Hollywood’s Biggest M&A Battle Enters Final Round

EXCLUSIVE | M&A · STREAMING · ENTERTAINMENT TECH

Hollywood’s Biggest M&A Battle Enters Final Round

WBD sets March 20 shareholder vote on $83B Netflix merger,

grants Ellisons a 7-day window for a final counterbid. $83B vs $108B—who takes Hollywood?

Warner Bros. Discovery (WBD) on Monday set March 20 as the date for a special shareholder meeting to vote on its $83 billion all-cash merger with Netflix, while simultaneously opening a seven-day negotiation window for Paramount Skydance (PSKY)—led by Oracle co-founder Larry Ellison’s son David Ellison—to submit a binding counteroffer above $31 per share.

The WBD board unanimously reaffirmed its support for the Netflix deal but left the door ajar: if PSKY delivers a definitively superior proposal by February 23, the board will reconsider. Netflix’s $27.75 per share ($83B enterprise value) versus PSKY’s indicated $31-plus ($108B)—the largest acquisition battle in Hollywood history has effectively entered its championship round.

A Spin-Off Strategy That Sparked a Bidding War

The genesis of this M&A saga lies in WBD’s structural overhaul. Bruce Campbell, WBD’s Chief Revenue & Strategy Officer, testified before the Senate Judiciary Committee’s Antitrust Subcommittee on February 3 that the company had concluded—following the 2022 merger of AT&T’s WarnerMedia with Discovery—that separating its streaming/studio business from its linear networks would best position both units for growth.

In June 2025, WBD officially announced the split into a streaming/studio entity (“Warner Bros.”—encompassing WB Television, Motion Picture Group, DC Studios, HBO/HBO Max, WB Games, and the Burbank/Leavesden studio lots) and a linear networks entity (“Discovery Global”—including CNN, TNT Sports, Discovery Channel, HGTV, Food Network, and Discovery+). Campbell told senators the separation would allow each company to “pursue opportunities to strengthen its competitive position more quickly and aggressively.”

Paradoxically, the spin-off announcement attracted outside suitors. In September 2025, David Ellison personally visited WBD CEO David Zaslav at his home to propose an acquisition at $19 per share (60% cash, 40% stock). That opening salvo triggered a fierce multi-party bidding contest involving PSKY, Netflix, and at least one additional undisclosed party. By December, Netflix had effectively secured pole position with a $27.75 all-cash merger agreement.

The Structural Shift in the Streaming Wars

Campbell’s Senate testimony provided critical data framing the industrial context of this deal. Between 2021 and 2025, U.S. streaming viewership surged 71%, with streaming for the first time surpassing broadcast and cable combined to account for roughly 50% of all TV viewing (per Nielsen). The number of streaming platforms tracked by Nielsen more than doubled over the same period.

Platform proliferation has driven consumer fatigue. Some 46% of streaming viewers reported difficulty finding desired content due to service overload, while the average U.S. household now subscribes to four streaming services at a combined $69 per month. YouTube has emerged as the “new TV,” with long-form content (30+ minutes) growing from 65% to 73% of its viewing between 2023 and 2024. Americans spend an average of more than two hours daily on short-form video platforms such as TikTok and Instagram Reels.

In this environment, HBO Max commands just 1.1% of total TV viewing. Campbell testified that consumers perceive HBO Max not as a Netflix substitute but as a premium add-on. Approximately 80% of HBO Max subscribers also subscribe to Netflix, suggesting the two services occupy complementary rather than competitive positions. This data forms the cornerstone of WBD’s argument that a Netflix–WB combination is fundamentally vertical in nature.

Netflix vs. PSKY: Two Bids, Two Visions

The structural differences between the two proposals are significant.

Netflix’s chief advantage is execution certainty: investment-grade credit and over $8 billion in annual free cash flow eliminate financing risk entirely. PSKY offers a 12% price premium but carries execution uncertainty tied to its complex capital structure involving Larry Ellison’s personal fortune, a bank consortium, and Gulf sovereign wealth funds.

Inside the 7-Day Window: A Phone Call That Reopened the Deal

The immediate catalyst for reopening negotiations came after PSKY’s February 10 revised proposal. A senior representative of PSKY’s financial advisor verbally communicated to a WBD board member that PSKY was “willing to pay $31 and that this was not its final offer.” The figure represents roughly a 12% premium over Netflix’s $27.75 per share.

