Netflix vs Paramount: Battle for Warner Bros. Intensifies, Korean Entertainment Industry at Stake

Hollywood's biggest M&A war reshapes global media landscape as Korea watches anxiously

David Ellison Extends Tender Offer to Feb. 20, Vowing "We're Not Giving Up"

January 22, 2026

The fight for Warner Bros. Discovery (WBD), a 102-year-old studio powerhouse, is heating up as global streaming giant Netflix and integrated media company Paramount Skydance wage a fierce bidding war over a deal worth over $100 billion. The outcome will not only reshape Hollywood but also profoundly impact the Korean entertainment industry, which has become increasingly dependent on Netflix's investment.

On Thursday, Paramount Skydance announced it was extending the deadline for its $30-per-share all-cash tender offer for WBD to February 20. David Ellison, Paramount's CEO, emphasized that "our $108.4 billion enterprise value offer is significantly superior to Netflix's $82.7 billion deal, providing WBD shareholders with a better choice."

$25.7 Billion Gap: Who Will Win?

The bidding war shows a stark contrast from the start. Paramount is offering $30 per share in all cash, seeking to acquire all of WBD including cable channels like CNN, TNT, and TBS. Netflix, on the other hand, revised its offer to $27.75 per share in all cash on January 20, switching from its initial cash-and-stock proposal to neutralize Paramount's "all-cash" advantage.

Yet numbers alone won't decide the winner. WBD's board has unanimously rejected Paramount's proposal eight times, and more than 93% of shareholders support the Netflix deal. WBD stated that "Paramount continues to make the same inferior proposal that our board has repeatedly and unanimously rejected."

Netflix is pursuing an $83 billion acquisition with $20 billion in cash on hand and $42.2 billion in debt financing secured from Wells Fargo, BNP Paribas, and HSBC. Paramount has showcased its financial strength with a $40.4 billion personal guarantee from Larry Ellison, Oracle founder and David Ellison's father, but WBD's board remains unconvinced, citing "insufficient funding guarantees."

Discovery Global Valuation Controversy

Paramount's main attack focuses on WBD's financial transparency. If the Netflix deal closes, WBD will spin off cable channels like CNN, TNT, TBS, HGTV, Food Network, and the Discovery+ streaming service into a separate entity called "Discovery Global." Netflix would acquire only the film and TV studios, HBO, and HBO Max.

The problem lies in Discovery Global's valuation. WBD's board claims it's worth $2.41-$3.77 per share (or $4.63-$6.86 in an acquisition scenario), but Paramount argues it's "essentially worthless, theoretically worth only $0.50 per share." Even WBD's own financial advisors produced discounted cash flow (DCF) analyses valuing it as low as $0.72 per share.

Paramount criticizes the lack of transparency: "Discovery Global's debt allocation will directly determine what shareholders actually receive, yet WBD is seeking shareholder approval without disclosing this critical information." WBD plans to allocate $17 billion in net debt to Discovery Global as of June 30, 2026, but if any portion is reallocated to the Warner Bros. business, shareholders' actual proceeds would decrease dollar-for-dollar, Paramount points out.

In response, Paramount sued WBD's board earlier this month to force disclosure of financial details including Discovery Global's valuation methodology. However, WBD voluntarily disclosed Discovery Global's five-year financial projections in an SEC filing on Tuesday, asserting they are "transparent without a court order."

Why Hollywood Is Afraid

The deal's impact on the industry is profound. James Cameron, director of the Avatar series, called Netflix's acquisition of Warner Bros. a "disaster." The Directors Guild of America (DGA), Writers Guild of America (WGA), and Cinema United, a theater owners' organization, have all voiced strong opposition.

Their concerns fall into three main categories. First, job losses and reduced creative diversity. When a major platform absorbs a studio, redundant departments get eliminated, and content production tends to concentrate on proven IP. Second, the collapse of the theatrical release system. Netflix has traditionally shortened or ignored the "holdback" period between theatrical release and streaming availability. If Warner Bros. blockbusters skip theaters and go straight to Netflix, it could deliver a fatal blow to an already struggling cinema industry.

Third, market monopolization. Paramount argues that "if the Netflix deal closes, they'll control 43% of global subscription video-on-demand subscribers, inevitably leading to higher consumer prices, reduced creator compensation, and harm to the theatrical industry." In Europe, where Netflix dominates and HBO Max is the only viable competitor, antitrust concerns are particularly acute.

