The King of Cable Goes Podcast

K-ENTERTECH HUB · MEDIA INDUSTRY ANALYSIS · FEBRUARY 17, 2026

Twilight of Cable, Dawn of Podcasts

The king of cable news for 30 years packed up his microphone and moved to his Florida home. The cord-cutting tsunami, the podcast surge, the FAST sprint — and where K-content stands.

K-EnterTech Hub Media Industry Analysis Team · February 17, 2026

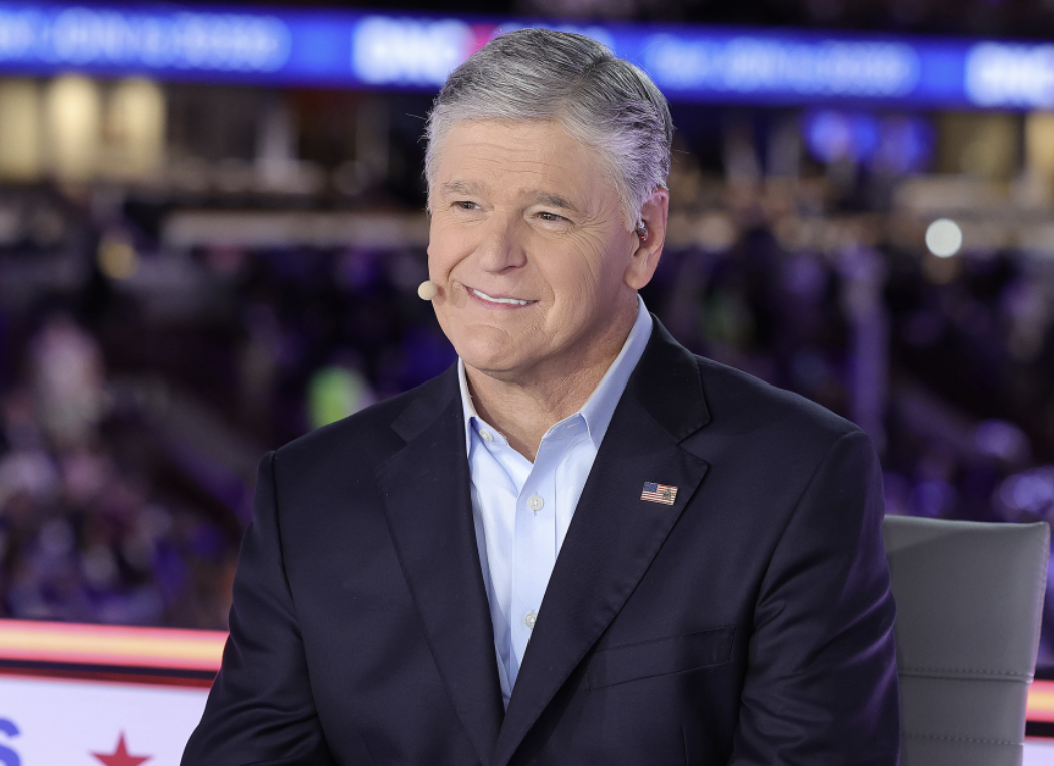

On February 17, 2026, a press release distributed by Fox News Media captured the attention of the global media industry. Sean Hannity — a cable news anchor who had anchored prime time since Fox News launched in 1996, making him the longest-running host in cable news history — had announced his move to podcasting. He reached 3.2 million average annual viewers in 2025 and 20 million weekly listeners across 750 radio stations. The thickest pillar of the cable news ecosystem had leaned decisively toward a digital platform.

The symbolism is unmistakable. In a U.S. media market where pay-TV subscriber churn has passed a critical threshold, even cable news anchors — the last bastion of traditional broadcasting — are accelerating their digital transitions to diversify revenue.

Fox News's vertical integration of its podcast ecosystem, CNN and MSNBC's pivot to anchor-branded personal channels, Netflix's partnership with iHeartMedia for video podcasting — all of this rests on a single structural reality: podcasting and FAST (Free Ad-Supported Streaming TV) are expanding at exactly the rate cable TV is contracting. Using Hannity's podcast launch as an inflection point, this report analyzes the structural shifts in the global media market with data and draws out the strategic implications for the K-content industry.

