2026: The Year of the Great U.S. Local TV Consolidation

Nexstar-TEGNA $6.2 Billion Merger Review Begins in Earnest

Sinclair, Gray Media, and Others Line Up for M&A Wave

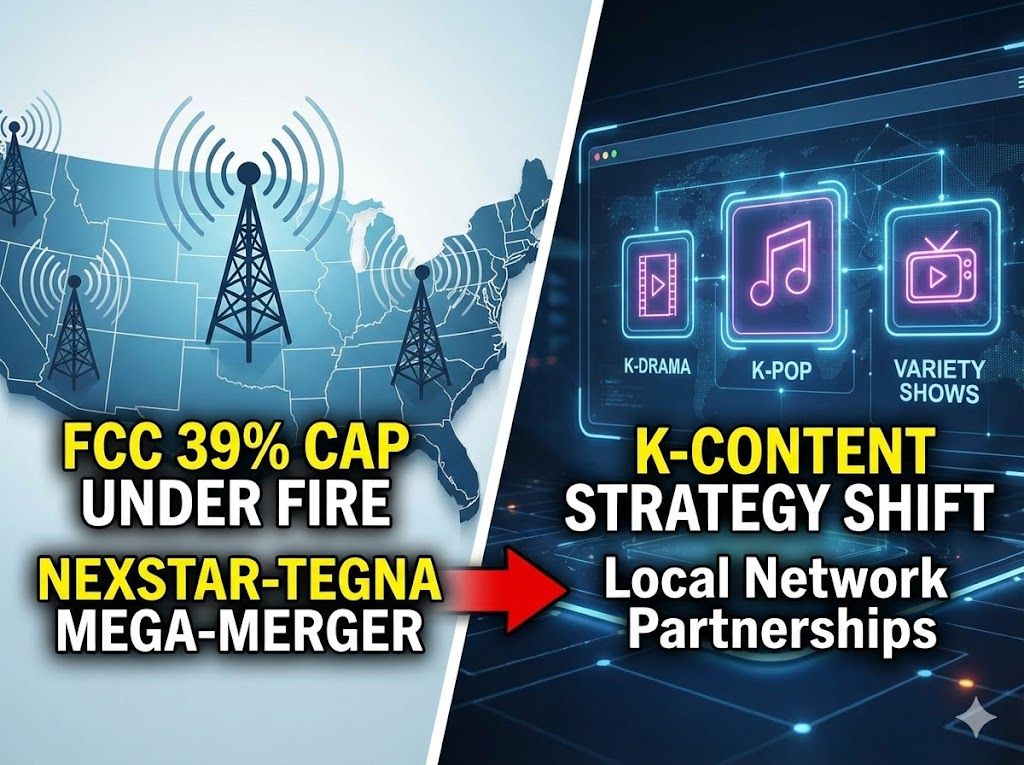

FCC Ownership Cap Decision Will Reshape the Industry — Implications for Korean Media

Introduction: 2026 — A Decisive Year for U.S. Broadcasting

The new year has arrived, and 2026 promises to be the most consequential year in recent memory for the U.S. local TV broadcasting industry. On December 31, 2025, the deadline passed for filing petitions to deny Nexstar Media Group's $6.2 billion acquisition of TEGNA. The Federal Communications Commission's substantive review now begins.

Following Nexstar-TEGNA, Sinclair Broadcast Group's attempted acquisition of E.W. Scripps, Apollo Global Management's potential sale of Cox Media Group, and Gray Media's aggressive duopoly strategy all point to what could become the largest industry restructuring in U.S. broadcast history.

The key variable determining the success or failure of all these deals is whether the FCC will relax its 39% ownership cap. First introduced in 1941 and reinforced by Congress in 2004, this regulation prohibits a single company from owning stations that reach more than 39% of U.S. TV households. This 80-year-old cornerstone of American broadcasting regulation could disappear in 2026.

However, President Trump's unexpected opposition has cast uncertainty over the industry. The unusual disagreement between the President and his appointed FCC Chairman is poised to be the biggest wildcard for broadcast M&A in 2026.