Netflix responded by granting WBD a “limited waiver” under its merger agreement, valid for just seven days through February 23. In a statement, Netflix said it had granted the waiver “to fully and finally resolve” the disruption caused by PSKY, emphasizing that “the only signed, board-recommended agreement is ours.” Crucially, Netflix retains matching rights under the merger agreement—if PSKY tables a superior price, Netflix can raise its own bid in response.

Business Insider’s Peter Kafka characterized the move as “theoretically reopening a deal that was concluded last December.” WBD, in a letter from CEO David Zaslav and Board Chair De Piazza to PSKY, transmitted an executable term sheet demanding resolution of key outstanding issues, including refinancing costs, bridge loan terms, MAE definitions, and equity cure commitments.

Ellison’s “Billions of Dollars” in Sweeteners

PSKY’s February 10 revised offer layered significant financial enhancements onto its base $30 all-cash proposal. A ticking fee of $0.25 per share per quarter (approximately $650 million) kicks in if the deal isn’t completed by year-end 2026. PSKY agreed to absorb the $2.8 billion breakup fee WBD would owe Netflix, backstop $1.5 billion in refinancing costs, and pay a $5.8 billion reverse termination fee plus separate refinancing reimbursement if regulators block the deal.

The bid is backed by $43.6 billion in equity commitments from Larry Ellison—one of the world’s wealthiest individuals—and RedBird Capital Partners, $54 billion in debt financing from Bank of America, Citigroup, and Apollo Global Management, and participation from sovereign wealth funds of Saudi Arabia, Qatar, and Abu Dhabi. Ellison stated that the consortium was “investing billions of dollars to provide shareholders with certainty of value, a clear regulatory path, and protection against market volatility.”

The Regulatory Battleground: ‘Vertical’ vs. ‘Five Horizontal Overlaps’

Netflix, in a February 17 statement, characterized its deal as “a largely vertical merger of complementary assets” with “a clear path to timely regulatory approval.” The logic: Netflix’s streaming distribution platform combining with WB’s studio production capabilities constitutes a vertical integration, not a merger of direct competitors. Netflix and WBD have each filed HSR notifications and are engaging “cooperatively and constructively” with the U.S. DOJ, state attorneys general, the European Commission, and the UK’s CMA.

By contrast, Netflix attacked the PSKY proposal as creating severe horizontal overlaps across five domains: consolidation of two of Hollywood’s five major studios (Paramount + Warner Bros.), two major theatrical distributors, two major TV studios, two major news networks (CBS News + CNN), and two major sports broadcasters (CBS Sports + TNT Sports).

Financial risk compounds the regulatory challenge. A PSKY–WBD combination would produce approximately $84 billion in pro forma debt at an estimated leverage ratio of roughly 7x (Debt / 2026 LTM EBITDA)—described by Netflix as “the largest leveraged buyout in history.” Achieving PSKY’s stated deleveraging targets would require approximately $16 billion in cost reductions, more than 2.5 times PSKY’s publicly announced $6 billion-plus synergy figure. Netflix declared that a business plan dependent on $16 billion in cost cuts was “a clear red flag for regulators, policymakers, union leaders, and creators.”

National security adds another layer. Netflix flagged PSKY’s Middle Eastern funding sources as raising “serious national security concerns,” with CFIUS, Team Telecom, and European authorities expected to scrutinize the Gulf investors. Politically, Republicans have criticized Netflix as “too woke” while Democrats have raised concerns about industry consolidation—ensuring neither deal will sail through unopposed. PSKY, meanwhile, hired Rene Augustine, a former Trump-era DOJ antitrust deputy, as Senior Vice President of Global Public Policy, signaling an effort to leverage political connections.

Timeline and Three Scenarios

Scenario A—Bidding war escalation. PSKY submits a binding offer above $31. WBD’s board deems it “superior.” Netflix exercises matching rights. Both sides raise bids, potentially pushing final price well above $31.

Scenario B—Netflix prevails. PSKY’s offer falls short or talks collapse. The March 20 vote approves the Netflix deal. PSKY may attempt a proxy fight, but its prospects are limited without board support.

Scenario C—PSKY upset. PSKY tables an overwhelming offer; Netflix declines to match. The WBD–PSKY merger proceeds, but regulatory uncertainty—given horizontal overlaps and national security concerns—intensifies significantly.