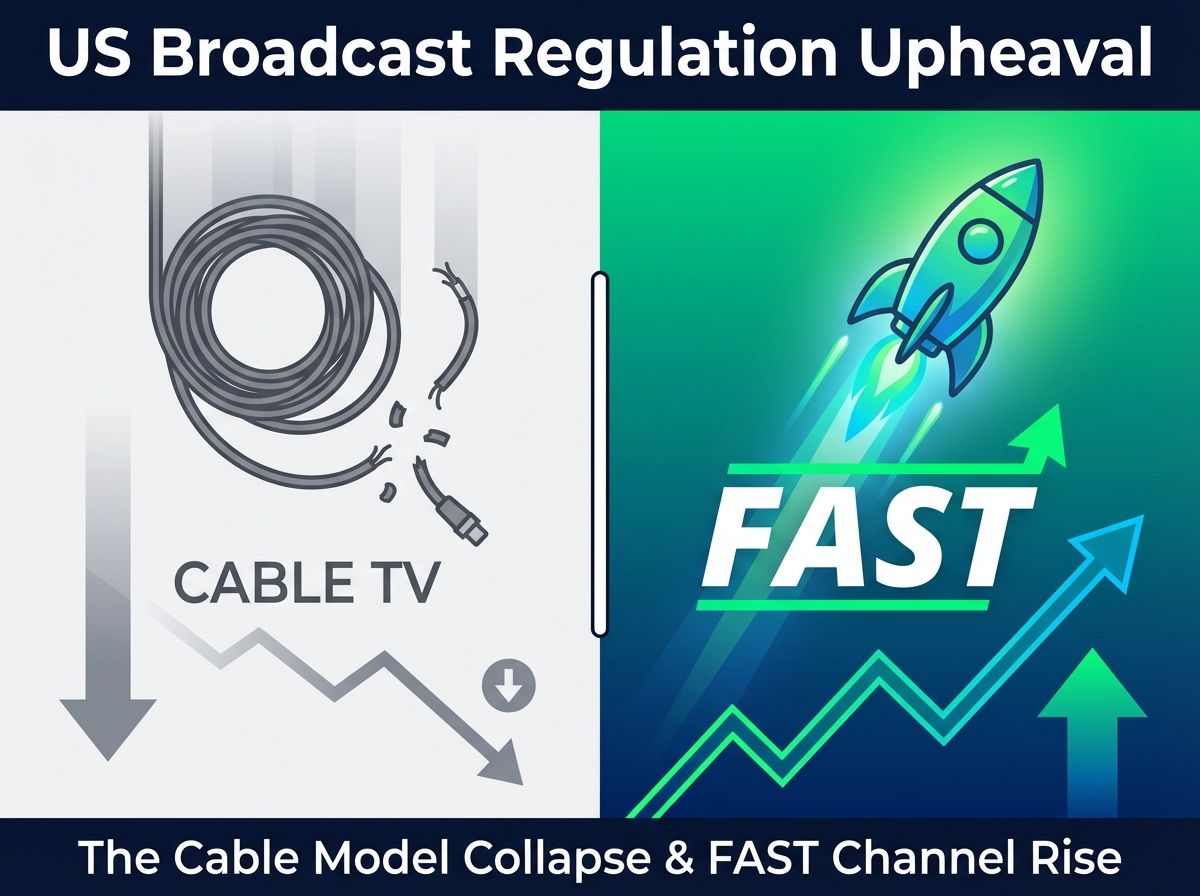

1. THE STRUCTURAL COLLAPSE OF CABLE TV

The twilight of U.S. cable TV is an ongoing present-tense story. In a Pew Research Center survey of approximately 9,400 adults conducted in April 2025, 83% reported using a streaming service, while only 36% said they subscribed to cable or satellite TV — in a country where cable penetration was 88% just over a decade ago.

According to eMarketer, U.S. cord-cutting households reached 77.2 million in 2025 — double the 37.3 million of 2018 in just seven years. Traditional cable TV households shrank from 90.3 million to 69 million over the same period. By 2026, cord-cutting households are projected to exceed 80.7 million, fully surpassing traditional pay-TV subscribers.

Financial damage has become visible. Comcast's earnings release on January 29, 2026, revealed a loss of 1.15 million TV subscribers in the full year 2025 — roughly 3,500 per day. Across the industry, pay-TV revenue has shriveled from a $100 billion peak in 2017 to $84.3 billion in 2024 (Statista). Pay-TV advertising revenue is forecast to decline further, from $62.3 billion in 2022 to $53.1 billion by 2027.

Sources: eMarketer, Cable Compare, Softonic (2025). 2026 figures are eMarketer projections.

Nielsen's May 2025 Gauge data showed the transition trend precisely. Streaming captured 44.8% of total U.S. TV viewing, surpassing the combined share of cable (24.1%) and broadcast (20.1%) for the first time. Free streaming services like Tubi and Pluto TV collectively commanded more viewing time than any single broadcast network.

