converge.

Featuring over 9,000 LED panels and 8K+ resolution technology, the venue has evolved beyond experimental platform status to become next-generation media infrastructure. The recent staging of K-Pop Demon Hunters: Immersive Experience demonstrated how Korean content can expand with global sensibility through 360-degree visuals, spatial audio, and full-dome immersive production that fully engaged audiences' senses.

The Post-Screen Era: When Space Becomes Entertainment

Measured against the Las Vegas Sphere, the Dorrance Dome is smaller in scale—but its symbolic significance is substantial.

The Sphere, standing 366 feet tall with seating for 18,600 and standing capacity of 20,000, represents the apex of immersive architecture, having cost $2.3 billion to construct. Its 160,000-square-foot interior LED screen operates at 16K resolution, setting the global benchmark for large-scale immersive venues. Meanwhile, the Dorrance Dome seats approximately 200 guests within an 18-meter diameter LED dome, offering an intimate yet technologically sophisticated alternative.

What distinguishes the Dorrance Dome is its hybrid operational model. Powered by Cosm's CX System—offering brightness 100 times greater than traditional projection domes—the venue demonstrates how public science centers can transform into location-based entertainment hubs while maintaining educational missions. This represents a replicable template for cities worldwide seeking to develop mid-scale immersive infrastructure without Sphere-level investment.

Technology Infrastructure Driving Immersive Expansion

Immersive theatre is not merely visual experimentation—it represents technological infrastructure advancement creating entirely new entertainment formats. Ultra-high-resolution displays, curved LED engineering, multi-projection blending, and real-time rendering engines have pushed immersive capabilities far beyond planetarium conventions. Across the globe, domes, exhibition halls, and performance venues are being reconfigured into what might be termed a spatial content network.

Key Global Hubs in the Immersive Ecosystem:

- Las Vegas Sphere — Wraps an entire building in LED displays to establish the worldwide benchmark for immersive performance; 366 feet tall, 516 feet wide, with 580,000 square feet of exterior LED and 160,000 square feet of interior 16K display

- Cosm Theatres (Los Angeles & Dallas) — Combine real-time content pipelines with 87-foot, 12K+ ultra-high-resolution LED domes for hybrid entertainment spanning sports, art, film, and concerts; 2,000-person capacity venues offering "shared reality" experiences

- Digital Planetariums (Tokyo, Berlin, New York) — Evolving from education-focused facilities into urban immersive spaces absorbing animation, music, and art content

- Experiential Art Venues (Lighthouse Immersive, ARTECHOUSE, Frameless London) — Merge art exhibition with projection mapping to create new visual art consumption cultures

Market Dynamics: A $400+ Billion Opportunity

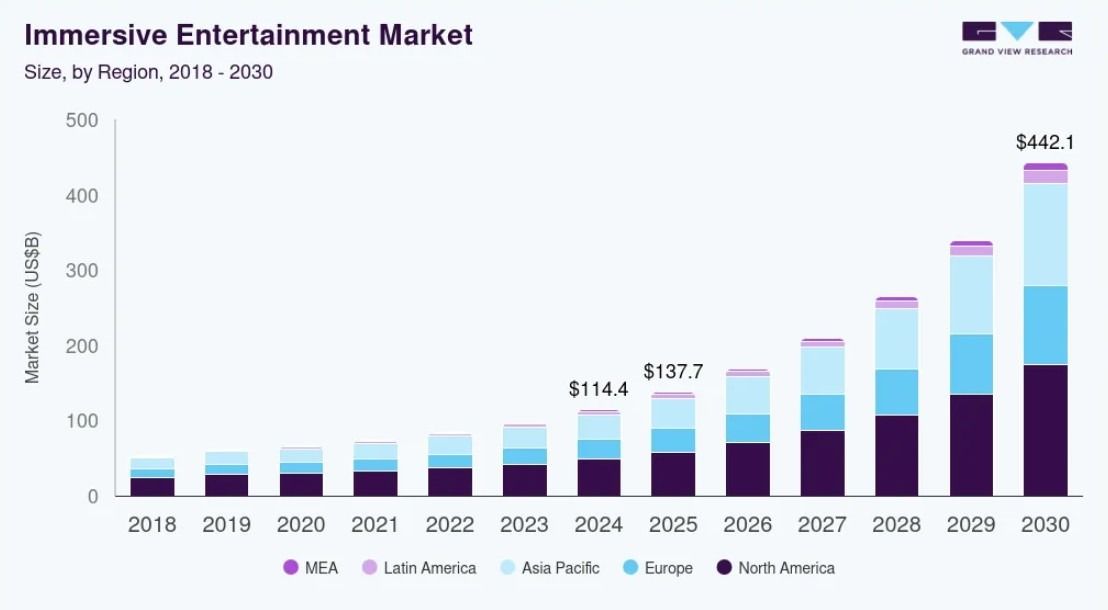

This global expansion aligns with substantial market growth projections. According to Grand View Research, the worldwide immersive entertainment market was valued at approximately $114.37 billion in 2024 and is projected to reach $442.11 billion by 2030, representing a compound annual growth rate of 26.3% from 2025 to 2030.