Chapter 1: Nexstar-TEGNA — The Mega-Merger Under Scrutiny

1-1. CAR Urges Swift FCC Approval

The Center for American Rights (CAR) filed a 14-page brief with the FCC on December 30, 2025, urging the agency to swiftly approve the regulatory waivers necessary for Nexstar Media Group's acquisition of TEGNA.

Daniel Suhr, CAR's President, stated: "Deregulation is the best tool to help prevent the decline of local news, allow stations to invest in trusted journalism, negotiate for valuable programming, and drive technological innovation. The FCC should promptly approve the license transfer applications."

"What matters for diversity in local news is not how many owners there are, but how those owners run their stations."

1-2. Deal Overview: Largest in U.S. Broadcast History

Announced on August 19, 2025, Nexstar will acquire all outstanding shares of TEGNA for $22.00 per share in cash. This $6.2 billion transaction represents a 31% premium to TEGNA's 30-day average stock price.

Upon completion, the combined company will own 265 TV stations in 44 states and Washington, D.C., with presence in 9 of the top 10 DMAs (Designated Market Areas) and 41 of the top 50 DMAs, reaching approximately 80% of U.S. TV households.

Nexstar CEO Perry Sook stated: "Nexstar's acquisition of TEGNA is vitally important to the future of local television and local journalism. We are grateful that the Trump administration and the FCC recognize that the current television ownership regulations are outdated and do not reflect the competitive media landscape as it has evolved over the past 25+ years."

1-3. Company Profiles: Two Giants of Local Broadcasting

Nexstar Media Group

Founded in 1996 in Irving, Texas by Perry Sook

Acquired Tribune Media in 2019 ($4.6 billion)

Acquired 75% stake in The CW network in 2022

Currently operates 201 stations in 116 markets, producing 316,000+ hours of programming annually

Operates 24-hour cable news channel NewsNation

TEGNA Inc.

Spun off from Gannett in 2015, headquartered in Tysons, Virginia

Operates 64 TV stations in 51 markets

Big Four affiliates in major markets including Phoenix, Atlanta, and Portland

Standard General's $8.6 billion acquisition was blocked by FCC in 2023

1-4. Core Issue: The 39% Ownership Cap

The central issue in this merger is the national broadcast ownership cap, first introduced in 1941 and codified by Congress in 2004. Currently, Nexstar is the largest local TV station owner in the U.S., operating 201 directly owned or partner stations in 116 markets. Acquiring TEGNA's 64 stations in 51 markets would push the combined company's reach to 54.5% of U.S. TV households.

Nexstar is requesting not only a waiver of the 39% cap but also waivers from rules prohibiting common ownership of more than two TV stations in 23 local markets.

Democratic FCC Commissioner Anna Gomez argues that the 39% cap is codified in statute and only Congress can change it. Meanwhile, FCC Chairman Brendan Carr maintains that the FCC has authority to modify the cap and that it has been "harmful" to local broadcasters.

1-5. Supporters: "No Scale, No Competition with Big Tech"

Merger supporters argue that current ownership rules disadvantage local broadcasters in competition against digital platforms like YouTube and Netflix.

More than 20 Republican senators, led by Kevin Cramer (R-ND), sent a letter to Chairman Carr urging "modernization of broadcast ownership regulations in a rapidly evolving media market" and calling for elimination of the national reach cap.

The senators argued: "Without modernized rules, broadcasters struggle to invest in journalism, maintain adequate newsroom staffing, and compete with unregulated global Big Tech competitors."

1-6. Opponents: "Monopoly and Local Journalism Concerns"

Colorado's Senator Michael Bennet and Representative Joe Neguse sent a letter to the FCC warning that "if this merger is approved, it would violate the national broadcast ownership cap and could have serious consequences for Colorado."

A petition launched by MoveOn Civic Action has gathered over 23,000 signatures, criticizing that "this deal has corporate corruption and government overreach written all over it — and everyday Americans are going to pay the price."

