"Too Big, or Too Small" — A Century of U.S. Broadcast Ownership Rules at a Crossroads, and the Ripple Effects on K-Content and Korean Viewers' Rights

[K-EnterTech Hub | U.S. Media Policy Deep Dive]

"Too Big, or Too Small" — A Century of U.S. Broadcast Ownership Rules at a Crossroads, and the Ripple Effects on K-Content and Korean Viewers' Rights

U.S. Senate stages two-hour showdown over Nexstar–Tegna merger, Trump’s endorsement, and AI threats

JTBC’s Olympic monopoly in Korea adds a parallel flashpoint to this ‘US–Korea media transition,’ underscoring how both countries are now wrestling with the same core question: whether marquee national sports should remain widely accessible public events or migrate fully behind paywalls.

The war over a mega-merger that would cover 80% of U.S. TV households has moved to the Senate hearing room.

On February 10, the U.S. Senate Commerce Committee held a hearing titled “We Interrupt This Program: Media Ownership in the Digital Age,” debating for more than two hours how to redesign the broadcast ownership regulatory framework—in place since the 1930s—for the streaming and AI era.

This came just days after President Donald Trump publicly endorsed the Nexstar–Tegna merger as “a good deal that will take down fake news,” with FCC Chairman Brendan Carr immediately responding, “The President is right. Let’s get this deal done.”

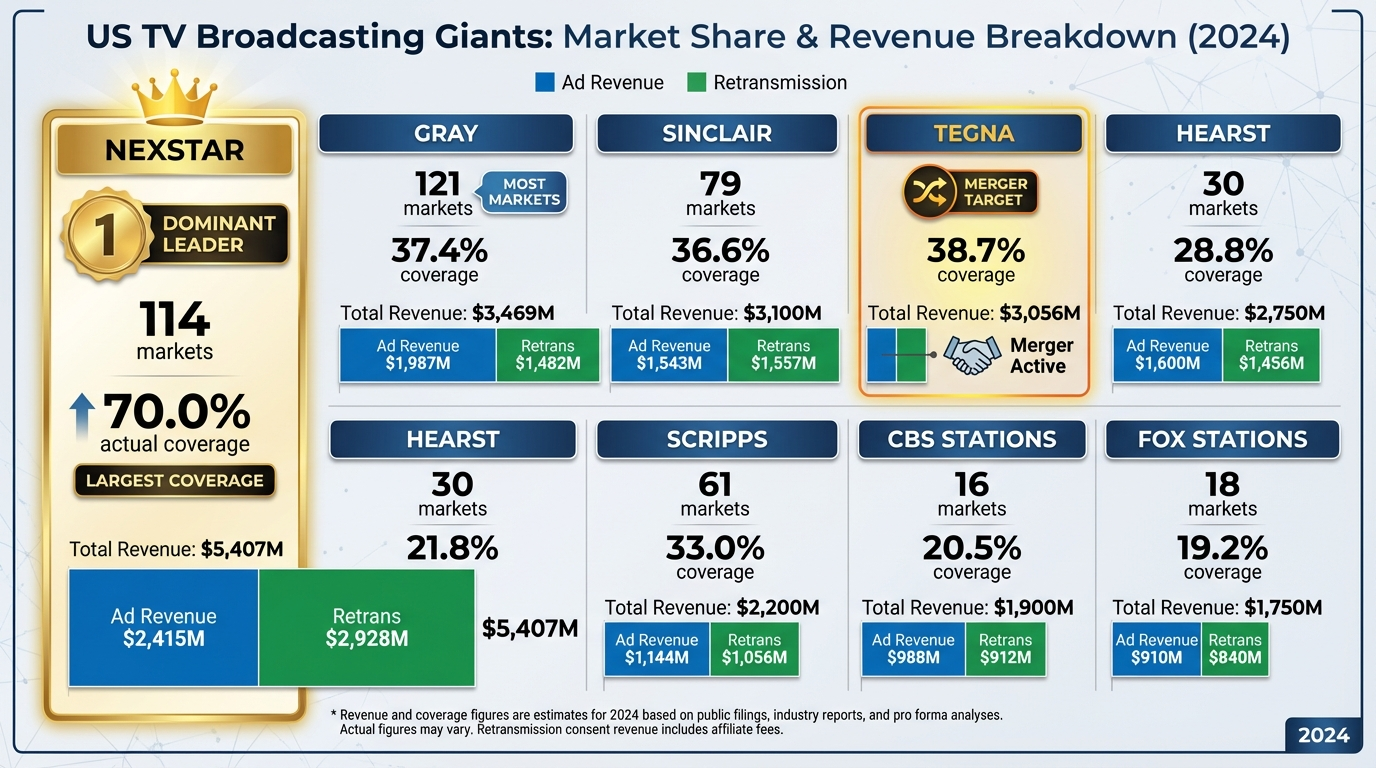

If approved, the merger would make Nexstar the owner of 265 full-power stations across 44 states and Washington D.C., reaching approximately 80% of all U.S. TV households—an unprecedented local broadcasting colossus. With FCC rules nominally capping national reach at 39%, the controversy intensifies over whether to effectively allow double that coverage, even accounting for various exceptions and the “UHF discount.”