Netflix's Rebuttal: "We're Still a Small Player"

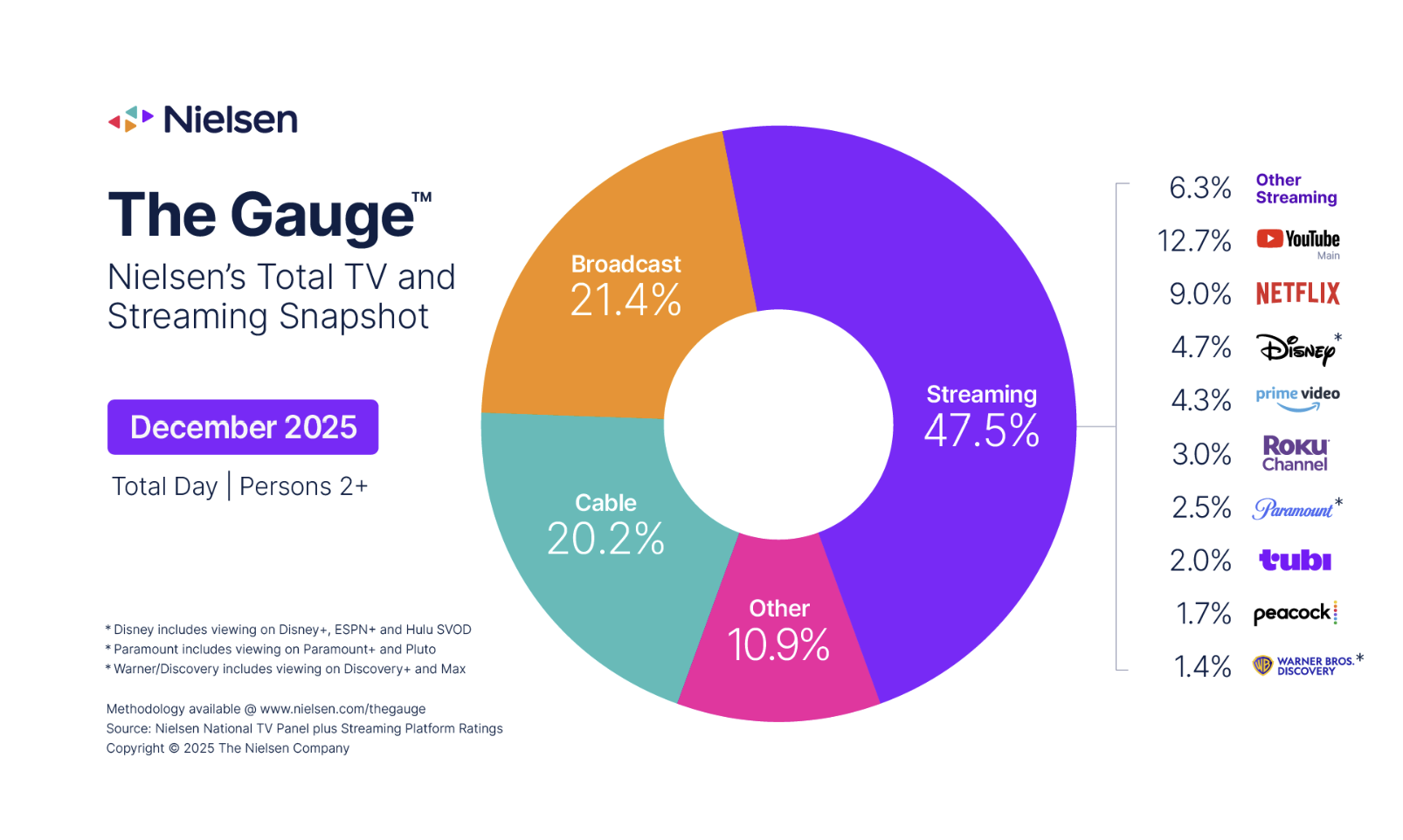

Netflix co-CEO Greg Peters pushed back directly. "Even after merging with Warner Bros., our U.S. TV viewing share would only rise from 8% to 9%," he stressed, "which remains well behind YouTube (13%) and a potential Paramount/WBD combination (14%)." This strategy positions competitors not as traditional media but as YouTube, deflecting monopoly concerns.