Analysts currently view the landscape as modestly favoring Netflix. Guggenheim Securities’ Michael Morris called the WBD bid outcome “a key sentiment variable and appreciation limiter” for Netflix stock over the next three months. MoffettNathanson’s Robert Fishman echoed the view, noting that a Netflix share price recovery is unlikely while the bidding war continues. WBD shares, up roughly 170% over the past year, trade near $28—approaching Netflix’s $27.75 offer—suggesting the market is pricing in some probability of a higher PSKY bid.

What It Means for K-Content and Global Entertainment

■ If Netflix–WB goes through

A combined Netflix–Warner Bros. would marry the world’s largest streaming platform with Hollywood’s premier franchise IP (DC, Harry Potter, Lord of the Rings) and HBO’s celebrated original library. Netflix’s in-house IP pipeline would expand dramatically, potentially triggering a recalibration of its content sourcing from external markets, including South Korea.

Netflix currently invests hundreds of billions of won annually in K-content, making Korea its second-largest production hub after the United States. However, given K-content’s proven track record in driving global subscriber growth—the Squid Game franchise being the marquee example—an outright investment reduction is less likely than a strategic shift: from exclusive originals toward co-productions, IP-based expansions, and franchise development.

■ If PSKY acquires WBD

A PSKY victory would create a media conglomerate spanning CBS, Paramount, HBO Max, and Discovery—making large-scale restructuring inevitable. The $16 billion cost-reduction target implies a wholesale renegotiation of content licensing agreements, potentially reopening existing K-content supply deals. At the same time, the enlarged Paramount+ platform would need Asian content to fuel growth, creating new partnership opportunities for Korean producers.

■ Entertainment tech ripple effects

A Netflix–WB combination would fuse Netflix’s recommendation algorithms, AI-powered dubbing and subtitling, and interactive storytelling capabilities with WB’s physical production infrastructure and WB Games’ interactive entertainment assets, accelerating tech integration across the entire content value chain. Under a PSKY scenario, Oracle’s cloud infrastructure and AI technology could reshape the entertainment tech stack entirely. Gulf sovereign wealth fund participation opens a direct pipeline between Hollywood and Middle Eastern entertainment mega-projects—NEOM, Qatar Media City—creating new market entry paths for Korean entertainment tech companies.