Whether this deal becomes a lifeboat to save local news or a Trojan horse that collapses the remaining foundation of local journalism—the debate has expanded into a comprehensive review of media order, encompassing Congress’s legislative authority, the FCC’s independence, democracy’s information infrastructure, and the threats posed by AI and Big Tech.

Notably, this debate does not follow typical partisan lines. Even within the Republican camp—traditionally supportive of deregulation—there is strong criticism of the Nexstar–Tegna merger and the relaxation of the ownership cap.

The hearing’s central clash was organized around two main axes. On one side stood Curtis LeGeyt, President and CEO of the National Association of Broadcasters (NAB), and Thomas Johnson, legal representative for Nexstar. LeGeyt argued that “more than half of local broadcast newsrooms are operating at a loss, and outdated ownership rules are forcing broadcasters to compete with Big Tech with one hand tied behind their back,” urging the abolition of the cap and regulatory relaxation.

On the opposing side was Newsmax CEO Chris Ruddy. He countered that “Nexstar’s EBITDA grew from $300 million in 2015 to $1.8 billion in 2024—nearly 500%. Tegna reported $813 million and Sinclair $800 million. All top seven local TV groups exceeded $500 million in EBITDA. How is this a ‘crisis’?” He declared: “The crisis is fictitious.”

The hearing ended without a conclusion. While both parties agreed on the severity of the crisis facing local journalism, consensus on whether abolishing or relaxing broadcast ownership rules would be the solution remains distant. Three variables—the FCC’s decision, President Trump’s final stance, and whether Congress acts legislatively—will shape the direction of U.S. broadcast, streaming, and AI regulation for years to come.

We cover this U.S. local broadcast issue here because it directly affects the Korean market as well. This debate mirrors Korean concerns: universal viewing rights for nationally significant sporting events like the Olympics, K-content window design in FAST and streaming, AI content protection, and local journalism support systems. Depending on how the mega-broadcast rollup and AI/Big Tech regulatory overhaul play out in the U.S., the pathways through which K-drama, K-variety, and K-news reach American viewers’ screens will change. This is precisely why this debate warrants close tracking.

▲ Curtis LeGeyt, NAB President & CEO — "Competing with one hand tied behind our back"

▲ Chris Ruddy, Newsmax CEO — "The crisis is fictitious. We are prepared to litigate"

■ Key Hearing Confrontation

|

Issue |

Pro-Deregulation (NAB / Johnson) |

Pro-Regulation (Newsmax / Waldman) |

|

Industry

Status |

Survival

crisis from Big Tech. 70% of ad revenue migrated. Streaming 50% vs broadcast

20%. More than half of newsrooms in the red |

Nexstar

EBITDA $1.8B, Tegna $813M, Sinclair $800M. All top 7 groups exceed $500M. The

crisis is fictitious |

|

Local

News |

Consolidation

→ scale → investment. Broadcasts up 40%, airtime up 50% over 10 years. 27,000

newsroom employees |

Tribune

merger: 16,193 → 12,142 employees (-25%). 14 markets had newsrooms merged.

$300M savings: $165M from station cuts |

|

Consumer

Impact |

Scale →

keeping sports on free broadcast. Retrans fees declining for 3 consecutive

years |

Retrans

fees up 2,000%+ since 2010. $135M of merger savings from retrans hikes. Costs

passed to cable subscribers |

|

FCC

Authority |

'Modify

its rules' language → FCC retains discretion. D.C. Circuit & Supreme

Court precedent support |

Congress

explicitly set 39%. Former FCC chairs recognized it as 'law.' Ex-Commissioner

O'Rielly called discretion 'pure fantasy' |

|

Solution |

Abolish

cap → level playing field. Retain DOJ antitrust + FCC public interest review |

Maintain

39%. Prioritize Big Tech regulation. Mandate reporter retention in mergers

(Waldman) |

■ Key Hearing Figures

|

Figure |

Affiliation |

Position |

Key Statement |

|

Ted Cruz |

Commerce

Cmte. Chair (R-TX) |

Skeptical

of FCC unilateral authority |

"Could

the FCC have raised the cap to 100% the day after the law was enacted?"

— Pressed with extreme hypothetical |

|

Maria

Cantwell |

Ranking

Member (D-WA) |

Anti-merger;

diversity first |

"Changing

the cap does not solve structural problems and only reduces diversity of

local voices" |

|

Chris

Ruddy |

Newsmax

CEO |

Pro-regulation;

strongly anti-merger |

"Top

7 groups all EBITDA $500M+. The crisis is fictitious" / "We are

prepared to litigate" |

|

Curtis

LeGeyt |

NAB

President & CEO |

Pro-deregulation;

abolish cap |

"More

than half of newsrooms are in the red. Without modernizing ownership rules,

local TV will share the fate of newspapers" |

|

Thomas

Johnson |

Wiley

Rein (ex-FCC counsel; Nexstar legal rep.) |

FCC

authority positive; abolish rules |

"All

prescriptive rules are outdated and should be abolished" / Cites D.C.

