ByteDance vs Alibaba: The Lunar New Year AI Supremacy Battle

ByteDance vs Alibaba: The Lunar New Year AI Supremacy Battle

Simultaneous launches of LLM, video & image models | Seedance 2.0 Hollywood copyright firestorm | Battle for 1.4 billion Chinese users

KEY TAKEAWAYS

■ ByteDance: Launched Doubao Seed 2.0 (LLM) + Seedance 2.0 (video) + Seedream 5.0 (image) simultaneously

■ Alibaba: Unveiled Qwen 3.5 flagship model, declaring the dawn of the agentic AI era

■ Copyright storm: Disney & Paramount issue cease-and-desist letters; Japan launches investigation

■ JPMorgan projects China’s AI cloud market to reach ~$90 billion by 2030

■ Both companies developing all-in-one AI models (text, image, audio, video & code)

1. The Lunar New Year AI Supremacy Battle: Overview

The battle for AI dominance in China has entered a decisive new phase. Timed to the 2026 Lunar New Year (Spring Festival) holiday, ByteDance and Alibaba Group have each unveiled their next-generation flagship AI models in a head-on collision. As The Information reported on January 29, both companies had planned to launch new models around the holiday window, in what has been described as the most consequential battle in China’s tech sector.

The backdrop to this competition is DeepSeek’s unexpected breakthrough during the 2025 Lunar New Year. DeepSeek became a global sensation during that holiday period, wiping $593 billion off Nvidia’s market capitalization in a single day (Reuters). This year, both ByteDance and Alibaba are leveraging the same “holiday effect”—when China’s vast population takes a week off with ample screen time—to compete for AI app users. DeepSeek is also preparing its next-generation model V4 after a year-long hiatus, creating a three-way race.

According to The Information, the stakes go far beyond model performance. The winner could control China’s AI cloud market, which JPMorgan projects will reach nearly $90 billion by 2030, and shape how 1.4 billion Chinese people use AI in all aspects of their everyday lives.

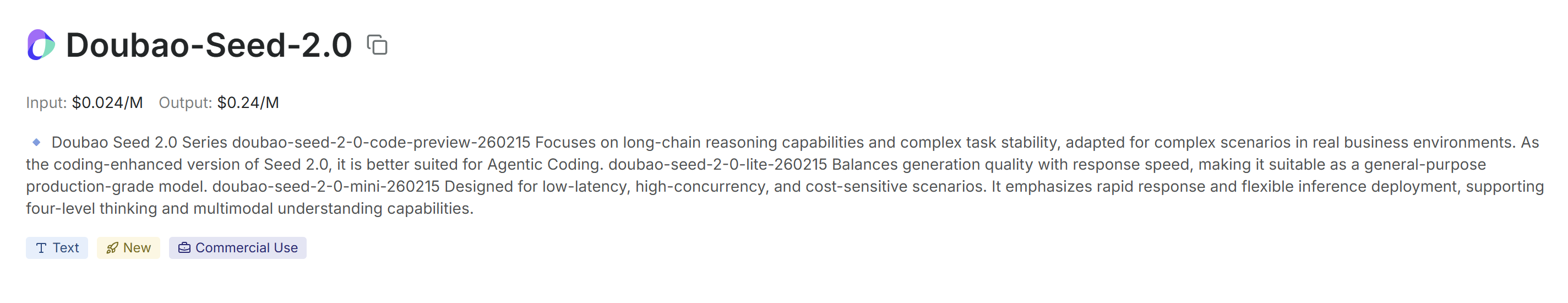

2. ByteDance: Doubao Seed 2.0 Technical Analysis

Four-Model Family and Benchmarks

ByteDance officially launched Doubao Seed 2.0 on February 14. Rather than a single model, it is a family of four variants—Pro, Lite, Mini, and Code—with the flagship Pro model specialized in long-chain reasoning and agent-based tasks (TechNode). ByteDance positioned Seed 2.0 as a direct competitor to GPT-5.2 and Gemini 3 Pro, with benchmark results shown in the table below.

[Table 1] Seed 2.0 Pro Key Benchmark Comparison

Sources: ByteDance announcements, TechNode, Digital Applied. Red indicates top score.

Seed 2.0’s most distinctive capability is its superior visual understanding (The Information). It can analyze complex documents combining tables, charts, graphics, and video, and process up to one hour of video content. The Pro model also scored 55.8 on Terminal Bench, demonstrating autonomous web browsing and coding agent workflow capabilities. ByteDance is positioning this as a transition to the “Agent Era.”