Cable and satellite operators have also expressed concerns. Grant Spellmeyer, President and CEO of America's Communications Association (ACA), warned: "We know exactly what will happen because of a major broadcaster consolidation — more blackouts and increased monthly bills."

1-7. The Jimmy Kimmel Incident: Shadow of Political Pressure

In September 2025, Nexstar made headlines by pre-empting 'Jimmy Kimmel Live!' on its ABC affiliates. This came after Kimmel commented that the MAGA movement was trying to exploit the attempted assassination of Charlie Kirk for political gain.

FCC Chairman Carr strongly criticized Kimmel's remarks on a conservative podcast, suggesting that ABC affiliates' broadcast licenses could be at risk if they didn't pull Kimmel's show. With the TEGNA deal pending, Nexstar's decision was widely interpreted as an attempt to curry favor with Chairman Carr.

1-8. 2026 Review Timeline

The FCC initiated its public comment period on December 1, 2025. Petitions to deny the merger were due by December 31, with oppositions to those petitions due by January 15 and replies due by January 26.

Nexstar is also in discussions with the Department of Justice (DOJ). The transaction is targeted to close in the second half of 2026, timing that coincides with the 2026 midterm elections — promising a significant boost in political advertising revenue upon completion.

Chapter 2: Sinclair-Scripps — The Acquisition Battle Continues

2-1. Sinclair's Aggressive Move

Shortly after the Nexstar-TEGNA deal was announced, Sinclair Broadcast Group, the second-largest U.S. broadcast group, made its own move. Sinclair acquired an 8.2% stake in E.W. Scripps and disclosed it had been in "constructive discussions for several months regarding a potential combination of the two companies."

In its SEC filing, Sinclair argued that "recent industry consolidation and intensifying competition" support the view that "further scale in the broadcast television industry is essential to address secular headwinds and compete effectively with larger-scale big-tech and big-media players."

2-2. Unsolicited Offer and Scripps' Rejection

On November 24, 2025, Sinclair announced an unsolicited offer to acquire all Scripps shares it doesn't already own for $7 per share ($2.72 cash + $4.28 stock). This represented a 200% premium to Scripps' 30-day volume-weighted average price as of November 6.

However, Scripps' board unanimously rejected Sinclair's offer on December 16, 2025. Scripps stated: "Following a careful review and evaluation in consultation with its financial and legal advisors, the board determined that Sinclair's offer is not in the best interests of the company and its shareholders."

2-3. Company Profiles

Sinclair Broadcast Group

Operates 185 TV stations in 85 markets

Owns Tennis Channel, Comet, Charge!, TBD, and The Nest

Known for conservative political leanings (2018 "must-run" commentary controversy)

E.W. Scripps

Headquartered in Cincinnati

Owns Scripps News and Court TV

Entertainment brands include ION, Bounce, Grit, and Laff

2-4. 2026 Outlook

Sinclair claims the deal "can be completed in a timely manner with limited select divestitures" under existing 39% rules. Though Scripps' board rejected the offer, it remains unclear whether Sinclair will give up. A higher offer or emergence of a third-party bidder cannot be ruled out in 2026.

Chapter 3: Cox Media Group — $4 Billion Premium Asset for Sale

3-1. Apollo's Exit Strategy

Private equity firm Apollo Global Management is exploring a sale of Cox Media Group. Apollo has retained Moelis & Co. to explore potential options, with Nexstar and Gray Media reportedly showing interest in some or all of Cox Media's TV assets.

3-2. Cox Media Group Profile

Cox Media Group operates 50 radio stations in 10 markets and 15 TV brands in 9 markets.

Key TV Stations:

WSB-TV (ABC) - Atlanta: Flagship station, #1 in market

KIRO-TV (CBS) - Seattle

WFXT-TV (FOX) - Boston

WPXI-TV (NBC) - Pittsburgh

WFTV-TV (ABC) - Orlando

WSOC-TV (ABC) - Charlotte

3-3. Acquisition Competition Outlook

Apollo is reportedly seeking a buyer for the entire operation rather than splitting radio and TV assets. Gray Media has expressed interest in acquiring WSB-TV, Atlanta's top station, which would give it a duopoly in its home market if approved.