Circuit precedent |

|

Steven

Waldman |

Rebuild

Local News |

Neutral;

conditional relaxation |

"Both

sides have a point. Look at reporter headcount, not airtime. Tie any

relaxation to reporter retention requirements" |

1. A Century of Regulation at a Turning Point — From the Beatles to AI

Ted Cruz, Chair of the Senate Commerce Committee

Chairman Cruz opened by invoking broadcasting’s century-long arc—from "I Love Lucy" to the Beatles on Ed Sullivan, the Apollo 11 moon landing, the Nixon-Kennedy TV debate, and Reagan’s "Tear Down This Wall" speech—before declaring: "That era is over."

Chairman Cruz: "The days when holding a broadcast license was called a ‘license to print money’ are over. Cable TV and satellite brought 24-hour news, and the internet and mobile unleashed streaming, social media, and an infinite flood of content that fragmented the once-universal audience into thousands of niche audiences."

The history of TV regulation is complex. In the Telecommunications Act of 1996, Congress directed the FCC to review broadcast ownership rules every four years while separately addressing the national TV audience reach cap. In 2004, Congress explicitly set this cap at 39%, explicitly prohibited the FCC from using its forbearance authority to grant exemptions, and excluded the 39% cap from the FCC’s periodic regulatory review process. This cap—unchanged for 22 years—now stands at a breaking point.

2. The Economies of Scale Debate — "Loss-Making Newsrooms" vs "Greedy Mergers"

The hearing’s most fierce clash erupted between NAB President LeGeyt and Newsmax CEO Ruddy. They offered completely opposite diagnoses of the same industry.

LeGeyt argued that current ownership regulations are "outdated and distorting today’s video and advertising markets." His case for deregulation rested on the fact that 70% of local ad spending has migrated to Google and Meta over the past 20 years. Meanwhile, streaming accounts for nearly half of all viewing by Nielsen metrics, while broadcast stands at just 20%. LeGeyt warned, "When you have to compete with Netflix and Amazon for NFL games, more than half of national broadcast newsrooms independently evaluated are not turning a profit."

LeGeyt: "If we don’t modernize ownership rules, the last bastion of truly local journalism in many communities—local TV news—will share the fate of thousands of local newspapers."

Newsmax CEO Chris Ruddy painted a completely opposite picture. Nexstar’s EBITDA grew from $300 million in 2015 to $1.8 billion in 2024—nearly 500%. Tegna posted $813 million and Sinclair $800 million. All top seven TV broadcast groups exceeded $500 million in EBITDA in 2024.

Ruddy: "The broadcast industry has not presented the Senate with any data proving a crisis. They are manufacturing a crisis because abolishing the rules would let them make billions more."

Ruddy also exposed Newsmax’s direct damages: Nexstar-owned NewsNation draws only one-fifth of Newsmax’s viewership, yet leverages its 200 stations’ retransmission bargaining power to force cable operators into mandatory carriage at higher fees.

When Cruz directly asked LeGeyt to verify these figures, LeGeyt acknowledged the viewership gap but deflected on fees, saying they were "not public information." Cruz responded: "You don’t want to answer that question. That’s fine."

LeGeyt fired back at Ruddy: "We must firmly reject arguments that empower national single-channel outlets—cable news channels or streaming services—that don’t invest a single dollar in local communities." Ruddy countered: "Over 70% of Democratic voters and 75% of Republican voters oppose this merger in polls, with support below 7%." CPAC and the National Religious Broadcasters (NRB) also filed formal objections with the FCC, publicly opposing the Nexstar–Tegna merger and ownership deregulation.

3. Local News — Does Consolidation Save or Bury It?

LeGeyt emphasized that it was "local broadcasters, not global streaming services or national pay-TV" that stayed on the ground during storms and floods, providing life-saving information. He cited data: from 2011 to 2023, local news broadcasts increased 40%, total airtime grew 50%, and broadcast newsrooms employ over 27,000 people.

Ruddy presented starkly different numbers. After Nexstar acquired Tribune, headcount fell from 16,193 to 12,142 within a year—a 25% reduction. In 14 markets, Nexstar operates two stations and has merged newsrooms in the same market. "For the Tegna merger, they project over $300 million in immediate cost savings—$135 million from retransmission fee increases and $165 million from local station cost reductions, which generally means newsroom consolidation."

Ruddy: "If you’re a reporter working for Nexstar, you should start updating your resume."

Steven Waldman of Rebuild Local News acknowledged merit on both sides but stressed the need to change the key metric: quality over quantity of airtime.