Aggressive Pricing and Volcano Engine

ByteDance is offering Seed 2.0 through its cloud platform Volcano Engine at roughly one-tenth the price of Western competitors. Volcano Engine commands 46.4% of China’s cloud LLM API market, ranking first (MarketScreener). The Doubao app has surpassed 200 million monthly active users (MAU), the undisputed leader in China’s AI app market (Aicpb.com). ByteDance has integrated Doubao into Douyin, its massive short-video platform and e-commerce hub, building a comprehensive AI ecosystem (The Information).

3. Alibaba: Qwen 3.5 Technical Analysis

Alibaba unveiled Qwen 3.5 on February 16 (CNBC, SCMP). The open-weight model features 397 billion parameters with a hybrid linear attention + sparse MoE architecture that activates only 17 billion parameters per forward pass. The company emphasized 60% lower operating costs and 8x improved efficiency for large workloads compared to its predecessor. Alibaba claims Qwen 3.5 outperforms GPT-5.2, Claude Opus 4.5, and Gemini 3 Pro across multiple benchmarks (self-reported).

Qwen 3.5’s key differentiator is its “visual agentic capabilities.” It can autonomously operate mobile and desktop applications, support 2-hour video inputs, and handle 201 languages and dialects. Alibaba has designated the Qwen app as the centerpiece of its AI strategy, targeting full integration of its ecosystem services—e-commerce, online travel, and Ant Group payments—within the app by H1 2026 (The Information). The Qwen app now exceeds 100 million MAU, with a recent coupon campaign driving a 7x increase in active users (Reuters).

Notably, Alibaba’s open-source strategy stands in stark contrast to ByteDance’s proprietary approach. Qwen 3.5 is available as both an open-weight model and a hosted API (Qwen-3.5-Plus), with cumulative downloads of the Qwen family exceeding 20 million (CNBC). This developer ecosystem flywheel strategy aims to create lock-in through community adoption.

4. ByteDance vs Alibaba: Head-to-Head Comparison

[Table 2] ByteDance vs Alibaba AI Strategy Comparison

Sources: The Information (1/29, 2/16), TechNode, CNBC, SCMP, Aicpb.com

5. Seedance 2.0: The Hollywood Copyright Firestorm

Viral Videos and Hollywood’s Full-Scale Backlash

Seedance 2.0, the video generation model launched on February 12, can produce 15 seconds of high-quality video from text prompts alone, drawing comparisons to OpenAI’s Sora. Reuters noted it was also compared to DeepSeek, and praised for its ability to generate cinematic storylines from just a few lines of prompt. However, after Irish filmmaker Ruairi Robinson generated AI videos that went viral on social media, a copyright firestorm erupted.

Users began mass-generating and sharing videos featuring Disney characters, Marvel superheroes, and celebrity likenesses. The Motion Picture Association (MPA) condemned what it called “massive” infringement of U.S. copyrighted works “in a single day” (Variety). SAG-AFTRA declared that “unauthorized use of our members’ voices and likenesses is unacceptable” (TechCrunch).

[Table 3] Seedance 2.0 Copyright Controversy Timeline

Sources: Reuters, Variety, TechCrunch, CNBC, Al Jazeera, BBC

Disney-OpenAI Licensing: The Legal Precedent

Critically, Disney is not opposed to AI collaboration per se. According to Reuters, Disney signed a licensing deal with OpenAI in December 2025, authorizing the use of Star Wars, Pixar, and Marvel franchise characters on Sora. This establishes a clear boundary between unauthorized use and legitimate licensing of content IP in the AI era.

A Deadpool screenwriter’s reaction—“this could be the end for us”—captures the industry’s sense of crisis. Meanwhile, Japan’s government investigation signals that the issue is expanding beyond the U.S. into a global copyright concern. Global Times’ editorial praising Seedance 2.0 as a “showcase of Chinese AI technology” underscores the geopolitical dimensions of this controversy (Reuters).

6. Battle for 1.4 Billion Users: China’s AI Ecosystem

According to The Information, the ByteDance-Alibaba rivalry could shape how China’s 1.4 billion people use AI in all aspects of their everyday activities. The winner could also control the country’s AI cloud market, which JPMorgan projects will reach nearly $90 billion by 2030. Both companies are simultaneously developing ambitious “all-in-one AI models” that seamlessly process and generate text, images, audio, video, and code.

[Table 4] China AI Ecosystem: Key Players Overview

Sources: The Information, Reuters, Aicpb.com, QuestMobile, SCMP

The Information reports that Tencent CEO Pony Ma acknowledged at a recent annual staff meeting that the company had moved too slowly on AI, while emphasizing the appointment of Yao Shunyu—recruited from OpenAI—as the new chief AI scientist and an ongoing rebuilding of the AI team. With WeChat’s 1.4 billion+ MAU, Tencent retains the potential to reshape the competitive landscape if it fully commits to the AI race.