Chapter 4: Gray Media — Leading the Duopoly Strategy

4-1. Aggressive Acquisition Spree

No broadcaster has pursued the duopoly strategy (owning two stations in a single market) as aggressively as Gray Media. In recent weeks, Gray has announced a series of swift acquisitions and exchanges that look more like a master plan than opportunistic buying.

Gray's Recent Major Deals:

$80 million acquisition of TV stations from Block Communications

Secured rare Big Four duopoly in Louisville (Fox & NBC affiliates + The CW)

Expansion into Midwest markets including Decatur (IL) and Lima (OH)

4-2. Gray Media Profile

Gray operates a portfolio of stations in 113 markets, reaching approximately 37% of U.S. TV households. Headquartered in Atlanta, the company is particularly interested in expanding in its home market.

4-3. The Two Sides of Duopolies

The key advantage of duopolies is resource sharing between stations. It costs less for one owner to operate two stations than for two separate owners. This can include reduced real estate costs or smaller newsroom staff.

Sean McLaughlin, VP at Graham Media Group, noted: "The interesting question is how much consolidation happens in newsrooms. Everyone starts with the best intentions, but financial realities will continue to challenge them over time."

Industry analysts suggest Gray's current triopoly in Lafayette, Louisiana, may soon become the blueprint rather than the exception. If the ownership cap is lifted, today's two-station markets could easily become three, four, or even five-station fiefdoms.

Chapter 5: Regulatory Environment — Trump vs. Carr, Unexpected Tension

5-1. FCC Chairman Carr Pushes for Deregulation

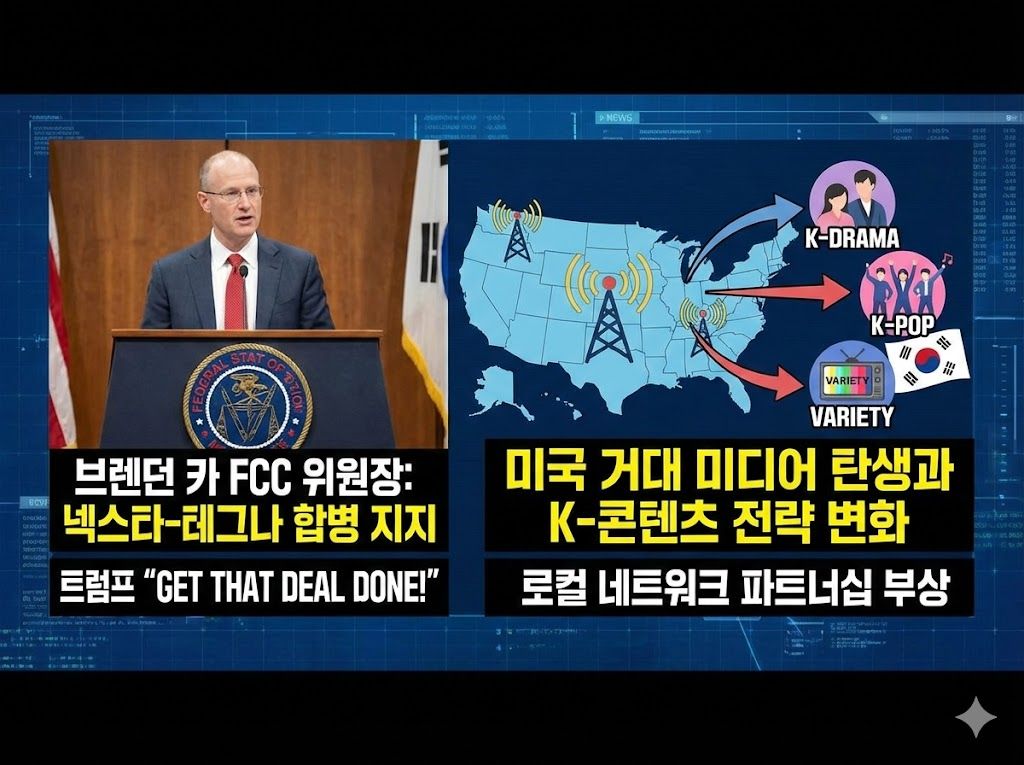

FCC Chairman Brendan Carr is pushing to eliminate the national TV ownership cap introduced in the 1940s. Carr has criticized the regulation as "outdated" and "artificial," arguing it shackles local broadcasters from competing fairly with Big Tech.