"If local reporter headcount has declined while airtime has increased, what remains is either shallower local news or simple news copying," he pointed out, noting approximately 3,500 newspapers have closed over the past 20 years and local reporter headcount has dropped 75%. Waldman proposed that any ownership deregulation "must be conditioned on maintaining and increasing local reporter headcount."

Senator Cantwell, the ranking Democrat on the Commerce Committee, stressed that "simply adjusting the ownership cap cannot solve the real structural problems" and warned it "risks reducing diversity of local voices without fixing the economic foundation of the local news business." She called for "policy solutions that directly support local journalism rather than simple deregulation."

4. Sports Broadcasting — The Super Bowl & Winter Olympics ‘Paywall’ Debate

Just two days before the hearing, the Seattle Seahawks won the Super Bowl, watched by over 100 million viewers. The Senate hearing room immediately pivoted to the question: Are sports broadcasts a public good or a premium paid product?

Senator Cantwell stated: "Viewers don’t want to have to pay for streaming and various subscription packages to watch sports they used to access free with just ads." She expressed concern about the drift of sports to Big Tech and paid platforms.

NAB’s LeGeyt warned that artificially constraining the size of major broadcasters would push them out of competition for NFL, Olympic, and other major sports rights, ultimately reducing the options for watching sports on free over-the-air and local channels.

Newsmax’s Ruddy countered that retransmission fees have surged over 2,000% since 2010: "If milk prices had risen at the same rate, a half-gallon would cost $40 today." He argued these costs are being passed on to pay-TV and streaming subscribers.

This debate parallels Korea’s 2026 Milano–Cortina Winter Olympics controversy, where JTBC—a pay TV channel—bought exclusive Korean rights to the Olympics (2026–2032) and World Cup (2026–2030) from the IOC, ending the long‑standing “Korea Pool” system under which the three free‑to‑air terrestrial networks (KBS, MBC, SBS) jointly acquired and aired these events nationwide.

In practice, that means—for the first time—no Korean household can watch the Olympics on the traditional free nationwide channels; instead, viewers must either subscribe to JTBC on pay TV or use its online partner, Naver, prompting public complaints that “to watch the national team, you now have to pay,” in tension with Korea’s legal principle of “universal viewing rights,” which says major events like the Olympics and World Cup should be available to over 90% of households on free TV.

Korea’s media regulator has already called this “regrettable” and is preparing legal amendments to curb future sports‑rights monopolies and better protect viewers’ access.

Put simply for a U.S. audience: imagine if, overnight, the Super Bowl, the Olympics, and the World Cup all moved off ABC/CBS/NBC/FOX and could only be watched on a single cable channel plus one streaming app—no free over‑the‑air access at all—despite a law and long tradition that such events should be available to almost every household.

Both the U.S. Super Bowl debate and Korea’s Olympic fight are grappling with the same core question: how far do we let marquee national sports drift behind paywalls, and who ultimately pays while who profit

5. Legal Battle — "Is the 39% a Law or a Rule?"

Former FCC General Counsel Johnson argued for FCC authority based on D.C. Circuit precedent and textualist interpretation: "If Congress had wanted to remove discretion, it would have codified the cap in the statute itself. But Congress did not do that." According to TV Tech, Johnson disclosed at the hearing that his law firm represents Nexstar.

Cruz pressed with an extreme hypothetical: "Could the FCC have raised the cap to 100% the day after the law was enacted?" When LeGeyt conceded it could be done through APA procedures, Cruz’s skepticism became unmistakable. Ruddy countered by citing former Trump-era FCC Chairman Ajit Pai’s repeated statements that "the law must be obeyed," and noted that former Chairwoman Rosenworcel and then-Commissioner Carr’s concurrent opinions did not dispute this.

