Roku Declares Long-form Wins in the Age of AI and Short-form

Roku Declares Long-form Wins in the Age of AI and Short-form

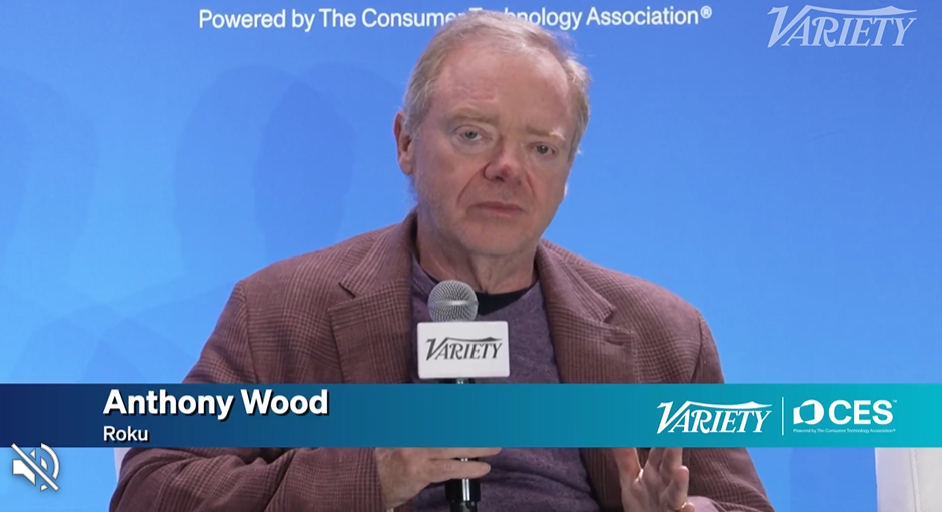

Record Q4 earnings in hand, CEO Anthony Wood bets AI will expand long-form consumption and unlock $600B in SMB advertising

Roku reported all-time record platform revenue, adjusted EBITDA, and net income for Q4 2025 — then its CEO delivered a counterintuitive read on AI’s impact on streaming. Where the industry fears that generative AI will fuel a short-form surge and erode traditional TV viewership, Anthony Wood argued the opposite: falling production costs will drive more long-form consumption, and AI will throw open the doors to a $600 billion SMB advertising market that CTV has never been able to reach. With record earnings as evidence, this report examines Roku’s strategy at the intersection of AI, short-form disruption, and platform monetization.

1. The Numbers Speak First — Record Q4 2025 Results

Roku’s Q4 2025 earnings, released February 13, beat Wall Street expectations on every major metric. Platform revenue, adjusted EBITDA, and net income all hit all-time quarterly records simultaneously — a clean validation of Roku’s transformation from a streaming device maker into a software-driven platform business built on advertising and subscriptions.

■ Key Financial Metrics

Source: Roku Q4 2025 Earnings Release (Feb. 13, 2026) / K-EnterTech Hub

The most important story in these numbers is the structural shift in the revenue mix. At 52.8% gross margin in Q4, Roku’s platform business now generates software-grade profitability. Device revenue grew just 3% year-over-year — it is no longer the growth engine. The platform is.

Roku had set a target in 2024 to reach adjusted EBITDA break-even by end of 2025. It hit that milestone a full year ahead of schedule, freeing up capital to accelerate platform monetization investment — capital that drove the record results now on the books.

On the subscription side, Q4 was Roku’s biggest quarter ever for premium subscription net adds. The additions of HBO Max, the acquisition of virtual MVPD Frndly TV, and the holiday promotional season all converged at once. The Roku Experience now accounts for more than half of all subscription sign-ups on the platform. Roku ended 2025 with 90 million streaming households and is targeting 100 million in 2026.

2. The Earnings Call Debate — “AI Is on the Side of Long-form”

On the day Roku posted its record numbers, the Q4 earnings call quickly shifted toward a bigger question: what does generative AI mean for streaming? Analysts pressed hard on the dominant industry fear — that as AI slashes the cost of video production, short-form content will flood the market and consumers will spend even more time on TikTok and YouTube Shorts. Netflix had recently signaled its intention to add short-form and UGC to its platform, amplifying the anxiety.

Anthony Wood pushed back with a counterargument that few in the room were expecting.

“As long-form content costs come down, that’s going to grow engagement on our platform and we monetize engagement. That’s basically our business model. AI reducing long-form costs is a big opportunity for us.”

— Anthony Wood, CEO — Q4 2025 Earnings Call (Feb. 13, 2026)

The logic is clean: lower production costs mean more long-form content gets made, which means more diverse content to attract more viewers, who then spend more time in front of a TV screen. Roku monetizes that screen time through advertising and subscriptions. The very trend the industry fears — AI-enabled content proliferation — becomes a tailwind for Roku rather than a headwind.