The National Association of Broadcasters (NAB) strongly supports Carr's position, stating: "Ownership modernization is not about making national networks bigger; it's about empowering local broadcasters that provide trusted news, emergency information, and local journalism to their communities."

5-2. Trump's Surprise Opposition

On November 24, 2025, President Trump posted on Truth Social that he "would not be happy" if the FCC lifted the national ownership cap. This put him in direct opposition to his ally, FCC Chairman Carr.

Trump wrote: "If this would also allow the Radical Left Networks to 'enlarge,' I would not be happy. ABC & NBC, in particular, are a disaster. NO EXPANSION OF THE FAKE NEWS NETWORKS. If anything, make them SMALLER!"

5-3. Newsmax CEO's Opposition Logic

Newsmax CEO Chris Ruddy, a Trump confidant, strongly advocates maintaining the ownership cap. He argued: "Reagan understood that if left-leaning networks like ABC, NBC, CBS, or groups like today's Nexstar controlled all local stations and local news, Republicans would have little chance of winning state and federal elections."

5-4. Industry Confusion and 2026 Outlook

Industry observers have noted the contradiction in Trump's position. Currently, Fox's station group is the largest by FCC measurement at about 26% coverage, followed by CBS (Paramount) at 24%. ABC (Disney) and NBC (Comcast) are both at about 20%. None of these network-owned station groups are close to the ownership cap and would not be immediately affected by raising or eliminating it.

The FCC voted in September to begin a quadrennial review of several broadcast ownership rules and is currently seeking public comment. While Chairman Carr has consistently supported deregulation for local broadcasters, the Trump-Carr conflict has heightened uncertainty for the 2026 regulatory environment.

Chapter 6: Implications for the Korean Media Industry

The massive consolidation wave in the U.S. local TV broadcast industry offers important insights for Korean broadcasting and content companies competing in the global media market.

Implication 1: The Need for Economies of Scale Against Global Platforms

The core logic behind the Nexstar-TEGNA merger is "you can't compete with Big Tech without scale." Just as U.S. broadcasters are choosing consolidation to survive against global platforms like YouTube and Netflix, Korean broadcasters should consider alliance or consolidation strategies to strengthen their negotiating power in overseas markets.

Action Items:

Explore joint overseas content distribution platform among KBS, MBC, and SBS terrestrial broadcasters

Strengthen global OTT negotiating power through strategic alliances with CJ ENM, JTBC, and general programming channels

Enhance K-content export consortium functions and establish joint licensing framework

Implication 2: Strategic Approach to FAST Channel Global Expansion

The combined Nexstar-TEGNA entity with 265 stations will have a strong position for FAST channel expansion with its vast content library. Rather than operating individual FAST channels, Korean broadcasters should pursue joint platform or unified channel strategies to increase their negotiating power with global FAST platforms (Pluto TV, Tubi, Samsung TV Plus, etc.).

Action Items:

Push for unified K-content FAST channel brands (e.g., 'K-Drama Channel', 'K-Variety Channel')

Establish joint negotiation framework with global FAST platforms

Develop genre-specific FAST channel differentiation strategies

Implication 3: Rediscovering Global Competitiveness of Regional Content

The value of local news and regional programming is being reaffirmed in the U.S. CAR's Suhr emphasized "how owners run their stations" — ultimately a question about the value of localism and diversity. Korea should also move beyond Seoul-centric broadcast content production, strengthen regional MBC and local commercial broadcaster content capabilities, and leverage this as a differentiation factor in global markets.