6. The Trump Effect — FCC Independence Under Strain

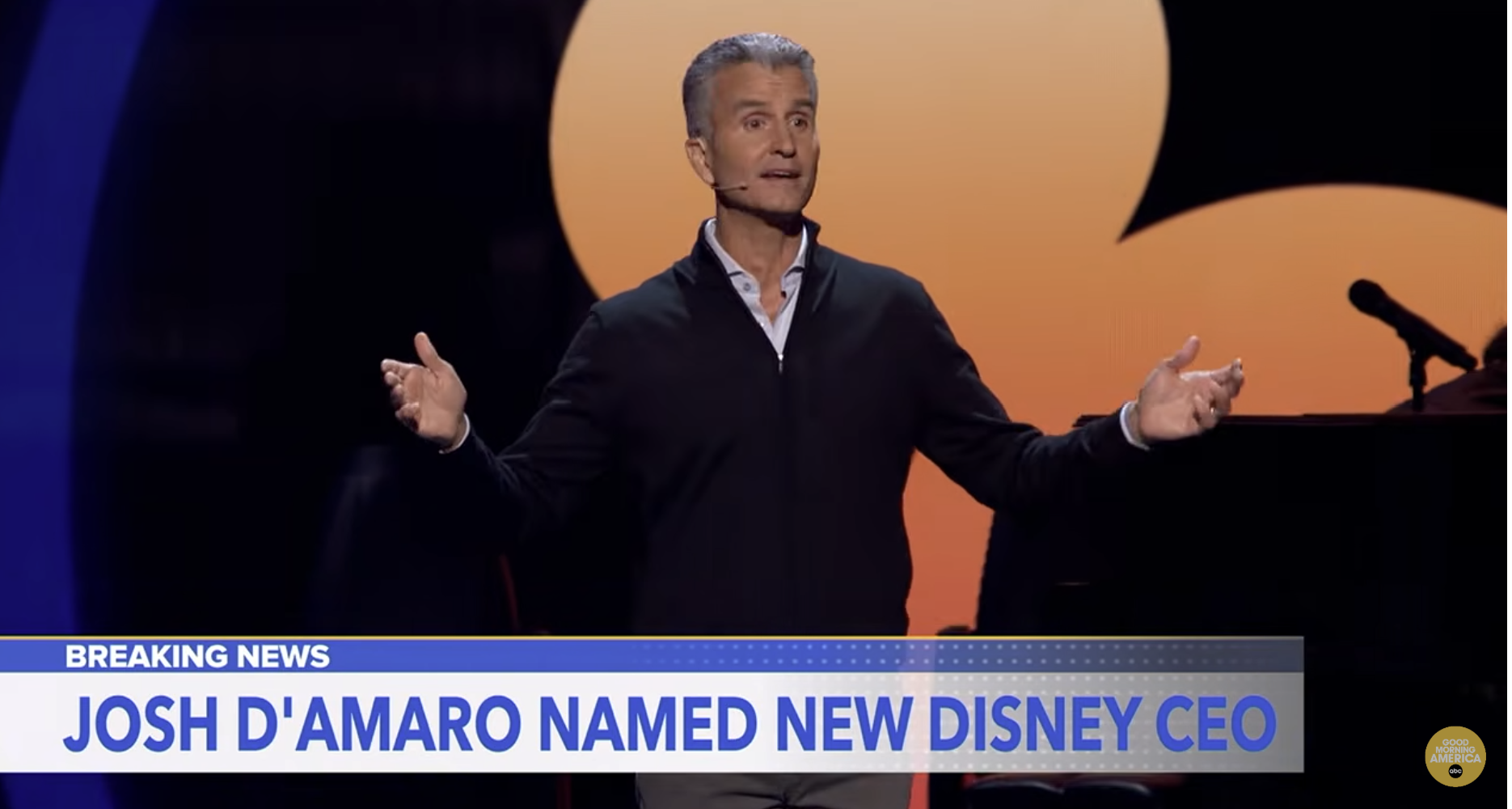

The Nexstar–Tegna merger controversy has become a political litmus test measuring the distance between the White House and regulatory agencies. President Trump endorsed the deal on social media, calling it "a good deal" that would "create more competition to take down fake news."

FCC Chairman Brendan Carr immediately responded: "President Trump is exactly right. National networks like Comcast and Disney have too much power. Let’s get this deal done and bring real competition to them." With only 71 of the FCC’s statutory 180-day review period elapsed, concerns about FCC procedural independence erupted immediately across the political and media landscape.

Earlier, in December 2025, Senator Ben Ray Luján extracted an admission from Chairman Carr at a Senate hearing that "the FCC is not formally an independent agency." Luján then revealed that the FCC had deleted the phrase "Independent U.S. government agency" from its official website shortly after his questioning.

Luján stated: "Until I asked, the FCC described itself as an independent agency. When I asked if it was independent, the chairman said no, and minutes later someone removed the word ‘independent’ from the website. Can you call an agency independent when it changes its own definition to match the president’s political agenda?"

Ruddy pointed out the contradiction: Trump had been critical of raising the broadcast ownership cap as recently as November 2025. "The President is someone who makes good decisions when given proper information," Ruddy said, "but the problem is Chairman Carr is steering him in the wrong direction." Consequently, the Nexstar–Tegna debate has been recorded as a rare “Trump Effect” case in U.S. broadcast regulatory history—where the president’s “fake news” framing and the FCC chairman’s public concurrence have become intertwined.

7. The AI Wild Card — Local News’s ‘Vicious Cycle’

AI emerged as a key agenda item at this hearing, rivaling broadcast ownership regulation in intensity. Steven Waldman of Rebuild Local News warned: "AI is absorbing the articles local newsrooms painstakingly produce to train its models, and then AI assistants provide self-contained answers without sending readers to the news outlets—a double blow."

As Google, OpenAI, and other generative AI services provide summary answers at the top of search results, search-driven traffic to major outlets like The Washington Post and HuffPost has dropped nearly 50% over the past three years. The Washington Post reportedly cut local reporting staff by over 70% as part of restructuring.