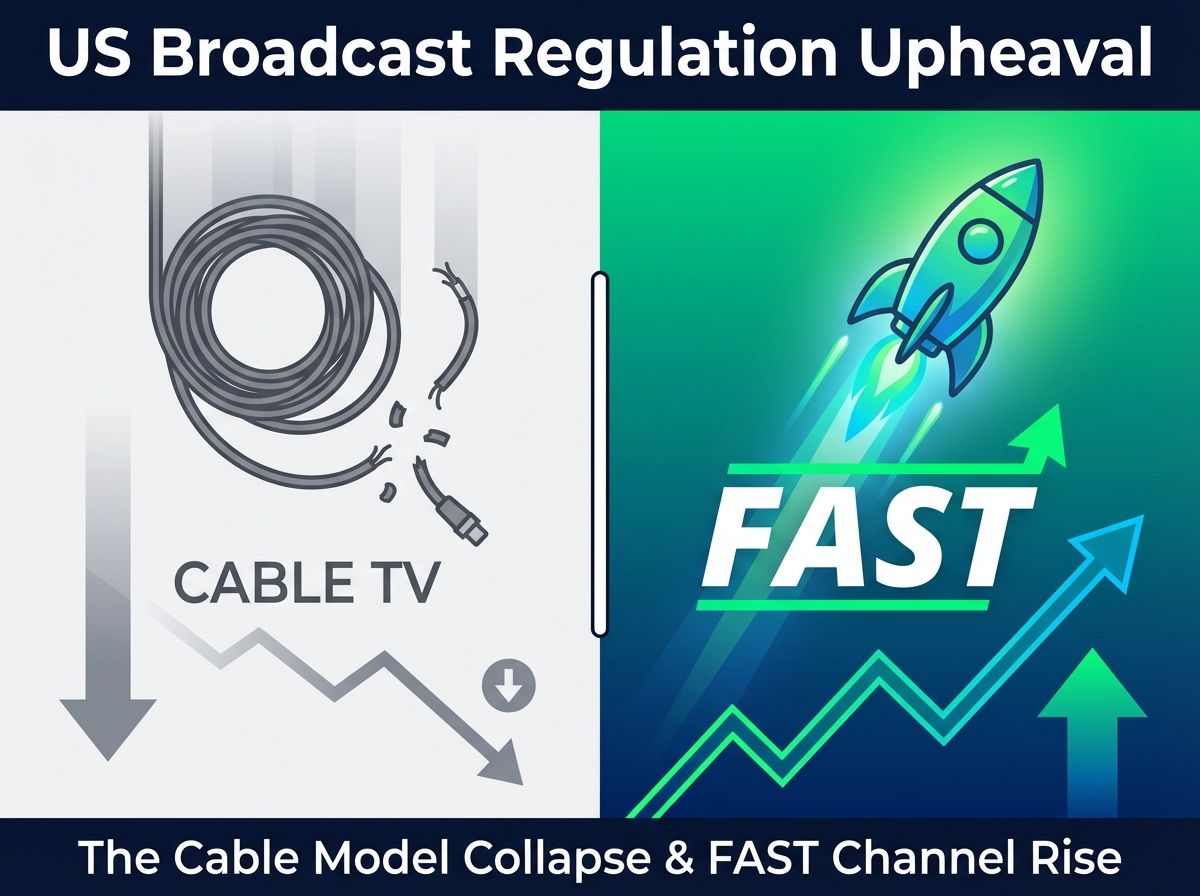

■ FAST channel market restructuring

Regardless of which side wins, this M&A will directly impact the FAST (Free Ad-Supported Streaming TV) market. If the Netflix deal closes, Discovery Global’s spin-off will likely accelerate its pivot to FAST channels as a survival strategy. In the global FAST market—projected to grow from $5.8 billion in 2025 to $10.6 billion by 2030—Discovery Global’s vast library flooding into FAST will intensify competition with K-content FAST channels, but simultaneously drive demand for differentiated content such as K-drama, K-entertainment, and K-documentary programming.

■ Strategic imperatives for Korean entertainment

Korean production companies and entertainment tech firms need to prepare multiple strategic options applicable regardless of this deal’s outcome: global franchising of Korean IP (webtoon → drama → game → theme park), strengthened multi-platform distribution capabilities, competitive advantages in AI and virtual production technologies, and direct-to-consumer global distribution through FAST channels. Korea’s government and industry have already launched pilot programs combining AI dubbing, AI localization, and FAST channels to distribute K-content across more than 20 countries, positioning the nation as Asia’s next FAST hub.

Not ‘Who Buys Hollywood’—But Where AI-Era Platform Power Consolidates

This battle over WBD transcends a mere content-and-platform merger. If Netflix absorbs WBD, its vast IP library—DC, Harry Potter, HBO—becomes fuel for AI-driven personalization, generative advertising and trailer production, and production workflow optimization, creating a content-plus-data-plus-AI superplatform. If the PSKY–Gulf capital axis prevails, the combination of sovereign wealth fund AI and cloud investment portfolios with Hollywood studio assets could spawn an entirely new AI-entertainment hub anchored in the Middle East.

The seven-day negotiation window through February 23 and the March 20 shareholder vote—the next month will determine the global media power map. For K-content companies, the message is clear: this is not a change to watch from the sidelines. Those who position themselves now at the intersection of AI localization, FAST distribution, and fandom business models—maintaining multi-track strategies that treat both the Netflix–Warner axis and the PSKY–Gulf axis as potential partners—will be the ones writing the next chapter of the global entertainment story.

Sources

1. Variety, “Warner Bros. Discovery Agrees to Engage With Paramount in Sales Talks” (Todd Spangler, Feb. 17, 2026)

2. The Hollywood Reporter, “Warner Bros. Discovery Sets Date for Netflix Deal Vote” (Alex Weprin & Georg Szalai, Feb. 17, 2026)

3. Business Insider, “Larry and David Ellison are getting a chance to break up the Netflix/WBD deal” (Peter Kafka, Feb. 17, 2026)

4. CNBC, “Netflix grants Warner Bros. Discovery 7-day waiver to reopen deal talks” (Feb. 17, 2026)

5. WBD Press Release, “Warner Bros. Discovery Sets Special Meeting Date of March 20, 2026” (Feb. 17, 2026)

6. Statement of Bruce Campbell, CRO, WBD, U.S. Senate Antitrust Subcommittee (Feb. 3, 2026)

7. Variety, “Paramount Skydance Says It Will Pay WBD an Extra $650M per Quarter” (Feb. 10, 2026)

8. Bloomberg, “Warner Bros. Weighs Reopening Sale Negotiations With Paramount” (Feb. 15, 2026)

© 2026 K-EnterTech Hub. This article is based on publicly available sources and does not constitute investment advice.

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)