Netflix also reversed its stance on theatrical releases. Co-CEO Ted Sarandos wrote in a staff letter that "in the past, theatrical releases weren't part of Netflix's business model, but if this deal closes, we will focus on the theatrical release business." This means Warner Bros.' blockbuster IPs like Harry Potter, the DC Universe (Batman, Superman), and Game of Thrones would continue to have theatrical releases.

Peters stated that "our deal provides superior shareholder value and is fundamentally pro-consumer, pro-innovation, pro-creator, and pro-growth," adding that they are "fully prepared to put ourselves in a strong position for approval."

Regulatory Approval Is the Biggest Variable

Ultimately, regulators hold the key to determining the final winner. Netflix and WBD are aiming to complete the transaction within 12-18 months after signing the original agreement on December 4, 2025, pending approval from the U.S. Department of Justice and the European Commission. The Justice Department has already launched an antitrust review.

Political variables also come into play. President Donald Trump's friendship with Larry and David Ellison could work in Paramount's favor, analysts suggest. Trump recently indicated he would carefully examine potential antitrust violations.

If the deal falls through, Netflix must pay WBD a $5.8 billion breakup fee. Paramount also faces the challenge of convincing shareholders to reject the Netflix deal at WBD's special meeting in April—a difficult task given the current 93% support level.

Korean Entertainment Industry Caught in the Crossfire

This acquisition battle directly affects Korea's entertainment industry, which has become increasingly intertwined with global streaming platforms. Amid the ongoing Warner Bros. takeover fight, Netflix held its "Next on Netflix 2026" event at the Conrad Hotel in Seoul's Yeouido on January 21, unveiling this year's Korean content lineup and emphasizing its unwavering commitment to the Korean market.

33-Title 2026 Lineup: A Show of Confidence

Netflix's 2026 Korean content slate includes 25 series, 4 films, and 4 variety shows—totaling 33 titles. Don Kang, Netflix's Vice President of Korean Content, stated that "over the past five years, more than 210 Korean titles have ranked in the global top 10," adding that "K-content is the most-watched non-English content on Netflix."

This year's lineup features highly anticipated projects including:

Major Series:

- Boyfriend on Demand - A rom-com starring BLACKPINK's Jisoo and Seo In-guk about a webtoon producer who subscribes to a virtual dating simulation service

- The WONDERfools - A superhero action-comedy starring Park Eun-bin and Cha Eun-woo, directed by Yoo In-sik (Extraordinary Attorney Woo)

- Tantara - Song Hye-kyo and Gong Yoo reunite in a series about Korea's entertainment industry in the 1960s-80s, written by Noh Hee-kyung (Our Blues) and directed by Lee Yoon-jung (Coffee Prince)

- The Scandal - A period romance starring Son Ye-jin and Ji Chang-wook, exploring forbidden desire in Joseon-era Korea

- Tantara - Featuring Song Hye-kyo, Gong Yoo, Kim Seol-hyun, Cha Seung-won, and Lee Hanee in a story set in Korea's reckless entertainment industry

Prestige Cinema:

- Possible Love - Master director Lee Chang-dong's first film in 8 years, starring Jeon Do-yeon, Sul Kyung-gu, Zo In-sung, and Cho Yeo-jeong. Jeon Do-yeon reunites with Lee after Secret Sunshine, while Sul marks his third collaboration following Peppermint Candy and Oasis.

Variety Shows:

- Singles Inferno Season 5 - Korea's first variety show to reach a fifth season, already premiered

- Culinary Class Wars Season 3 - The cooking competition that topped Netflix's Global Top 10 Non-English Shows for two consecutive years

- The Devil's Plan Season 3 - Producer Jeong Jong-yeon's brain-battle survival show returns

Investment Commitment Amid Uncertainty

Netflix promised to invest approximately 3 trillion won ($2.5 billion) in Korean content over four years from 2023 to 2026, with 2026 being the final year of this commitment cycle. Kang emphasized that "we will continue our long-term investment in Korea" and "believe in Korean creators' potential." Following 31 Korean titles in 2025, the expansion to 33 titles in 2026 demonstrates increased investment.

However, concerns remain about potential medium to long-term adjustments to Korean content investment if the massive Warner Bros. acquisition cost ($83 billion) is deployed. Professor Yoo Gun-sik of Sungkyunkwan University's Graduate School of Media and Culture warned that "with Korean production costs rising significantly, Netflix might shift focus to markets like Japan or Thailand where production costs are 30-50% lower."