Senator Cantwell declared: "Local news is AI’s seed corn—information planted by local reporters and newsrooms is becoming training material for AI models, but they’re not receiving proper compensation, and their business models are collapsing."

Waldman proposed solutions: collective licensing compensation from AI companies for using local and small media content; allocating a percentage of data center and cloud infrastructure investment to local reporter hiring and retention funds; and imposing a “mitigation fee” on AI and social media platforms to fund local journalism support.

Cantwell has reintroduced the bipartisan COPIED Act with Senators Blackburn and Heinrich, which would establish transparency and watermarking standards for AI-generated deepfakes and unauthorized content use. Senator Amy Klobuchar is pursuing the parallel No Fakes Act to prevent unauthorized synthesis and commercialization of individuals’ voices and likenesses, signaling a legislative offensive to restore local news and creator rights in the AI era.

8. State-Level Realities — "When the Storm Hits, You Watch Local TV"

Senators brought their constituents’ daily experiences to the hearing. West Virginia’s Shelley Moore Capito described how, just two weeks earlier during a storm, residents turned first to local TV and radio for road closures, school cancellations, and evacuation information: "In disasters, people still see local broadcast as their lifeline."

Nebraska’s Deb Fischer noted that KNEP, a Panhandle station, closed in 2024, instantly stripping the community of local news, weather, and public notices.

Indiana’s Todd Young argued: "If residents don’t even know a county planning meeting or redevelopment hearing is happening, they can’t make informed choices at the ballot box." Massachusetts’ Ed Markey encapsulated the discussion: "When ownership is local, journalism is local"—reminding everyone that national ownership concentration is not just an economic issue but a question of local voice diversity.

9. The Radio Lesson, and Looming Litigation

Ruddy offered the radio market as a cautionary tale for TV deregulation—an experiment already concluded. "Today, most major U.S. radio licenses are held by three large companies. In the process, local programming has been effectively gutted, and these companies are now drowning in debt."

After 1990s deregulation, iHeart, Cumulus, and Audacy consolidated national radio. The result was the elimination of local programming. Ruddy stated: “They killed local news, talk, and community programs one by one, keeping only nationally syndicated content to cut costs.”

When Cruz asked whether Newsmax would litigate if the FCC unilaterally raised or abolished the ownership cap without explicit congressional legislation, Ruddy answered: "We are prepared to litigate the matter." He argued that under the Communications Act, the 39% national ownership cap is a congressionally mandated norm, and the FCC’s effective abolition would be "a clear violation circumventing Congress’s intent."

NAB’s LeGeyt also acknowledged that "historically, whenever the FCC has touched ownership rules, court challenges have followed almost without exception," suggesting the Nexstar–Tegna cap relaxation debate could escalate into protracted administrative and constitutional litigation.

10. U.S.–Korea Media Regulation Comparison

Comparing U.S. and Korean broadcast ownership regulation, AI, and streaming environments reveals that while structures differ, both face the common challenges of a ‘local news crisis’ and ‘Big Tech/streaming regulatory asymmetry.’

|

Category |

United States |

South Korea |

|

Core

Regulation |

39%

national TV reach cap (with UHF discount & exceptions). Duopoly rule

limits owning 2 of top 4 stations in a single market |

Equity

caps prevent conglomerates/newspapers/telcos from directly controlling

terrestrial broadcasters. Comprehensive channels capped at ~40% single-owner

stake |

|

Big Tech

Regulation |

No

ownership caps or localism mandates for Netflix, YouTube, Amazon Prime, FAST,

or social platforms. Broadcasters argue 'same content/ad market, completely

asymmetric regulation' |

Digital

streamers (Coupang Play, Wavve, Tving) largely exempt from traditional

broadcasting law ownership/programming mandates. AI/platform regulation still

nascent |

|

Local

News Crisis |

~3,500

local newspapers closed in 20 years. Local reporter headcount down 75%. 'News

deserts' expanding. Key hearing issue: does ownership deregulation worsen the

crisis? |

Regional

MBC affiliates and private broadcasters facing ad revenue declines and

cumulative losses. Local newspaper closures accelerating. JTBC Olympic

monopoly raising 'universal viewing rights' and localism concerns |

|

AI

Response |

COPIED

Act (deepfake/unauthorized use transparency & watermarking), No Fakes Act

(voice/likeness protection) advancing in Congress |

'AI Basic

Law' discussions underway but licensing/compensation frameworks for AI

training on journalism/news content still undeveloped |

|

Sports

Broadcasting |

NFL/MLB/NBA

migrating to streaming/Big Tech. Free over-the-air access to Super Bowl,

playoffs becoming key political issue |

Pro

sports streaming monopolies (Coupang Play) plus Olympics/World Cup

monetization debates. Growing calls for broadcasting law/sports rights

guideline reform |

|

Current

Debate |

39% cap:

'Need scale to compete with Big Tech' vs 'Caps protect local voices and

diversity.' Head-on collision |

Consensus

that traditional broadcast regulation doesn't fit the streaming/AI era.