Source: Nielsen Gauge, Sep 2023 / May 2025. May 2025 marks the first time streaming exceeded cable + broadcast combined.

2. THE PODCAST MARKET: SCALE AND VELOCITY

The space vacated by cable news is being rapidly filled by streaming services — but podcasting's growth is equally formidable.

As cable viewership and advertising revenue drain away, podcasting — built on a global audience of over 500 million listeners and rapidly growing ad revenue — is replacing "watched news" with "heard news." According to Grand View Research, the global podcast market grew from $30.7 billion in 2024 to $39.6 billion in 2025, with a 27% CAGR pointing toward $131.1 billion by 2030. Mordor Intelligence pegs the 2025 market at $31.49 billion with a 29.45% CAGR. Individual firm estimates vary, but the direction is unanimous.

The listener base is growing fast. Aggregating multiple sources including Edison Research, global monthly podcast listeners reached approximately 584 million in 2025 and are projected to reach 619 million in 2026. In the U.S. alone, 52% of adults listen to a podcast at least once per month, and weekly listeners number 104 million — 36% of the population aged 12 and older.

Notably, news and politics has emerged as podcasting's leading genre by revenue, accounting for over 27% of total podcast ad sales according to eMarketer. This is precisely why Hannity is extending his journalism into podcasting — his conservative audience has already migrated to podcast platforms, and he is simply following them.

Sources: Grand View Research, Mordor Intelligence, Edison Research, eMarketer, LimeLight Digital (2025–2026).

"I want to stay relevant. I want to be with what is current."— Sean Hannity · LA Times interview, February 17, 2026

A Story That Never Ends

Format is also strategy. Fox News host Sean Hannity announced his intention to explore an interview format that continues "until the story is done" — freed from the rigid time constraints of broadcast television. This is a direct benchmark of the 2–3 hour long-form interview format pioneered by the world's largest podcast host, Joe Rogan.

Rogan negotiated a $250 million deal with Spotify, then broke platform boundaries through a separate collaboration with YouTube, generating millions of views per episode and reshaping the global media landscape. Hannity cited extended interviews with Sylvester Stallone and Steve A. Smith on Fox Nation as the catalyst for his format decision — widely read as his attempt to replicate Rogan's long-form conversational content success in his own voice.

3. CABLE NEWS'S PODCAST OFFENSIVE

Hannity is not alone. All major cable news networks are extending into podcasting. CNN's Anderson Cooper has hosted the podcast "All There Is" since 2022. MSNBC launched Nicolle Wallace's "The Best People" last year, followed last week by "Clock It" with journalists Eugene Daniels and Symone Sanders-Townsend.

Sources: Official company announcements, LA Times, Variety (2022–2026).

Fox Corporation's vertical integration strategy is the most sophisticated of the group. In 2025, Fox acquired Red Seat Ventures, a platform supporting independent journalist podcasts. The company had provided operational and technical support to the podcasts of Tucker Carlson and Megyn Kelly after they left Fox. Fox then completed the ecosystem by acquiring Supercast, a podcast creator subscription platform. The structure keeps current Fox anchors in-house through an internal podcast division, while indirectly capturing departed stars through Red Seat. Even after leaving the network, Fox stars still generate revenue within the Fox ecosystem.

4. FAST: THE QUIET REVOLUTION IN FREE STREAMING

While podcasts capture the ears of news fans who have left cable TV, their eyes are increasingly turning to FAST (Free Ad-Supported Streaming TV) news channels. FAST — which offers free content in exchange for ad exposure — has emerged as a leading news alternative platform as SVOD services like Netflix, Disney+, and Max have repeatedly raised prices, inducing "subscription fatigue" among viewers who are flocking to free alternatives.

Market data makes this shift tangible. Multiple surveys indicate that total viewing time across major free streaming services grew at a double-digit rate between 2024 and 2025. The total number of FAST channels worldwide grew approximately 14% in 2025 alone, reaching around 1,800. By genre, documentaries and dramas lead, with news ranking third at approximately 9.9% of content. Measured purely by scheduling growth, however, news leads all genres at 37% — cementing its position as the core growth category within FAST. Fox Corporation's Tubi recorded approximately 100 million monthly active users (MAU) as of 2025, establishing it as America's defining FAST platform.