North America currently commands the largest market share at over 42% in 2024. However, the Asia-Pacific region is expected to record the fastest growth through 2030—signaling expanding investment and policy support for immersive content and dedicated facilities across Asian markets, including South Korea.

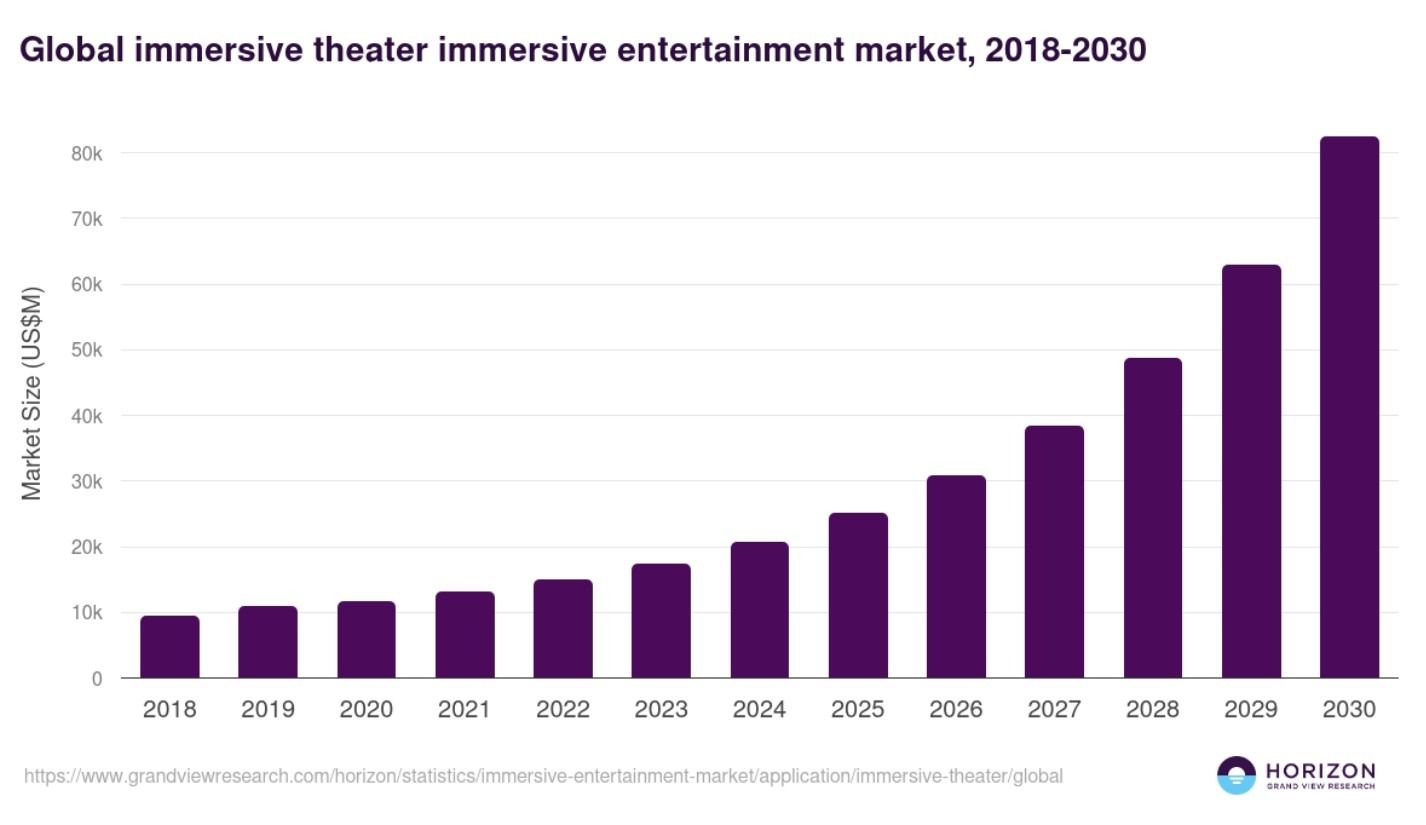

Within this landscape, the immersive theatre segment specifically is projected to expand from approximately $20.66 billion in 2024 to roughly $82.39 billion by 2030, with an annual growth rate of 26.9%. These figures underscore that immersive venues are not a passing trend but rather a structural pillar of the entertainment industry's future architecture.

Source: Grand View Research

K-Content: Natural Fit for Immersive Environments

Korean content possesses inherent characteristics that align naturally with immersive spatial environments. The distinctive color palettes, narrative density, performance-centric production, and dynamic musical expression of K-content combine to create IP that readily translates audiences from passive viewing to experiencing full spatial immersion.

K-pop's performance structures and the visual aesthetics of Korean animation and action fantasy are particularly well-suited for reinterpretation in dome-based interactive environments. When combined with multi-screen editing, real-time effects, and 360-degree camera work, existing concert footage or animation clips can be reborn as entirely new forms of spatial experience.