Simultaneous demands for comprehensive broadcasting law reform, Big Tech

regulatory inclusion, and AI compensation frameworks |

Five Key Implications for K-Content

(1) FAST Channels & ATSC 3.0: The Rise of a Mega-Gatekeeper and New K-Content Pathways

If the Nexstar–Tegna merger is approved, a single broadcast group would own 265 local stations covering ~80% of U.S. TV households. This group would operate its own FAST and CTV channels as well as partner with FAST platforms (Samsung TV Plus, Pluto TV, Tubi, Amazon Freevee, etc.), effectively becoming the pivotal gatekeeper for K-content distribution to “8 out of every 10 American homes.” On the bargaining front, the standalone negotiating leverage of individual K-drama, K-variety, and K-lifestyle FAST channels (so-called “K-FAST” channels) could weaken against a counterparty of this scale.

However, a simultaneous structural opportunity arises. As the mega-group concentrates its capital on sports rights and news operations, it will need to fill non-sports and non-news time slots with compelling global premium content. K-content—already proven in the U.S. through Netflix, Disney+, and Viki—is a natural candidate to fill these FAST slots. Korean broadcasters and content companies should explore K-FAST channel packaging strategies tailored to a consolidated U.S. partner: bundled K-drama marathon blocks, K-variety prime-time strips, and K-lifestyle weekend programming that can be deployed at scale across hundreds of local stations and affiliated FAST platforms.

Critically, the ATSC 3.0 (NextGen TV) rollout adds another dimension. ATSC 3.0 is an IP-based, over-the-air broadcast standard that enables multicasting—broadcasting multiple sub-channels on a single frequency—along with targeted advertising, interactive features, and hybrid broadcast-broadband delivery.

A mega-TV stations group owning 265 stations transitioning to ATSC 3.0 could, in principle, launch dedicated K-content sub-channels on U.S. terrestrial airwaves at national scale, reaching cord-cutters and antenna-only households who are unreachable by SVOD or cable-delivered FAST platforms.

This represents a genuinely new distribution pathway for K-content: free, over-the-air, targeted, and scalable—a “K-FAST on steroids” that merges the reach of traditional terrestrial broadcasting with the targeting capabilities of digital streaming. Korean media groups should proactively engage with Nexstar and other ATSC 3.0 adopters (including Sinclair, which has been an aggressive early mover in NextGen TV deployment) to explore sub-channel partnerships and ad-tech integration opportunities.

(2) The Sports Vacuum: K-FAST’s Structural Opportunity

As NFL, MLB, and Olympic content migrates to paid streaming (Amazon’s Thursday Night Football, Apple’s MLS Season Pass, Peacock’s NFL exclusives), free ad-supported FAST and terrestrial channels face growing “event time slot gaps.” The evening and weekend slots vacated by premium sports are precisely the high-viewership windows where K-content can be positioned as replacement premium programming.

The strategic playbook for K-FAST channels in this environment is specific: K-drama marathon blocks on sports-free weeknights, K-variety prime-time strips for non-game weekends, K-pop concert and awards show simulcasts during off-season gaps, and K-drama recap/fan engagement shows that build appointment viewing habits. On ATSC 3.0-enabled stations, targeted advertising allows K-content blocks to serve Korean-language ads to Korean-American households in the same time slot where English-language ads reach general audiences—dramatically improving the advertising economics for Korean brand sponsors and making K-FAST sub-channels commercially viable even at niche scale. The goal is to preemptively establish K-content as “the premium alternative when sports aren’t on”—a positioning that becomes more valuable as sports rights continue migrating behind paywalls.

(3) AI Content Protection: Direct Impact on K-IP

The COPIED Act and No Fakes Act under Senate discussion directly affect K-drama, K-pop, and K-variety IP protection on global streaming platforms. As regulations around deepfake idol videos, AI-synthesized K-drama clips, and unauthorized translation/summary content take shape, Korean stakeholders (broadcasters, production companies, entertainment agencies, copyright organizations) need to proactively design Korea–U.S. policy coordination channels covering mutual recognition, collective licensing, and watermarking/provenance standards.

(4) FCC Monitoring & K-FAST Strategy: A Direct Variable for Market Entry

Whether the Nexstar–Tegna deal is approved, the 39% cap is maintained or abolished, and subsequent litigation outcomes are direct variables for Korean media groups’ U.S. market entry strategies. If the mega-merger goes through, counterpart bargaining power for Korean channel retransmission, local affiliations, and station-level co-productions becomes extremely concentrated in a single entity. K-FAST channel operators would negotiate with one gatekeeper controlling 80% reach—potentially accepting lower licensing fees in exchange for unmatched distribution scale.