Meanwhile, startups such as DeepSeek and Moonshot AI are developing competitive models, but unlike ByteDance and Alibaba, they lack proprietary cloud platforms or massive user bases to fund model development (The Information). According to a RAND report, Chinese models operate at roughly one-sixth to one-quarter the cost of comparable U.S. systems, a pricing advantage that is accelerating enterprise AI adoption (Reuters).

7. The Price War: Strategic Implications

[Table 5] China vs U.S. AI Model Pricing Comparison

Sources: Company announcements, RAND, Reuters

The “low-cost, high-performance” paradigm established by DeepSeek in 2025 has now become the standard across China’s AI industry. Both ByteDance and Alibaba are following this approach while differentiating through their respective ecosystem strengths—ByteDance through proprietary models and Douyin integration, Alibaba through open-source and e-commerce ecosystem integration. As Omdia’s chief analyst noted, “DeepSeek showed the industry that you can create a very good model even when you’re resource-constrained,” and this combination of open-source access and low deployment costs has become the defining model for Chinese AI vendors (Reuters).

8. Implications for the K-Content Industry

Direct impact on content production: Seedance 2.0’s video generation capabilities demonstrate the potential to transform content production workflows. A Deadpool screenwriter’s reaction—“this could be the end for us”—captures the existential anxiety felt across creative industries. For the Korean content industry pursuing global expansion, the rapid evolution of AI-powered production tools demands urgent attention.

Copyright protection and new licensing models: The Disney-OpenAI licensing deal and the Seedance 2.0 controversy illustrate the polarization of content IP usage in the AI era. K-content IP holders need to strengthen unauthorized usage monitoring while simultaneously exploring legitimate licensing agreements with AI companies as a new revenue stream.

Pricing competitiveness implications: Aggressive pricing strategies—1/10 of Western prices (ByteDance), 60% cost reduction (Alibaba)—are dramatically lowering barriers to AI-powered content creation and analysis tools. Korean content companies can now access AI tools for content production, localization, and overseas market analysis at significantly reduced costs.

Platform strategy reference: ByteDance’s proprietary model + integrated platform strategy and Alibaba’s open-source + ecosystem integration approach are contrasting but both directly leverage AI to strengthen ecosystem competitiveness. Both offer valuable reference points for Korean content platform companies formulating AI integration strategies. Alibaba’s model of integrating e-commerce and payments into an AI app is particularly relevant to K-content platform commerce strategies.

The all-in-one model future: The “all-in-one AI models” both companies are developing—integrating text, image, audio, video, and code—signal a future where a single AI system handles the entire content lifecycle from planning through production to distribution. The K-content industry must accelerate its preparations for this transformation.

Sources

- The Information – "ByteDance, Alibaba to Launch New Models in Race for AI Supremacy in China" (Jan 29, 2026)

- The Information – "ByteDance Launches New LLM With Better Visual Understanding" (Feb 16, 2026)

- Reuters – "ByteDance pledges to prevent unauthorised IP use on AI video tool after Disney threat" (Feb 15, 2026)

- Reuters – "A year on from DeepSeek shock, get set for flurry of low-cost Chinese AI models" (Feb 12, 2026)

- TechCrunch – "Hollywood isn’t happy about the new Seedance 2.0 video generator" (Feb 15, 2026)

- Variety – "ByteDance Pledges Safeguards for Seedance 2.0 After Disney and Paramount Legal Threats" (Feb 17, 2026)

- Variety – "Paramount Sends ByteDance Cease-and-Desist Letter Over Seedance AI Videos" (Feb 16, 2026)

- Variety – "MPA Denounces ‘Massive’ Infringement on Seedance 2.0" (Feb 14, 2026)

- CNBC – "Alibaba unveils Qwen3.5 as China’s chatbot race shifts to AI agents" (Feb 17, 2026)

- CNBC – "ByteDance says it will add safeguards to Seedance 2.0" (Feb 16, 2026)

- South China Morning Post – "Alibaba unveils Qwen-3.5, sharpening global race" (Feb 16, 2026)

- TechNode – "ByteDance Releases Doubao-Seed-2.0, Positions Pro Model Against GPT 5.2" (Feb 14, 2026)

- Al Jazeera – "ByteDance pledges fixes to Seedance 2.0 after Hollywood copyright claims" (Feb 16, 2026)

- MarketScreener – "China’s ByteDance releases Doubao 2.0 AI chatbot" (Feb 14, 2026)

- Gulf News – "ByteDance launches AI models challenging OpenAI" (Feb 15, 2026)

This document is an AI industry briefing by K-EnterTech Hub. Unauthorized reproduction and redistribution prohibited.

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)