Streaming service Philo's moves illustrate the FAST-news fusion directly. Philo recently added "CBS News 24/7," crime news channel "48 Hours," and lifestyle information channels "The Martha Stewart Channel" and "The Emeril Lagasse Channel" to its free FAST lineup. While offering 70 paid channels for $33/month (first month $25), Philo also operates more than 120 free channels through its app and website — simultaneously functioning as a "cable replacement streaming bundle" and a "free FAST news and information hub."

Sources: Grand View Research, Mordor Intelligence, Statista, Comscore, Nielsen Gracenote, Fox Corporation (2025).

The composition of FAST news viewers is equally noteworthy. One report found that approximately one in four U.S. households already watches live and information content including news through FAST; FAST news viewers are more than seven times as likely to be cord-cutters compared to average TV viewers, with roughly double the concentration of viewers aged 18–34. Other analyses confirm that FAST TV viewers skew younger, lean more mainstream, and show higher loyalty to news, sports, and live information content.

Established news players — Fox, CNN, BBC — are racing to launch dedicated FAST news channels. BBC News and CNN are maintaining traditional TV-style schedules on FAST platforms, training viewers to tune in at specific times for specific news programs. Fox delivers a live breaking-news streaming experience through LiveNOW that minimizes commentary and foregrounds raw footage. As premium news and current affairs content migrates to FAST alongside high-cost sports rights, FAST is evolving from a secondary outlet for aging library content into a next-generation news platform that is genuinely reshaping how people consume news.

Sources: Official platform data, Gracenote 2025 State of Play.

5. K-CONTENT'S NEXT MOVE

Five years after Squid Game, the Korean content industry has proven its global competitiveness — but its revenue structure remains fragile. In deals with global platforms like Netflix, core IP and data flow to the platform, while Korean production companies and broadcasters retain limited profits and control. As the streaming market stratifies from SVOD into podcasts and FAST news channels, now is the structural moment for Korean news and current affairs content to diversify its distribution channels.

Demand for English-language K-entertainment related podcast content is already validated. Global monthly podcast listeners are estimated at 584 million as of 2025, and news, politics, and current affairs has established itself as a top global category. Unofficial fan podcasts targeting K-pop and K-drama fandoms rack up tens of millions of views and downloads — yet Korean broadcasters and newsrooms directly operating global news and current affairs podcasts are virtually nonexistent. Official podcast channels that repackage K-news into English, Spanish, and other languages alone could accumulate meaningful new revenue and brand equity that is categorically distinct from existing TV news licensing income.

The opportunity in FAST is even more concrete. What FAST platforms need most is a continuous supply of linear news and information channels and extensive library content. The decades of news, current affairs, and documentary archives held by Korean terrestrial broadcasters, general programming channels, and news specialty channels are a precisely matched supply source for this demand. With K-pop, K-drama, and K-movies already established in global consciousness, themed K-news FAST channels — "K-News Archive Channel," "K-Issue Explainer Channel" — can play a complementary role that adds credibility and depth to the Korean Wave.

Source: K-EnterTech Hub internal analysis (2026).

Advances in AI dubbing and subtitle generation are also accelerating the multilingualization of K-news. Recent surveys show that a significant share of global podcast producers and media companies already use AI tools for editing, summarization, and subtitle generation — substantially reducing production and localization costs. If Korean news content builds an AI dubbing and subtitle pipeline, not just large broadcasters but mid-sized production companies and digital newsrooms could rapidly produce English, Spanish, Arabic, and other language versions. This is the technical foundation that would allow K-news to enter global FAST news channels and podcast platforms directly.

Ultimately, "the next stage of Hallyu is platform independence." Beyond generating temporary hits on someone else's platform, Korean news and current affairs content must operate its own FAST channels and global podcast feeds under its own brand. Only then — controlling its own programming, revenue, and data — can Korea build "K-News" into a new pillar of the Korean Wave, following K-pop and K-drama.

EDITOR'S NOTE

The news industry is now dividing not by format, but by revenue structure. As traditional pay-TV's advertising and subscription revenue has contracted for consecutive years, digital news consumption is shifting its center of gravity from streaming and social toward podcasting and FAST. The essence of this transformation is not "where people watch news" but "who owns the distribution channel, and who captures the data and advertising revenue."

Podcasting has already become the second front page of the news business. Global podcast listeners surpassed 584 million in 2025, and news and current affairs has solidified its position as a top genre. In particular, news podcasts build loyal audiences at the individual program level, creating high-margin models that combine premium CPM advertising rates, host-read ads, and paid memberships. This represents a "personalized news channel" that traditional TV news never achieved — a structure in which anchors and journalists become brands in their own right.