Korean Streaming Platforms Face Existential Threat

With Netflix holding a 40% subscriber share (48% by revenue) in Korea's streaming market, acquiring Warner Bros.' premium IP could further weaken local platforms like Tving, Wavve, and Coupang Play. The implications are far-reaching:

- Coupang Play's HBO Dilemma: Coupang Play currently holds exclusive streaming rights to HBO content in Korea. If Netflix acquires HBO, this contract could be terminated, stripping Coupang Play of one of its major competitive advantages.

CJ ENM Partnership at Risk: The K-content co-production partnership between CJ ENM and Warner Bros. Discovery signed in October 2025 could be subject to renegotiation. This partnership included:

- Joint production of original Korean content

- Launching a Tving branded section within HBO Max

- Expansion into 17 Asia-Pacific marketsNetflix already has a close relationship with Studio Dragon (CJ ENM's production subsidiary), potentially making the WBD-CJ ENM partnership redundant.

- Market Concentration Concerns: S&P Global Market Intelligence estimates that Netflix's revenue share in major Asia-Pacific markets averages 30%, but in Korea it exceeds 48%. Adding Warner Bros.' content library could push this even higher, raising serious competition concerns.

Long-term Strategic Implications for K-Content

Industry experts warn that Korea's entertainment industry must evolve beyond being merely a "content supplier" to Netflix. Han Jung-hoon, CEO of K Entertainment Tech Hub, advised: "Netflix's investment is shifting toward proven titles. Korea needs to focus on IP ownership rather than just content sales. We also need government-level intervention to establish 'residual' payment systems where creators receive ongoing compensation based on viewership performance."

Structural challenges facing Korean content creators include:

- Rising production costs reaching global standards but with unbalanced revenue distribution

- IP dependency where Netflix owns intellectual property, relegating Korean production companies to subcontractor status

- Lack of residual systems unlike Hollywood, where creators share in ongoing success

- Unresolved net neutrality disputes over network usage fees

Professor Kim Sook-young of UCLA, who spoke at Netflix's "Next on Netflix Insight" event, noted that "as of 2024, over 80% of Netflix's global subscribers have watched at least one Korean title." This demonstrates K-content's global value, but the question remains whether Korean creators can capture more of this value.

The Korea Herald reported that "Netflix executives confirm the investment in Korean content will remain steady despite broader corporate uncertainty," but added the caveat that "Korean content faces critical 2026 as Netflix's investment cycle enters final year."

Asia-Pacific Market Implications

According to S&P Global Market Intelligence research, the Netflix-Warner Bros. deal could significantly impact the broader Asia-Pacific streaming landscape:

Market Share Dynamics:

- India: Netflix's mobile tier costs 3x more than competitors like JioStar and Prime Video, but premium pricing contributes to dominant revenue share

- Japan: Prime Video leads in subscribers, Netflix in revenue. Prime Video's recent MLB series launch and ad-supported tier expansion pose new challenges

- South Korea: Netflix leads with 32.9% subscriber share and 48% revenue share. Local competitors Tving and Wavve have received conditional approval to merge, potentially creating the country's largest streamer

HBO Max's Regional Footprint: HBO Max has maintained a relatively minor presence in Asia-Pacific, primarily available through licensing deals:

- India: JioHotstar (exclusive)

- Japan: U-NEXT (exclusive)

- South Korea: Coupang Play (exclusive)

All these partnerships face uncertainty if Netflix acquires HBO Max, potentially forcing local platforms to seek alternative Hollywood content sources.

A New Era for Global Media

Bank of America (BofA) Global Research defined this acquisition battle as "not just a transaction but industry realignment." The New York Times analyzed it as potentially "the culmination of tech companies' takeover of Hollywood."

Indeed, the media industry has been reshaped through major M&A over the past five years:

- 2019: Disney acquired 21st Century Fox ($71.3 billion)

- 2022: WarnerMedia and Discovery merged to form WBD

- 2024: Paramount acquired Skydance ($8 billion)

- 2026: Netflix vs Paramount battle for WBD (up to $108.4 billion)

The industry is rapidly consolidating into a structure where only platforms with over 100 million subscribers survive. Netflix boasts 312.5 million paid subscribers globally, while Disney+ has surpassed 100 million.