The K-Pop Demon Hunters immersive event at the Dorrance Dome validated this potential before live audiences, demonstrating that Korean content can effectively utilize immersive domes as new performance stages. As part of the Art360 series—the Dome's signature evening programming combining art, music, and immersive visuals—the production showcased how K-content's visual intensity and narrative energy translate powerfully into 360-degree spatial storytelling.

New Business Models: Beyond Streaming Screens

K-content is generating new business models within immersive spaces. As IP extends beyond streaming screens into physical venues like domes and spheres, a new commercial axis is forming around spatially-touring content that travels between cities. Beyond simple screenings, this opens format variations including:

- Limited-run engagements

- Touring immersive shows

- Local collaboration events

- Branded entertainment experiences

- Hybrid education-entertainment programming

This adds another global distribution channel for Korean content—one that cannot be replicated through streaming alone.

Revenue Diversification for Cultural Facilities:

For science centers and cultural facilities seeking revenue diversification, K-content offers direct contribution potential. When Korean IP with established global fandom enters a venue:

- Visitor traffic increases significantly

- Venue rental opportunities expand

- IP co-production partnerships emerge

- Merchandise and package sales multiply

- Sponsorship value rises

The moment K-content enters programming, a regional science center effectively begins functioning as a global cultural hub—connected to worldwide fandom networks that transcend local market limitations.

The Dorrance Dome Model: Public-Private Convergence

The Dorrance Dome is named for the Dorrance family, whose wealth derived from Campbell Soup Company holdings. Through their foundation, the family has provided sustained support for Arizona's education, science, and arts infrastructure. The partnership structure between the Arizona Science Center, the Dorrance Family and Corporate Foundation, and technology partner Cosm presents a new model for how public facilities can collaborate with private capital and immersive technology companies to build next-generation media infrastructure.

This represents a departure from traditional science center models dependent on public budgets, experimenting instead with hybrid revenue structures combining:

- Philanthropic foundation support

- Corporate and brand partnerships

- Ticket and membership revenues

- Event rental and sponsorship income

- Content licensing opportunities

The governance format has attracted attention as a potential benchmark for other municipal science centers and cultural facilities worldwide seeking sustainable paths to immersive technology adoption.

Dorrance Dome Technical Specifications:

The Dorrance family are direct descendants of the inventor of condensed soup at Campbell Soup Company and are now its largest shareholder family based in Arizona. John T. Dorrance’s grandson, Bennett Dorrance, has held around 15% of Campbell Soup’s shares, making him one of the company’s biggest individual owners and a key member of its controlling family bloc.

He served on Campbell Soup’s board for about 33 years before retiring from the board in 2022, while the family continues to hold significant ownership and influence through multiple heirs.

Competitive Positioning: Experience Economy Emergence

While mega-venues like the Sphere focus on iconic architecture combined with superstar performances, the Dorrance Dome represents a high-efficiency model rotating education, culture, and entertainment within an intimate 200-seat environment.

The LED fulldome environment encompasses:

- Daytime astronomy and science education programming

- Family and educational group experiences

- Evening Art360 cultural showcases

- Wellness programming (yoga, mindfulness sessions)

- Community events and private rentals

- Limited-run immersive entertainment

This diverse programming competes for audience attention with traditional cinemas, planetariums, small theaters, and even some concert halls—creating a new category of experience space that blurs conventional entertainment boundaries.

Venue Comparison:

This expansion of immersive domes signals the post-streaming era's direction for offline entertainment upgrades, triggering competition among cities seeking to establish their own immersive hubs. The Dorrance Dome serves as a public science center reference model—a testing ground for hybrid strategies pursuing education, culture, and revenue simultaneously.

Strategic Implications: The Next Chapter

From mega-venues like the Sphere to mid-scale digital domes like the Dorrance Dome to projection-based art spaces distributed throughout urban centers, immersive venues now form a continuum gradually reshaping the entertainment industry landscape. Immersive theatre is no longer a subsidiary facility of science exhibitions or a venue for one-off performances—it is emerging as the central stage where technology, space, and content intersect.

In this environment, audiences are no longer passive viewers before screens. Within spaces where light and sound intermingle, audiences stand at the center of narrative—at the heart of experience itself—while storytelling shifts from linear temporal structures to new formats built around spatial axes and participation.

The convergence of K-content with spatial entertainment represents not isolated events but the starting point for music, film, gaming, and webtoon IP expanding into three-dimensional global ecosystems. Connected through fandom networks, streaming platforms, and now physical immersive venues, Korean content is building an infrastructure for cultural presence that spans digital and physical realms.

Which formats will become standard, which cities' domes and which IP will dominate the landscape—these questions remain open. But one trajectory is clear: as audiences spend less time simply sitting before screens, that vacancy will increasingly be filled by experiences encompassing entire spaces.

This signals the rise of the experience economy. Ultimately, who fills these newly opened spaces—and with what stories—may determine the next chapter of entertainment in the post-streaming era.