■ AI’s Impact on Streaming — Industry Fears vs. Roku’s Outlook

Source: Q4 2025 Earnings Call · CES 2026 remarks / K-EnterTech Hub

3. Short-form as Supplement, Not Strategy — Roku’s Deliberate Choice

Roku’s position on short-form is neither rejection nor pursuit. It is deliberate restraint. Roku President of Media Charlie Collier was explicit on the earnings call: short-form content will be introduced against specific, well-understood audience segments and placed in context — not deployed platform-wide.

The most immediate opportunity Collier identified is the Sports Zone, where league-partnership clips, highlights, and commentary can deliver short-form content to sports viewers in a natural, high-context environment. On brand safety, he drew a clear line: premium content will remain “the majority of what we do in the foreseeable future,” protecting Roku’s premium advertiser relationships.

■ Short-form Strategy Positioning: Roku vs. Competitors

Source: Company disclosures / K-EnterTech Hub

4. AI Opens a $600 Billion Door — The SMB Advertising Revolution

If the long-form argument is Roku’s most strategic AI bet, the SMB advertising play is its most immediate. Wood said on the earnings call that AI is “if not more important” on the advertising side than on the content side.

TV advertising has historically been the exclusive domain of large brands. High video production costs, agency fees, and minimum spend requirements effectively locked small and medium-sized businesses out of television entirely. AI is dismantling those barriers through Roku Ads Manager — a self-serve platform that lets businesses handle targeting, creative, and campaign execution without an agency.

“That’s an entire new segment in the ad business that was not accessible to TV platforms before, but is now because of AI. The easier it is to create video ads, the larger the number of advertisers that can advertise on a TV platform.” — Anthony Wood, CEO

The addressable market: an estimated $600 billion in SMB advertising spend that has never had meaningful access to television. On the supply side, 2025 also saw Roku deepen its infrastructure for large-brand advertisers: CTV inventory integration with FreeWheel’s Streaming Hub, expanded DSP partnerships, and enhanced measurement capabilities. Large-brand supply strengthening and SMB demand opening simultaneously — a dual-engine growth structure.

■ Roku AI Applications — Current Deployment

Source: Q4 2025 Earnings Call · Roku Shareholder Letter · CES 2026 / K-EnterTech Hub