Conversely, if the FCC blocks the merger or maintains/strengthens the 39% cap, the U.S. local broadcast landscape remains fragmented among multiple mid-size groups—Sinclair (~185 stations with its own FAST platform STIRR and aggressive ATSC 3.0 deployment), Gray Television, Hearst, Cox, and others. In this scenario, K-FAST channels can pursue diversified partnerships: launching K-content blocks on Sinclair’s STIRR platform and NextGen TV sub-channels, negotiating market-specific K-drama programming with Gray Television in underserved Southern and Midwestern markets, and piloting ATSC 3.0 K-content sub-channels with early-adopter stations. This fragmented scenario actually favors K-content distributors, as competition among multiple mid-size groups for premium non-sports content drives up licensing terms and programming commitments.

K-content companies and platforms must therefore maintain a dual-track strategy: preparing for both mega-consolidation (single-partner, high-volume, lower-margin deals) and continued fragmentation (multi-partner, market-specific, higher-margin K-FAST deployments). Monitoring the FCC’s review timeline, DOJ antitrust review, Sinclair’s own ATSC 3.0 rollout pace, and key litigation outcomes should be integral to calibrating M&A timing, K-FAST channel launches, ATSC 3.0 sub-channel pilots, and investment schedules.

(5) Lessons for Korean Regulatory Reform

The key lesson from this debate is that ownership deregulation and roll-ups do not automatically strengthen local content. As Waldman proposed, any deregulation, tax incentives, or subsidies should be tied to “newsroom staffing maintenance and expansion” as a condition. Korea should similarly design incentives tied to content investment, reporter headcount, and local programming ratios when pursuing streaming/AI deregulation alongside support for regional MBC affiliates, private broadcasters, and local newspapers—ensuring that “scale expansion = local journalism and content expansion.”

Conclusion: Three Variables, One Certainty

The hearing reached no immediate conclusion, but one point became clear: the current U.S. broadcast ownership rules have reached a point where the status quo is unsustainable. As TV Tech’s George Winslow noted: “Witnesses and senators largely agreed that local journalism faces serious challenges threatening communities and democracy, but they were deeply divided on whether abolishing or relaxing broadcast ownership rules is the right solution.”

Three key variables will determine the outcome.

First, the FCC’s decision. If Chairman Carr raises or abolishes the 39% national cap without congressional legislation, Ruddy’s pledge to "litigate" is likely to materialize. Even LeGeyt acknowledged that "historically, FCC ownership rule changes have been followed by court challenges almost without exception," meaning any regulatory change will pass through years of administrative and constitutional litigation uncertainty.

Second, President Trump’s final position. He was critical of raising the 39% cap as recently as November 2025, but by February 2026 suddenly praised the Nexstar–Tegna merger as "a good deal to take down fake news." Ruddy noted: "The president makes good decisions when properly informed, but Chairman Carr is advising him in the wrong direction." The timing and substance of the White House’s messaging directly affects calculations by the FCC, courts, and market participants.

Third, whether Congress legislates. Chairman Cruz was openly skeptical of unilateral FCC action at the hearing. Senators have until February 17 to submit additional written questions, and witnesses until March 3 to respond. A comprehensive legislative package addressing the 39% cap’s legal status, Big Tech/streaming regulatory asymmetry, and local journalism support schemes may begin to take shape.

For Korean media and entertainment-tech companies, this debate is not someone else’s story.

The restructuring of U.S. local TV means structural changes to the U.S. FAST, CTV, and streaming ecosystem—directly impacting K-content channel entry, programming slot acquisition, and advertising/sponsorship terms. Simultaneously, the AI/deepfake regulatory discussions around the COPIED Act and No Fakes Act intersect with K-drama, K-pop, and K-variety IP protection, global fandom marketing, and creator economy models—heightening the need for Korea–U.S. policy coordination.

In particular, as U.S. broadcasters concentrate resources on Super Bowl and local sports rights, the expanding demand for non-sports, non-scripted content on free FAST and TV channels—amplified by ATSC 3.0’s multicasting and targeted advertising capabilities—represents a structural opportunity for K-drama, K-variety, and K-live content. Whether through K-FAST channels on legacy FAST platforms, dedicated K-content sub-channels on NextGen TV terrestrial broadcasts, or hybrid ATSC 3.0 broadband-broadcast delivery, the pathways for K-content to reach American screens are multiplying even as the ownership structure around them is being rewritten.

References

1. Deadline, "Too Big Or Too Small" (Ted Johnson, Feb. 10, 2026)

2. TV Tech, "Senate Hearing Witnesses Spar Over Ownership Caps" (George Winslow, Feb. 10, 2026)

3. U.S. Senate Commerce Committee, "We Interrupt This Program: Media Ownership in the Digital Age" — Full Hearing Transcript (Feb. 10, 2026)

4. YouTube: https://www.youtube.com/watch?v=qsxBj_QklF0

* This article was restructured and analyzed by K-EnterTech Hub based on original source articles and the full hearing transcript.

![[보고서]전통 언론사의 크리에이터 전략 대전환](https://cdn.media.bluedot.so/bluedot.kentertechhub/2026/02/0nwc9z_202602100212.png)