FAST is the third channel bundle for news. Linear schedule-based free news and information channels inherit cable's "always-on news" model while simultaneously connecting to data-driven targeting and the growth of the Connected TV advertising market. News, current affairs, and documentary genres have already risen to the top FAST categories in multiple countries, and broadcasters are fragmenting and repositioning their brands into standalone "headline channels," "explainer news channels," and "region-specific channels" separate from their main news output. For advertisers, FAST news occupies a middle ground — more precise than cable, and safer in terms of brand safety than social media.

For K-news, this transition is not "a future to prepare for eventually" — it is a test of the second Korean Wave that has already begun. The Netflix-centered K-drama boom gave Korean producers global recognition, but it also deepened dependence in terms of IP, data, and revenue. To avoid repeating the same mistake with news, K-news must build a strategy that presupposes owning its own channels on podcasting and FAST from the outset — moving beyond simply "supplying" news clips to global platforms and instead directly growing K-news-branded audio and video feeds and FAST channels.

In this process, decades of accumulated Korean news, current affairs, and documentary archives are not simply historical records — they are the raw material of a new business model. The combinations for creating new revenue streams without restructuring IP are already sufficient: archive-edited news podcasts, themed K-news FAST channels, global news feeds powered by multilingual AI dubbing. The problem is not technology but resolve. Which newsroom first declares, "We are not a broadcaster — we are a multi-channel news platform," will determine the next decade.

REFERENCES

[1] Stephen Battaglio, "Fox News star Sean Hannity joins the podcast parade," Los Angeles Times, February 17, 2026.

[2] Todd Spangler, "Fox News' Sean Hannity Is Launching a 'Hang Out' Podcast From His Man Cave in Florida," Variety, February 17, 2026.

[3] Pew Research Center, "83% of US Adults Watch Streaming TV, Far Fewer Subscribe to Cable or Satellite," July 1, 2025. (n=9,397, surveyed April 14–20, 2025)

[4] eMarketer; Cable Compare, "U.S. Cable TV Subscribers 2025: Ongoing Decline & Cord-Cutting Trends." Cord-cutting households 77.2M, traditional cable 69.0M (2025 basis).

[5] adwave.com, "How many Americans have cut the cord? Q4 2025," citing eMarketer and Comcast Q4 2025 Earnings.

[6] Comcast Corporation, Q4 2025 & Full-Year 2025 Earnings Release, January 29, 2026. Annual TV subscriber loss of 1.15 million.

[7] Statista, "Pay TV Revenue United States 2017–2025." Revenue $100.09B (2017) → $83.42B (2025).

[8] Nielsen, The Gauge, May 2025. Streaming 44.8%, cable 24.1%, broadcast 20.1%. First time streaming exceeded cable + broadcast combined.

[9] Grand View Research, "Podcasting Market Size & Share, Industry Report, 2030." 2024: $30.72B, 2025: $39.63B, CAGR 27%, 2030: $131.13B.

[10] Mordor Intelligence, "Podcast Market Size," November 2025. 2025: $31.49B, 2030: $114.48B, CAGR 29.45%.

[11] Research Nester, "Podcasting Market Size," September 2025. 2025: $32.48B, 2026: $40.46B, CAGR 27.3%.

[12] Edison Research, "The Infinite Dial 2025." U.S. adult monthly listen rate 52%, weekly listeners 104 million.

[13] LimeLight Digital, "Podcast Statistics 2026," January 2026. Global listeners 584M (2025), 619M projected for 2026.

[14] Grand View Research, "Free Ad-Supported Streaming TV Market Report." FAST market 2024: $9.73B, 2025: $11.5B, CAGR 16.9%, 2033: $40.2B.

[15] Mordor Intelligence, "Free Ad-Supported Streaming TV Market," September 2025. 2025: $12.26B, 2030: $27.14B, CAGR 17.22%.

[16] Comscore, "2025 State of Streaming," October 2025. FAST viewing time up 43% from August 2024 to August 2025.

[17] Nielsen Gracenote, "2025 State of Play." FAST channel count up 21%, 1,900+ worldwide.

[18] Fox Corporation, Tubi Monthly Active Users Disclosure, June 2025. Tubi MAU exceeds 100 million.

[19] allrites.com, "FAST Channels Spread Fast in 2025," June 2025. Sports FAST channels +105% (mid-2024 → Feb 2025).

[20] Statista, "U.S. FAST Advertising Revenue Forecast 2025." U.S. FAST ad revenue $5.78B.

© 2026 K-EnterTech Hub. This report is based on publicly available primary data and industry research. Unauthorized reproduction or redistribution is prohibited.

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)