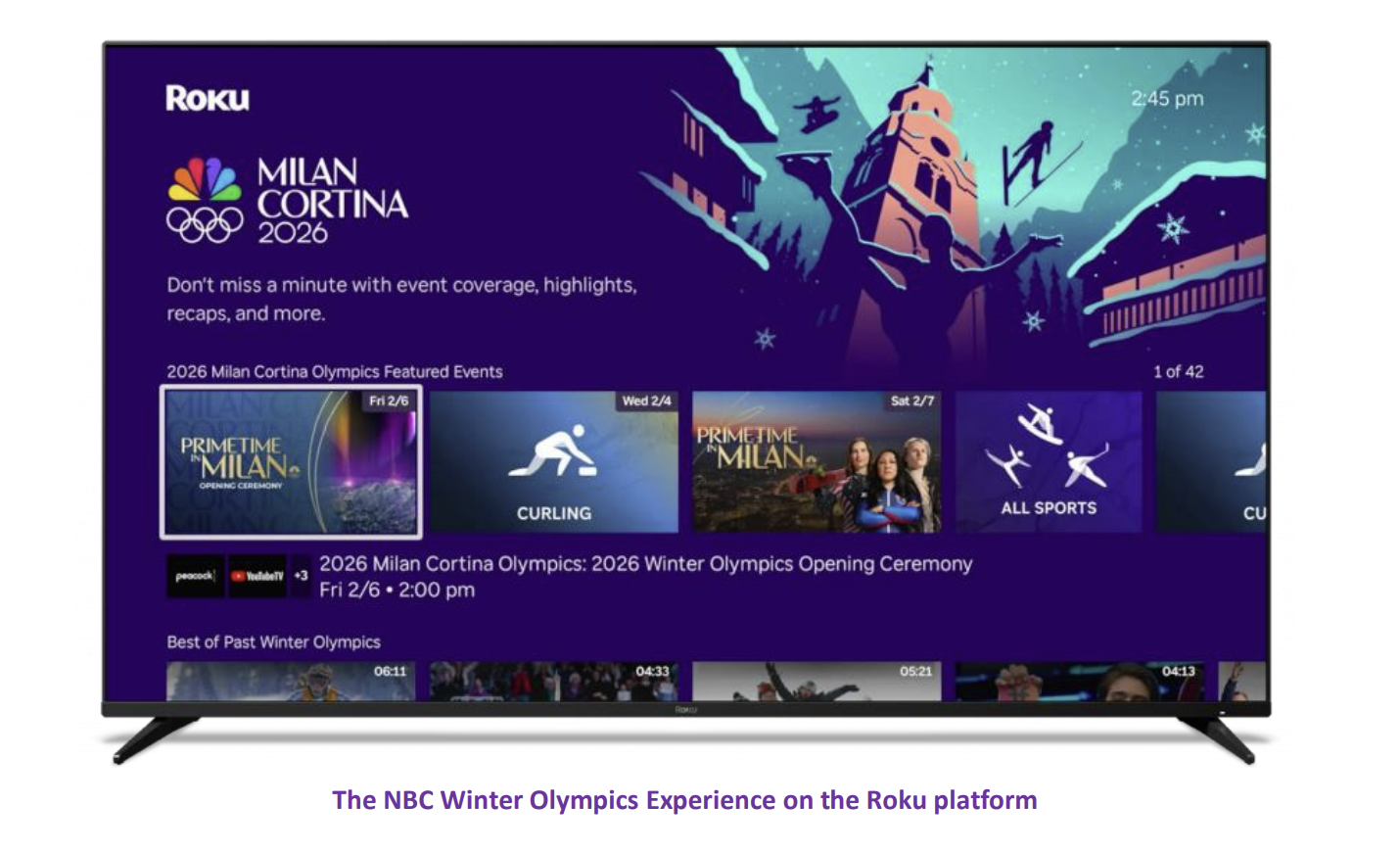

5. Looking Back — CES 2026 as the Blueprint

The AI arguments that dominated Roku’s February earnings call were not improvised. They had been laid out in detail a month earlier, at the Variety Entertainment Summit during CES 2026 in Las Vegas — where Roku founder and CEO Anthony Wood sat down with Variety co-editor-in-chief Cynthia Littleton for a wide-ranging conversation on the future of streaming and AI.

Roku CEO Anthony Wood (right) in conversation with Variety’s Cynthia Littleton at the Variety Entertainment Summit, CES 2026, Las Vegas — January 7, 2026.

The most-quoted line from that conversation: “I predict within the next three years, we’ll see the first 100% AI-generated hit movie.” The statement generated headlines, but its significance is less about the specific prediction than about the underlying assumption — that the cost structure of content production is about to change fundamentally, and Roku is positioning to benefit.

“I think people underestimate how dramatic that’s going to be. Obviously, I don’t think people are going to get replaced — humans are still the creative force behind hit shows. But the cost is going to come down dramatically, and that’s going to change a lot of companies’ business models. I’m focused on how we take advantage of that.” — Anthony Wood, CEO — CES 2026 (Jan. 7, 2026)

At CES, Wood also outlined the three-bucket framework for Roku’s AI approach: operational efficiency to lower costs relative to competitors; product integration to upgrade recommendations and ad targeting from legacy machine learning to generative AI; and content cost reduction as the structural tailwind that grows platform engagement over time.

“I have no idea if there’s an investment bubble, but I know that AI is going to be huge — and it already is,” Wood said. That statement, paired with record Q4 results reported five weeks later, is the clearest possible articulation of Roku’s strategic posture: AI is not a risk to be managed, it is a force to be harnessed.

6. Implications for Korean Content, Advertising, and Media Tech

Roku’s earnings and strategy signals send both opportunity and urgency to Korean companies targeting the U.S. CTV market. As AI and short-form reshape the streaming ecosystem, positioning decisions made now will determine competitive standing three to five years out.

Source: K-EnterTech Hub Analysis

Timing is the critical variable. Roku is actively expanding partner content exposure across its key UI surfaces. Launching a K-content FAST channel now, while the platform is aggressively promoting partner content, is a fundamentally different proposition than entering a crowded, mature market later.

AI production tool integration is no longer a medium-term agenda item. When the cost compression Wood predicts materializes, the productivity gap between studios that have embedded AI workflows and those that have not will widen rapidly. Korean content already has proven global demand — studios that pair that demand with AI-enabled production capacity will scale faster and at lower cost.

The SMB advertising opening is arguably the most underappreciated opportunity for Korean brands in the U.S. market. Roku Ads Manager offers K-beauty, K-food, and K-entertainment companies access to 90 million U.S. streaming households at price points that were simply not available on television before. The entry window for first-mover advantage on this channel is now.

Conclusion: Record Results, and a Bigger Bet

Roku’s Q4 2025 results — record platform revenue, record EBITDA, record net income — arrived alongside a clear strategic declaration: in the age of AI and short-form disruption, Roku is betting on long-form. AI lowers content production costs, which expands long-form consumption, which grows CTV engagement, which Roku monetizes. AI automates ad creation, which opens the $600 billion SMB market to television advertising for the first time.

Both bets carry risk. If short-form proves powerful enough to displace TV viewing rather than merely supplement it, a long-form-first strategy becomes a liability. But the evidence on the table — 90 million households, 40% of U.S. streaming flows, record subscription net adds — suggests the thesis is holding.

For Korean content, advertising, and media tech companies, Roku’s evolving ecosystem is both a target and a toolkit. The platform has 90 million households, a proven subscription conversion engine, and an AI-powered advertising platform newly open to businesses of every size. The question is not whether this market matters. The question is how quickly Korean companies move to claim their position within it.

![[고삼석의 인사이트]한국과 말레이시아의 콘텐츠 산업 공진화 전략](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/ce8vbo_202602170357.jpeg)

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)