Action Items:

Expand global distribution support programs for regional broadcast content

Brand regional specialties (Busan film, Daegu fashion, Jeonju food, etc.)

Build support systems connecting regional producers with global platforms

Implication 4: Proactive Response to Regulatory Changes

Just as FCC ownership deregulation triggered massive M&A in the U.S., Korean industry structure could change rapidly with Korea Communications Commission policy shifts. With ongoing discussions on Broadcasting Act amendments, media rep system reform, and OTT regulations, Korean media companies need to prepare proactively for regulatory changes.

Monitoring Points:

Broadcasting Act amendment discussions and ownership regulation changes

OTT regulation and support policy directions

Global media M&A trends and Korean market impact

Media rep system reform and advertising market structure changes

Implication 5: Political Risk Management in U.S. Market Entry

President Trump's surprise opposition creating uncertainty for multi-billion dollar M&A demonstrates how sensitive the media industry is to the political environment. As the Jimmy Kimmel incident shows, tensions between U.S. broadcast networks and local affiliates, and programming decisions under political pressure, can also affect Korean content distribution strategies in the U.S.

Risk Management Measures:

Build U.S. political environment and media policy monitoring systems

Diversify distribution channels to reduce dependence on specific partners

Strengthen pre-screening processes for potentially politically controversial content

Implication 6: Revenue Diversification and Advertising Market Response

U.S. broadcasters are looking to maximize political advertising and sports rights revenue through 2026 midterm elections, FIFA World Cup, Winter Olympics, and NBA games. Sinclair and Nexstar expect 2026 political ad revenue to match their 2022 midterm record of $333 million. Korean broadcasters also need strategies to strengthen digital advertising capabilities and leverage K-content viewership data to attract global advertisers.

Action Items:

Strengthen digital advertising capabilities and build programmatic ad platforms

Develop data-driven targeting advertising platforms

Develop K-content viewership data packages to attract global advertisers

Chapter 7: Transaction Summary

Chapter 8: Key Dates for 2026

Conclusion: 2026 — An Inflection Point for Global Broadcasting

In the new year of 2026, the great consolidation of the U.S. local TV broadcast industry goes beyond simple corporate M&A to pose fundamental questions about how traditional media will survive and evolve in the age of Big Tech.

Supporters argue that without economies of scale, broadcasters cannot compete with global platforms like YouTube and Netflix. Opponents worry that consolidation will harm the diversity of local journalism and give a handful of large corporations excessive influence over local public opinion.

Industry analysts note that "the current surge in duopolies is not the end point but the beginning." If ownership caps are lifted, today's two-station markets could easily become three, four, or even five-station fiefdoms.

The unexpected clash between President Trump and FCC Chairman Carr is poised to be the biggest variable for broadcast M&A in 2026. Whether the FCC will push forward with deregulation despite the President's opposition, or adjust its position to political realities, remains to be seen.

The Korean media industry should also watch these global trends closely and prepare strategic responses to strengthen K-content's global competitiveness. 2026 will be a pivotal year not only for the U.S. but also for the Korean media industry.

How will traditional media survive and evolve in the age of Big Tech? The answer to this question will gradually emerge throughout 2026.

Sources and References

Nexstar-TEGNA Merger

Nexstar Official Announcement

https://www.nexstar.tv/nexstar-media-group-inc-enters-into-definitive-agreement-to-acquire-tegna-inc-for-6-2-billion-in-accretive-transaction/

Nexstar FCC Filing

https://www.nexstar.tv/nexstar-seeks-approval-of-tegna-acquisition-from-federal-communications-commission/

FCC Public Comment - TheDesk

https://thedesk.net/2025/12/fcc-seeks-public-comment-on-nexstar-tegna-merger/

DOJ Discussions - TheDesk

https://thedesk.net/2025/12/nexstar-to-discuss-tegna-merger-with-doj-ceo-confirms/

Variety Coverage

https://variety.com/2025/tv/news/nexstar-fcc-tegna-acquisition-waiver-ownership-cap-rule-1236584991/

Poynter Analysis

https://www.poynter.org/business-work/2025/nexstar-tegna-fcc-ownership-rules-media-consolidation/