What's at Stake

The outcome of this battle will determine:

For Hollywood:

- Whether traditional studios remain independent or become content libraries for tech platforms

- The future of theatrical releases and cinema economics

- Job security for tens of thousands of entertainment workers

- Creative diversity in content production

For Korea:

- The sustainability of Netflix's 3 trillion won investment commitment beyond 2026

- Viability of local streaming platforms against a Netflix-Warner Bros. behemoth

- Bargaining power of Korean content creators and production companies

- Strategic partnerships and co-production agreements

For Global Audiences:

- Subscription pricing as market concentration increases

- Content diversity and creative risk-taking

- Access to premium franchises and back catalogs

- Competition and choice in streaming services

The Final Countdown

The ball is now in the court of WBD's special shareholder meeting scheduled for April. Whether shareholders will side with Netflix's board-approved deal or be swayed by Paramount's higher cash offer remains to be seen. Current indicators strongly favor Netflix:

- 93% shareholder support for Netflix deal

- Board unanimity - 8 rejections of Paramount's proposal

- Regulatory preparation - Netflix claims readiness for approval process

- Financial structure - Fully financed with committed bank funding

However, Paramount isn't conceding defeat:

- $2.25 per share premium over Netflix's offer

- Larry Ellison's backing - $40.4 billion personal guarantee

- Political connections - Trump administration relationship

- Transparency campaign - Attacking WBD's Discovery Global valuation

The decision will reverberate far beyond Warner Bros.' Burbank lot. It will set precedents for:

- Platform-studio vertical integration in the streaming era

- Regulatory tolerance for media consolidation

- Valuation of legacy media assets in a digital-first world

- The balance of power between Silicon Valley and Hollywood

Conclusion: The End of an Era

The moment Warner Bros., a 102-year-old prestigious studio that gave the world Casablanca, The Wizard of Oz, and the DC Universe, is absorbed by a streaming platform, Hollywood's "Golden Age" will officially end, and the "Platform Age" will truly begin.

For Korea, the stakes are equally high. After a decade of explosive K-content growth fueled by streaming investment, the industry faces a critical juncture. Will Korean creators secure their position as essential partners in the global content ecosystem, or will they find themselves squeezed as platforms prioritize their own franchises and cost efficiencies?

As one Korean entertainment executive put it: "We've been riding Netflix's wave for years. Now we need to learn to swim on our own—before the tide goes out."

The answer will come in April, when WBD shareholders cast their votes. But the implications will unfold over years, reshaping how stories are told, financed, and consumed around the world.

About the Deal:

- Netflix Offer: $27.75/share, $82.7B enterprise value, all cash

- Paramount Offer: $30/share, $108.4B enterprise value, all cash

- Target: Warner Bros. Discovery (studios, HBO, HBO Max)

- Timeline: April 2026 shareholder vote, 12-18 months to close

- Breakup Fee: $5.8 billion if deal fails

Key Players:

- Greg Peters & Ted Sarandos (Netflix Co-CEOs)

- David Ellison (Paramount Skydance CEO)

- Larry Ellison (Oracle founder, financial backer)

- Don Kang (Netflix VP, Korean Content)

![[CES 2026] "모노컬처는 죽었다"

투비(Tubi)·삼성 TV 플러스(Samsung TV Plus)가 이끄는 무료 스트리밍의 미래](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xe6byc_202601212355.png)

![[CES 2026]로쿠(Roku), AI·저가 스트리밍·광고 '3대 전략'으로](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/2ug8x9_202601150040.jpeg)

![[분석]FAST 투비는 어떻게 1위 스트리밍이 됐나..."엔터테인먼트의 미래는 무료다"](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/e8524i_202512310731.jpg)

![[CES2026]미디어 기업 업프론트(광고 설명회) 장소로 변신](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/xjbio9_202601222334.png)

![[CES 2026]레딧, 구글 메타 도전장 '맥스 캠페인 진행'](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/o4o2vj_202601220249.jpg)

![[CES 2026] AI, 스트리밍 전쟁, 마이크로드라마](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/nf0b2a_202601210349.png)

![[CES 2026] 크리에이터 이코노미 보고서(무료 요약본)](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/5wiefh_202601190237.png)

![[CES 2026]크리에이터 이코노미 종합 분석 리포트](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/d48ydy_202601190208.jpeg)

![[2026엔터테크] 윤리적 AI 스튜디오 종합 보고서](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/01/ylqs2w_202601040723.png)