Axios Coverage

https://www.axios.com/2025/11/08/nexstar-tegna-merger-fcc-ownership-cap

Broadband Breakfast

https://broadbandbreakfast.com/fcc-opens-review-of-nexstar-tegna-merger-amid-39-cap-controversy/

Deadline Coverage

https://deadline.com/2025/08/nexstar-acquires-tegna-local-tv-merger-donald-trump-1236491712/

Opposition

Senator Bennet Official Release

https://www.bennet.senate.gov/2025/10/24/bennet-neguse-urge-fcc-to-reject-nexstar-media-tegna-merger/

Colorado Lawmakers Opposition - TheDesk

https://thedesk.net/2025/10/colorado-lawmakers-oppose-nexstar-tegna-merger/

MoveOn Petition - TheWrap

https://www.thewrap.com/nexstar-tegna-fcc-merger-moveon-petition/

Sinclair-Scripps

Sinclair Stake Acquisition - Poynter

https://www.poynter.org/business-work/2025/sinclair-scripps-takeover-bid-fcc-ownership-caps/

Sinclair Offer - Variety

https://variety.com/2025/tv/news/sinclair-bid-scripps-7-per-share-unsolicited-takeover-1236590893/

Scripps Rejection - Variety

https://variety.com/2025/tv/news/scripps-rejects-sinclair-unsolicited-acquisition-offer-1236610349/

Merger Talks - Variety

https://variety.com/2025/tv/news/sinclair-acquisition-talks-ew-scripps-1236583646/

Deadline Coverage

https://deadline.com/2025/11/sinclair-reveals-merger-talks-with-e-w-scripps-local-tv-1236620042/

Axios Coverage

https://www.axios.com/2025/11/17/sinclair-scripps-stake-acquisition-push

Axios - Sinclair Takeover Bid

https://www.axios.com/2025/11/24/sinclair-makes-full-takeover-bid-for-scripps

CNBC Analysis

https://www.cnbc.com/2025/12/02/broadcast-station-owners-consolidation-regulation-deal-structure.html

Cox Media Group & Gray Media

Apollo Sale Review - TheDesk

https://thedesk.net/2025/03/apollo-considers-selling-cox-media-group/

Bloomberg Report

https://www.bloomberg.com/news/articles/2025-03-21/apollo-exploring-sale-of-cox-media-broadcast-tv-stations

Radio Ink Report

https://radioink.com/2025/03/22/report-cox-media-group-owner-exploring-4b-sale/

Gray Media Expansion - AJC

https://www.ajc.com/business/2025/08/atlanta-tv-station-owner-wants-to-expand-a-looser-fcc-might-help/

Duopoly Analysis - TVREV

https://www.tvrev.com/news/broadcast-groups-duopolies-position-post-cap-expansion

Regulatory Environment

Trump Opposition - Axios

https://www.axios.com/2025/11/24/trump-opposes-broadcast-cap-lift-fcc

Deadline Coverage

https://deadline.com/2025/11/trump-fcc-ownership-cap-nexstar-1236626906/

NewscastStudio Report

https://www.newscaststudio.com/2025/11/24/trump-questions-fcc-ownership-cap-changes-as-nexstar-defends-merger-plans/

TV Technology Report

https://www.tvtechnology.com/news/president-trump-says-lifting-39-percent-station-ownership-cap-could-help-radical-left-fake-news-networks

Washington Examiner

https://www.washingtonexaminer.com/news/white-house/3897451/fcc-broadcast-ownership-cap-review/

Senator Letter - Cramer

https://www.cramer.senate.gov/news/press-releases/letter-calls-on-fcc-chairman-brendan-carr-to-modernize-federal-broadcast-ownership-rules

Fox Business Analysis

https://www.foxbusiness.com/fox-news-opinion/mike-davis-how-fcc-can-help-president-trump-rebalance-media

This article is based on original reporting by Ted Hearn of Broadband Breakfast,

edited by K-EnterTech Hub with added implications for the Korean media industry.

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)